The Required Rate of Return is a fundamental concept in finance, denoting the minimum return an investor expects from an investment, given its risk level. This expected return compensates the investor for the time value of money and the associated investment risk. RRR serves as a benchmark for deciding whether to pursue an investment. If an investment's projected returns do not meet or exceed the RRR, the investor may choose to forego the opportunity. This rate varies among investors based on their risk tolerance, investment horizons, and financial goals. RRR plays a pivotal role in investment decisions. It assists investors in evaluating potential investments, comparing them against their personal return expectations. RRR helps ensure investors are adequately compensated for their risk exposure. In financial planning, RRR is vital for determining the feasibility of financial goals. By understanding their RRR, individuals can calculate how much they need to save and invest to achieve specific objectives, such as retirement, education funding, or large purchases. The Capital Asset Pricing Model (CAPM) is a popular method for calculating RRR. According to CAPM, RRR is the sum of the risk-free rate and the product of the investment's beta (systematic risk measure) and the market risk premium. Several factors can influence the calculation of RRR. The risk-free rate, typically represented by a government bond yield, can change due to shifts in monetary policy or economic conditions. Additionally, an investment's beta value and the market risk premium can fluctuate based on market volatility and the investment's risk relative to the overall market. In equity investments, RRR helps investors determine the value they should pay for a stock. If the stock's expected return doesn't meet the investor's RRR, they may consider the stock overvalued. For bonds, RRR is used to calculate the bond's intrinsic value. If the bond's yield to maturity exceeds the investor's RRR, the bond may be considered undervalued, making it an attractive investment. In mutual fund investments, RRR serves as a benchmark against which the fund's performance can be assessed. A fund that consistently generates returns exceeding its investors' RRR would be highly valued. The risk premium, an integral part of the RRR, compensates investors for taking on additional risk. It is the difference between the expected return of the investment and the risk-free rate. RRR is fundamentally a measure of risk-adjusted return. It reflects the return an investor expects to receive, factoring in the investment's risk level. This perspective allows investors to compare investments on equal footing, regardless of their risk profiles. In corporate finance, RRR is used in capital budgeting decisions. Projects with an internal rate of return exceeding the company's RRR are often pursued, as they promise to add value to the firm. RRR also influences business valuation. When estimating a company's value using discounted cash flow models, the RRR serves as the discount rate, affecting the present value of future cash flows. In portfolio management, RRR is essential for estimating a portfolio's expected return. By understanding their RRR, investors can adjust their portfolio's asset allocation to target this desired return. The RRR is a key component of Modern Portfolio Theory (MPT). According to MPT, investors can achieve their RRR by constructing an optimal portfolio that maximizes returns for a given level of risk. One criticism of RRR is its subjectivity. Individual investors may have different expectations and risk tolerances, leading to different RRRs for the same investment. Furthermore, estimating future returns involves uncertainty, potentially leading to errors in the RRR calculation. Another limitation of RRR is its focus on quantitative factors. While risk levels and expected returns are crucial, other factors, such as the investor's financial situation, investment horizon, and personal preferences, are also important and may not be adequately captured in the RRR. The Required Rate of Return (RRR) is the minimum return an investor expects from an investment, considering its risk level. It serves as a benchmark for evaluating potential investments and plays a crucial role in financial planning, corporate finance, and portfolio management. RRR is crucial in investment decisions, financial planning, and evaluating different types of investments, including stocks, bonds, and mutual funds. It plays a significant role in understanding risk premiums and risk-adjusted returns. Despite its importance, investors should be mindful of the limitations of RRR, including its inherent subjectivity and potential overemphasis on quantitative factors. Investors should carefully consider their RRR when making investment decisions. While it's an important tool, it shouldn't be the sole determinant of investment choices. Investors should also consider their financial goals, risk tolerance, and other personal factors. While understanding RRR can help you make more informed investment decisions, it's always a good idea to seek the advice of a financial advisor. They can provide personalized guidance based on your unique financial situation and goals.What Is the Required Rate of Return (RRR)?

