Portfolio performance evaluation is an essential aspect of the investment process that allows investors and portfolio managers to assess the effectiveness of their investment strategies. The main goal of performance evaluation is to determine whether the chosen investment strategy is achieving the desired risk and return objectives. A crucial part of evaluating portfolio performance is assessing the level of risk taken by the investor. This can be done by examining the volatility of the portfolio, measured by the standard deviation or other risk metrics, as well as the correlation of the portfolio's returns with the broader market. Return assessment involves analyzing the returns generated by the portfolio over a specific period. This can include measures such as absolute returns, relative returns compared to a benchmark, or even risk-adjusted returns that take into account the level of risk taken to achieve the given returns. Risk-adjusted performance metrics allow investors to evaluate the effectiveness of a portfolio by considering both the returns generated and the level of risk taken to achieve those returns. This is important as it helps determine whether a portfolio is generating sufficient returns for the level of risk taken. Attribution analysis seeks to identify the sources of a portfolio's performance, such as sector allocation, security selection, and interaction effects. This information can help investors and portfolio managers make more informed decisions about their investment strategies. Comparing a portfolio's performance to a relevant benchmark is a common practice in performance evaluation. This allows investors to determine whether the portfolio is outperforming or underperforming the market or its peers, providing valuable insight into the effectiveness of the investment strategy. Total return is a measure of the total gain or loss of a portfolio over a specific period, expressed as a percentage of the initial investment. It includes both capital gains and any income generated, such as dividends or interest. CAGR is a measure of the average annual growth rate of a portfolio over a specific period. It is a useful metric for comparing the performance of different investments, as it smooths out the effects of short-term fluctuations and provides a standardized measure of growth. The Sharpe ratio measures the excess return per unit of risk taken by a portfolio. A higher Sharpe ratio indicates a better risk-adjusted performance, as it shows that the portfolio is generating higher returns for each unit of risk taken. The Sortino ratio is similar to the Sharpe ratio but focuses only on downside risk or the risk of negative returns. This makes it a more appropriate measure for investors who are particularly concerned about the potential for losses. The Treynor ratio measures the excess return per unit of systematic risk taken by a portfolio, as measured by its beta. A higher Treynor ratio indicates that a portfolio is generating higher returns for each unit of market risk taken. Jensen's alpha measures the excess return of a portfolio above what would be expected given its level of market risk, as measured by its beta. A positive Jensen's alpha indicates that a portfolio is outperforming its expected return, while a negative alpha indicates underperformance. Sector allocation refers to the impact of a portfolio's allocation to different sectors on its performance. By analyzing this factor, investors can determine whether their investment decisions in certain sectors contributed positively or negatively to the overall performance. Security selection refers to the impact of individual security selection within a sector on a portfolio's performance. Analyzing this factor allows investors to determine if their choices of specific securities contributed positively or negatively to the overall performance. The interaction effect is the combined impact of sector allocation and security selection on portfolio performance. Understanding this effect can help investors identify whether their investment decisions resulted in a synergy that enhanced overall performance. Choosing an appropriate benchmark is crucial for meaningful performance evaluation. An accurate benchmark should have similar risk characteristics and investment objectives as the portfolio being evaluated to provide a fair comparison. Market indices, such as the S&P 500 or the NASDAQ, are