The "Dogs of the Dow" refers to a popular investment strategy in the world of finance. Originating from the concept of "bargain hunting", it involves investing in the 10 highest dividend-yielding stocks out of the 30 listed in the Dow Jones Industrial Average (DJIA) at the beginning of each year. The strategy derives its name from its approach, where the 'dogs' symbolize underperforming stocks in terms of price, which are expected to perform better in the future. Investors who follow this strategy believe that blue-chip companies do not alter their dividend to reflect trading conditions and, therefore, the dividend yield can act as a measure of the average worth of the company. If the company's share price falls, the dividend yield rises (assuming dividend payments remain constant), meaning these high-yield companies are undervalued. The underlying principle of the Dogs of the Dow strategy hinges on the notion of mean reversion. This implies that high-performing blue-chip stocks have their periods of ebb and flow, but in the long run, they will likely revert to the mean. As we delve into the workings of the Dogs of the Dow strategy, stock selection emerges as the fundamental step. At the beginning of each year, an investor scrutinizes the 30 companies in the DJIA and selects the ten with the highest dividend yield. The selection is based solely on the dividend yield, not on the company's fundamentals or the broader market outlook. Such a selection method banks on the market’s cyclicality, assuming that these stocks have underperformed during the previous year and thus, are primed for a rebound in the coming year. This annual reshuffling allows investors to always have the top ten high-yield Dow stocks in their portfolio. The criteria for choosing the stocks is straightforward: the ten companies of the DJIA with the highest dividend yield. It's important to note that the strategy doesn’t account for the size of the company or other qualitative factors. Once the portfolio is established, the investor holds these stocks for the entire year. When it comes to portfolio rebalancing, it happens once every year. At the start of the year, the investor adjusts the portfolio to reflect the current Dogs of the Dow. Stocks no longer meeting the criteria are sold, and new ones are purchased. The process is repeated annually, creating a rotating portfolio of Dow components. Since the strategy focuses on the top ten dividend-yielding stocks of the DJIA, it inherently leans toward companies that reward their shareholders through substantial dividend payouts. This feature makes the strategy particularly appealing for income investors, who can benefit from the double bonanza of potential price appreciation and robust dividend income. Moreover, the dividend payments can act as a buffer during market downturns, providing regular income to investors when stock prices may be falling. This can help reduce the overall volatility of the portfolio and provide a steady stream of income. The Dow Jones Industrial Average consists of 30 well-established, large-cap companies that are considered leaders in their respective industries. By investing in these blue-chip stocks, investors are essentially putting their money behind companies with a proven track record of stability and longevity. This focus on established companies can provide a sense of security to investors. These companies are typically less volatile compared to smaller or riskier stocks, making the strategy appealing to conservative investors who prioritize capital preservation over aggressive growth. The selection process is straightforward, based solely on dividend yield, and the portfolio is rebalanced annually. This simplicity can be attractive to investors who prefer a more hands-off approach to investing or who may not have the time or expertise to thoroughly analyze individual stocks or complex investment strategies. By following a predefined set of rules and focusing on a select group of stocks, investors can reduce the need for constant monitoring and decision-making, allowing them to potentially save time and effort while still participating in the stock market. By investing in only ten stocks, the strategy inherently lacks the diversification benefits that a more broadly diversified portfolio can provide. Concentrating investments in a small number of companies exposes investors to company-specific risks and increases the potential impact of any negative developments affecting those companies. For instance, if one or more of the selected stocks experience a significant decline in value or encounter financial difficulties, the overall performance of the portfolio could be adversely affected. In a diversified portfolio, the negative impact of such events may be mitigated by the positive performance of other investments. However, the concentrated nature of the Dogs of the Dow strategy leaves investors more vulnerable to the performance of the selected stocks. Value traps occur when stocks appear undervalued based on traditional valuation metrics, such as low price-to-earnings ratios or high dividend yields, but their prices continue to decline or fail to recover. Investing in stocks solely based on high dividend yield without considering other fundamental factors can expose investors to the risk of investing in companies with deteriorating financial health or facing significant challenges in their industry. It is crucial for investors to exercise due diligence and conduct thorough research to ensure that the high dividend yield of a stock is not a result of temporary or unsustainable factors. Evaluating the company's financials, industry dynamics, competitive positioning, and growth prospects can help investors avoid falling into value traps and make more informed investment decisions. The Dogs of the Dow strategy's primary focus on dividend yield may cause investors to overlook the potential of growth stocks. Growth stocks are companies that are expected to grow at an above-average rate compared to the overall market or their industry peers. These stocks often reinvest their earnings back into the business instead of distributing them as dividends, as they aim to expand and increase their market share. By solely focusing on high dividend-yielding stocks, the Dogs of the Dow strategy may exclude companies with significant growth potential. While dividends can provide a steady stream of income, investors may miss out on the opportunity for capital appreciation that growth stocks can offer. It's important for investors to strike a balance between income and growth when constructing their investment portfolios. Incorporating a diversified mix of dividend-yielding stocks and growth-oriented investments can help capture both income and capital appreciation potential. The Dogs of the Dow High Yield 10 is a variation of the traditional Dogs of the Dow strategy that focuses on the ten stocks with the highest dividend yield among the 30 DJIA stocks. This variation aims to maximize dividend income by concentrating on the highest-yielding stocks. It may appeal to income-focused investors who prioritize a higher yield over other factors. The Small Dogs of the Dow is another variation that selects the five lowest-priced stocks among the ten highest-yielding Dogs of the Dow. This modification focuses on the potential for capital appreciation in addition to dividend yield. The rationale behind this approach is that the lowest-priced stocks among the high-yielders may have the most significant room for price appreciation. The Dow 5 is a further modification that narrows down the portfolio to just five stocks out of the ten highest-yielding stocks. This approach aims to increase concentration and potentially amplify the impact of the selected stocks on the overall portfolio performance. It may appeal to investors who have a high level of conviction in the prospects of a smaller number of stocks. Dogs of the Dow is an investment strategy that focuses on selecting high-dividend-yielding stocks from established companies. By following this strategy, investors aim to outperform the broader market. The Dogs of the Dow strategy works by annually selecting the top dividend-yielding stocks from the Dow Jones Industrial Average and rebalancing the portfolio accordingly. When considering Dogs of the Dow as an investment approach, its potential for high dividend yield, focus on established companies, and simplified investment approach are notable advantages. However, there are limitations to this strategy, including limited diversification, potential for value traps, and neglect of growth stocks. While Dogs of the Dow has its merits, investors should carefully evaluate their investment goals and risk tolerance before adopting this strategy. Ultimately, a well-rounded investment strategy should incorporate a diversified portfolio and a thorough understanding of the underlying risks and rewards.What Are Dogs of the Dow?

