Lump-sum investing is the practice of investing a large amount of money in a single transaction. This strategy can be beneficial, allowing investors to take advantage of market opportunities and potentially earn higher returns over time. However, it also carries certain risks, such as the possibility of investing at the wrong time or in a declining market. Before making a lump-sum investment, it is important to assess your risk tolerance. This involves determining how much risk you are willing to take on in pursuit of higher returns. If you have a low-risk tolerance, there might be better strategies than lump-sum investing. Another important factor to consider is the current market conditions. While timing the market perfectly is nearly impossible, it is still important to understand market trends and valuations before making a lump-sum investment. Your investment time horizon, or how long you plan to keep your money invested, should also be considered. Generally, the longer your investment horizon, the more suitable lump-sum investing might be, as it allows for greater potential growth over time. Lump-sum investing requires a significant amount of cash upfront. Make sure you have enough cash available to make the investment without jeopardizing your financial stability or emergency fund. Diversification is key when it comes to investing, and this is especially true for lump-sum investments. Ensure that your investment is spread across different asset classes, sectors, and geographic regions to minimize risk. Before making a lump-sum investment, it's essential to establish clear investment goals. These goals might include saving for retirement, funding a college education, or purchasing a home. Next, identify the investment vehicles that best align with your goals and risk tolerance. Some common options include: Individual stocks can offer significant growth potential but also carry higher risk. Bonds are typically lower-risk investments that pay interest over a fixed period. Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets. Exchange-Traded Funds (ETFs) are similar to mutual funds but trade like stocks on an exchange. Real Estate Investment Trusts (REITs) are companies that own and manage income-generating real estate properties. Thoroughly research and analyze the investments you're considering, examining factors such as past performance, management team, and financial health. Decide on the appropriate allocation of your lump-sum investment across different asset classes, sectors, and geographic regions to minimize risk and maximize potential returns. Finally, execute the lump-sum investment through a brokerage account or financial advisor. Timing the market is notoriously difficult, as it's nearly impossible to predict short-term market movements accurately. Despite the challenges, historical data suggests that investors who can successfully time the market may achieve higher returns than those who do not. A well-balanced portfolio can help investors achieve their desired returns while minimizing risk. Strategic asset allocation involves setting long-term allocation targets, while tactical asset allocation involves making short-term adjustments based on market conditions. Diversification reduces the overall risk of an investment portfolio by spreading investments across different asset classes, sectors, and geographic regions. To maximize the benefits of diversification, ensure your investments are spread across various sectors, regions, and asset classes, as this helps to minimize the impact of any single investment's poor performance. Lump-sum investments may result in capital gains taxes when investments are sold for a profit. Understanding the tax implications can help you make more informed investment decisions. Consider tax-efficient investment vehicles, such as tax-exempt municipal bonds or tax-advantaged retirement accounts, to minimize your tax burden. Tax-loss harvesting is a strategy that involves selling investments at a loss to offset capital gains and reduce your tax liability. This strategy can be particularly useful for lump-sum investors. A Traditional IRA allows you to make tax-deductible contributions and grow your investments tax-deferred until you withdraw the funds in retirement. A Roth IRA allows you to make after-tax contributions and grow your investments tax-free, with no taxes due upon withdrawal in retirement. Employer-sponsored retirement accounts, such as 401(k)s and 403(b)s, can also be useful vehicles for lump-sum investing, as they often offer tax advantages and matching contributions from employers. Lump-sum investing in retirement accounts can offer tax advantages and the potential for employer matching, but it may also limit your investment options and flexibility. Dollar-cost averaging (DCA) is an investment strategy where an investor contributes a fixed amount of money at regular intervals over time, regardless of market conditions. Reduces the impact of market volatility Encourages disciplined, long-term investing Eliminates the need for market timing May result in lower returns during a consistently rising market Requires regular contributions, which may not be feasible for some investors Risk and Volatility: DCA tends to be less risky, as it reduces the impact of market fluctuations; lump-sum investing exposes investors to more market risk, especially in the short term. Potential Returns: Lump-sum investing has the potential for higher returns in a rising market, while DCA may offer more consistent returns in a fluctuating market. Investment Approach: Lump-sum investing requires a larger initial investment, while DCA allows investors to build their portfolios gradually over time. Market Timing: Lump-sum investing may be more suitable for investors with a strong understanding of market trends and valuations; DCA eliminates the need for market timing. Deciding between lump-sum investing and dollar-cost averaging depends on factors such as your risk tolerance, investment goals, financial situation, and market outlook. Consulting with a financial advisor can help you determine which strategy best suits your circumstances. Lump-sum investing can be a powerful strategy for achieving your financial goals, but it's essential to carefully weigh the risks and rewards before committing to this approach. A thorough understanding of your individual financial situation, risk tolerance, and investment goals is crucial, as is seeking professional financial advice to ensure you make informed decisions.What Is Lump-Sum Investing?