common benchmarks used for evaluating portfolio performance. These indices represent broad market performance and can be useful for comparing the performance of a portfolio to the overall market. Peer group comparisons involve comparing a portfolio's performance to that of similar portfolios or investment funds. This method can help investors gauge the effectiveness of their portfolio manager relative to other managers with similar investment strategies. Custom benchmarks are created to match the specific risk and return characteristics of a portfolio. They can be particularly useful for evaluating the performance of portfolios with unique investment objectives or strategies that may not be well-represented by market indices or peer groups. Benchmark comparisons are not without their limitations. Issues such as data quality, benchmark selection bias, and the risk of overemphasis on short-term performance can impact the validity of benchmark comparisons. Accurate and reliable data is essential for effective performance evaluation. Ensuring that all data, such as prices, returns, and risk metrics, is up-to-date and accurate can help avoid erroneous conclusions. Determining the appropriate frequency for performance evaluations depends on factors such as investment objectives, time horizon, and market conditions. Regular evaluations can help investors stay informed and make necessary adjustments to their investment strategies. The evaluation period should be long enough to capture a representative sample of the portfolio's performance. This can help minimize the impact of short-term fluctuations and provide a more accurate assessment of the investment strategy's effectiveness. Investment fees and taxes can significantly impact portfolio performance. It is essential to consider these factors when evaluating performance to obtain a clear understanding of the net returns generated by the portfolio. Numerous software and platforms are available to assist investors and portfolio managers in evaluating portfolio performance. These tools can help automate the process, provide advanced analytics, and generate detailed reports. Portfolio analytics involves using various quantitative techniques to analyze the risk and return characteristics of a portfolio. These techniques can include optimization, stress testing, and scenario analysis, among others. Effective reporting and visualization can help investors and portfolio managers better understand and communicate their portfolio's performance. Tools such as charts, graphs, and tables can help illustrate complex data in a more digestible format. Performance evaluation can help investors identify the strengths and weaknesses of their investment strategies. This information can be used to make adjustments to improve performance or reduce risk. Regular performance evaluations can help investors and portfolio managers refine their investment strategies by identifying areas that require improvement or adjustment based on market conditions and individual objectives. For investors who use professional portfolio managers, performance evaluations can be an essential tool for monitoring the manager's effectiveness and ensuring that they are adhering to the agreed-upon investment strategy. Portfolio performance evaluation is a critical aspect of the investment process that helps investors and portfolio managers make informed decisions and optimize their strategies. By assessing risk, return, and risk-adjusted performance, investors can identify the strengths and weaknesses of their investment approaches and make necessary adjustments. Regular evaluations also help investors monitor their portfolio managers' performance and maintain confidence in their investment decisions. Incorporating a wide range of performance metrics, appropriate benchmarks, and advanced tools can provide a more accurate and comprehensive evaluation. However, it is essential to consider practical factors such as data accuracy, evaluation frequency, and the impact of fees and taxes to ensure a true representation of a portfolio's performance. As markets and investment objectives evolve, performance evaluation methodologies must adapt to provide meaningful insights. Ultimately, regular and thorough portfolio performance evaluations can lead to better investment decisions and improved investor confidence and trust.Definition of Portfolio Performance Evaluation

