Tax-exempt municipal bonds are debt securities issued by governmental entities, such as states, cities, and counties, to finance public projects. The interest income earned on these bonds is exempt from federal income taxes and, in some cases, state and local taxes, making them attractive to investors. Municipal bonds serve as a critical source of financing for public projects, such as schools, hospitals, transportation infrastructure, and utilities. By issuing municipal bonds, governmental entities can raise the necessary capital to fund these projects without raising taxes. There are two main types of municipal bonds: General Obligation (GO) bonds and Revenue bonds. GO bonds are backed by the full faith and credit of the issuing government and are supported by its taxing power. In contrast, Revenue bonds are backed by the revenues generated from a specific project or enterprise, such as toll roads or water systems. One of the main advantages of investing in tax-exempt municipal bonds is the tax-free interest income. The interest earned on these bonds is exempt from federal income taxes and, often, state and local taxes, making them particularly attractive to investors in higher tax brackets. In addition to the tax-free interest income, tax-exempt municipal bonds offer the potential for capital appreciation, as bond prices may rise in response to changes in market conditions or credit quality improvements. Investing in tax-exempt municipal bonds can provide diversification benefits to an investor's portfolio. Because municipal bonds have a low correlation with other asset classes, such as stocks, they can help to reduce overall portfolio risk. Tax-exempt status makes municipal bonds more attractive to investors, enabling the issuing entities to borrow funds at lower interest rates than comparable taxable bonds. By issuing tax-exempt municipal bonds, governmental entities gain flexibility in financing public projects, as they can spread the costs over a longer period and allocate funds more efficiently. Tax-exempt municipal bonds help attract investment capital from various sources, including individual and institutional investors, thereby facilitating economic growth and development. Credit risk is the possibility that the issuer of a municipal bond may default on its debt obligations. Factors such as economic conditions, fiscal management, and political stability can affect the creditworthiness of the issuer. Credit ratings agencies, such as Moody's, Standard & Poor's, and Fitch Ratings, evaluate the credit risk of municipal bond issuers and assign credit ratings to their bonds. These ratings can serve as a guide for investors in assessing the credit quality of a particular bond issue. Interest rate risk is the potential for bond prices to decline due to rising interest rates. Generally, bond prices and interest rates have an inverse relationship, meaning that when interest rates rise, bond prices fall, and vice versa. Investors who need to sell their bonds before maturity may face losses if interest rates have increased since the time of purchase. Changes in market interest rates can affect the market value of tax-exempt municipal bonds. Investors should be aware of prevailing interest rates and the potential impact on their bond investments, particularly when investing in longer-term bonds, which are more sensitive to interest rate fluctuations. Reinvestment risk refer to the possibility that an investor may not be able to reinvest the interest income or principal received from a bond at the same rate of return. Some municipal bonds have call provisions, allowing the issuer to redeem the bonds before maturity, which can result in prepayment risk for investors. Investors can employ various strategies to mitigate reinvestment risk, such as investing in bonds with different maturities, utilizing bond ladders, or reinvesting in different asset classes. The tax-exempt municipal bond market involves several key participants: Issuers: States, cities, and local governments issue municipal bonds to finance public projects. Underwriters: Financial institutions, such as banks and investment firms, serve as underwriters in the bond issuance process, helping to market and distribute