The term "share class" represents a category of shares investors can purchase, each having its own set of features such as fee structures, minimum investment requirements, and eligibility conditions. A single mutual fund, therefore, can issue multiple share classes, and although they invest in the same portfolio of securities, they vary in the cost and benefits offered to investors. This differentiation in mutual fund shares is vital to accommodate diverse investor needs and preferences. While each share class represents the same underlying portfolio, the distinction lies in the share's unique features. Therefore, an investor must be well-informed and scrutinize each share class's specific attributes before deciding which one to purchase. Companies provide an opportunity to tailor offerings to meet the varying demands and capabilities of investors. The company can structure different share classes in a way that attracts a broader range of investors, thereby raising more capital. Class A shares typically involve a front-end sales charge, meaning investors pay the fee upfront when they buy the shares. These shares often have lower annual expenses compared to other share classes. The fee, also known as a sales load, reduces the amount of the initial investment that actually goes into the fund. In addition to lower annual fees, Class A shares often include a benefit called "breakpoints," which are quantity discounts on the sales load. Investors get these discounts when they invest above certain amounts, encouraging larger, long-term investments. Class B shares do not have an upfront sales charge. Instead, they possess a back-end load, or a contingent deferred sales charge (CDSC). This fee applies if the investor sells the shares within a specific period after purchase, generally declining over time until it reaches zero. The annual expenses for Class B shares are usually higher than Class A shares. However, they automatically convert to Class A shares after a certain period, benefiting from the lower annual expenses of the latter. Class C shares, also known as "level-load" shares, typically do not have a front-end or back-end sales charge. Instead, they have higher annual operating expenses compared to Class A shares. The structure of Class C shares enables investors to access the full amount of their capital immediately. Despite their high operating expenses, Class C shares are often favored by investors with a short-term investment horizon. These shares are designed to discourage short-term trading, as the lack of sales charges allows investors to put more money to work immediately. The investor profile is a crucial factor influencing share class selection. Each investor has different financial capabilities, investment goals, risk tolerance, and investment horizons. For example, an investor who can invest a large sum for a long-term period might prefer Class A shares to take advantage of the breakpoint discounts and lower annual expenses. On the other hand, an investor who wants to invest a smaller amount for a shorter period might choose Class C shares to avoid the upfront sales load of Class A shares and the back-end load of Class B shares. If an investor's goal is to make a short-term gain, they might lean towards Class C shares. On the other hand, an investor with a long-term perspective who wants to accumulate wealth over time may opt for Class A shares. Likewise, an investor seeking regular income might choose a share class that distributes dividends more frequently. Therefore, the investment objectives heavily influence the type of share class an investor chooses. Risk tolerance, or the level of variability in investment returns an investor is willing to withstand, influences share class selection. Some share classes may come with higher risks due to their fee structure or volatility. Investors with a high risk tolerance may opt for a share class that, despite higher fees, offers the potential for higher returns. In contrast, risk-averse investors might choose a share class with lower potential returns but also lower volatility and fees. The investment time horizon, or the expected time span an investor plans to hold an investment before selling it, is another factor influencing the selection of share classes. Class A shares, with their upfront sales load and breakpoint discounts, are more suited to long-term investors. Conversely, short-term investors may find Class C shares appealing due to the absence of front-end or back-end sales loads. The investment time horizon, therefore, can greatly influence the selection of a suitable share class. Management fees represent the cost of having professionals manage a mutual fund's portfolio of investments. These fees are generally expressed as a percentage of the fund's average net assets. The fee covers portfolio management, investment advisory services, and administrative expenses. Every share class of a mutual fund bears management fees. However, the rate may differ between classes. Generally, the fee forms a significant part of a fund's expense ratio, contributing to the total cost of investing