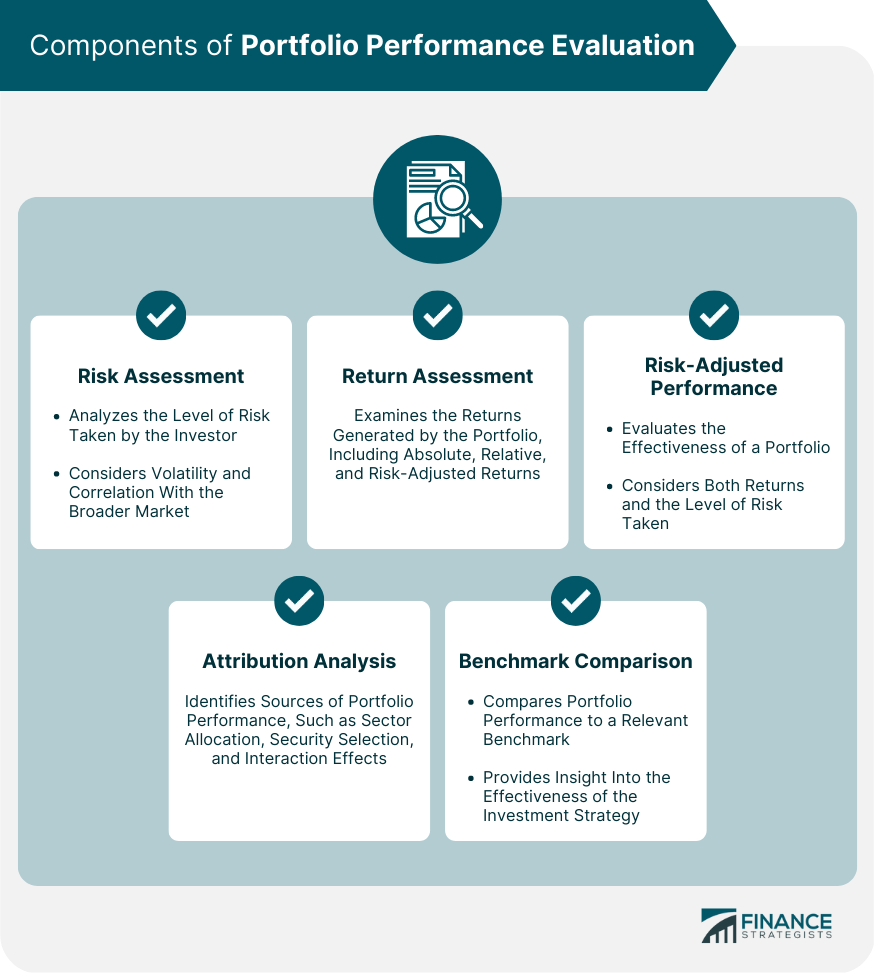

Components of Portfolio Performance Evaluation

Risk Assessment

Return Assessment

Risk-Adjusted Performance

Attribution Analysis

Benchmark Comparison

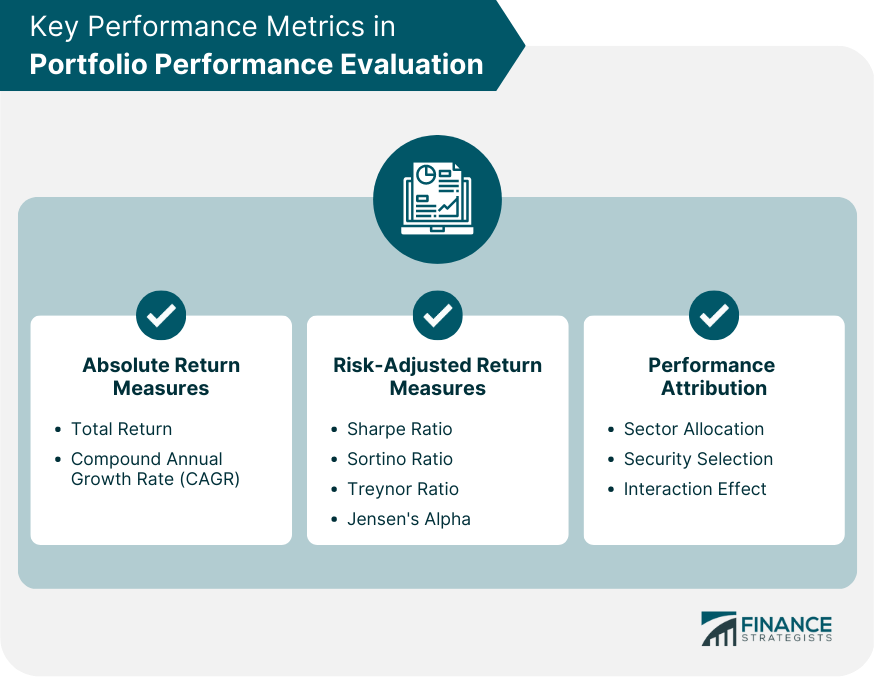

Key Performance Metrics

Absolute Return Measures

Total Return

Compound Annual Growth Rate (CAGR)

