A beneficial owner is an individual or group who enjoys the benefits of ownership even though the title to some form of property is in another name. They are the true owners, either directly or indirectly, having the power to vote or influence transaction decisions regarding a specific security, such as shares in a company. A beneficial owner enjoys the benefits of ownership, even though the property's title is in another name. Beneficial ownership is distinguished from legal ownership. In most cases, the legal and beneficial owners are one and the same. Publicly traded securities are often registered in the name of a broker for safety and convenience. Wealthy individuals often list their assets under trust while they remain the beneficial owner. Understanding beneficial ownership is crucial for various stakeholders, including investors, regulators, and financial institutions. Identifying the true owners of assets helps prevent money laundering, tax evasion, and other financial crimes. Moreover, it promotes transparency and ensures compliance with legal and regulatory requirements. The legal owner is the individual or entity whose name is on the title or deed of the property. They have the legal right to sell, transfer, or encumber the property, subject to any restrictions or limitations imposed by law or contract. While a beneficial owner enjoys the benefits of ownership, the legal owner holds the title to the property. In some cases, the legal and beneficial owners may be the same, but in others, they may differ. The key distinction lies in the control and benefits derived from the property rather than the mere holding of the title. 1. Trusts: A common scenario where legal and beneficial ownership diverge is when assets are held in a trust. The trustee holds legal title to the assets, while the beneficiary enjoys the benefits of ownership. 2. Securities: In the case of publicly traded securities, shares may be held in the name of a broker or custodian (legal owner), while the investor (beneficial owner) retains control and benefits. 3. Real Estate: In real estate transactions, a nominee may be registered as the legal owner to maintain the anonymity of the beneficial owner. In securities, brokers play a crucial role in managing the registration and transfer of ownership. They hold securities in their name on behalf of their clients, ensuring safety and convenience. This arrangement allows for efficient trading and settlement while clients retain the benefits of ownership, such as voting rights and dividends. Street name registration refers to the practice of registering securities in the name of a broker, bank, or other financial institution rather than the individual investor. This is done for convenience and to facilitate the trading and settlement process. The investor, as the beneficial owner, retains control and benefits from the securities. Direct ownership of securities occurs when the investor's name is on the registration, while indirect ownership occurs when securities are registered in the name of a broker or other intermediary. Indirect ownership is more common, as it simplifies trading and settlement, but it may introduce additional counterparty risk. A trust is a legal arrangement where one party, the trustee, holds and manages assets for the benefit of another party, the beneficiary. Trusts can be established for various reasons, such as estate planning, asset protection, and tax planning. The trustee has a fiduciary duty to act in the best interests of the beneficiary and manage the trust's assets accordingly. 1. Grantor: The grantor, also known as the settlor, is the person who establishes the trust and transfers assets to it. 2. Trustee: The trustee is the individual or entity responsible for managing the trust's assets and carrying out the terms of the trust agreement. 3. Beneficiary: The beneficiary is the person or entity who benefits from the trust, receiving income or assets as specified in the trust agreement. Understanding the different types of trusts and their implications for beneficial ownership is essential for effective estate planning, tax planning, and compliance with legal and regulatory requirements. 1. Revocable Trust: In a revocable trust, the grantor retains control over the assets and can modify or terminate the trust during their lifetime. They are considered the beneficial owner of the trust assets for tax purposes. 2. Irrevocable Trust: Once established, an irrevocable trust cannot be modified or terminated by the grantor. The beneficiaries are considered the beneficial owners of the trust assets, and the trust itself becomes a separate legal entity for tax purposes. 3. Living Trust: A living trust, also known as an inter vivos trust, is created during the grantor's lifetime and can be either revocable or irrevocable. 