The debt ratio is the ratio of a company's debts to its assets, arrived at by dividing the sum of all its liabilities by the sum of all its assets. The debt ratio is a measurement of how much of a company's assets are financed by debt; in other words, its financial leverage. If the ratio is above 1, it shows that a company has more debts than assets, and may be at a greater risk of default. The purpose of calculating the debt ratio of a company is to give investors an idea of the company's financial situation. Too high a debt ratio can indicate a looming problem for a company. At the very least, a company with a high amount of debt may have difficulty paying or maintaining dividend payments for investors. Likewise, too low of a debt ratio could mean that the company in question is underinvesting in assets and stunting their own growth, which could mean that equity shares will be slow to appreciate in value, if at all. Total debt encompasses all of a company's outstanding liabilities. This can include long-term obligations, such as mortgages or other loans, and short-term debt like revolving credit lines and accounts payable. The sum of all these obligations provides an encompassing view of the company's total financial obligations. Total assets represent everything a company owns or has rights to, from tangible assets like machinery and real estate to intangible assets such as patents, trademarks, and goodwill. In the context of the debt ratio, total assets serve as an indicator of a company's overall resources that could be utilized to repay its debt, if necessary. To find a business' debt ratio, divide the total debts of the business by the total assets of the business. Check out the debt ratio equation: A low debt ratio, typically less than 0.5 or 50%, indicates that a company relies more on equity than on borrowed funds to finance its assets. This conservative financial stance might suggest that the company possesses a strong financial foundation, has lower financial risk, and might be more resilient during economic downturns. However, it could also mean the company isn't leveraging available credit opportunities that could fuel growth. On the other hand, a high debt ratio—often above 0.5 or 50%—suggests the opposite: a company has a significant portion of its assets financed by debt. While this could indicate aggressive financial practices to seize growth opportunities, it might also mean a higher risk of financial distress, especially if cash flows become inconsistent. Stakeholders, especially creditors, may view a high debt ratio as an increased risk, potentially impacting the company's borrowing costs and terms. Debt ratios can vary widely depending on the industry of the company in question. For example, capital intensive businesses, such as those in the energy sector, generally take on more debt than companies in the IT sector. Because of this, what is considered to be an acceptable debt ratio by investors may depend on the industry of the company in which they are investing. In order to get a more complete picture, investors also look at other metrics, such as return on investment (ROI) and earnings per share (EPS) to determine the worthiness of an investment. The debt-to-equity ratio, often used in conjunction with the debt ratio, compares a company's total debt to its total equity. It gives stakeholders an idea of the balance between the funds provided by creditors and those provided by shareholders. A higher ratio might indicate a company has been aggressive in financing growth with debt, which could result in volatile earnings. The long-term debt ratio focuses specifically on a company's long-term debt (obligations due in more than a year) relative to its total assets or equity. It offers insights into the company's long-term solvency and its ability to meet its long-term obligations. Conversely, the short-term debt ratio concentrates on obligations due within a year. This ratio provides a snapshot of a company's short-term liquidity and its ability to meet immediate financial obligations using its most liquid assets. Different industries have varying levels of capital requirements, operational risks, and profitability margins. For instance, capital-intensive industries such as utilities or manufacturing might naturally have higher debt ratios due to significant infrastructure and machinery investments. Conversely, technology startups might have lower capital needs and, subsequently, lower debt ratios. Comparing a company's debt ratio with industry benchmarks is crucial to assess its relative financial health. Newer businesses or startups might rely heavily on debt financing to kick-start operations, leading to higher debt ratios. As businesses mature and generate steady cash flows, they might reduce their reliance on borrowed funds, thereby decreasing their debt ratios. In contrast, companies looking to expand or diversify might again increase borrowing, potentially raising the ratio. Understanding where a company is in its lifecycle helps contextualize its debt ratio. In a low-interest-rate environment, borrowing can be relatively cheap, prompting companies to take on more debt to finance expansion or other corporate initiatives. Conversely, during economic downturns, businesses might reduce debt to minimize risks associated with decreased revenues or uncertain market conditions. The broader economic landscape can serve as a lens through which a company's debt ratio is viewed. The debt ratio offers stakeholders a quick snapshot of a company's financial stability. A lower debt ratio often suggests that a company has a strong equity base, making it less vulnerable to economic downturns or financial stress. This assessment can be particularly vital for creditors, investors, and other stakeholders when evaluating the financial health of an organization. By examining a company's debt ratio, analysts and investors can gauge its financial risk relative to peers or industry averages. Companies with high debt ratios might be viewed as having higher financial risk, potentially impacting their credit ratings or borrowing costs. Such comparisons enable stakeholders to make informed decisions about investment or credit opportunities. Debt ratio provides insights into a company's capital structure by showcasing the balance between debt and equity. This understanding is crucial for investors and analysts to ascertain a company's financing strategy. A balanced capital structure often indicates sound financial management and strategic thinking about the cost of capital. While the debt ratio quantifies the proportion of assets financed by debt, it doesn't account for the costs or interest rates associated with that debt. Two companies with similar debt ratios might have significantly different interest obligations, impacting their overall financial performance and risk. Debt ratio on its own doesn't provide insights into a company's operating income or its ability to service its debt. Companies with strong operating incomes might comfortably manage higher debt loads, while those with weaker incomes might struggle even with lower debt ratios. The debt ratio focuses exclusively on the relationship between total debt and total assets. However, companies might have other significant non-debt liabilities, such as pension obligations or lease commitments. These liabilities can also impact a company's financial health, but they aren't considered within the traditional debt ratio framework. The debt ratio defines the relationship between a company's debts and assets, and holds significant relevance in financial analysis. This ratio, calculated by dividing total liabilities by total assets, serves as a valuable tool for assessing a company's financial stability, gauging risk exposure, and evaluating capital structure. A lower debt ratio often signifies robust equity, indicating resilience to economic challenges. Conversely, a higher ratio may suggest increased financial risk and potential difficulty in meeting obligations. Industry norms, business lifecycle, and economic conditions contextualize this ratio's interpretation. Additionally, different types of debt ratios, such as the debt-to-equity ratio, long-term debt ratio, and short-term debt ratio, provide further insights into a company's financial health and financing strategies. However, while the debt ratio offers advantages in analyzing financial stability and risk, it has limitations, such as not considering interest rate variations, omitting operating income, and excluding non-debt liabilities from assessment.Define Debt Ratio in Simple Terms

