Risk-neutral refers to an individual's or entity's indifference to risk when making investment decisions. Unlike risk-averse or risk-seeking individuals who prefer safer or riskier options, respectively, risk-neutral entities focus mainly on potential returns, irrespective of the risk involved. This concept significantly simplifies financial modeling, derivative pricing, and decision-making processes by assuming all investors are risk-neutral. Within this framework, the allure of high returns from high-risk investments is considered equal to the certainty of smaller gains from low-risk ones, as long as the expected returns are the same. While risk neutrality is a cornerstone of many theoretical financial models and economic assumptions, it may not accurately reflect real-world investment behavior, which can be heavily influenced by psychological factors and individual risk tolerances. Risk neutral valuation is a method used to price financial derivatives and make investment decisions in the context of uncertainty. The fundamental principle behind risk neutral valuation is the assumption that the expected return on a financial instrument should be equivalent to the risk-free rate of return. This principle is grounded in the assumption of risk neutral, where the risk or uncertainty of future outcomes does not affect the pricing of financial derivatives. Risk neutral valuation is critical in option pricing, particularly in the Black-Scholes-Merton model. It provides a framework for pricing options by equating the expected return on the underlying asset to the risk-free rate. In fixed-income markets risk neutral valuation aids in pricing bonds and interest rate derivatives. By assuming risk neutral, the complexities of risk preferences are eliminated, making the valuation process more straightforward. Risk neutral valuation simplifies the pricing of derivatives, such as futures and forwards. It eliminates the need to consider the risk preferences of individuals, focusing solely on the expected returns of the derivative contracts. Risk neutral probability is a hypothetical probability measure used in financial modeling and valuation, which assumes that all investors are risk-neutral. Under risk neutral probability, all financial instruments are expected to grow at a risk-free rate. Therefore, the probabilities of future outcomes are adjusted or "tilted" to reflect this assumption. Real-world probabilities reflect the actual probabilities of outcomes as estimated by market participants. Risk neutral probabilities, on the other hand, are adjusted based on the risk-free rate. They do not represent real-world expectations but are a mathematical convenience used in financial modeling and pricing. Risk neutral probabilities streamline decision-making processes and financial modeling. They simplify the pricing of complex derivatives, portfolio optimization, and risk management. By assuming a risk neutral world, financial analysts can focus on the possible outcomes and their payoffs rather than individual risk preferences. In a risk-neutral model, all investments are evaluated based solely on their expected returns, regardless of the associated risk. However, in real-world measures, investors often account for their risk tolerance. Some investors are risk-averse and prefer safer investments, while others are risk-seeking and favor high-risk, high-reward ventures. Thus, personal risk perceptions significantly influence real-world investment choices, unlike in risk-neutral models. Risk-neutral models, with their assumption of indifference to risk, offer a more predictable, uniform way to evaluate and price financial derivatives. In contrast, real-world measures, influenced by market fluctuations and investor sentiment, can be much more unpredictable. The unpredictability often stems from a myriad of factors, including economic indicators, political events, or changes in investor sentiment. In the risk-neutral framework, decision-making primarily hinges on potential returns, effectively simplifying complex financial calculations. However, real-world measures are far more multifaceted, incorporating factors such as market trends, investor psychology, business performance, and macroeconomic indicators into the decision-making process. While risk-neutral models provide a theoretical foundation for derivative pricing and financial modeling, their real-world applicability is limited due to their inherent assumptions. Real-world measures, though more complex, offer a more realistic reflection of market dynamics and investor behavior, making them more applicable to actual investment strategies and decisions. In portfolio management, the concept of risk neutral can simplify the portfolio optimization process. Under the assumption of risk neutral, portfolio optimization can focus on maximizing expected returns without considering the risk associated with the assets. Risk neutral measures can be incorporated into investment strategies to evaluate and price risky assets. For instance, options can be priced using risk neutral valuation, providing insights for strategic investment decisions. Risk neutral portfolios, constructed under the assumption of risk neutral, can be evaluated based on their expected returns. However, it's important to consider that such portfolios might not reflect the actual risk preferences of investors. In corporate finance, risk neutral valuation can be used in capital budgeting decisions. By assuming risk neutral, corporations can focus on the expected returns of different projects, simplifying the decision-making process. Risk neutral measures can be used to estimate a corporation's cost of capital. By equating the expected return on equity to the risk-free rate, corporations can estimate their cost of equity under the assumption of risk neutral. In mergers and acquisitions, risk neutral valuation can be used to evaluate and price potential deals. By simplifying the valuation process, corporations can make more efficient decisions. Risk neutral valuation rely on the assumption that all investors are risk-neutral, which is not accurate in real-world scenarios. This can lead to mispricing and misjudgment of risk, especially in volatile markets. Alternative methods that account for risk preferences and actual expectations of returns include utility theory and risk-adjusted performance measures. These methods provide a more realistic representation of market conditions and investor behavior. The finance industry continues to debate the validity and applicability of risk neutral methods. While some experts argue for their simplicity and mathematical convenience, others criticize them for their unrealistic assumptions and potential for mispricing. Risk-neutral investors play a significant role in financial models by simplifying the pricing of complex instruments. These investors focus solely on expected returns and disregard risk, which allows for easier calculations and analysis. However, it is crucial to recognize that real-world investors are not always risk-neutral. This discrepancy between risk-neutral assumptions and actual investor behavior can lead to mispricing in financial markets. It is important to consider alternative approaches, such as utility theory and risk-adjusted performance measures, which account for investors' risk preferences and provide a more comprehensive understanding of market dynamics. By incorporating these alternatives, financial models can better capture the complexities of real-world investing and contribute to more accurate pricing and decision-making processes.Definition of Risk Neutral

