Pooled income funds is a type of charitable giving vehicle that allows donors to contribute assets to a common investment pool managed by a nonprofit organization. These funds provide a way for donors to generate income for themselves or their designated beneficiaries, while simultaneously supporting the nonprofit's mission. The donated assets are combined with those of other donors, and the fund's income is distributed proportionately among the participants, based on their respective shares. Upon the death of the donor or their beneficiaries, the remaining assets are transferred to the nonprofit organization to be used in accordance with its charitable purpose. A standard Pooled Income Fund (SPIF) is the most common type of Pooled income fund. In this arrangement, donors contribute cash or securities to a fund managed by a charitable organization. The organization invests the assets and distributes the income generated, usually in the form of dividends or interest, back to the donors on a pro-rata basis. When the donor passes away, the remaining assets in their account are transferred to the designated charity. In this arrangement, donors establish a trust and contribute assets to it, retaining a lifetime income stream. Upon the donor's passing, the remaining assets are transferred to the designated charity. CRTs provide donors with an immediate tax deduction and can be a valuable estate planning tool for those looking to reduce estate taxes. A deferred Pooled Income Fund (DPIF) allows donors to contribute assets to a pooled income fund but instead of receiving an immediate income stream, the donor defers the income payments for a specified period. This deferral can result in higher future income payments and tax advantages for the donor. At the end of the deferral period, the donor begins receiving income payments, and when they pass away, the remaining assets are transferred to the designated charity. Targeted Pooled Income Funds (TPIFs) are designed to support specific causes or projects within a charitable organization. Donors who are passionate about a particular mission can contribute to a TPIF, knowing that their investment will directly benefit that specific cause. Income is distributed to donors in a manner similar to standard PIFs, and the remaining assets are transferred to the designated charity upon the donor's passing. Pooled income funds are typically established by charitable organizations, including public charities, private foundations, and religious institutions. Donors who contribute to these funds can be individuals, families, or corporations with a desire to support the charitable organization's mission while receiving income for themselves or their designated beneficiaries. To establish a pooled income fund, a charitable organization must meet specific legal and regulatory requirements. These include creating a trust agreement that outlines the fund's purpose, investment strategy, and beneficiary designations. Additionally, the fund must comply with relevant tax laws and regulations, such as the Internal Revenue Code and the Pension Protection Act. Pooled income funds can accept a variety of assets, including cash, marketable securities, and real estate. However, the fund may impose limitations on accepting illiquid assets, like closely-held business interests or tangible personal property, due to potential valuation and management challenges. Donors who contribute to a pooled income fund can receive various tax benefits, including an immediate income tax deduction for the charitable portion of their contribution. They may also avoid or defer capital gains taxes on appreciated assets and reduce their estate and gift tax liabilities. The income payouts from a pooled income fund depend on the fund's net income and investment returns. These payouts are typically distributed to beneficiaries quarterly or annually, based on the fund's distribution rate. Donors can designate themselves, their spouses, or other individuals as income beneficiaries. However, additional beneficiaries may be subject to specific restrictions and requirements set by the fund. Income distributions from a pooled income fund are generally treated as ordinary income for tax purposes. Beneficiaries must report these distributions on their tax returns and may be subject to withholding requirements. Fund managers are responsible for overseeing the pooled income fund's investments, ensuring compliance with legal and regulatory requirements, and managing the fund's administration. This includes portfolio management, risk assessment, and performance reporting. Pooled income funds typically invest in a diversified mix of assets, such as stocks, bonds, and other income-generating investments. The fund's investment strategy should be aligned with its objectives and risk tolerance while generating income for beneficiaries and preserving capital for the charitable organization. Managing a pooled income fund involves various fees and expenses, including investment management fees, administrative costs, and legal and regulatory expenses. These fees are typically deducted from the fund's income before distributions are made to beneficiaries. When the last income beneficiary passes away, their interest in the pooled income fund terminates. At this point, the remaining assets in the fund are distributed to the charitable organization. The remaining assets in the pooled income fund are used to support the charitable organization's mission and programs, providing a lasting legacy for the donor. When a pooled income fund terminates, the charitable organization receives the remaining assets tax-free, allowing them to maximize the impact of the donor's gift. Pooled income funds are subject to annual reporting and disclosure requirements, including filing tax returns with the Internal Revenue Service and providing financial statements to donors and beneficiaries. To ensure compliance with legal and regulatory requirements, pooled income funds may be subject to audits and oversight by government agencies and independent accounting firms. Implementing best practices in fund administration and governance can help ensure the long-term success of a pooled income fund. These practices may include transparent reporting, maintaining a diverse and experienced board, and implementing sound investment and risk management policies. Pooled income funds offer a unique and effective charitable giving strategy that allows donors to make a lasting impact on their chosen organizations while receiving income for themselves or their designated beneficiaries. By understanding the process of establishing a pooled income fund, the types of assets accepted, income distribution, tax implications, and management responsibilities, donors can make informed decisions about their philanthropic efforts. Moreover, it is essential to consider the potential challenges and future trends affecting pooled income funds, such as evolving donor preferences, technological advancements, and changes in legislation and regulation. By learning from past successes and failures, implementing best practices in fund administration and governance, and adapting to the changing landscape, pooled income funds can continue to play a vital role in supporting charitable organizations and their missions.Definition of Pooled Income Funds

