A fee schedule is a comprehensive and organized list of fees or charges associated with specific products or services a business or organization provides. It outlines the cost of each product or service, enabling clients or customers to understand the financial implications of engaging with the provider. Fee schedules are used across various industries, such as healthcare, legal, financial services, and education, to ensure pricing transparency and help customers make informed decisions about their purchases. A well-structured fee schedule should be clear, transparent, and easily accessible, allowing customers to quickly evaluate the costs associated with engaging with the business. Fee schedules also assist businesses in communicating their pricing structure, managing their financial expectations, and ensuring compliance with industry regulations and legal requirements. The medical industry uses fee schedules to outline the costs associated with various healthcare services. Government programs, such as Medicare and Medicaid, have established fee schedules to regulate the amount providers can charge for specific services. These schedules provide a standardized pricing system to ensure affordability and accessibility for beneficiaries. Private insurance companies also utilize fee schedules to determine their reimbursement rates for healthcare providers. These rates are negotiated between the insurance company and the provider, often based on the Medicare fee schedule as a reference point. For patients without insurance or with high-deductible plans, fee schedules help them understand the out-of-pocket costs for medical services. This transparency enables patients to make informed decisions about their healthcare and budget accordingly. Legal professionals often charge clients based on hourly rates, which can vary depending on their experience and specialization. A legal fee schedule clearly outlines these rates and any additional fees associated with specific services, such as document preparation or court appearances. Some legal services, such as drafting a will or handling a real estate transaction, can be charged using a flat fee. This simplifies the pricing structure and provides clients with a clear understanding of the total cost upfront. Contingency fees are common in personal injury cases, where the attorney receives a percentage of the settlement or award if the case is successful. The fee schedule should clearly state the percentage and any additional fees or costs for which the client may be responsible. Banks and financial institutions rely on fee schedules to communicate the cost of various services, such as account maintenance, ATM usage, and overdraft fees. Investment management firms use fee schedules to outline the costs associated with managing clients' portfolios. Financial planners often charge clients based on a fixed fee or a percentage of assets under management. Their fee schedules should clearly communicate these charges and any additional fees for services like tax planning or estate planning. Educational institutions, such as colleges and universities, use fee schedules to communicate the cost of tuition, mandatory fees, and other charges associated with enrollment. Course materials and textbooks can be a significant expense for students. A well-structured fee schedule should include information about the costs of required materials, as well as any optional resources that may be available. Extracurricular activities, such as sports or clubs, often have associated fees. Fee schedules should clearly outline these costs, so students and their families can plan and budget accordingly. Before developing a fee schedule, businesses should conduct thorough market research to understand the industry landscape, customer preferences, and competitor pricing strategies. Analyzing competitor fee schedules provides valuable insight into the prevailing pricing structures in the market. This allows businesses to identify potential gaps or opportunities to differentiate themselves from the competition. Understanding the costs associated with providing products or services is crucial in developing a profitable fee schedule. Businesses should carefully evaluate their direct and indirect costs to ensure the fees they charge adequately cover expenses and allow for a reasonable profit margin. Fixed pricing involves setting a single price for a product or service, regardless of variations in cost or demand. This pricing structure offers simplicity and predictability for both the business and the customer. Tiered pricing offers multiple pricing levels based on the product or service's features, quantity, or quality. This structure allows businesses to cater to a wide range of customers with different needs and budgets. Value-based pricing focuses on the perceived value of the product or service to the customer rather than the actual cost to the business. This pricing structure can result in higher profit margins if the business can effectively communicate and justify the value of its offering. A transparent fee schedule is essential for