the bonds to investors. Investors: Individuals, mutual funds, and institutional investors, such as pension funds and insurance companies, invest in tax-exempt municipal bonds to earn tax-free income and diversify their portfolios. The tax-exempt municipal bond market is a significant component of the overall bond market, with outstanding municipal debt estimated to be over $4 trillion as of 2023. Growth trends in the market are influenced by various factors, including demographic shifts, infrastructure needs, and changes in tax laws. The performance of the tax-exempt municipal bond market can be affected by economic factors such as interest rate fluctuations, inflation, and changes in the credit quality of issuers. Regulatory factors, such as changes in tax laws or financial regulations, can also have a significant impact on the market. Credit ratings play a crucial role in evaluating the credit quality of municipal bond issuers. Investors should consider the credit ratings assigned by major rating agencies when assessing the risk associated with a particular bond issue. In addition to credit ratings, investors should examine the financial health of the issuer, including its revenue sources, debt levels, and fiscal management practices, to assess the potential credit risk of a bond issue. Investing in municipal bonds from different geographic regions can help reduce the impact of local economic or political factors on an investor's portfolio. Investors can also diversify their municipal bond holdings by investing in bonds issued for various types of public projects, such as education, transportation, or utilities, to mitigate sector-specific risks. Investors should match their investment horizon with the maturity of the bonds they purchase. Longer-term bonds generally offer higher yields but are more sensitive to interest rate fluctuations, while shorter-term bonds tend to have lower yields but are less sensitive to interest rate changes. Investors should be aware of the yield curve, which represents the relationship between bond yields and maturities. Different yield curve shapes can provide insights into market expectations for future interest rates and economic conditions, helping investors make informed decisions about the maturity and duration of their municipal bond investments. Municipal bond funds are investment vehicles that pool investors' money to purchase a diversified portfolio of tax-exempt municipal bonds. These funds can be structured as mutual funds, Exchange-Traded Funds (ETFs), or closed-end funds, and they may focus on specific maturities, credit qualities, or geographic regions. Municipal bond funds are managed by professional portfolio managers, who have the expertise to analyze the credit quality of bond issuers, monitor interest rate trends, and adjust the fund's portfolio to optimize returns and manage risks. Investing in municipal bond funds can provide instant diversification, as these funds typically hold a large number of bonds from various issuers and sectors. Additionally, municipal bond funds offer greater liquidity compared to individual bond investments, as shares of the funds can be bought or sold on a daily basis. Investors should be aware of the risks and considerations associated with investing in municipal bond funds, including credit risk, interest rate risk, and reinvestment risk. Additionally, while tax-exempt municipal bond funds primarily invest in bonds that generate tax-free income, some funds may hold a small portion of taxable bonds or other investments, which could result in taxable income for the investor. Tax-exempt municipal bonds play a crucial role in public financing, providing funds for essential public projects while offering investors tax-free income and portfolio diversification benefits. Investors should carefully consider the credit quality, maturity, and diversification of their municipal bond investments and may benefit from investing in professionally managed municipal bond funds. By understanding the benefits, risks, and market dynamics associated with tax-exempt municipal bonds, investors can make informed decisions and potentially enhance their investment returns.Definition of Tax-Exempt Municipal Bonds

