The Bank Secrecy Act (BSA), also known as the Currency and Foreign Transactions Reporting Act, is a United States law enacted in 1970 to combat money laundering, tax evasion, and other financial crimes. The BSA requires financial institutions to maintain records and report specific types of transactions to federal authorities, aiding in the detection and prevention of illegal activities. The primary objectives of the BSA are to deter and detect money laundering, terrorism financing, and other illicit financial activities. The BSA aims to achieve these objectives by establishing a comprehensive regulatory framework that promotes transparency and accountability in the financial system. The BSA was enacted in response to the growing concerns of money laundering and tax evasion in the 1960s. Over the years, the Act has undergone several amendments to address emerging threats and improve its effectiveness. Key amendments include the USA PATRIOT Act in 2001, which expanded the BSA's scope to address terrorism financing, and the Anti-Money Laundering Act of 2020, which further strengthened the BSA framework. Financial institutions are required to file Currency Transaction Reports for cash transactions exceeding $10,000. The CTRs provide valuable information for identifying potential money laundering and other illicit financial activities. Financial institutions must file Suspicious Activity Reports if they suspect or have reason to suspect that a transaction involves funds derived from illegal activities or is indicative of money laundering, terrorism financing, or other violations of the BSA. The BSA mandates financial institutions to maintain specific records, including customer identification, transaction records, and account statements, for a minimum of five years. These records assist law enforcement and regulatory agencies in their investigations. U.S. citizens and residents with a financial interest in, or signature authority over, foreign bank accounts with an aggregate value exceeding $10,000 must report these accounts annually to the U.S. Department of the Treasury. Financial institutions are required to establish and maintain AML programs that include policies, procedures, and controls to detect and prevent money laundering and terrorism financing. FinCEN is the primary agency responsible for administering the BSA. It collects, analyzes, and disseminates financial intelligence to support law enforcement and regulatory agencies. The OCC supervises and regulates national banks and federal savings associations, ensuring compliance with the BSA and other regulations. The Federal Reserve supervises and regulates bank holding companies and state-chartered banks that are members of the Federal Reserve System, enforcing BSA compliance. The FDIC supervises and regulates state-chartered banks that are not members of the Federal Reserve System, ensuring their adherence to the BSA. The NCUA oversees federal credit unions and enforces BSA compliance within the credit union industry. Financial institutions are expected to adopt a risk-based approach to BSA compliance, allowing them to allocate resources effectively and focus on higher-risk areas. Regulatory agencies conduct regular audits and examinations of financial institutions to assess their compliance with the BSA and identify potential weaknesses in their AML programs. Financial institutions and individuals found to be non-compliant with the BSA may face civil and criminal penalties, including fines, cease and desist orders, and imprisonment. The FATF is an intergovernmental organization that sets global AML and counter-terrorism financing standards, influencing BSA policies and promoting international cooperation. The BSA framework encourages international cooperation and information sharing among financial intelligence units, law enforcement agencies, and regulatory bodies to combat global financial crimes. The BSA faces various challenges, including the emergence of new technologies, difficulties in information sharing, and balancing privacy concerns with regulatory requirements. The Bank Secrecy Act plays a crucial role in combating money laundering, terrorism financing, and other illicit financial activities. Through its various components and regulatory oversight, the BSA promotes transparency and accountability within the financial system. The BSA is essential in preserving the integrity of the financial system, ensuring that financial institutions are not exploited for criminal purposes, and maintaining public trust in the banking system. The BSA faces ongoing challenges due to the rapidly evolving financial landscape, technological advancements, and emerging threats. It is crucial to continuously improve and adapt the BSA framework to maintain its effectiveness and protect the financial system from illicit activities. Consult a banking professional or financial advisor for more information on the Bank Secrecy Act. These experts can help with the intricacies of this federal law and how it affects citizens.What Is the Bank Secrecy Act (BSA)?