How the Dogs of the Dow Strategy Works

Selection of the Stocks

Criteria for Choosing the Stocks and Rebalancing of the Portfolio

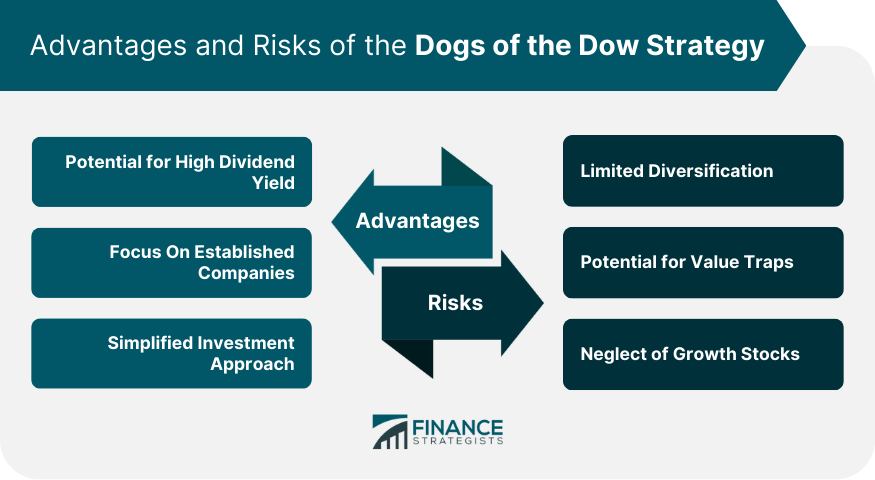

Advantages of the Dogs of the Dow Strategy

Potential for High Dividend Yield

Focus On Established Companies

Simplified Investment Approach

Risks of the Dogs of the Dow Strategy

Limited Diversification

Potential for Value Traps

Neglect of Growth Stocks

Variations and Modifications of the Dogs of the Dow Strategy

Dogs of the Dow High Yield 10

Small Dogs of the Dow

Dow 5

Conclusion

Dogs of the Dow FAQs

The historical performance of the Dogs of the Dow strategy has varied over time. Some years have seen strong outperformance compared to the broader market, while other years have underperformed. It's important to note that past performance is not indicative of future results, and the strategy's success depends on various factors such as market conditions and the performance of the selected stocks.

While the Dogs of the Dow strategy is specifically tailored to the DJIA, similar strategies can be applied to other stock market indices. Investors can identify the highest-yielding stocks in different indices and construct their portfolios accordingly. However, it's crucial to consider the characteristics and dynamics of the specific index and its constituent stocks before applying the strategy.

No investment strategy can guarantee high returns. The Dogs of the Dow strategy, like any other investment approach, carries risks and uncertainties. The performance of the strategy depends on various factors, including market conditions, economic trends, and the individual performance of the selected stocks. Investors should carefully evaluate the strategy's potential risks and rewards before implementing it.

Rebalancing the portfolio annually is a key component of the Dogs of the Dow strategy. The purpose of rebalancing is to ensure that the portfolio always holds the ten highest-yielding stocks of the DJIA. By rebalancing, investors capture the potential benefits of the strategy, which are based on the assumption that high-yield stocks tend to revert to the mean. However, individual investors may choose to adjust the frequency of rebalancing based on their preferences and market conditions.

Yes, the Dogs of the Dow strategy can be combined with other investment approaches to create a diversified portfolio. Investors may choose to incorporate other strategies such as growth investing, value investing, or sector rotation alongside the Dogs of the Dow strategy to achieve a more comprehensive investment approach. Diversification and a well-rounded investment strategy can help mitigate risks and capture a broader range of investment opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.