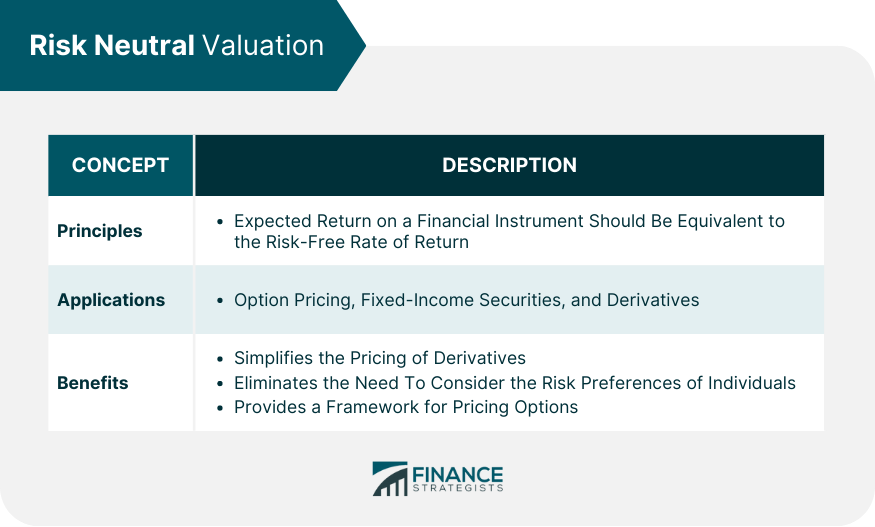

Risk Neutral Valuation

Principles of Risk Neutral Valuation

Applications in Financial Markets

Option Pricing

Fixed Income Securities

Derivatives

Risk Neutral Probability

Concept of Risk Neutral Probability

Relationship With Real-World Probabilities

Applications in Decision-Making and Financial Modeling

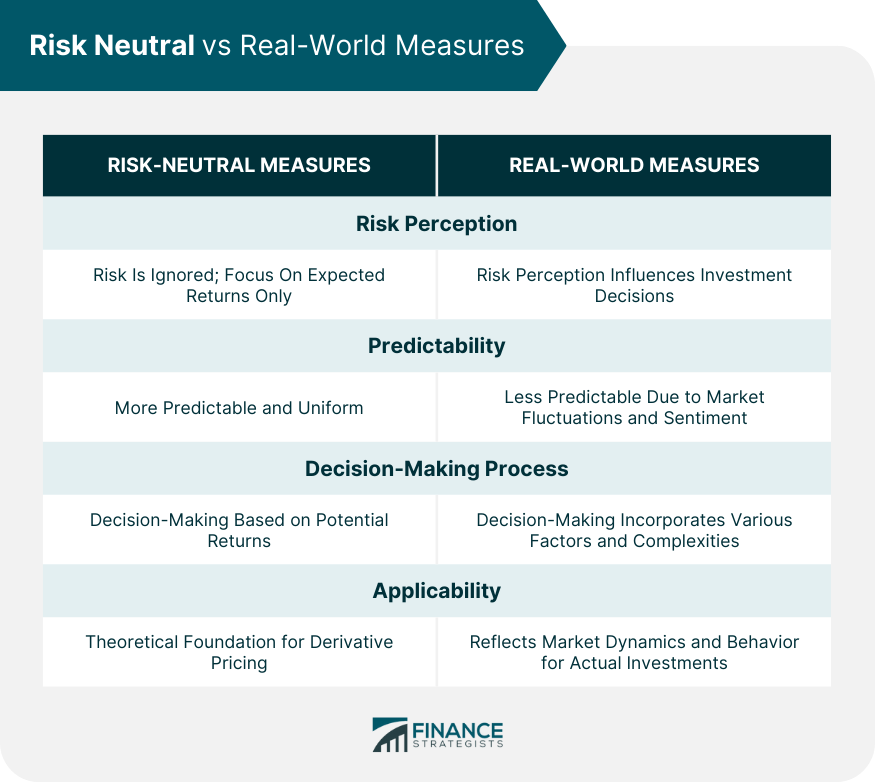

Risk Neutral vs Real-World Measures

Risk Perception

Predictability

Decision-Making Process

Applicability

Risk Neutral in Portfolio Management

Portfolio Optimization

Investment Strategies

Performance Evaluation

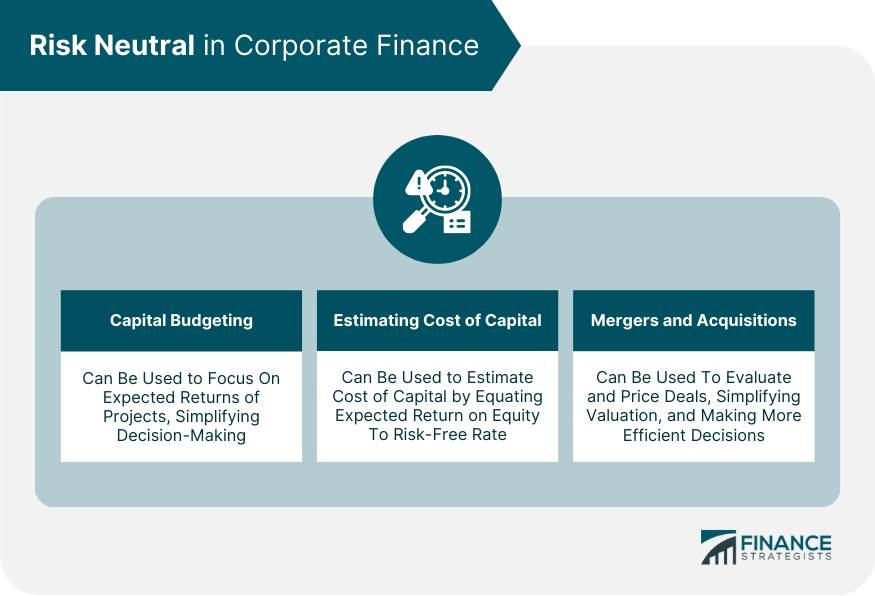

Risk Neutral in Corporate Finance

Capital Budgeting

Estimating Cost of Capital

Applications in Mergers and Acquisitions

Limitations and Critiques of Risk Neutral Approaches

Assumptions and Limitations of Risk Neutral Valuation

Alternatives to Risk Neutral Methods

Ongoing Debates in the Finance Industry

Final Thoughts

Risk Neutral FAQs

Risk neutral refers to indifference towards the level of risk when making an investment decision. A risk-neutral individual or entity is primarily concerned with potential returns and not the associated risk level.

Risk neutral valuation is a method used to price financial derivatives and make investment decisions in uncertain conditions. It assumes that the expected return on a financial instrument should be equivalent to the risk-free rate of return.

In portfolio management, risk neutral simplifies the optimization process. Under this assumption, the focus is on maximizing expected returns without considering the risk associated with the assets.

Risk neutral methods assume that all investors are risk-neutral, which isn't accurate in real-world scenarios. This can lead to mispricing and misjudgment of risk, especially in volatile markets.

Yes, alternative methods that account for risk preferences and actual expectations of returns include utility theory and risk-adjusted performance measures. These methods provide a more realistic representation of market conditions and investor behavior.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.