building trust and fostering positive customer relationships. Transparent pricing enables clients to understand the costs associated with their purchase and make informed decisions. Fee schedules should be clear and easy to understand, avoiding any ambiguous language or hidden fees. Providing a concise explanation of each fee, as well as any applicable discounts or promotions, can help reduce confusion and enhance customer satisfaction. Businesses should ensure their fee schedule is easily accessible to potential customers, whether it's displayed on their website, included in marketing materials, or provided upon request. This accessibility allows customers to quickly and easily evaluate the cost of engaging with the business. Regularly reviewing and updating the fee schedule ensures it remains competitive and relevant in the face of market changes. Factors such as inflation, changes in demand, or shifts in the competitive landscape may necessitate adjustments to the fee schedule. Customer feedback can provide valuable insights into the effectiveness and fairness of the fee schedule. Businesses should actively solicit and incorporate feedback to refine their pricing strategies and improve customer satisfaction. Inflation can erode the purchasing power of money over time, necessitating adjustments to the fee schedule to maintain profitability. Offering discounts for early payment can encourage prompt payment from customers, improving cash flow and reducing the risk of bad debts. Volume discounts reward customers who purchase large quantities of products or services, encouraging customer loyalty and repeat business. Loyalty programs, such as reward points or membership benefits, can incentivize customers to continue engaging with the business, fostering long-term relationships and driving revenue growth. Businesses must ensure their fee schedules comply with all applicable legal requirements, such as price transparency laws or industry-specific regulations. Non-compliance can result in fines, penalties, or damage to the business's reputation. Adhering to industry standards and best practices can help businesses maintain a positive reputation and foster trust among customers. Familiarity with industry norms can also inform the development and management of an effective fee schedule. Ensuring the fee schedule is ethically sound and fair to customers is essential for building and maintaining a positive brand image. Fee schedules enable consumers to compare the costs of different providers, empowering them to make informed decisions about which provider best meets their needs and budget. By providing a clear breakdown of costs, fee schedules help consumers budget for the expenses associated with a particular product or service. This transparency lets customers plan their finances more effectively and avoid unexpected costs. In some cases, clearly understanding a provider's fee schedule can give consumers leverage when negotiating fees. This knowledge can help customers secure more favorable pricing or additional services, resulting in a better overall value. Consumers often weigh the quality of a product or service against its cost when making purchasing decisions. A well-structured fee schedule can help consumers evaluate the value of a provider's offerings and determine whether the cost is justified based on the quality of the product or service. Fee schedules allow consumers to assess the value for money of a particular product or service. By comparing the costs and benefits of different providers, customers can make informed decisions about which option offers the best overall value. In some cases, the convenience of a particular product or service may outweigh the cost considerations. A comprehensive fee schedule can help consumers weigh the benefits of convenience against the financial implications, enabling them to make well-informed decisions. A fee schedule is a comprehensive list of fees or charges associated with specific products or services that businesses or organizations provide. Fee schedules are used across various industries, such as healthcare, legal, financial services, and education, to ensure pricing transparency and help customers make informed decisions about their purchases. Developing a well-structured fee schedule involves market research, competitor analysis, cost analysis, and establishing a pricing structure. Communicating the fee schedule requires transparency, clarity, and accessibility. Fee schedule management involves regular review and updates, evaluating customer feedback, adjusting for inflation, offering discounts and incentives, compliance with regulations, and ethical considerations. Fee schedules enable consumers to compare providers, budget for expenses, and negotiate fees. They also play a crucial role in decision-making by helping consumers assess the value for money and convenience of a particular product or service. Overall, fee schedules are essential tools for businesses and consumers to understand the financial implications of their engagements and make informed decisions.What Is a Fee Schedule?