in the fund. Sales loads are fees that investors pay when they buy or sell shares of a mutual fund. A front-end sales load, charged at the time of purchase, reduces the amount of the initial investment that goes into the fund. A back-end sales load, or a contingent deferred sales charge, is levied when investors sell their shares. Sales loads vary across share classes. Class A shares typically have a front-end sales load, while Class B shares have a back-end sales load. Class C shares generally avoid these charges. It's crucial for investors to consider sales loads when comparing the cost of different share classes. Named after a section of the Investment Company Act of 1940, 12b-1 fees cover the cost of marketing and distributing the fund. These fees, combined with management fees and other expenses, form the fund's total annual fund operating expenses. While all share classes might have 12b-1 fees, the exact amount can differ from one class to another. For example, Class B and Class C shares usually have higher 12b-1 fees than Class A shares, contributing to their higher overall expense ratios. Redemption fees are another type of fee that can be associated with mutual fund share classes. These are not sales loads, but rather fees charged when shares are sold within a specific period after purchase. The purpose of redemption fees is to discourage short-term trading, which can disrupt the fund's investment strategy and increase the fund's expenses. Investors must be aware of potential redemption fees when choosing between different share classes, especially if they anticipate needing to sell their shares soon after purchase. Net Asset Value (NAV) is the price per share of a mutual fund or an ETF at the close of the trading day. It represents the value of all the fund's assets, minus its liabilities, divided by the number of outstanding shares. While NAV is a crucial measure for evaluating a fund's performance, investors should remember that different share classes of the same fund will have the same NAV since they invest in the same underlying portfolio. Total return is another important performance measure for mutual fund share classes. It includes all changes in the NAV and assumes the reinvestment of dividends and capital gains. Different share classes of the same fund may produce different total returns for investors due to varying expense structures and fee schedules. Therefore, investors should consider both the NAV and the total return when evaluating the performance of different share classes. The expense ratio is the annual fee that all mutual funds or ETFs charge their shareholders. It is expressed as a percentage of the fund's average net assets. The expense ratio includes management fees, 12b-1 fees, and other operational costs. Different share classes of the same fund may have different expense ratios due to varying fee structures. A higher expense ratio can significantly reduce an investor's total return over time. Hence, comparing expense ratios between different share classes is crucial for investors. Investor preferences can change over time due to various reasons such as a shift in financial goals, change in risk tolerance, or modification in investment time horizon. As these preferences change, the investor may want to convert or exchange their existing share class to one that better aligns with their current needs and objectives. Changes in investment objectives, such as switching from a growth-focused strategy to an income-focused one, could warrant a share class conversion. A particular share class might be better suited to the new investment objective due to its specific features and fee structure. Share class conversions or exchanges can also be prompted by cost efficiency. For instance, as an investor's assets in a mutual fund grow, converting to a share class with a lower expense ratio can make the investment more cost-effective. The process of share class conversion should be carefully considered, with a thorough analysis of the costs and benefits associated with the new share class. It's also recommended to consult with a financial advisor before making such decisions. A share class is a category of mutual fund or ETF shares that investors can purchase, with each class having its unique features and fee structures. The availability of different share classes allows investors to choose the most suitable investment based on their financial goals, risk tolerance, and investment horizon. The selection of a share class is influenced by various factors such as the investor's profile, investment objectives, risk tolerance, and investment time horizon. Share class expenses and fees, including management fees, sales loads, 12b-1 fees, and redemption fees, form a significant part of the fund's total operating expenses. Share class conversion or exchange can occur due to changes in investor preferences, investment objectives, or for cost efficiency. A thorough grasp of these aspects allows investors to select the most suitable share class, manage costs effectively, and achieve their investment objectives.What Is a Share Class?

