A Callable CD, or Callable Certificate of Deposit, is a unique financial instrument offered by banks. Unlike a traditional CD where the interest rate and term are fixed until maturity, a Callable CD provides the issuing bank the option to "call" or terminate the CD before its maturity date. This typically happens when market interest rates fall below the CD's rate. In such scenarios, the bank can return the investor's principal and the accrued interest up to that point. In return for this flexibility granted to the bank, Callable CDs usually offer a slightly higher interest rate compared to standard CDs. However, they pose a reinvestment risk for investors, as they might have to reinvest the returned amount at potentially lower prevailing rates. It's crucial for investors to weigh the benefits against the risks before opting for a Callable CD. Every Callable CD comes with a call protection period - a set time during which the bank cannot choose to "call" the CD. This period is clearly defined at the outset, allowing you to plan your investment accordingly. Post the call protection period, the bank retains the right to "call" the CD, essentially meaning they can terminate the CD before its maturity. This usually happens when market interest rates fall, and the bank can reissue CDs at lower rates. Callable CDs often come with higher initial interest rates as compared to regular CDs. This is an incentive for investors to compensate for the call risk involved. As mentioned above, the interest rates offered on Callable CDs are often higher initially than their non-callable counterparts. This can be an attractive proposition for investors looking for higher returns. Callable CDs can serve as a valuable addition to a diversified investment portfolio. They can provide an income stream that may be higher than standard CDs, while the call feature can add a unique dynamic to your investment strategy. If you're an investor who can handle fluctuations in your investment portfolio, Callable CDs can be an attractive option. While the CD can be called at any time after the call protection period, the potentially higher returns can often justify the added risk. The primary risk with Callable CDs is the CD being called before it reaches maturity. When interest rates fall, the bank may decide to call the CD and reissue new CDs at a lower rate. This could leave you with cash that you now need to reinvest at these new lower rates. Reinvestment risk arises from having to reinvest the principal and earned interest in a less favorable investment climate. If your CD is called during a period of falling interest rates, you may find yourself having to settle for lower-return investments. Interest rates are a double-edged sword with Callable CDs. While higher initial rates make them attractive, falling rates may lead to the CD being called. It's essential to monitor interest rate trends if you're considering investing in Callable CDs. As mentioned before, Callable CDs usually offer a higher initial interest rate than regular CDs. However, regular CDs carry lower risk as the interest rate is fixed for the term, providing stability. Regular CDs offer more control to the investor as the bank cannot terminate them before their maturity date. Callable CDs, however, may be called by the bank after the call protection period. In the long term, Callable CDs carry more uncertainty due to the call feature. On the other hand, regular CDs can offer a predictable and stable income source for investors. Market interest rates play a significant role in influencing whether a CD will be called. If interest rates drop, it becomes financially beneficial for the bank to call the CD and reissue at the lower rate. The bank's liquidity needs and overall financial strategy can also influence whether a CD is called. If the bank has enough liquidity, it might not call the CD, even in a falling interest rate environment. Broader economic conditions, such as economic recessions or booms, can also impact the decision to call a CD. Banks closely monitor these conditions to make financially sound decisions. Before investing in a Callable CD, it's essential to assess your financial goals and risk tolerance. Callable CDs may not be suitable for conservative investors who prefer stable returns. Spreading your investments across various asset classes can help manage risk. You can consider investing a part of your portfolio in Callable CDs, thus benefiting from potentially higher returns without exposing your entire portfolio to risk. Keep a close eye on the terms and conditions of your Callable CD. Stay updated with the call protection period and the prevailing market conditions to make informed decisions. The digital banking revolution has made it easier for investors to access and manage Callable CDs. With online banking, you can track your investments in real-time, allowing for more proactive management. Competition among financial institutions is driving innovation in the CD market. This includes creating new CD products and features that could benefit investors. In response to the evolving needs of investors and market dynamics, financial institutions are continuously modifying their CD offerings. This includes adjusting the terms of Callable CDs and potentially offering higher interest rates to attract investors. Callable CDs, with their unique features, offer a distinct advantage in the form of higher initial interest rates. However, they come with inherent risks, most notably the potential of the bank terminating the CD prior to maturity. Their attractiveness primarily hinges on prevailing market interest rates and the financial strategies of banks. While they can be a valuable addition to a diversified portfolio, especially for investors willing to embrace some level of volatility, it's crucial to be aware of the reinvestment risks and the influence of external economic factors. In today's rapidly evolving digital banking landscape, where competition drives constant innovation, staying informed and actively monitoring your investment is more important than ever. As with any financial instrument, understanding the nuances of Callable CDs is vital to leveraging their benefits while mitigating potential pitfalls.Callable CD Overview

