A Variable-Rate Certificate of Deposit (CD) is a financial product offered by banks and credit unions that combines features of a traditional CD and a savings account. It is a time deposit with a fixed maturity period, usually ranging from a few months to several years, during which the depositor agrees not to withdraw the funds. However, unlike a standard CD with a fixed interest rate, a variable-rate CD offers interest rates that can fluctuate over time based on market conditions and other factors. The purpose of a Variable-Rate CD is to provide depositors with the potential for higher returns compared to traditional CDs, especially during periods of rising interest rates. It is an attractive option for investors seeking some flexibility and protection against inflation, as it allows them to take advantage of increasing interest rates and adjust to changing market conditions. A Variable-Rate Certificate of Deposit (CD) operates differently from a Fixed-Rate CD in terms of interest rates and how they are determined. The interest rates on Variable-Rate CDs are not fixed for the entire term, unlike Fixed-Rate CDs. Instead, they are linked to an external benchmark or reference rate, which can be an interest rate determined by the broader market. Common benchmarks include the prime rate, the London Interbank Offered Rate (LIBOR), or the federal funds rate, among others. When the benchmark rate changes, the interest rate on the Variable-Rate CD is adjusted accordingly. For example, if the benchmark rate increases by a certain percentage, the interest rate on the CD will also increase by the same percentage. Financial institutions that offer Variable-Rate CDs typically set a margin or spread over the benchmark rate to determine the final interest rate paid to depositors. The margin represents the additional interest rate that the CD earns above the benchmark rate. This spread is determined by the bank or credit union and can vary from one institution to another. For instance, if the benchmark rate is 3% and the bank sets a margin of 1%, the final interest rate on the Variable-Rate CD would be 4% (3% benchmark rate + 1% margin). The frequency and conditions for rate changes in a Variable-Rate CD depend on the specific CD product and the financial institution offering it. Some CDs may have periodic rate adjustments, such as monthly, quarterly, or annually. In these cases, the interest rate will change at regular intervals based on changes in the benchmark rate. Other Variable-Rate CDs may adjust rates in response to significant changes in the benchmark rate. For example, if the benchmark rate experiences a sharp increase or decrease beyond a certain threshold, the interest rate on the CD may be adjusted immediately to reflect the new benchmark rate. The performance of a Variable-Rate CD is closely linked to changes in market interest rates. When the benchmark rate increases, the interest rate on the CD will also rise, potentially leading to higher returns for the depositor. This feature can be advantageous during periods of rising interest rates, as investors can benefit from higher yields on their deposits. However, in a falling interest rate environment, the interest rate on the CD will decrease, resulting in potentially lower returns for depositors. This is a risk associated with Variable-Rate CDs, as the interest earned is not guaranteed and may fluctuate over time. One of the main advantages of a variable-rate CD is its potential to offer higher returns than traditional fixed-rate CDs, especially when interest rates are rising. As market rates increase, the interest earned on the CD also rises, allowing depositors to capitalize on favorable economic conditions. Inflation can erode the purchasing power of money over time. A variable-rate CD can act as a hedge against inflation because the interest rate adjusts with changes in the market. If inflation rises, the interest rate on the CD is likely to increase, helping to maintain the real value of the investment. Variable-rate CDs provide investors with the flexibility to adapt to changing market conditions. Unlike fixed-rate CDs, which lock in a specific interest rate for the entire term, variable-rate CDs allow investors to benefit from potential interest rate increases during the CD's tenure. The variable nature of interest rates introduces uncertainty into the returns of a variable-rate CD. While there is potential for higher returns, there is also the risk of lower returns if market rates decrease. This uncertainty can make it challenging for investors to predict the future performance of their investment accurately. In periods of declining interest rates, variable-rate CDs may provide lower returns than fixed-rate CDs. If the benchmark rate decreases significantly, the interest rate on the CD will also decrease, potentially leading to reduced earnings for the depositor. Some variable-rate CDs may have frequent rate adjustments, which can be both an advantage and a disadvantage. While frequent adjustments allow investors to take advantage of short-term rate fluctuations, they can also lead to more complex financial planning and tracking of the investment's performance. The interest rates in the broader market can significantly impact the returns on a variable-rate CD. Unlike