4. Testamentary Trust: A testamentary trust is created through the provisions of a will and takes effect upon the grantor's death. The beneficial ownership of the assets depends on the terms of the trust and the applicable laws. Beneficial owners are generally responsible for paying taxes on income and gains derived from their assets, even if the legal title is held by another party. This includes dividends, interest, and capital gains. Tax obligations may vary depending on the jurisdiction and the specific type of asset or income. Opaque beneficial ownership structures can facilitate tax evasion by concealing the true owner of assets and income. This may involve the use of shell companies, trusts, and other vehicles to hide the beneficial owner's identity and evade taxes. Governments and international organizations are increasingly focused on combating tax evasion by enhancing transparency and disclosure requirements for beneficial ownership. Various international initiatives aim to improve tax compliance and transparency, including the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). These initiatives require financial institutions to identify and report information on beneficial owners of accounts and assets to the relevant tax authorities. Identifying beneficial owners is crucial for preventing money laundering, terrorist financing, and other financial crimes. Financial institutions and other regulated entities are required to conduct due diligence on their customers, including identifying and verifying the beneficial owners of accounts and assets. Anti-money laundering regulations, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, require financial institutions to establish and maintain AML compliance programs, including policies and procedures for identifying and verifying beneficial ownership. Failure to comply with these requirements can result in significant penalties and reputational damage. Know Your Customer (KYC) and Customer Due Diligence (CDD) procedures involve collecting and verifying customer information, including the identification and verification of beneficial owners. This may include obtaining documents, conducting background checks, and monitoring transactions to detect suspicious activity. Robust KYC and CDD procedures are essential for maintaining AML compliance and mitigating financial crime risks. Increased transparency in beneficial ownership is essential for combating financial crime, promoting tax compliance, and enhancing corporate governance. It enables regulators, law enforcement, and other stakeholders to identify the true owners of assets and hold them accountable for their actions. Public companies are generally subject to more stringent disclosure requirements than private companies, including the disclosure of significant shareholders and their beneficial ownership. However, there is a growing trend towards enhanced transparency and disclosure requirements for private companies as well, particularly in the context of AML regulations and tax compliance initiatives. International organizations, such as the Financial Action Task Force (FATF) and the Organisation for Economic Co-operation and Development (OECD), are working to develop global standards and best practices for beneficial ownership transparency. This includes the development of beneficial ownership registries and enhanced information sharing among tax authorities and law enforcement agencies. Some legal and regulatory frameworks may contain loopholes that allow individuals and entities to conceal their beneficial ownership, thereby facilitating financial crime and tax evasion. Addressing these loopholes requires ongoing efforts by policymakers and regulators to enhance transparency and close gaps in the existing rules. The use of shell companies and offshore jurisdictions is a common strategy for concealing beneficial ownership. Shell companies are entities with no significant operations or assets, often used as vehicles to hold assets and facilitate financial transactions. Offshore jurisdictions offer favorable tax and regulatory environments, allowing individuals and entities to minimize taxes and maintain privacy. While transparency and disclosure of beneficial ownership are crucial for combating financial crime, privacy concerns also arise. Some individuals may have legitimate reasons for maintaining privacy, such as personal safety or protection of sensitive information. Striking the right balance between transparency and privacy is a challenge for policymakers, requiring the development of effective safeguards and mechanisms to ensure legitimate privacy concerns are respected. Understanding beneficial ownership is fundamental in finance, taxation, and regulatory compliance. Beneficial owners enjoy the benefits of ownership without holding the legal title. Distinguishing between beneficial and legal ownership is vital, with trusts, securities, and real estate being common scenarios for divergence. Comprehending trusts, their types, and their influence on beneficial ownership is essential for effective estate, tax planning, and compliance. Beneficial owners bear tax obligations and opaque structures could facilitate tax evasion, hence enhanced transparency and international compliance initiatives are pivotal. Identifying beneficial owners is also crucial in Anti-Money Laundering (AML) efforts, with KYC and CDD procedures playing an instrumental role. While increased transparency in beneficial ownership is vital for combating financial crime and promoting tax compliance, it also raises privacy concerns. Navigating these complex dynamics requires a thorough understanding of beneficial ownership and the obligations it entails.Who Is a Beneficial Owner?

