The concept of a 'value change' in the financial world refers to a shift in the worth of an investment, asset, or portfolio over time. This change can be positive, resulting in an increase in value, or negative, leading to a decrease in value. These value changes occur due to a myriad of factors and are an inherent part of investing. Understanding and managing value change is a fundamental aspect of wealth management and financial planning. Value change plays a critical role in the financial landscape, influencing decisions and strategies of both individual investors and financial institutions. It directly impacts the returns on investment and forms the bedrock of profit-making endeavors in the market. Moreover, the consideration of value change is vital in portfolio management, risk assessment, asset allocation, and in devising investment strategies. Recognizing the forces causing these changes helps in better financial planning and wealth preservation. Value change is inextricably tied to economic conditions, both on a macro and micro level. Elements like economic growth rates, interest rates, inflation, unemployment figures, consumer spending, and business sentiment can cause values to fluctuate. Understanding how these elements influence asset values can assist investors in making more informed decisions and potentially forecast shifts in value. Prevailing market trends, both long-term and short-term, can cause substantial changes in asset values. Trends might be influenced by shifts in industry patterns, changes in consumer behavior, or broader economic cycles. These trends can offer valuable insights, guiding investors towards potentially profitable investments or away from declining sectors. Technological advancements can disrupt existing market dynamics, leading to considerable changes in asset values. Innovations can transform industries, alter consumer behavior, and reshape economic landscapes. Investors attuned to technological developments can potentially spot opportunities for value growth and anticipate industry shifts. Demographic changes, such as population growth, aging populations, or shifts in societal norms and behaviors, can impact asset values. These changes can alter demand for different goods and services, affecting companies' profitability and, consequently, investment values. Understanding demographic trends can assist in predicting future market demand and identifying sectors poised for growth. Regulatory changes can have significant implications on asset values. New laws or regulations can alter the operating environment for businesses, influencing profitability and growth prospects. Staying informed about regulatory changes can help investors anticipate potential impacts on their investment values. Diversification, or spreading investments across various assets, sectors, or regions, is a common strategy for managing value change. By investing in a variety of areas, the impact of a value decrease in one asset can be offset by gains in others. Active portfolio management involves regularly reviewing and adjusting your investment portfolio to respond to value changes. This may include buying or selling assets, rebalancing your portfolio, or adjusting your investment strategy based on changes in the market. Risk management techniques are fundamental to managing value change. This can involve setting stop-loss orders to limit potential losses, hedging against risk with derivatives, or investing in safe-haven assets during periods of market uncertainty. Market timing involves making investment decisions based on predictions about future market movements. While this strategy is risky and often discouraged, some investors attempt to manage value change by buying or selling assets based on their forecasts. Asset allocation is a strategy that involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The asset allocation that works best for you at any given point in your life will depend largely on your tolerance for risk and your investment timeline. The ability to effectively manage value change can play a critical role in the preservation of wealth. By anticipating and responding to changes in asset values, investors can mitigate losses and protect their capital. Effective management of value change can also present capital growth opportunities. By identifying and capitalizing on value increases, investors can grow their capital and increase their wealth. Market volatility can cause significant fluctuations in asset values. However, with effective management strategies, investors can mitigate the impact of volatility and ensure more stable returns. Effective management of value change can lead to enhanced portfolio performance. By identifying trends, managing risks, and capitalizing on opportunities, investors can improve their returns and achieve their financial goals. Managing value change can be challenging due to market uncertainty and volatility. Markets can be unpredictable, with values influenced by a wide array of factors, many of which are beyond the control of investors. Despite the myriad tools and strategies available to investors, predicting value change can still be a difficult endeavor. Market movements can often defy expectations, leading to unforeseen losses. Investing often involves making difficult decisions under uncertainty. This can lead to emotional decision-making, which can negatively impact investment outcomes. In today's digital age, investors are often faced with an overload of information. Sorting through this information to identify relevant insights can be a daunting task, making it more difficult to effectively manage value change. Fundamental analysis involves examining a company's financials, industry position, and market conditions to assess its intrinsic value. This can help investors anticipate potential changes in the company's stock value. Technical analysis involves analyzing statistical trends gathered from trading activity, such as price movement and volume. It utilizes various charts and statistical measures to forecast price changes. Quantitative models use mathematical and statistical modeling to forecast changes in asset values. These models can be complex and require a strong understanding of financial mathematics. Market research and analysis involve studying market trends, economic conditions, and industry developments to forecast value changes. This can involve a wide range of techniques, from reviewing financial news to conducting detailed industry analysis. Financial technology solutions, such as robo-advisors and automated trading systems, can help investors monitor and manage value change. These technologies can provide real-time tracking of portfolio values, automate trading activities, and offer advanced analytics for better decision-making. Value change refers to the shift in the worth of an investment, asset, or a portfolio over time. It plays a vital role in the financial landscape and has a direct impact on returns from investments. Numerous strategies and tools can help manage value change effectively. Diversification, active portfolio management, and risk management are some of the key strategies. Tools such as fundamental and technical analysis, as well as financial technology solutions, can also aid in monitoring and managing value changes. Managing value change is a crucial aspect of wealth management. It helps preserve wealth, provides capital growth opportunities, and enhances portfolio performance. By understanding and effectively managing value change, investors can navigate the financial markets with greater confidence and success.What Is a Value Change?