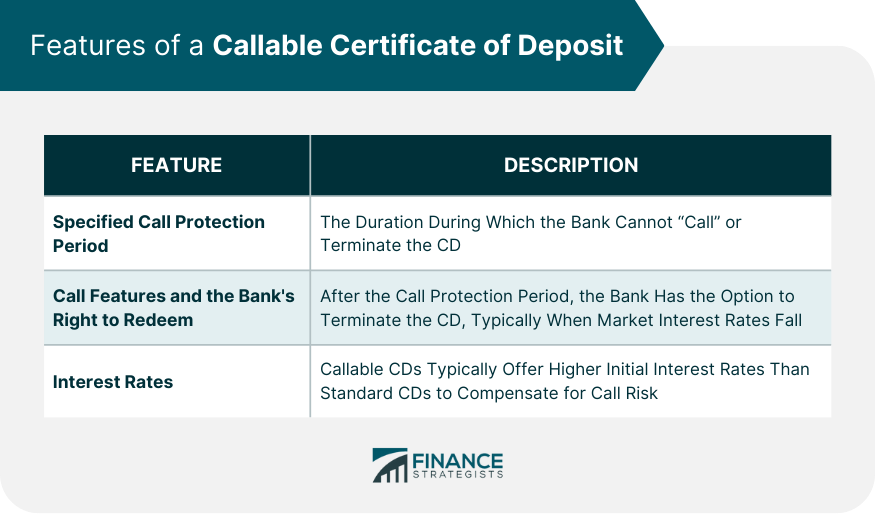

Features of a Callable CD

Specified Call Protection Period

Call Features and the Bank's Right to Redeem

Interest Rates and How They Might Be Higher Initially

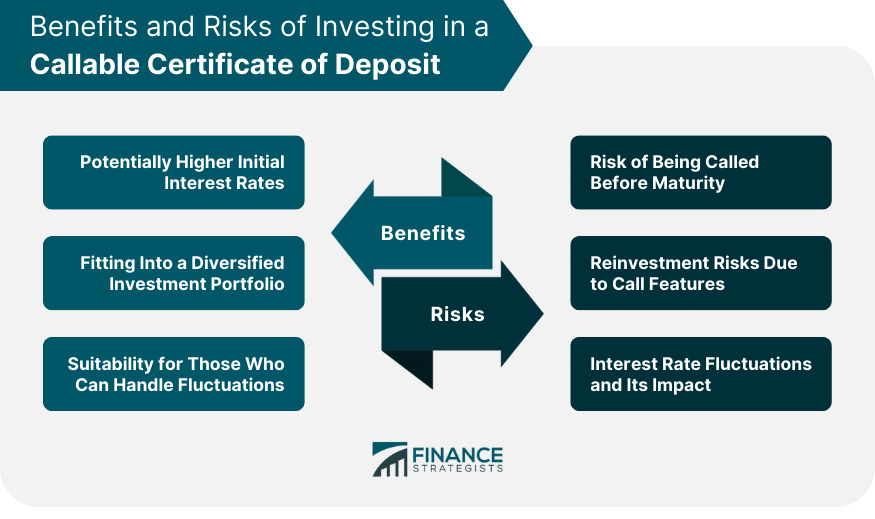

Benefits of Investing in a Callable CD

Potentially Higher Initial Interest Rates

Fitting Into a Diversified Investment Portfolio

Suitability for Those Who Can Handle Fluctuations

Risks Associated With Callable CDs

Risk of Being Called Before Maturity

Reinvestment Risks Due to Call Features

Interest Rate Fluctuations and Its Impact

Callable CD vs Regular CD: Comparative Analysis

Interest Rate Comparison

Flexibility and Control for the Investor

Long-Term Implications of Both

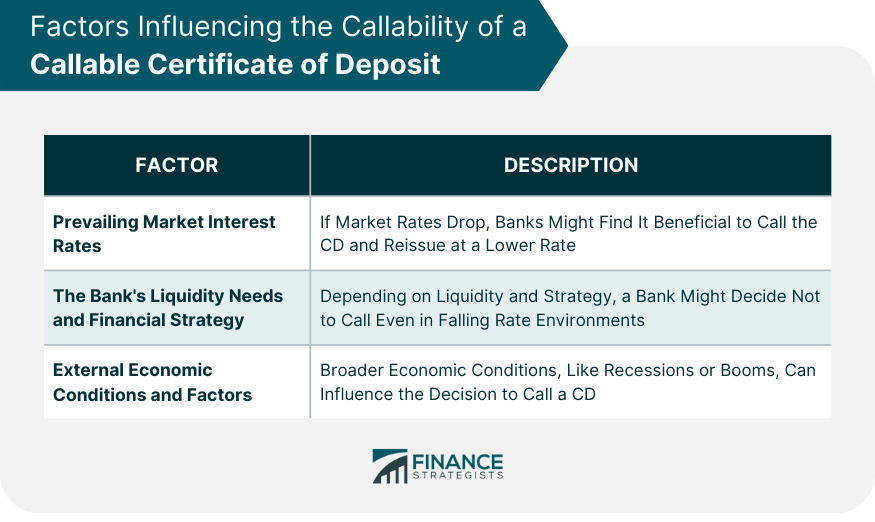

Factors Influencing the Callability of a Callable CD

Prevailing Market Interest Rates

Bank's Liquidity Needs and Financial Strategy

External Economic Conditions and Factors

Tips for Investors Considering Callable CDs

Assess Financial Goals and Risk Tolerance

Diversify Investments

Regularly Monitoring Callable CD Terms and Conditions

Callable CD in Modern Banking Landscape

Digital Banking and Its Impact on Callable CDs

Trends and Innovations in the CD Market

How Financial Institutions are Adapting

Conclusion

Callable CD FAQs

A Callable CD is a type of Certificate of Deposit that allows the issuing bank the right to "call" or terminate the CD after a specified call protection period, returning the investor's principal along with accrued interest.

A Callable CD typically offers a higher initial interest rate than a regular CD to compensate for the potential risk of the CD being called early by the bank.

Banks might decide to "call" a Callable CD, especially when market interest rates fall. By doing this, they can return the principal to the investor and then reissue new CDs at the now-lower rates.

The primary risks with a Callable CD include the possibility of the CD being called before its maturity and the associated reinvestment risks, which arise if you have to reinvest at lower interest rates.

To manage risks with a Callable CD, consider assessing your financial goals and risk tolerance, diversifying your investments, and regularly monitoring the terms and conditions of your Callable CD along with prevailing market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.