What Does Debt Ratio Mean in Finance?

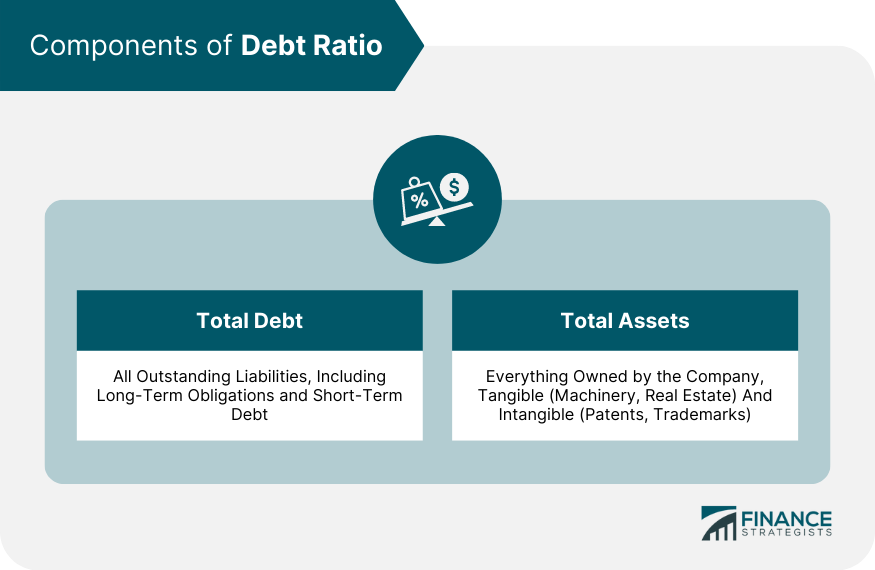

Components of Debt Ratio

Total Debt

Total Assets

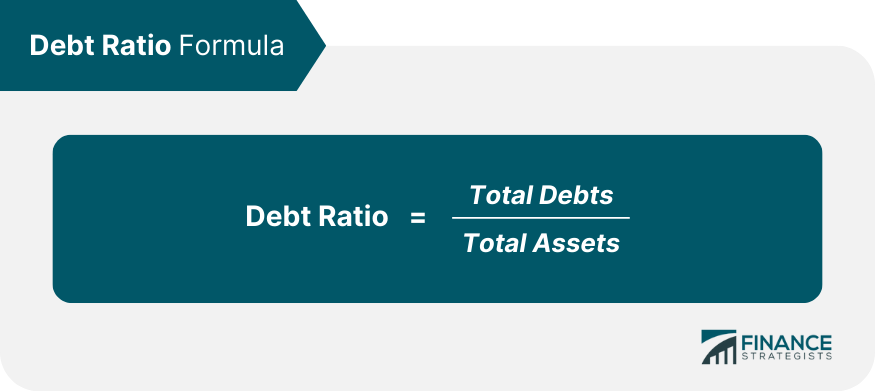

Debt Ratio Formula

Debt Ratio Example

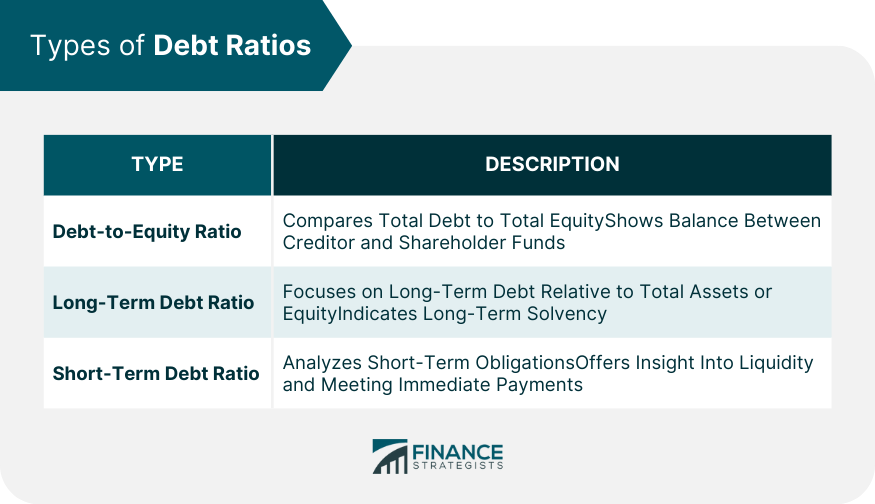

Types of Debt Ratios

Debt-to-Equity Ratio

Long-Term Debt Ratio

Short-Term Debt Ratio

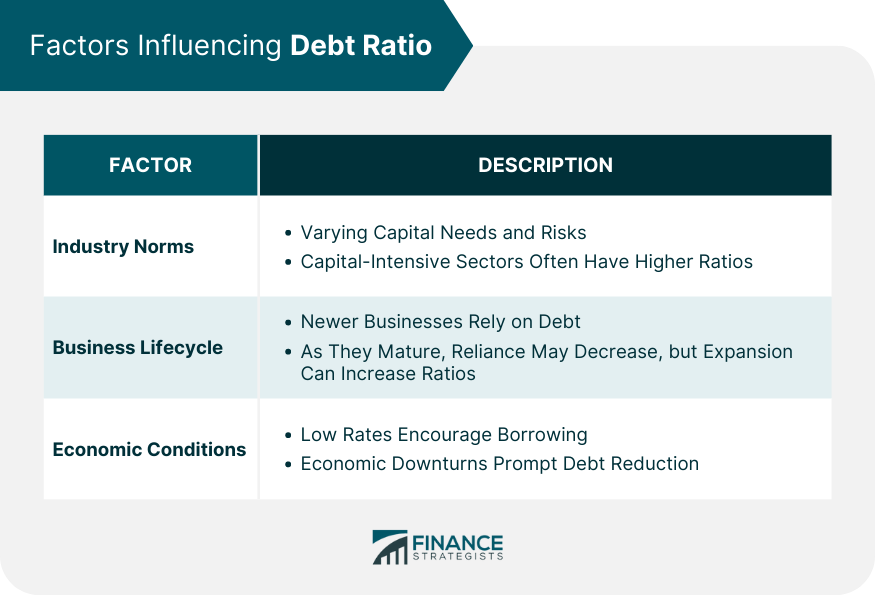

Factors Influencing Debt Ratio

Industry Norms

Business Lifecycle

Economic Conditions

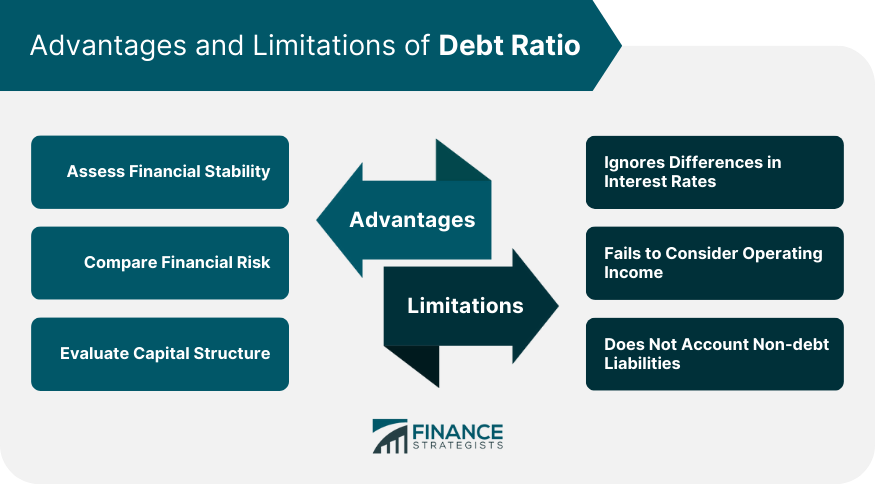

Advantages of Debt Ratio

Assess Financial Stability

Compare Financial Risk

Evaluate Capital Structure

Limitations of Debt Ratio

Ignores Differences in Interest Rates

Fails to Consider Operating Income

Does Not Account Non-debt Liabilities

Conclusion

Debt Ratio FAQs

It is a measurement of how much of a company’s assets are financed by debt; in other words, its financial leverage.

To find a business’s debt ratio, divide the total debts of the business by the total assets of the business.

The purpose of calculating the debt ratio of a company is to give investors an idea of the company’s financial situation.

Too high a debt ratio can indicate a looming problem for a company. At the very least, a company with a high amount of debt may have difficulty paying or maintaining dividend payments for investors.

What is considered to be an acceptable debt ratio by investors may depend on the industry of the company in which they are investing. For a more complete picture, investors also look at metrics such as return on investment (ROI) and earnings per share (EPS) to determine the worthiness of an investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.