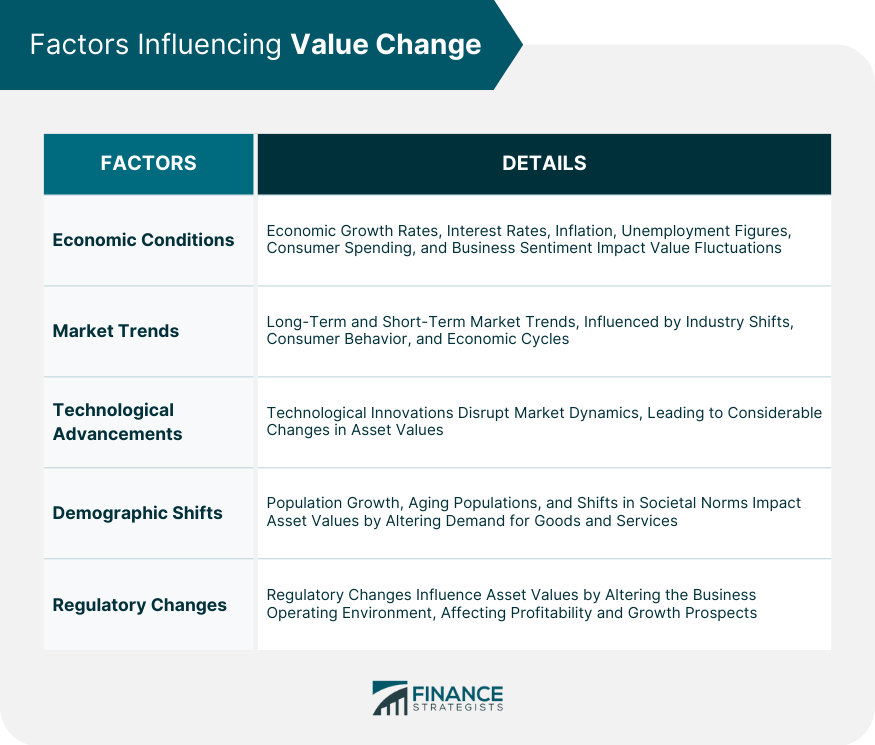

Factors Influencing Value Change

Economic Conditions

Market Trends

Technological Advancements

Demographic Shifts

Regulatory Changes

Strategies for Managing Value Change

Diversification of Investments

Active Portfolio Management

Risk Management Techniques

Market Timing

Asset Allocation

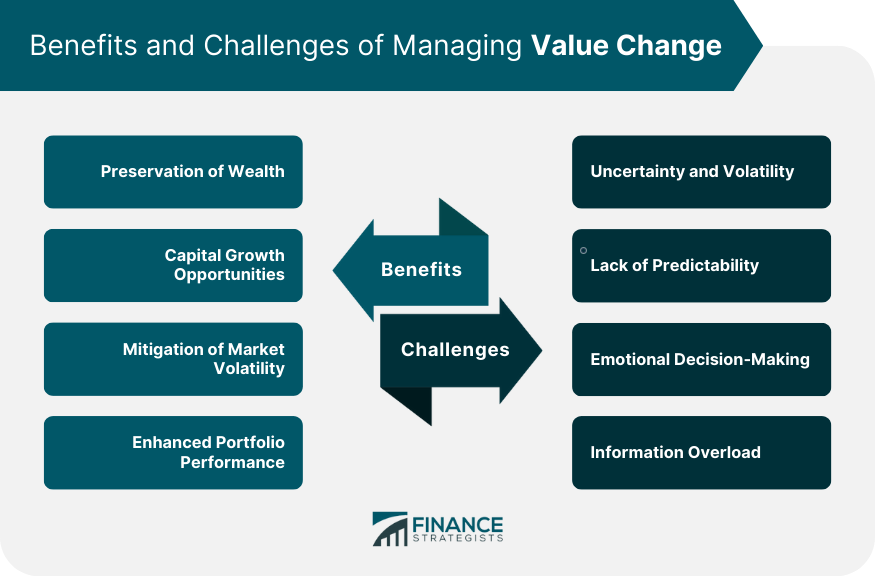

Benefits of Effectively Managing Value Change

Preservation of Wealth

Capital Growth Opportunities

Mitigation of Market Volatility

Enhanced Portfolio Performance

Challenges in Managing Value Change

Uncertainty and Volatility

Lack of Predictability

Emotional Decision-Making

Information Overload

Tools and Techniques for Monitoring Value Change

Fundamental Analysis

Technical Analysis

Quantitative Models

Market Research and Analysis

Financial Technology Solutions

Final Thoughts

Value Change FAQs

Value change refers to the fluctuation in the worth of an investment, asset, or a portfolio over a period of time.

Value change is influenced by a variety of factors including economic conditions, market trends, technological advancements, demographic shifts, and regulatory changes.

Some strategies for managing value change include diversification of investments, active portfolio management, use of risk management techniques, market timing, and asset allocation.

Effectively managing value change can lead to the preservation of wealth, provide capital growth opportunities, mitigate the effects of market volatility, and enhance overall portfolio performance.

Managing value change can be challenging due to market uncertainty and volatility, lack of predictability, the tendency for emotional decision-making, and information overload.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.