A Certificate of Deposit, commonly known as a CD, is a financial product offered by banks and credit unions. It allows you to invest your money over a set period (or term), during which you earn a fixed interest rate. The return is assured, which makes CDs a popular choice among those who prefer not to take on the risks associated with more volatile investments like stocks or mutual funds. When the term ends, you receive your initial deposit back along with the interest you've accrued, which is a simple, no-hassle way of growing your savings. When considering the question of how much money you can put into a CD, there are a few different factors to consider. Generally, banks and credit unions don't limit the amount you can deposit into a CD. However, it's crucial to understand that the FDIC (Federal Deposit Insurance Corporation) only insures up to $250,000 per depositor, per insured bank, for each account ownership category. This means that while you can put a substantial amount in a CD, being mindful of the insurance limit can help safeguard your investment. Essentially, the amount of money you put in a CD should align with your broader financial strategy and shouldn't jeopardize your liquidity needs. Standard CDs are the most common type you'll encounter. These have terms that range from a few months to several years, with penalties for early withdrawal. Their versatility makes them a good option for a range of investment needs, from short-term savings goals to longer-term financial planning. As mentioned earlier, there's technically no maximum limit to the amount you can put in a standard CD, but anything above the FDIC or NCUA insurance limit won't be insured. Jumbo CDs, which require a higher minimum deposit—often $100,000 or more, cater to individuals who can afford to invest larger sums. These CDs often provide slightly higher interest rates, making them attractive to investors looking to maximize their return. As with standard CDs, there's no maximum limit, but keep in mind that deposits over the insurance limit won't be covered. Brokered CDs are purchased through a brokerage rather than directly from a bank. They provide greater flexibility in terms of rates and terms and can be an excellent choice for savvy investors who are willing to shop around for the best deals. Once again, while there are no set maximums, the standard insurance limits apply, ensuring that you can invest confidently. The interest on a CD is compounded, which means you earn interest on the interest. Over time, this compounding effect can substantially boost your total return, especially with larger deposits. This makes CDs a great option if you're looking for a predictable income stream. Moreover, for Jumbo CDs, the interest rates are often higher, which can add to the overall growth of your investment. CDs offer a fixed return over a specified term, and the principal is insured up to the FDIC or NCUA limits. This means your investment is not only guaranteed to growg but it's also protected against any potential bank failures. This assurance makes CDs a reliable choice for risk-averse investors looking for a steady return. When you commit a large amount of money to a CD, that money is essentially locked away for the duration of the CD term. If you need to access your funds before the term ends, you'll likely face early withdrawal penalties. This can deter some people from CDs, especially those who might need their money for unexpected expenses. Therefore, ensuring you have sufficient liquid assets before investing in a CD is vital. Another risk of CDs, particularly those with longer terms, is inflation. If the inflation rate exceeds the interest rate on your CD, you may lose purchasing power over time. That's why it's important to carefully consider the term of your CD and how it fits into your overall financial strategy. Every investment decision comes with an opportunity cost. The money you put in a CD could be used elsewhere, potentially in investments with higher returns, like stocks or real estate. While CDs offer security, they often can't match the potential returns of riskier investments, so it's crucial to evaluate the trade-off. Before deciding how much to deposit in a CD, consider your financial goals and risk tolerance. The optimal amount for you depends on your specific needs and circumstances. A well-crafted financial plan can guide this decision and help ensure that your investment in a CD aligns with your broader financial objectives. The terms of the CD, including the interest rate, term length, and penalties for early withdrawal, are crucial factors to consider. Make sure you understand these details before making a deposit. If there's a chance you might need to access the money before the term ends, look for a CD that offers lower early withdrawal penalties. As the saying goes, "Don't put all your eggs in one basket." Spreading your money across different types of investments can help manage risk and potential returns. While it can be tempting to put a large sum in a CD due to the guaranteed return, diversification is a key principle of sound investing. Money Market Accounts (MMAs) are a type of savings account that offers higher interest rates and more liquidity than a CD. They're a great choice if you're looking for a flexible way to grow your savings without locking away your money. High-yield savings accounts offer higher interest rates than traditional savings accounts and have no set term. They're a good place to store emergency funds or money you might need in the short term. While their rates are often lower than those of CDs, their lack of a fixed term provides greater flexibility. If you're comfortable taking on a bit more risk, bonds and other fixed-income securities can be a good alternative. They typically offer higher returns than CDs and come in many varieties, from relatively safe government bonds to higher-risk corporate bonds. As always, be sure to do your research before investing. CDs are an excellent financial instrument for risk-averse investors seeking assured and stable returns. When deciding how much to deposit, remember to align your investment with your broader financial strategy and liquidity needs. Though CDs don't have a deposit limit, it's important to stay mindful of the FDIC or NCUA insurance limits to safeguard your investment. Consider the diverse types of CDs, such as Standard, Jumbo, and Brokered CDs, each offering unique advantages depending on your investment goals and the funds available. Though there may be potential drawbacks like liquidity concerns and inflation risk, a well-planned investment strategy can mitigate these challenges. Don't forget the golden rule of investing – diversification, which can further help manage risk. As a next step, consider reaching out to your bank or credit union to discuss your CD options, and start taking advantage of the predictable returns CDs offer to grow your savings today.Certificate of Deposit (CD) Overview

How Much Money Can You Put on a CD?

