The weighted average cost of capital (WACC) is the implied interest rate of all forms of the company's debt and equity financing which is weighted according to the proportionate dollar-value of each. It represents a firm's average after-tax cost of capital from all sources, including debt and equity. It provides a comprehensive measure of the return a company needs to generate to reward its investors, both equity holders and debtors. In simple terms, it's the average rate of return a company must earn from its existing assets to satisfy its stakeholders. Companies use WACC as a benchmark for evaluating the profitability of investment opportunities. If a proposed project or investment offers a return higher than the WACC, it's likely to create value for shareholders. On the other hand, projects returning less than the WACC could potentially diminish company value. Thus, understanding WACC helps companies determine the feasibility and attractiveness of different investment options. WACC is also used by company management to evaluate decisions such as capital projects, mergers and acquisitions, and other large-cost transactions in order to ensure that their WACC and Capital Structure are within investor expectations. If a company determines that they have a WACC which is too high, they can mitigate this by renegotiating debt or authorizing a share buy-back to reduce the proportion of equity to total financing. Capital budgeting involves determining which projects or investments a company should pursue. By using WACC as a discount rate in the Net Present Value (NPV) calculations, firms can evaluate the potential profitability of different projects. If the NPV is positive using the WACC as a discount rate, it indicates the project is expected to earn more than the cost of capital, making it a potentially value-adding proposition. For investment managers and analysts, WACC serves as a critical tool in equity valuation models. When valuing a firm or its equity, WACC is used as the discount rate in Discounted Cash Flow (DCF) analysis. By assessing future cash flows against the firm's WACC, analysts can determine an intrinsic value for the company, aiding in investment decisions. Companies constantly face decisions regarding their financing mix. Whether to finance through debt, issue new equity, or retain earnings are crucial choices. WACC provides insights into the blended cost of a firm's existing capital structure, enabling firms to make informed decisions that can minimize their cost of capital. WACC is also used by company management to evaluate decisions such as capital projects, mergers and acquisitions, and other large-cost transactions in order to ensure that their WACC and Capital Structure are within investor expectations. If a company determines that they have a WACC which is too high, they can mitigate this by renegotiating debt or authorizing a share buy-back to reduce the proportion of equity to total financing. The total cost of debt is typically the stated interest rate, minus the tax benefit derived from interest payments being deductible. Because equity has no stated cost, the formula often uses the Capital Asset Pricing Model, where the cost of equity is estimated to be the return that investors expect to receive from their investment. The formula for calculating the weighted average cost of capital is the proportion of total equity (E) to total financing (E + D) multiplied by the cost of equity (Re) , plus the proportion of total debt (D) to total financing (E + D), multiplied by the cost of debt (Rd), multiplied by one minus the tax rate (T). Prevailing market interest rates significantly impact the cost of debt. As interest rates rise, the cost of issuing new debt or refinancing existing debt also increases, leading to a higher WACC. Conversely, in a declining interest rate environment, companies can obtain debt more cheaply, potentially reducing their WACC. The market risk premium, an essential component in the CAPM for determining the cost of equity, represents the excess return investors expect over the risk-free rate for investing in the market as a whole. A higher market risk premium increases the cost of equity, and subsequently, the WACC. Given that interest on debt is tax-deductible, a company's effective tax rate can significantly impact its cost of debt. A higher corporate tax rate reduces the after-tax cost of debt, lowering the WACC, while a lower tax rate can increase the WACC. The inherent riskiness of a company's operations and financial structure can influence both the cost of equity and debt. Companies perceived as riskier may face higher interest rates when borrowing and will have a higher cost of equity, given the increased risk perceived by equity holders. Such heightened perceptions of risk can lead to an increased WACC. In conclusion, WACC is not just a theoretical concept but a fundamental metric that drives myriad financial decisions within a corporation. By understanding its components, calculation, and implications, companies can navigate their strategic initiatives more effectively, ensuring that they remain aligned with shareholder value creation. The Weighted Average Cost of Capital (WACC) offers a comprehensive approach to understanding a firm's cost of capital, which