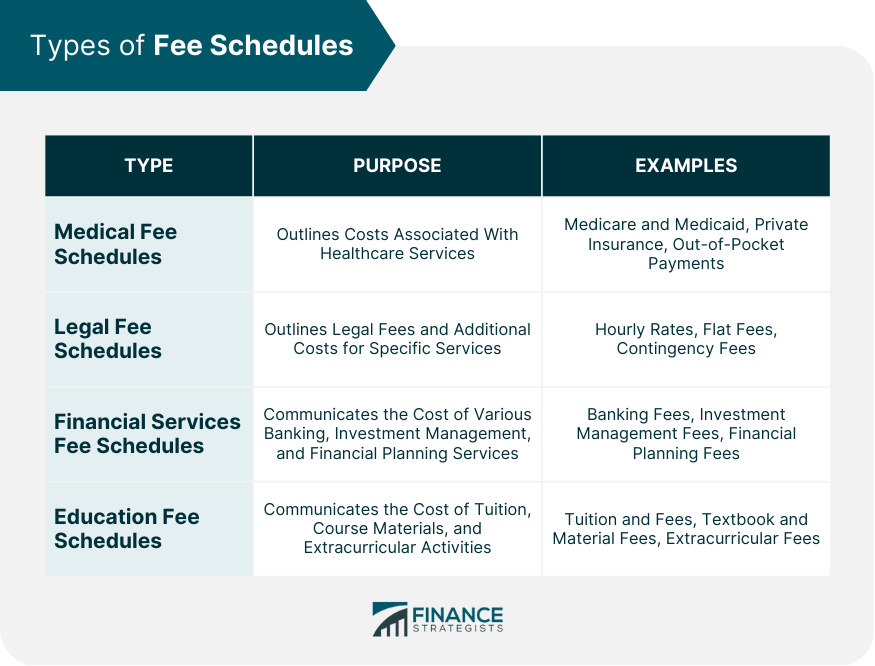

Types of Fee Schedules

Medical Fee Schedules

Medicare and Medicaid

Private Insurance

Out-of-Pocket Payments

Legal Fee Schedules

Hourly Rates

Flat Fees

Contingency Fees

Financial Services Fee Schedules

Banking Fees

These schedules enable customers to understand the charges associated with their accounts and make informed decisions about their banking needs.Investment Management Fees

These fees may include management fees, performance fees, and transaction costs. A transparent fee schedule lets clients compare investment managers and make informed decisions about their financial future.Financial Planning Fees

Education Fee Schedules

Tuition and Fees

These schedules give students and their families a clear understanding of the financial investment required for their education.Textbook and Material Fees

Extracurricular Fees

Developing a Fee Schedule

Factors to Consider

Market Research

This information can help inform pricing decisions and ensure the fee schedule is competitive and attractive to potential clients.Competitor Analysis

Cost Analysis

Establishing Pricing Structure

Fixed Pricing

Tiered Pricing

Value-Based Pricing

Communicating the Fee Schedule

Transparency

Clarity

Accessibility

Fee Schedule Management

Regular Review and Updates

Monitoring Market Changes

Evaluating Customer Feedback

Adjusting for Inflation

Regularly updating the fee schedule to account for inflation ensures the business remains financially stable and can continue to provide high-quality products and services.Discounts and Incentives

Early Payment Discounts

Volume Discounts

Loyalty Programs

Compliance With Regulations

Legal Requirements

Industry Standards

Ethical Considerations

Businesses should consider the potential impact of their pricing strategies on vulnerable populations, such as low-income customers or those with limited access to services, and make adjustments as needed to promote equity and fairness.Impact of Fee Schedules on Consumers

Understanding the Costs

Comparing Providers

Budgeting

Negotiating Fees

Role of Fee Schedules in Decision-Making

Quality vs. Cost

Value for Money

Convenience

Conclusion

Fee Schedule FAQs

A fee schedule is a document that lists the fees or charges that are associated with a particular service or product. It outlines the costs of each item or service and helps individuals or businesses to understand the costs they will incur.

A fee schedule in healthcare is a list of charges that providers use to bill insurance companies or patients. It outlines the costs of each medical service and provides a framework for reimbursement.

Reviewing a fee schedule before using a service is important because it helps you understand the costs associated with that service. This can help you make informed decisions about whether to use the service and can prevent unexpected costs.

The frequency with which fee schedules are updated varies by industry and service provider. Some fee schedules may be updated annually, while others may be updated more frequently.

In some cases, a fee schedule can be negotiated. This may be done by discussing the costs with the service provider or by negotiating with an insurance company. However, not all service providers or insurance companies may be willing to negotiate fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.