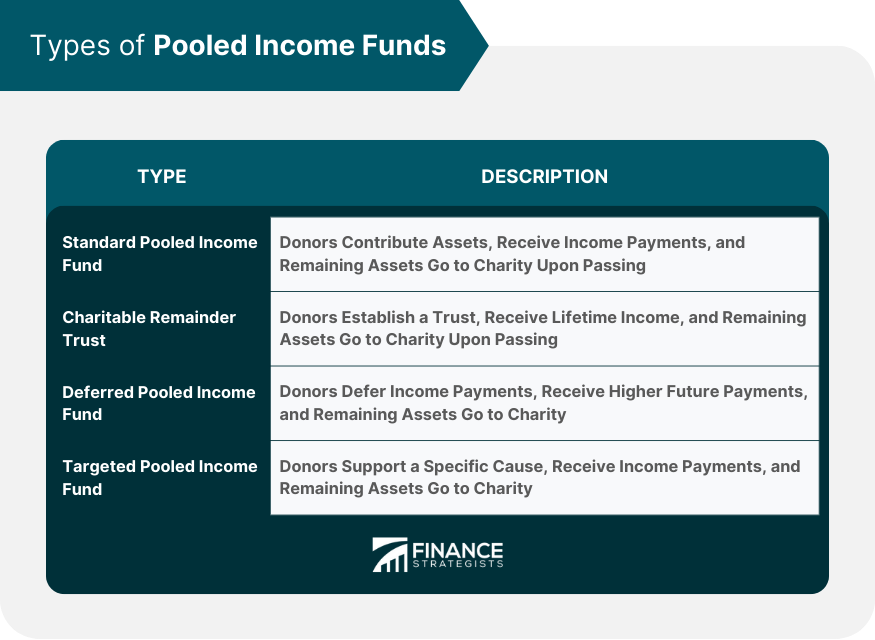

Types of Pooled Income Funds

Standard Pooled Income Funds

Charitable Remainder Trusts

Deferred Pooled Income Funds

Targeted Pooled Income Funds

Establishing a Pooled Income Fund

Eligible Organizations and Donors

Legal and Regulatory Requirements

Contributions to a Pooled Income Fund

Types of Assets Accepted

Tax Implications for Donors

Income Distribution From a Pooled Income Fund

Calculating Income Payouts

Beneficiary Designations

Tax Implications for Beneficiaries

Management and Investment of Pooled Income Funds

Roles and Responsibilities of Fund Managers

Investment Strategies and Portfolio Management

Fees and Expenses Associated With Fund Management

Termination of Interest in a Pooled Income Fund

Death of the Last Income Beneficiary

Distribution of Remaining Assets to the Charitable Organization

Tax Implications for the Charity

Reporting and Compliance Requirements in a Pooled Income Fund

Annual Filings and Disclosures

Audits and Regulatory Oversight

Best Practices for Fund Administration and Governance

Conclusion

Pooled Income Funds FAQs

Pooled income funds are a unique charitable giving strategy that allows donors to contribute assets to a trust managed by a charitable organization. These funds generate income for the donor or their designated beneficiaries for life, with the remaining assets distributed to the charity upon the death of the last beneficiary. Pooled income funds differ from other strategies, such as donor-advised funds or charitable remainder trusts, in terms of their structure, tax benefits, and income distribution.

Pooled income funds accept various assets, including cash, marketable securities, and real estate. However, they may impose limitations on accepting illiquid assets, such as closely-held business interests or tangible personal property, due to potential valuation and management challenges.

Income distributions from pooled income funds are calculated based on the fund's net income and investment returns. These payouts are typically distributed to beneficiaries quarterly or annually, based on the fund's distribution rate. For tax purposes, income distributions are generally treated as ordinary income and must be reported by beneficiaries on their tax returns.

Fund managers have various responsibilities in managing pooled income funds, such as overseeing investments, ensuring compliance with legal and regulatory requirements, and handling the fund's administration. This includes portfolio management, risk assessment, performance reporting, and managing fees and expenses associated with the fund.

Pooled income funds provide a lasting impact on charitable organizations and their missions by offering donors a unique and flexible giving option. These funds generate sustainable income for beneficiaries while supporting the long-term financial stability of charities. Upon the death of the last beneficiary, the remaining assets in the fund are distributed to the charitable organization, allowing them to further their mission and programs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.