Valuation is a critical aspect of business and finance, which seeks to determine the worth of a company or an asset. It is an essential tool for investors, financial analysts, business owners, and other stakeholders who are interested in making informed investment decisions. This is also applicable in selling or buying a company, or evaluating the financial health of a business. The valuation process involves using various techniques, such as market capitalization, discounted cash flow, price-to-earnings ratio, and asset-based valuation. A comparable company analysis may also be used to determine the estimated value of a company. It refers to the process of determining the estimated worth or fair value of a company or an asset. It measures the value of a company's equity or assets, which could include tangible and intangible assets, such as inventory, real estate, intellectual property, patents, and trademarks. Valuation is a critical aspect of finance and investing, and it helps investors and other stakeholders to make decisions based on a company's worth. Valuation is a critical aspect of business and finance, which plays a significant role in various business transactions. One of the primary reasons for valuation is to aid investment decisions. Investors use valuation to evaluate a company's financial health and potential for future growth. By assessing the valuation, investors can determine if a company is undervalued or overvalued and make informed investment decisions. Valuation is also essential for companies that are involved in buying or selling assets, merging with other companies, or going public. In these scenarios, valuation helps determine the fair value of the assets involved, ensuring that both parties get a fair deal. Additionally, accurate valuation is necessary for financial reporting purposes, such as annual reports, audits, and compliance with accounting standards. Companies need to determine the of their assets for accurate financial reporting. Valuation, therefore, plays a crucial role in ensuring transparency, accountability, and informed decision-making in business transactions. There are several methods of valuation, including: The market capitalization method is the most common valuation technique, and it is used to determine the value of a company's equity. It is calculated by multiplying the company's share price by its total number of outstanding shares. The market capitalization method is useful for valuing publicly traded companies. The discounted cash flow method is used to estimate the value of a company based on its future cash flows. This method involves calculating the present value of a company's expected future cash flows, discounted at a certain rate to reflect the time value of money. The price-to-earnings ratio method is used to value a company's stock by comparing its current market price to its earnings per share. This method is useful for valuing publicly traded companies. The asset-based valuation method is used to value a company's assets, such as inventory, real estate, and equipment. It involves calculating the fair value of a company's assets and subtracting its liabilities to arrive at the company's equity value. The comparable company analysis method is used to value a company based on the market prices of similar companies. This method involves identifying similar companies in the same industry and comparing their valuation ratios, such as price-to-earnings ratio or price-to-book value ratio, to the company being valued. Several factors can affect the valuation of a company, including: A company's financial performance is a critical factor in its valuation. Factors such as revenue growth, profitability, and return on investment can affect the company's valuation. A company with strong financial performance is likely to have a higher valuation than a company with poor financial performance. Industry trends and outlook can also impact a company's valuation. A company operating in a growing industry with positive growth prospects is likely to have a higher valuation than a company operating in a declining industry. The competitive landscape is another critical factor. A company operating in a highly competitive market may have a lower valuation than a company that has a competitive advantage and a strong market position. Macroeconomic factors, such as inflation, interest rates, and GDP growth, can also impact a company's valuation. A company operating in a strong economy is likely to have a higher valuation than a company operating in a weak economy. The management and governance of a company can also impact its valuation. A company with a strong management team and good governance practices is likely to have a higher valuation than a company with weak management and governance practices. Valuation has several benefits including the following: Investors use valuation to assess a company's financial health and potential for future growth. By determining the estimated value of a company, investors can make informed investment decisions. An overvalued company may not be a good investment, while an undervalued company may present a good investment opportunity. Valuation helps investors identify companies with sound fundamentals and good growth prospects, which increases the chances of making profitable investments. Valuation is also critical for company transactions, such as buying or selling assets, merging with other companies, or going public. In these scenarios, valuation helps determine the fair value of the assets involved, ensuring that both parties get a fair deal. For instance, if a company is selling its assets, accurate valuation ensures that it gets a fair price for the assets. On the other hand, if a company is buying assets, valuation ensures that it pays a fair price for the assets. Similarly, valuation is essential when companies merge or go public to ensure that both parties get a fair deal. Accurate valuation is necessary for financial reporting purposes, such as annual reports, audits, and compliance with accounting standards. Companies need to determine the fair value of their assets for accurate financial reporting. Accurate financial reporting ensures transparency and accountability, which is essential for investors, stakeholders, and regulatory bodies. There are several limitations of valuation, including: Valuation involves making assumptions and estimations, which can impact the accuracy of the valuation. The accuracy of the valuation depends on the accuracy of the assumptions and estimations used. Market volatility and uncertainty can also impact the accuracy of the valuation. Changes in market conditions, such as changes in interest rates or economic conditions, can impact the valuation of a company. Regulatory and legal constraints can also impact the accuracy of the valuation. Valuation must comply with accounting standards and regulations, and failure to do so can impact the accuracy of the valuation. Valuation is an essential tool for investors, financial analysts, business owners, and other stakeholders who are interested in making informed investment decisions, selling or buying a company, or evaluating the financial health of a business. The valuation process involves using various techniques, such as market capitalization, discounted cash flow, price-to-earnings ratio, asset-based valuation, and comparable company analysis, to determine the estimated value of a company. Factors such as financial performance, industry trends and outlook, competitive landscape, macroeconomic factors, and company management and governance can impact a company's valuation. Accurate valuation is essential for investment decisions, company transactions, and financial reporting purposes. However, there are limitations to valuation, such as assumptions and estimations, market volatility and uncertainty, and regulatory and legal constraints. Overall, valuation is a critical aspect of business and finance that helps investors and other stakeholders make informed decisions based on a company's worth.What Is Valuation of a Company?