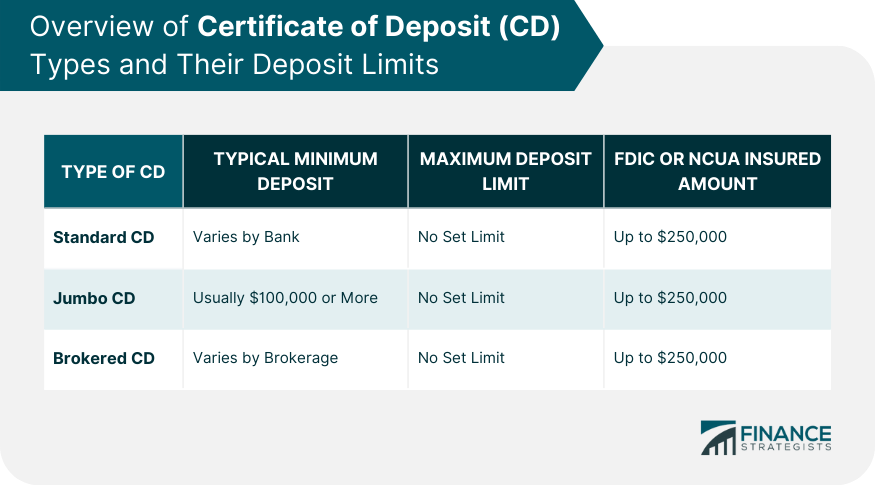

Types of CDs and Their Deposit Limits

Standard CDs

Jumbo CDs

Brokered CDs

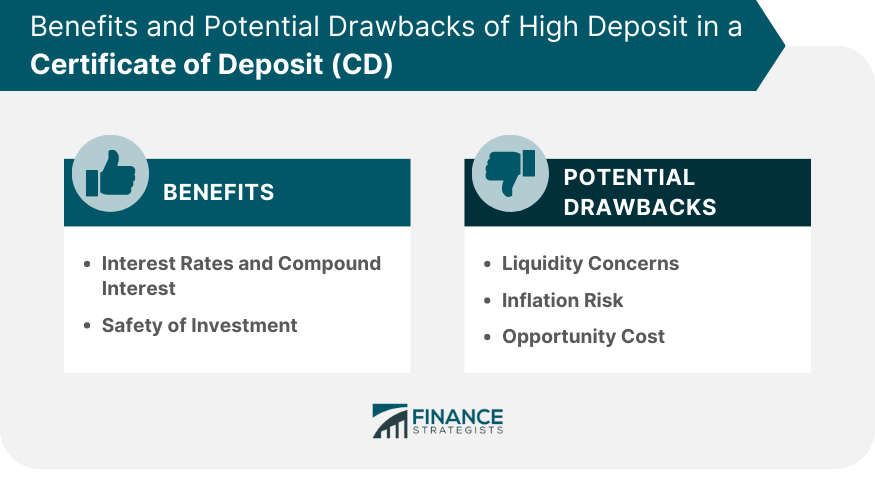

Benefits of High Deposit in a CD

Interest Rates and Compound Interest

Safety of Investment

Potential Drawbacks of High Deposit in a CD

Liquidity Concerns

Inflation Risk

Opportunity Cost

Guidelines on Choosing the Right Amount to Deposit in a CD

Assess Financial Goals and Risk Tolerance

Understand the CD Terms and Penalties

Utilize Diversification Strategies

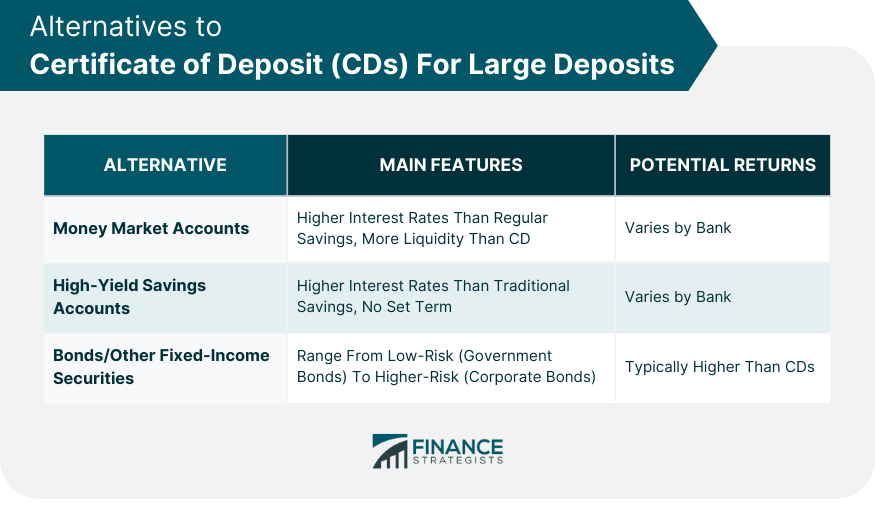

Exploring Alternatives to CDs for Large Deposits

Money Market Accounts

High-Yield Savings Accounts

Bonds and Other Fixed-Income Securities

Bottom Line

How Much Money Can You Put on a CD? FAQs

There's typically no limit to how much you can deposit in a CD, but deposits over $250,000 won't be fully insured by FDIC or NCUA.

High deposits in a CD earn more interest, thanks to compounding and possibly higher rates, especially in Jumbo CDs. Plus, they're a safe investment.

CDs lack liquidity, pose inflation risks, and present potential opportunity costs as your money could be used for potentially higher-return investments.

Assess your financial goals and risk tolerance, understand CD terms and penalties, and consider diversification strategies when deciding on the amount.

Alternatives include Money Market Accounts, High-Yield Savings Accounts, and other fixed-income securities like bonds. These options have varying returns and risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.