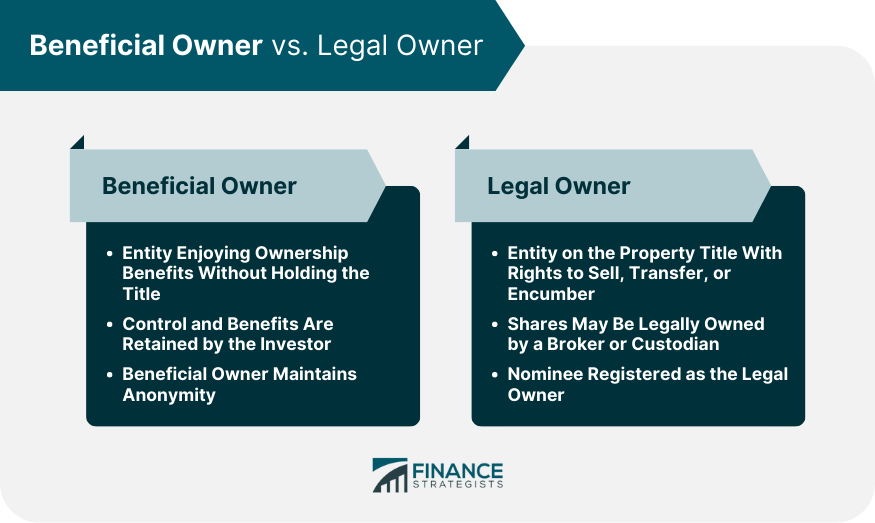

Beneficial Owner vs Legal Owner

Definition of Legal Owner

Distinction Between Beneficial and Legal Ownership

Common Scenarios of Separate Legal and Beneficial Ownership

Beneficial Ownership in Securities

Role of Brokers in Securities Ownership

Street Name Registration

Direct vs Indirect Ownership of Securities

Trusts and Beneficial Ownership

Definition and Purpose of Trusts

Grantor, Trustee, and Beneficiary Roles

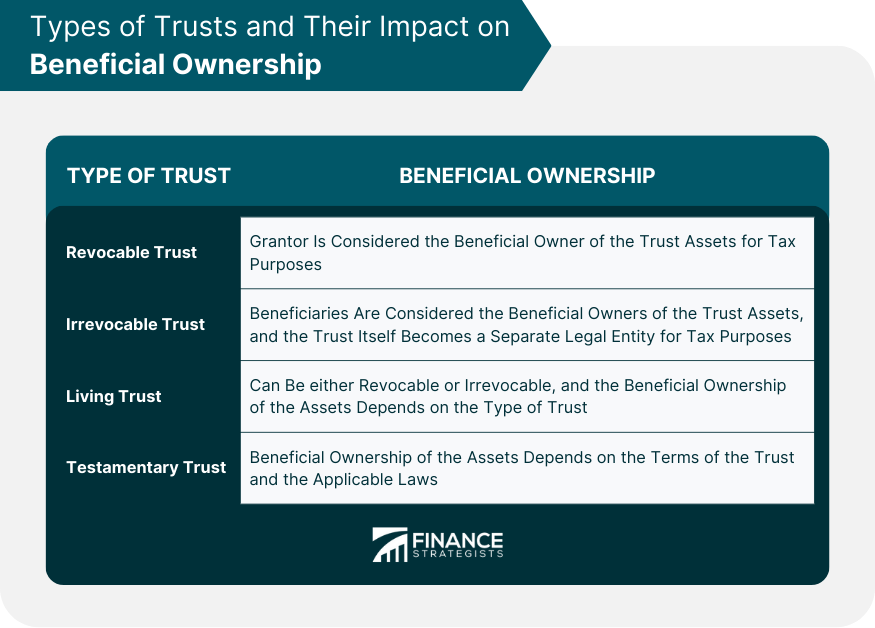

Types of Trusts and Their Impact on Beneficial Ownership

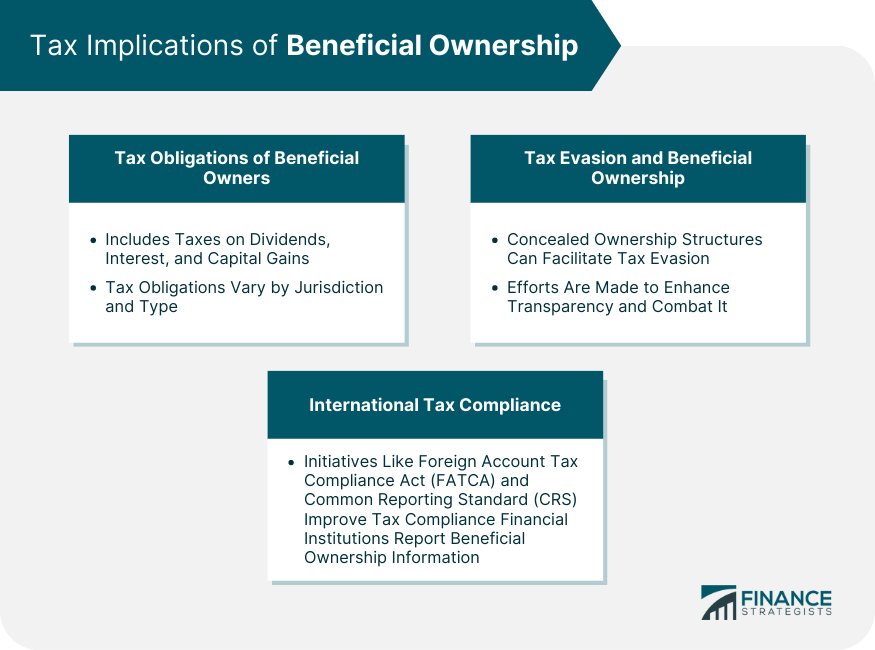

Tax Implications of Beneficial Ownership

Tax Obligations of Beneficial Owners

Tax Evasion and Beneficial Ownership

International Tax Compliance and Reporting Requirements

Beneficial Ownership and Anti-Money Laundering (AML) Regulations

Importance of Identifying Beneficial Owners

AML Regulatory Framework and Beneficial Ownership

Know Your Customer (KYC) and Customer Due Diligence (CDD) Procedures

Transparency and Disclosure of Beneficial Ownership

Reasons for Increased Transparency

Disclosure Requirements for Public and Private Companies

International Efforts to Improve Beneficial Ownership Transparency

Challenges and Controversies Surrounding Beneficial Ownership

Legal and Regulatory Loopholes

Use of Shell Companies and Offshore Jurisdictions

Privacy Concerns and Beneficial Ownership

Final Thoughts

Beneficial Owner FAQs

A beneficial owner is a person or group who enjoys the benefits of ownership even though the title to the property is in another name.

Beneficial ownership refers to the enjoyment of ownership benefits, while legal ownership is based on the title or deed to the property.

Yes, beneficial owners are generally responsible for paying taxes on income and gains derived from their assets, even if the legal title is in another name.

Identifying beneficial owners helps prevent money laundering and other financial crimes by ensuring transparency and accountability in financial transactions.

Challenges include legal and regulatory loopholes, the use of shell companies and offshore jurisdictions for hiding ownership, and the need to balance transparency with privacy concerns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.