fixed-rate CDs, the interest rate on a variable-rate CD is not predetermined and can fluctuate based on changes in market interest rates. Therefore, it is crucial to consider the forecast for market interest rates before investing in a variable-rate CD. If interest rates are expected to rise in the near future, a variable-rate CD may be a suitable choice. As market rates increase, the interest earned on the CD may also rise, allowing investors to benefit from potentially higher returns. Conversely, if market interest rates are predicted to decline, a fixed-rate CD may be a more appropriate option. In a falling rate environment, the interest earned on a variable-rate CD may decrease over time, resulting in lower returns. The investment horizon refers to the length of time an investor plans to keep the funds in the CD before needing access to the money or reinvesting it elsewhere. If your investment horizon is short (e.g., a few months or a year), a variable-rate CD may not be the best choice. Short-term fluctuations in interest rates may not allow enough time for significant rate increases, reducing the potential for higher returns. In such cases, a fixed-rate CD or a high-yield savings account may be more suitable due to their stability and guaranteed returns. If you have a longer investment horizon (e.g., several years), a variable-rate CD may be more appealing. Over time, fluctuations in interest rates can lead to higher overall returns if rates rise, making the variable-rate CD potentially advantageous. Your financial goals and risk tolerance play a significant role in determining the most suitable investment option. If you seek a balance between potentially higher returns and some level of liquidity, a variable-rate CD could be an attractive choice. While the interest rate may vary, there is still an opportunity for increased earnings during periods of rising interest rates. On the other hand, if your primary concern is capital preservation and stable, predictable returns, fixed-rate CDs or other investment products may be more suitable. Fixed-rate CDs provide certainty in returns, making them ideal for risk-averse investors who prioritize capital preservation over maximizing returns. Fixed-rate CDs are time deposits offered by banks or credit unions with a predetermined interest rate for a fixed term. They provide stability and predictability in returns since the interest rate remains constant throughout the CD's term, regardless of changes in the broader market interest rates. This makes fixed-rate CDs ideal for risk-averse investors who prioritize capital preservation and a guaranteed return on their investment. However, the downside is that if interest rates rise significantly during the CD's term, the investor may miss out on potentially higher returns that they could have earned with other investment options. Savings accounts are deposit accounts held at banks and credit unions, offering liquidity and safety for the deposited funds. They provide variable interest rates, which means that the interest rate can fluctuate over time based on changes in market conditions and the decisions of the financial institution. While savings accounts offer easy access to funds, they usually offer lower interest rates compared to fixed-rate CDs. Savings accounts are suitable for individuals who prioritize liquidity and need quick access to their money for emergencies or regular expenses but are willing to accept lower returns in exchange for that liquidity. Bonds and securities are debt instruments issued by governments, municipalities, corporations, or other entities to raise capital. They can offer higher yields than both fixed-rate CDs and savings accounts, but they also come with varying levels of risk and maturities. Bonds are typically considered safer investments compared to stocks since they have a fixed interest rate and maturity date, and the issuer is obligated to repay the principal upon maturity. However, there is still some risk associated with bonds, especially with corporate bonds, as the issuer's ability to repay the debt depends on their financial health. Securities, on the other hand, are financial instruments representing ownership in a company (e.g., stocks). They are riskier than bonds but offer the potential for higher returns over the long term. A Variable-Rate Certificate of Deposit (CD) is a hybrid financial product combining features of traditional CDs and savings accounts. It has a fixed maturity period, but its interest rate can fluctuate based on market conditions. Variable-Rate CDs offer potential for higher returns, making them attractive during rising interest rates, and they act as a hedge against inflation. However, uncertainty in returns and potential lower returns during declining interest rate environments are drawbacks. Investors with short-term horizons may prefer fixed-rate CDs or high-yield savings accounts for stability, while long-term investors could benefit from potential interest rate increases. Financial goals and risk tolerance are crucial considerations. Comparing Variable-Rate CDs to other investments, they offer more flexibility than fixed-rate CDs and savings accounts but come with varying risk levels compared to bonds and securities.What Is a Variable-Rate Certificate of Deposit?