is essential for effective financial management. Unlike other measures that focus on specific financing sources, WACC aggregates the costs associated with all sources, ensuring that decision-makers obtain a holistic view of their financing costs. This unified perspective allows for the integration of various risk factors and return requirements, making WACC a robust metric for both strategic and tactical decision-making. A defining feature of WACC is its simultaneous consideration of both debt and equity. This dual consideration ensures that the metric captures the entire spectrum of a company's capital structure, accounting for the differing expectations and risk profiles of lenders and shareholders alike. By doing so, WACC acknowledges the intricate balance firms must maintain to appease and reward both creditors and equity holders. One of the reasons WACC is so valuable to firms is its sensitivity to external market dynamics and investor expectations. The components of the WACC calculation, including the risk-free rate, market risk premium, and company-specific risk factors, all have roots in prevailing market conditions. This means that as the economic and investment climate shifts, WACC will naturally adjust, ensuring that it remains a timely and relevant benchmark for decision-making. WACC serves as the foundation for a myriad of financial decisions. From project selection to firm valuation, this metric provides a consistent benchmark against which potential returns can be compared. By offering a clear hurdle rate, WACC simplifies complex decisions, allowing firms to quickly identify value-adding opportunities and sidestep ventures that fail to meet the required rate of return. While WACC provides a comprehensive view of a firm's cost of capital, it does so with certain assumptions and simplifications. For instance, it assumes that the company's debt/equity ratio remains constant, which is often not the case in the dynamic business environment. Additionally, the models used to determine the cost of equity, like the CAPM, come with their own set of assumptions, which may not always hold. Although WACC's responsiveness to market conditions is an advantage, it's also a limitation. Rapid changes in the market, be it due to geopolitical events, economic downturns, or other disruptions, can lead to significant fluctuations in WACC. These fluctuations might complicate financial planning and decision-making, especially if they're unexpected. Flotation costs – the costs associated with issuing new securities – are often overlooked in the WACC calculation. While these costs may not be significant for larger firms or for companies that infrequently access capital markets, they can be material for smaller companies or those in the midst of aggressive expansion efforts. Start-ups and other non-mature companies may find WACC less applicable. Given the volatility of their operations and the potential lack of a clear capital structure, calculating a meaningful WACC can be challenging. Furthermore, these companies often face a higher cost of capital due to the perceived risk, making WACC potentially less indicative of their true operational environment. Lowering WACC isn't solely a function of financial engineering; often, operational improvements can significantly impact a firm's cost of capital. By enhancing efficiency, reducing waste, and streamlining operations, firms can bolster their financial health, thereby reducing the perceived risk from the perspective of investors and lenders. By optimizing the mix between short-term and long-term debt, adjusting interest rates through refinancing, or capitalizing on favorable lending conditions, companies can manage and potentially reduce their cost of debt, and thereby their WACC. The cost of equity, typically higher than the cost of debt, represents the return expectations of shareholders. Companies can manage this through transparent communication, consistent dividend policies, and by demonstrating sustainable growth and profitability. Furthermore, by mitigating operational and financial risks, firms can reduce their equity beta, leading to a lower cost of equity. The Weighted Average Cost of Capital (WACC) represents the aggregated cost of both debt and equity financing and provides a comprehensive measure of a firm's cost of capital. By utilizing WACC as a benchmark, companies can evaluate the feasibility of various investment opportunities, ensuring alignment with shareholder value creation. WACC's influence extends to capital budgeting, investment analysis, and financing decisions, making it an indispensable tool for strategic planning. Moreover, WACC's advantages lie in its holistic approach to cost assessment, its reflection of market conditions, and its role as a foundation for sound financial choices. However, it comes with limitations stemming from assumptions, market volatility, and applicability to non-mature companies. Effective management of WACC involves operational efficiency enhancements, strategic debt optimization, and strategies to reduce the cost of equity. By navigating these complexities, firms can make informed decisions that optimize their cost of capital and enhance overall financial performance.Weighted Average Cost of Capital (WACC) Definition