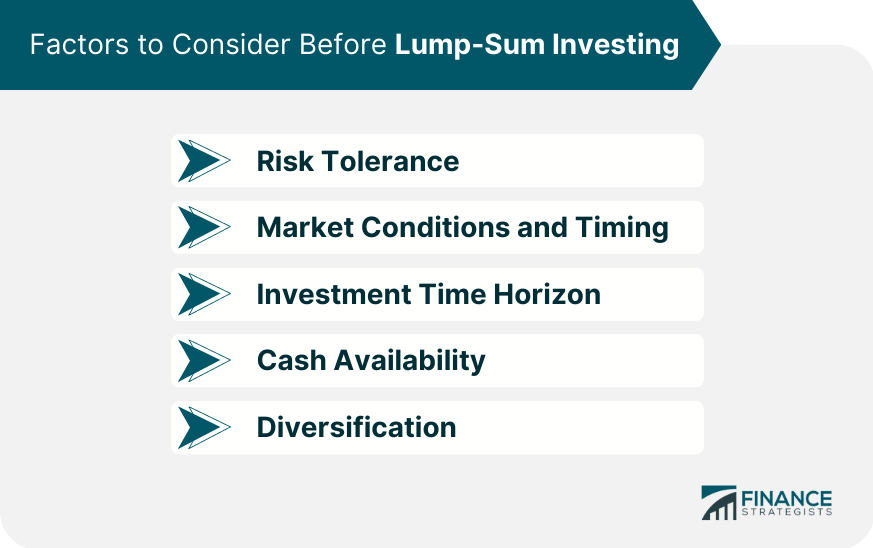

Factors to Consider Before Lump-Sum Investing

Risk Tolerance

Market Conditions and Timing

Investment Time Horizon

Cash Availability

Diversification

Steps to Execute a Lump-Sum Investment

Determine Investment Goals

Identify Appropriate Investment Vehicles

Stocks

Bonds

Mutual Funds

Exchange-Traded Funds (ETFs)

Real Estate Investment Trusts (REITs)

Perform Due Diligence and Research

Allocate and Diversify Investments

Execute the Investment

Key Strategies for Successful Lump-Sum Investing

Market Timing

Asset Allocation

Tax Considerations for Lump-Sum Investing

Capital Gains Tax Implications

Tax-Efficient Investment Vehicles

Tax-Loss Harvesting

Lump-Sum Investing in Retirement Accounts

Traditional IRA

Roth IRA

401(k) and 403(b) Accounts

Benefits and Drawbacks of Lump-Sum Investing in Retirement Accounts

Evaluating Lump-Sum Investing vs. Dollar-Cost Averaging

Definition of Dollar-Cost Averaging

Pros and Cons of Dollar-Cost Averaging

Pros

Cons

Comparing Lump-Sum Investing and Dollar-Cost Averaging

Choosing the Right Strategy

Conclusion

Lump-Sum Investing FAQs

Lump-sum investing is a strategy where an individual invests a large sum of money into an investment or portfolio in one go rather than making smaller, regular investments over time.

Lump-sum investing can be a good strategy if the investor has a large sum of money available to invest and wants to benefit from potentially higher returns over a longer time period. However, it can also be risky if the market experiences a downturn soon after the investment is made.

Lump-sum investing involves investing a large sum of money all at once, while dollar-cost averaging involves investing smaller, regular amounts over time. Both strategies have benefits and drawbacks, and the choice between them depends on individual circumstances.

Lump-sum investing can lead to higher returns over a longer period, as the entire investment amount is exposed to market growth immediately. It can also simplify the investment process by reducing transaction costs and management fees.

The main risk of lump-sum investing is that the market could experience a downturn soon after the investment is made, resulting in a significant loss of value. Additionally, the investor may miss out on potential gains that could have been made through dollar-cost averaging.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.