Types of Municipal Bonds

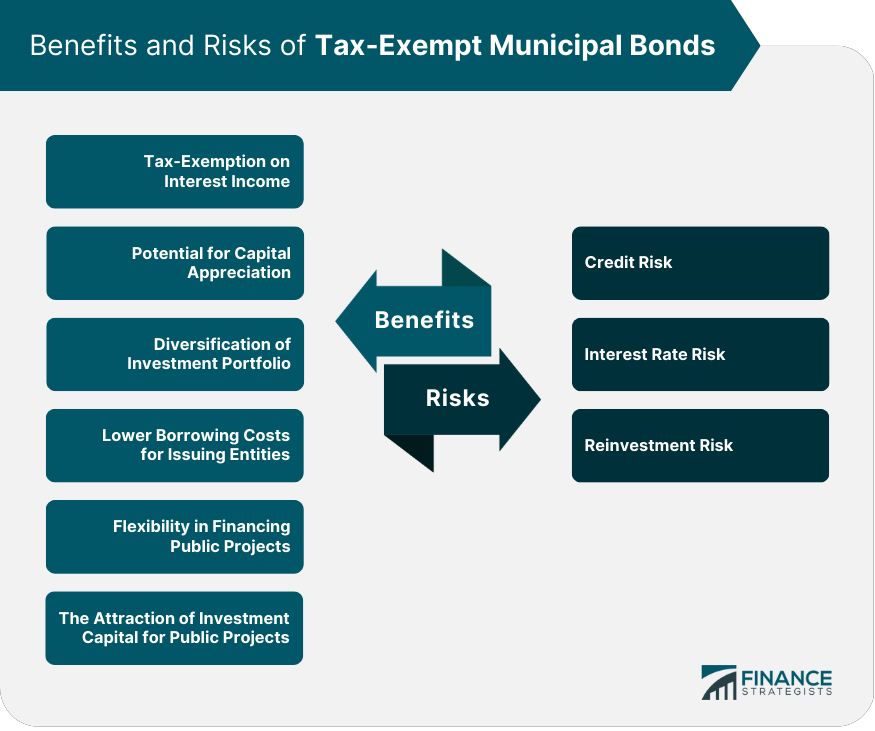

Benefits of Tax-Exempt Municipal Bonds

Benefits for Investors

Tax-Exemption on Interest Income

Potential for Capital Appreciation

Diversification of Investment Portfolio

Benefits for Issuing Entities

Lower Borrowing Costs

Flexibility in Financing Public Projects

The Attraction of Investment Capital

Risks Associated With Tax-Exempt Municipal Bonds

Credit Risk

Interest Rate Risk

Reinvestment Risk

Tax-Exempt Municipal Bond Market

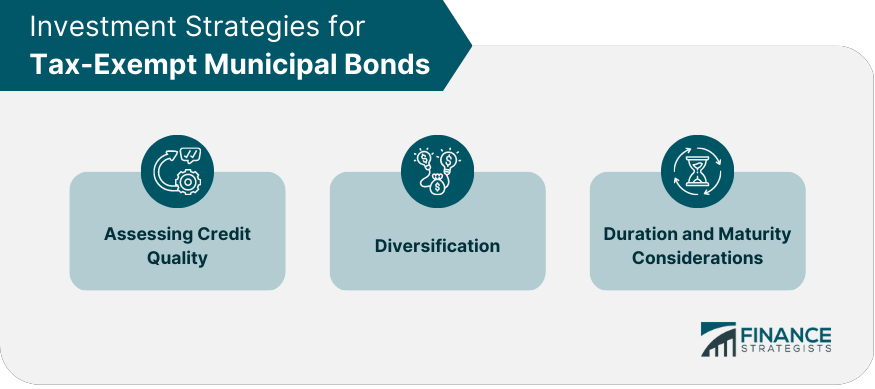

Investment Strategies for Tax-Exempt Municipal Bonds

Assessing Credit Quality

Diversification

Duration and Maturity Considerations

Tax-Exempt Municipal Bond Funds

Definition and Types of Municipal Bond Funds

Advantages of Investing in Municipal Bond Funds

Professional Management

Diversification and Liquidity

Risks and Considerations of Investing in Municipal Bond Funds

Conclusion

Tax-Exempt Municipal Bonds FAQs

Tax-exempt municipal bonds are debt securities issued by state, county, or local governments to finance public projects, such as schools, hospitals, and infrastructure. The interest income earned on these bonds is exempt from federal income taxes and, often, state and local taxes. This tax advantage differentiates them from other types of bonds, such as corporate or Treasury bonds, which typically generate taxable interest income.

Investors should consider investing in tax-exempt municipal bonds for several reasons, including tax-free interest income, potential capital appreciation, and portfolio diversification. The tax-exempt status of these bonds makes them particularly attractive to investors in higher tax brackets, who can benefit from the tax savings on interest income.

The main risks associated with investing in tax-exempt municipal bonds include credit risk, interest rate risk, and reinvestment risk. Credit risk is the possibility that the bond issuer may default on its debt obligations, while interest rate risk refers to the potential for bond prices to decline due to rising interest rates. Reinvestment risk occurs when an investor may not be able to reinvest the interest income or principal received from a bond at the same rate of return.

Investors can assess the credit quality of tax-exempt municipal bonds by examining credit ratings assigned by major rating agencies, such as Moody's, Standard & Poor's, and Fitch Ratings. Additionally, investors should evaluate the financial health of the issuer, considering factors such as revenue sources, debt levels, and fiscal management practices.

Investing in tax-exempt municipal bond funds offers several advantages over investing in individual bonds, such as professional management, diversification, and liquidity. Municipal bond funds are managed by professional portfolio managers, who have the expertise to analyze the credit quality of bond issuers and monitor interest rate trends. Furthermore, these funds provide instant diversification and greater liquidity, as they typically hold a large number of bonds from various issuers and sectors, and shares of the funds can be bought or sold on a daily basis.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.