Risk-Adjusted Return Measures

Sharpe Ratio

Sortino Ratio

Treynor Ratio

Jensen's Alpha

Performance Attribution

Sector Allocation

Security Selection

Interaction Effect

Benchmark Selection and Comparison

Importance of Appropriate Benchmark Selection

Types of Benchmarks

Market Indices

Peer Group Comparisons

Custom Benchmarks

Limitations of Benchmark Comparisons

Practical Considerations in Portfolio Performance Evaluation

Data Accuracy and Quality

Frequency of Evaluation

Evaluation Period

Impact of Fees and Taxes

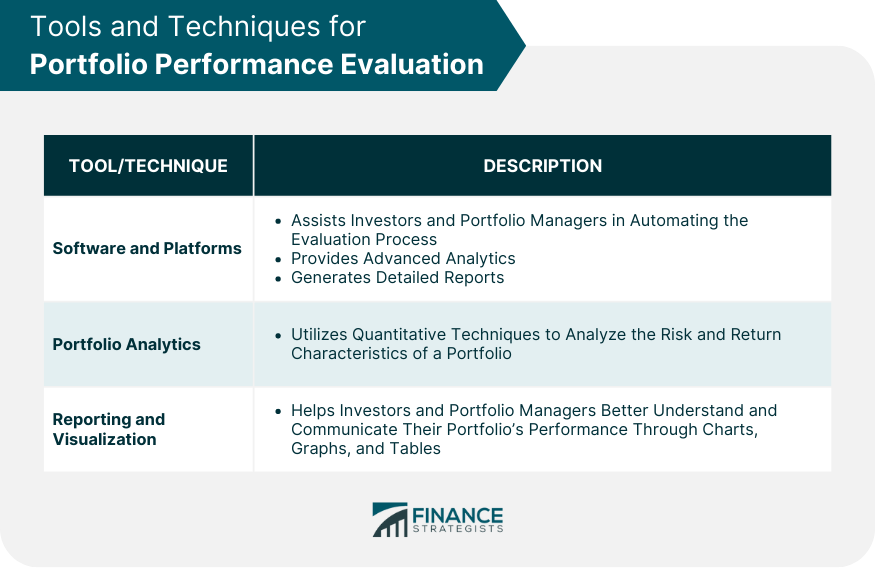

Tools and Techniques for Portfolio Performance Evaluation

Software and Platforms

Portfolio Analytics

Reporting and Visualization

Roles of Performance Evaluation in Investment Decisions

Identifying Strengths and Weaknesses

Improving Investment Strategy

Monitoring Manager Performance

Conclusion

Portfolio Performance Evaluation FAQs

Portfolio performance evaluation is a critical process that helps investors and portfolio managers assess the effectiveness of their investment strategies by analyzing risk, return, and risk-adjusted performance. It allows them to identify strengths and weaknesses, make necessary adjustments, and ensure they are meeting their investment objectives.

Some common key performance metrics used in portfolio performance evaluation include absolute return measures such as total return and compound annual growth rate (CAGR), risk-adjusted return measures like Sharpe ratio, Sortino ratio, Treynor ratio, and Jensen's alpha, and performance attribution metrics, which analyze sector allocation, security selection, and interaction effects.

Selecting an appropriate benchmark is crucial for a meaningful performance evaluation. Investors should choose a benchmark with similar risk characteristics and investment objectives as their portfolio. Common types of benchmarks include market indices, peer group comparisons, and custom benchmarks tailored to match the specific risk and return characteristics of the portfolio.

Practical considerations during portfolio performance evaluation include ensuring data accuracy and quality, determining the appropriate frequency and period for evaluations, and considering the impact of fees and taxes on the portfolio's performance. These factors can help provide a more accurate and representative assessment of the investment strategy's effectiveness.

Portfolio performance evaluation tools and techniques, such as software and platforms, portfolio analytics, and reporting and visualization, can help automate the evaluation process, provide advanced analytics, and generate detailed reports. These tools can assist investors in better understanding their portfolio's performance, identifying areas for improvement, and making informed decisions to optimize their investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.