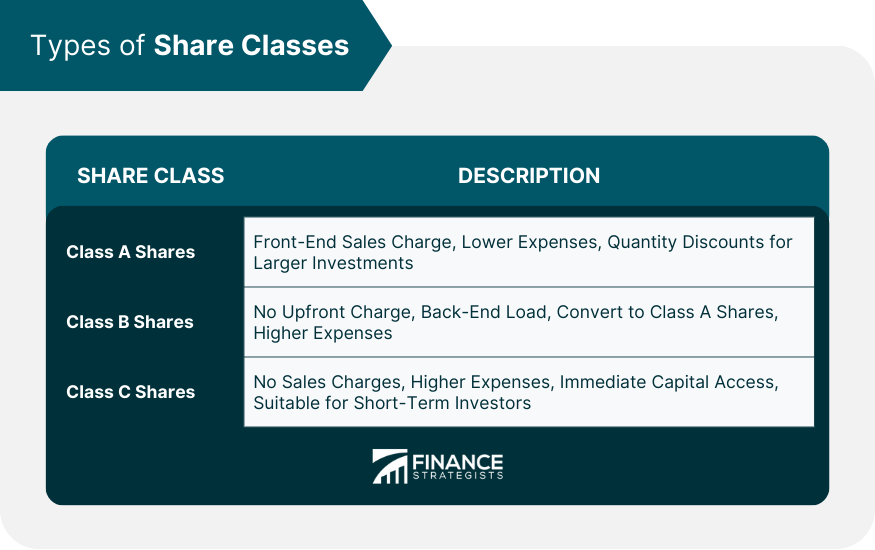

Types of Share Classes

Class A Shares

Class B Shares

Class C Shares

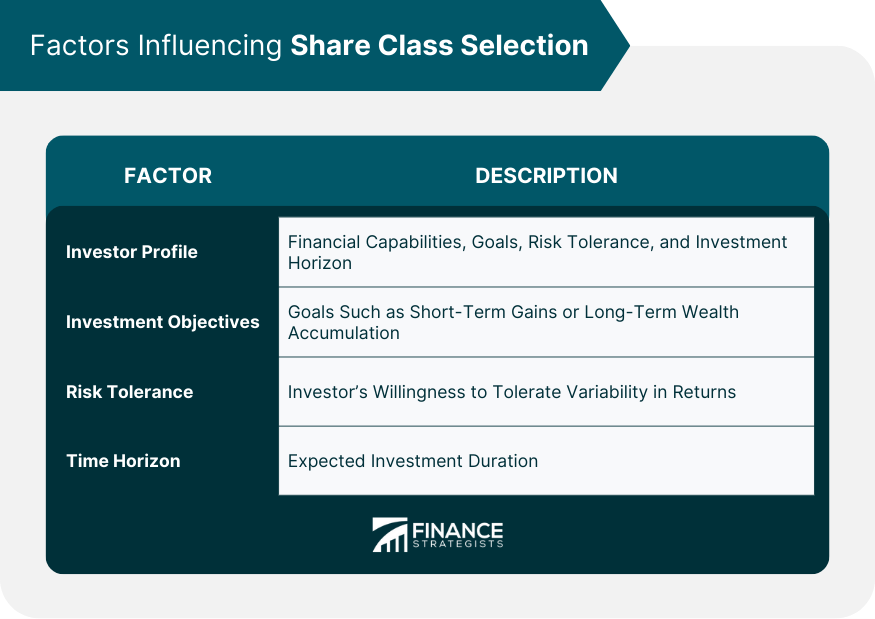

Factors Influencing Share Class Selection

Investor Profile

Investment Objectives

Risk Tolerance

Time Horizon

Share Class Expenses and Fees

Management Fees

Sales Loads

12b-1 Fees

Redemption Fees

Performance Measures of Share Class

Net Asset Value (NAV)

Total Return

Expense Ratio

Reasons for Share Class Conversion or Exchange

Investor Preferences

Changes in Investment Objectives

Cost Efficiency

Conclusion

Share Class FAQs

A share class represents a category of shares in a mutual fund, each with its unique features such as fee structures, minimum investment requirements, and eligibility conditions.

Different share classes in finance allow companies to tailor offerings to meet the varying demands and capabilities of investors. It enables investors to select the most suitable investment aligning with their financial goals, risk tolerance, and investment horizon.

The most common types of share classes include Class A, Class B, and Class C shares. Each class has different fee structures and characteristics.

Share class selection is influenced by various factors including investor's profile, investment objectives, risk tolerance, and investment time horizon.

An investor might want to convert share classes due to changes in their financial goals, risk tolerance, investment time horizon, or for cost efficiency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.