The current ratio is a liquidity ratio that is used to calculate a company's ability to meet its short-term debt and obligations, or those due in a single year, using assets available on its balance sheet. It is also known as working capital ratio. A current ratio of one or more is preferred by investors. A current ratio less than one is an indicator that the company may not be able to service its short-term debt. On the other hand, a current ratio greater than one can also be a sign that the company has too much unsold inventory or cash on hand. Current assets refers to the sum of all assets that will be used or turned to cash in the next year. This list includes cash, inventory, and accounts receivables. Current liabilities refers to the sum of all liabilities that are due in the next year. This list includes wages, accounts payable and mortgage payments and loans. For example, if a company has $100,000 in current assets and $150,000 in current liabilities, then its current ratio is 0.6. Current ratios can vary depending on industry, size of company, and economic conditions. Industries with predictable, recurring revenue, such as consumer goods, often have lower current ratios while cyclical industries, such as construction, have high current ratios. Even within an industry, current ratios can differ between companies. For example, supplier agreements can make a difference to the number of liabilities and assets. A large retailer like Walmart may negotiate favorable terms with suppliers that allow it to keep inventory for longer periods and have generous payment terms or liabilities. During times of economic growth, investors prefer lean companies with low current ratios and ask for dividends from companies with high current ratios. But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns. Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. This may not always be the case, especially during economic recessions. In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity.Current Ratio Definition

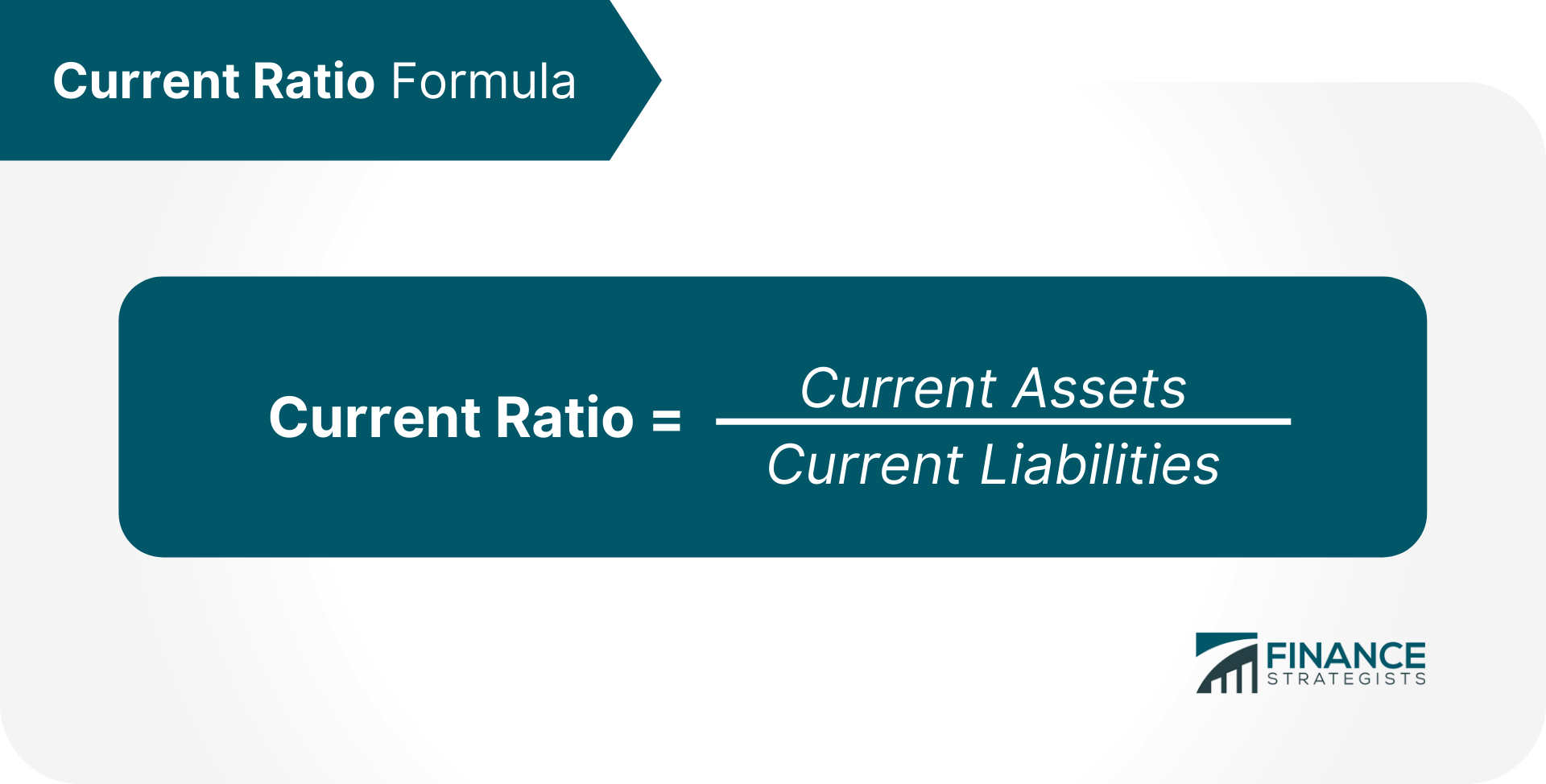

Current Ratio Formula

Current Ratio Calculation

What Does the Current Ratio Measure?

What Is a Good Current Ratio?

Current Ratio Calculation FAQs

The current ratio is a liquidity ratio that is used to calculate a company’s ability to meet its short-term debt and obligations, or those due in a single year, using assets available on its balance sheet.

The formula for the current ratio is: Current Ratio = Current Assets / Current Liabilities

A current ratio of one or more is preferred by investors.

For example, if a company has $100,000 in current assets and $150,000 in current liabilities, then its current ratio is 0.6.

Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash. This may not always be the case, especially during economic recessions. In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.