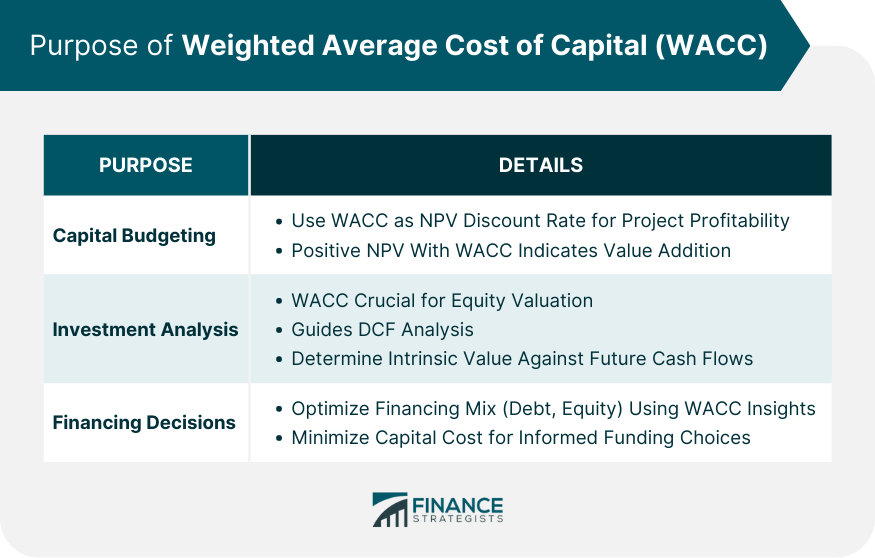

The Purpose of WACC

Capital Budgeting

Investment Analysis

Financing Decisions

Making Decisions With WACC

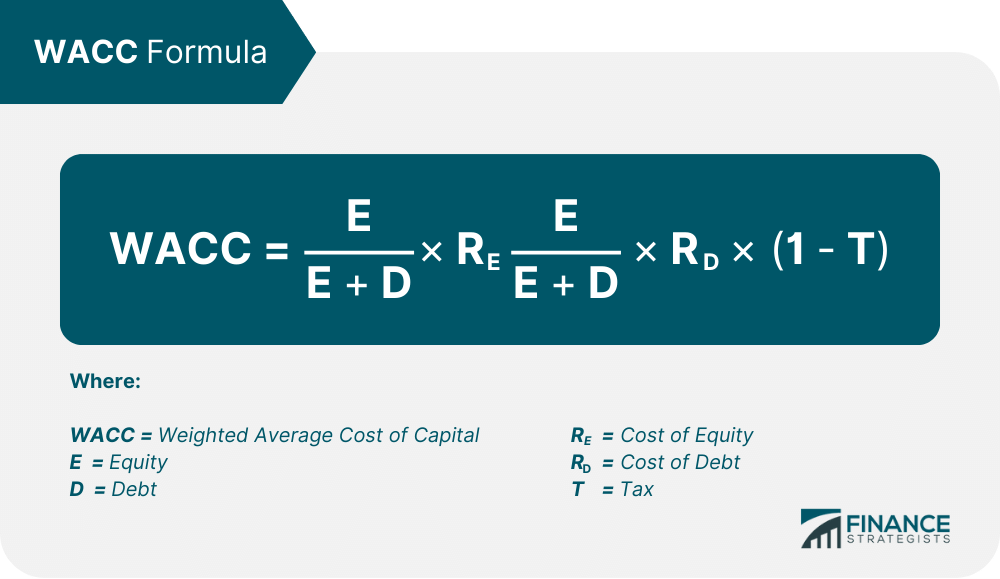

Formula for WACC in Simple Terms

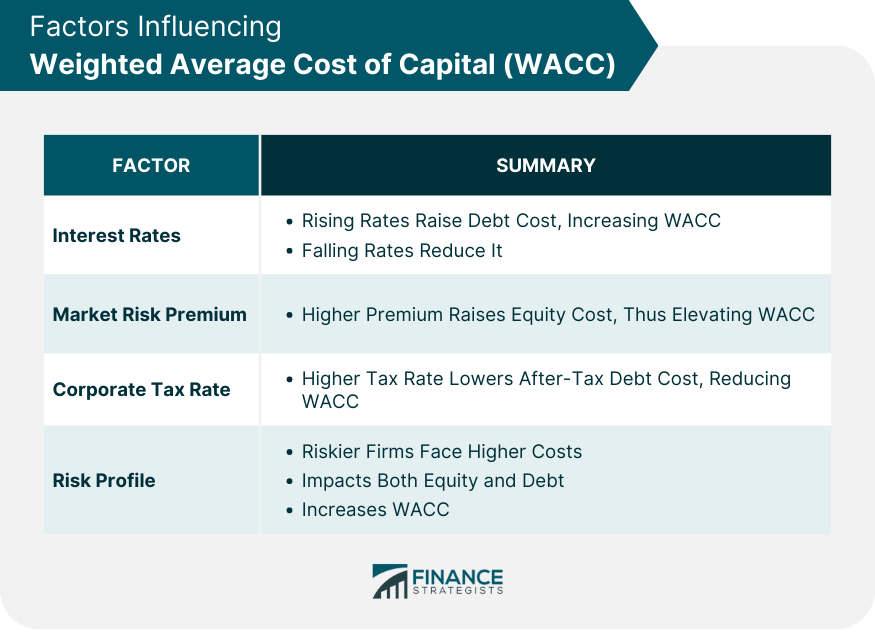

Factors Influencing WACC

Interest Rates

Market Risk Premium

Corporate Tax Rate

Company's Risk Profile

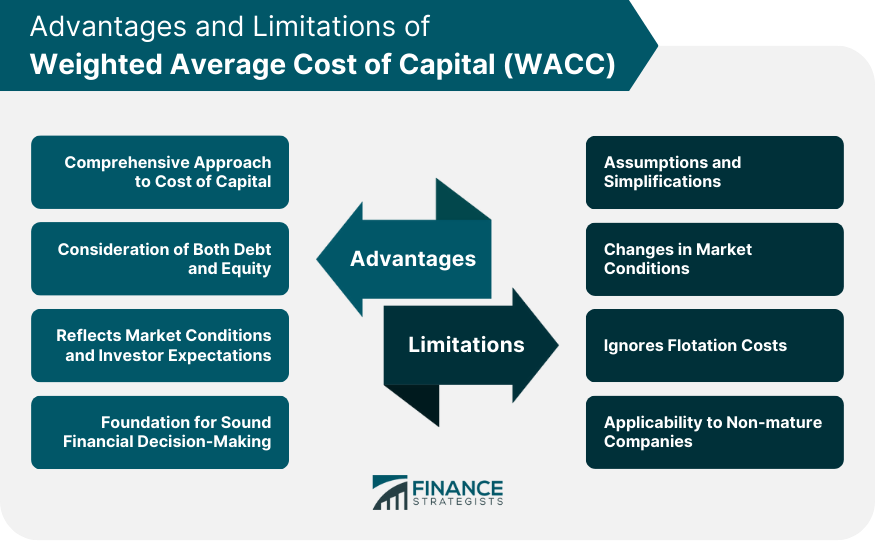

Advantages of WACC

Comprehensive Approach to Cost of Capital

Consideration of Both Debt and Equity

Reflects Market Conditions and Investor Expectations

Foundation for Sound Financial Decision-Making

Limitations of WACC

Assumptions and Simplifications

Changes in Market Conditions

Ignores Flotation Costs

Applicability to Non-mature Companies

Managing Weighted Average Cost of Capital (WACC)

Improve Operational Efficiency

Optimize Debt

Reduce Cost of Equity

Conclusion

Weighted Average Cost of Capital (WACC) FAQs

WACC stands for the Weighted Average Cost of Capital.

The weighted average cost of capital (WACC) is the implied interest rate of all forms of the company’s debt and equity financing which is weighted according to the proportionate dollar-value of each.

The total cost of debt is typically the stated interest rate, minus the tax benefit derived from interest payments being deductible.

WACC is also used by company management to evaluate decisions such as capital projects, mergers and acquisitions, and other large-cost transactions in order to ensure that their WACC and capital structure are within investor expectations.

If a company determines that they have a WACC which is too high, they can mitigate this by renegotiating debt or authorizing a share buy-back to reduce the proportion of equity to total financing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.