Key Components of the Bank Secrecy Act

Currency Transaction Reports (CTRs)

Suspicious Activity Reports (SARs)

Recordkeeping Requirements

Foreign Bank Account Reporting (FBAR)

Anti-money Laundering (AML) Programs

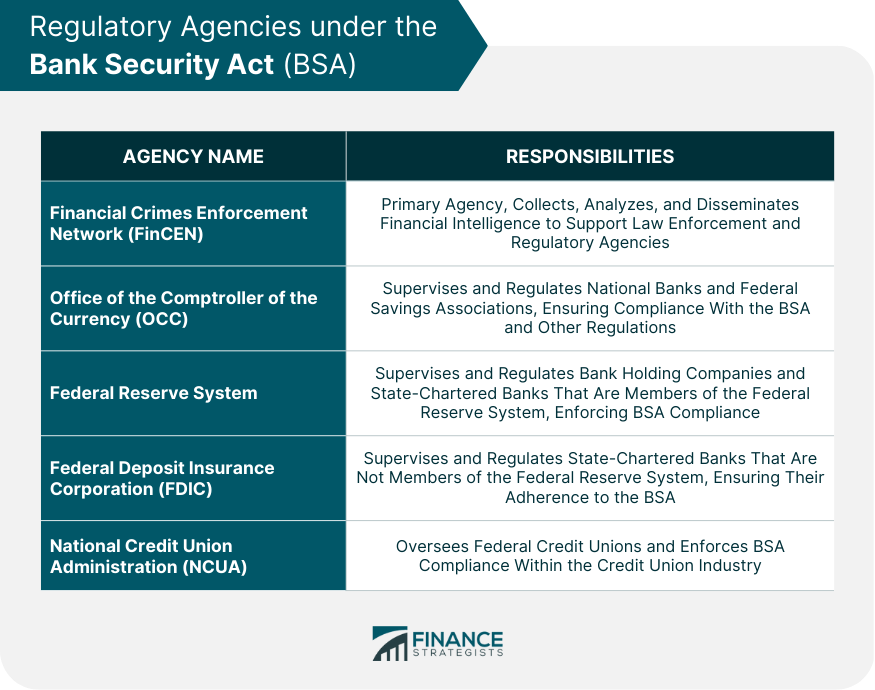

Regulatory Agencies and Oversight

Financial Crimes Enforcement Network (FinCEN)

Office of the Comptroller of the Currency (OCC)

Federal Reserve System

Federal Deposit Insurance Corporation (FDIC)

National Credit Union Administration (NCUA)

Compliance and Enforcement

Risk-Based Approach to BSA Compliance

BSA Audits and Examinations

Penalties and Sanctions for Non-compliance

Bank Secrecy Act (BSA) and International Efforts Against Money Laundering and Terrorism Financing

Role of the Financial Action Task Force (FATF)

International Cooperation and Information Sharing

Challenges and Criticisms of the Current BSA Framework

Final Thoughts

Bank Secrecy Act (BSA) FAQs

The primary purpose of the Bank Security Act is to prevent and detect financial crimes, such as money laundering, terrorist financing, and other illicit activities. By requiring financial institutions to implement anti-money laundering programs and report suspicious activity, the act aims to protect the integrity of the financial system and safeguard against these crimes.

Financial institutions must report a wide range of suspicious activity, including transactions involving large amounts of cash, unusual patterns of transactions, and transactions involving high-risk customers or countries. They must also report any activity that appears to be designed to evade reporting requirements, such as the use of multiple accounts or the structuring of transactions to avoid thresholds.

The Bank Security Act is enforced by a number of different agencies, including the Financial Crimes Enforcement Network (FinCEN), the Office of the Comptroller of the Currency (OCC), and the Federal Reserve System. These agencies have the authority to examine financial institutions for compliance with the act and to take enforcement actions against those that violate its provisions.

FinCEN is the primary agency responsible for administering the Bank Security Act. Its responsibilities include collecting and analyzing financial data, issuing guidance to financial institutions, and enforcing compliance with the act's provisions. FinCEN also maintains a database of suspicious activity reports filed by financial institutions, which is used by law enforcement agencies to investigate and prosecute financial crimes.

Since its passage in 1970, the Bank Security Act has been amended several times to expand its scope and strengthen its provisions. Some of the most significant changes have come in response to changing technologies and new methods of financial crime, such as the Patriot Act of 2001 and the Anti-Money Laundering Act of 2020.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.