Importance of the Required Rate of Return

Role in Investment Decisions

Impact on Financial Planning

Calculating the Required Rate of Return

Basic Formula

Factors Affecting Calculation

Required Rate of Return in Different Investment Types

Stocks

Bonds

Mutual Funds

The Concept of Risk and Required Rate of Return

Understanding Risk Premium

Risk Adjusted Return

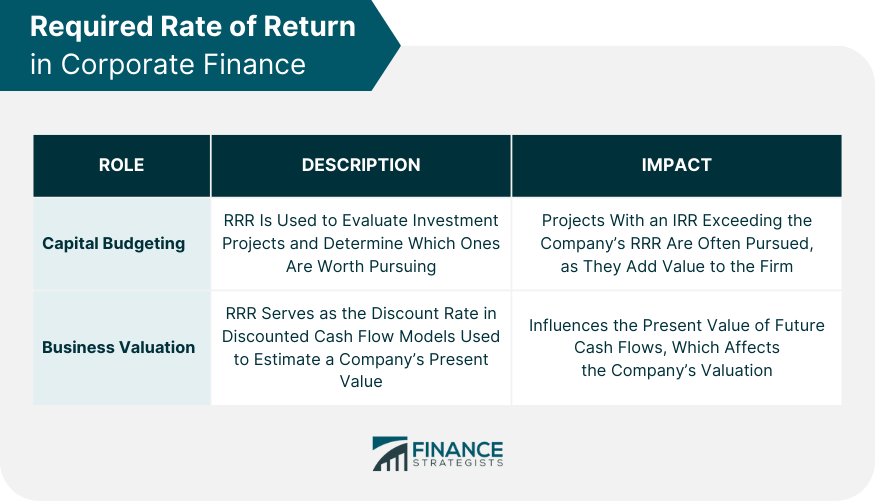

Required Rate of Return in Corporate Finance

Role in Capital Budgeting

Impact on Business Valuation

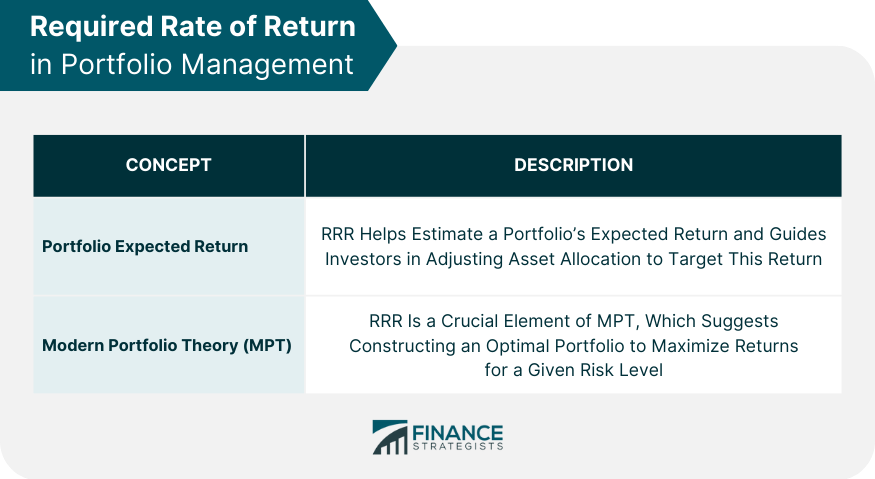

Required Rate of Return in Portfolio Management

Portfolio Expected Return

Modern Portfolio Theory

Limitations and Criticisms of the Required Rate of Return

Subjectivity and Estimation Errors

Overemphasis on Quantitative Factors

Final Thoughts

Required Rate of Return (RRR) FAQs

The required rate of return (RRR) refers to the minimum return an investor expects to earn in order to justify the risk of investing in a particular asset or project.

The required rate of return is determined by considering several factors such as the risk-free rate of return, the risk premium associated with the investment, and the investor's individual risk tolerance.

The required rate of return is crucial in making investment decisions because it helps investors assess the potential profitability and risk of an investment. It serves as a benchmark for evaluating the attractiveness of different investment opportunities.

Risk and the required rate of return are positively correlated. Investments with higher levels of risk are expected to generate higher returns to compensate investors for taking on additional risk. Conversely, investments with lower risk will have a lower required rate of return.

Yes, the required rate of return can change over time due to various factors such as changes in economic conditions, market sentiment, or shifts in the investor's risk appetite. It is important for investors to regularly reassess and adjust their required rate of return to reflect the current investment landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.