Definition

Purpose and Importance

How a Variable-Rate Certificate of Deposit Works

Basis of Variable Interest Rates

Margin or Spread Over Benchmark Rate

Conditions for Rate Changes

Interaction With Market Interest Rates

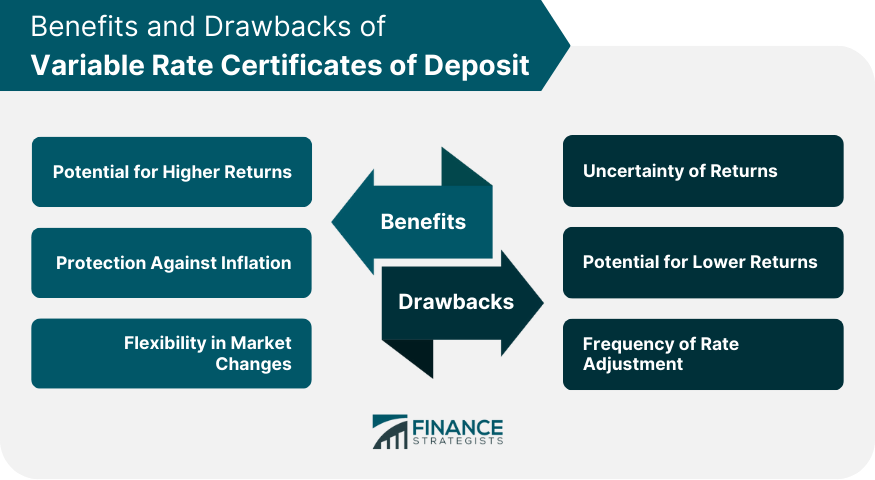

Benefits of a Variable-Rate Certificate of Deposit

Potential for Higher Returns

Protection Against Inflation

Flexibility in Market Changes

Drawbacks of a Variable-Rate Certificate of Deposit

Uncertainty of Returns

Potential for Lower Returns

Frequency of Rate Adjustment

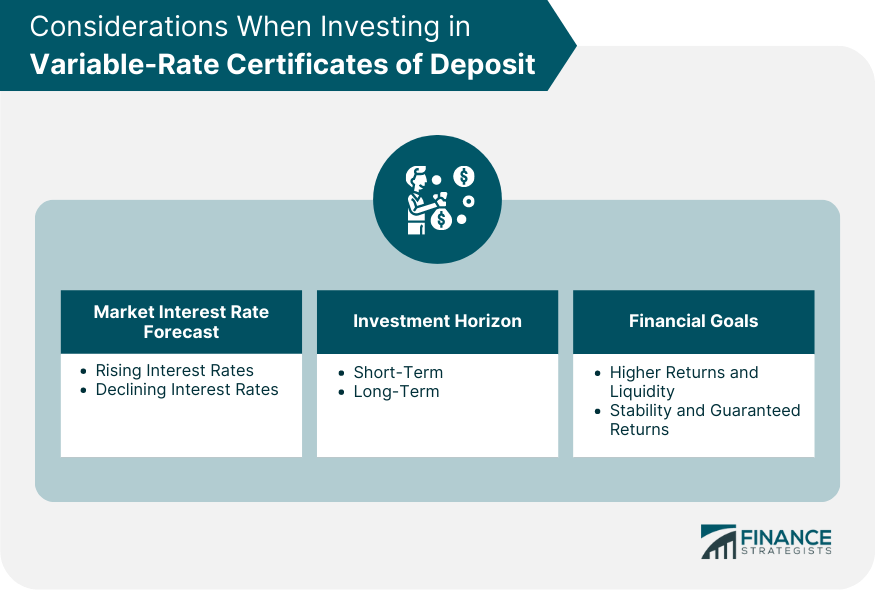

Considerations When Investing in Variable-Rate Certificates of Deposit

Market Interest Rate Forecast

Rising Interest Rates

Declining Interest Rates

Investment Horizon

Short-Term

Long-Term

Financial Goals

Higher Returns and Liquidity

Stability and Guaranteed Returns

Comparing Variable-Rate Certificates of Deposit With Other Investment Options

Fixed-Rate Certificates of Deposit

Savings Accounts

Bonds and Securities

Conclusion

Variable-Rate Certificate of Deposit FAQs

A Variable-Rate Certificate of Deposit (CD) is a financial product offered by banks and credit unions that combines features of a traditional CD and a savings account. It has a fixed maturity period, but its interest rate can fluctuate based on market conditions.

Unlike fixed-rate CDs, the interest rates on Variable-Rate CDs are not fixed for the entire term. They are linked to external benchmarks like the prime rate or LIBOR. When the benchmark rate changes, the CD's interest rate is adjusted accordingly.

A Variable-Rate CD offers potential for higher returns, making it attractive during rising interest rates. It also acts as a hedge against inflation, as the interest rate adjusts with market changes, maintaining the investment's real value.

Yes, Variable-Rate CDs come with uncertainty in returns, as the interest rate is not fixed. Additionally, during declining interest rate environments, they may provide lower returns compared to fixed-rate CDs.

Consider your investment horizon, financial goals, and risk tolerance. If you seek higher returns and flexibility in market changes, a Variable-Rate CD may be suitable. However, if you prioritize stability and guaranteed returns, fixed-rate CDs or other options may be better.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.