Importance of Valuation of a Company

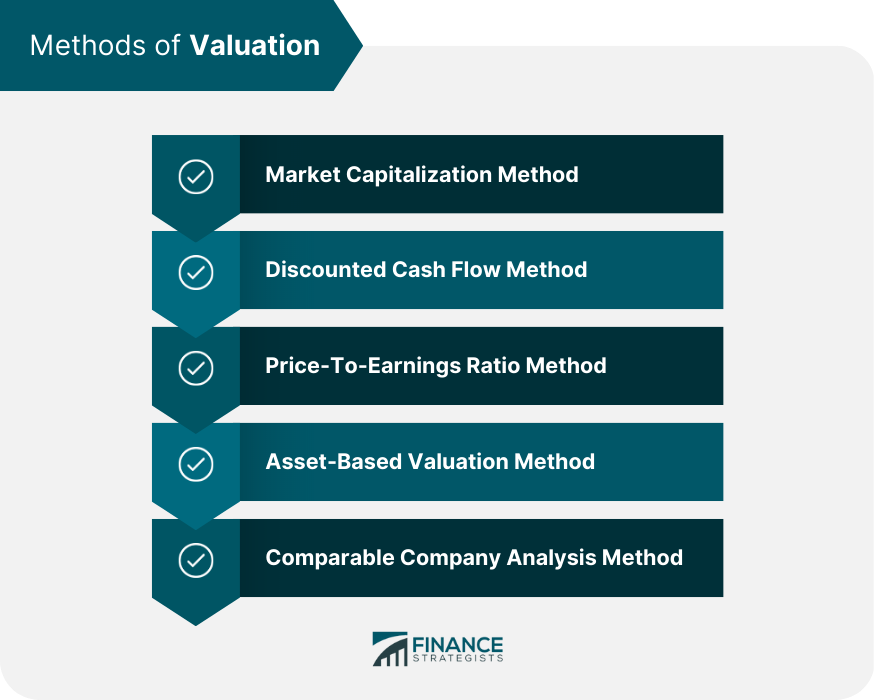

Methods of Valuation

Market Capitalization Method

Discounted Cash Flow Method

Price-To-Earnings Ratio Method

Asset-Based Valuation Method

Comparable Company Analysis Method

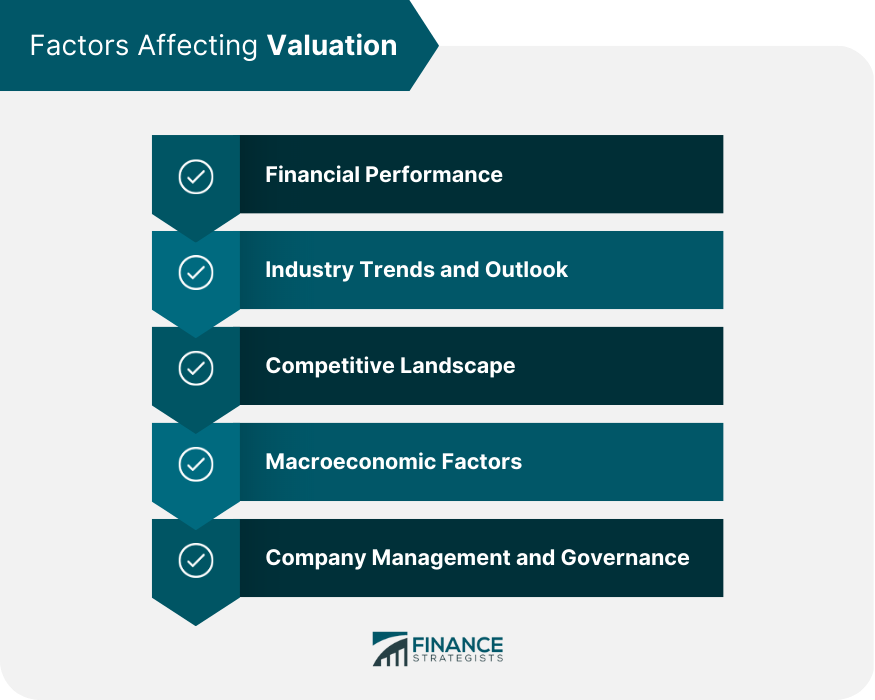

Factors Affecting Valuation

Financial Performance

Industry Trends and Outlook

Competitive Landscape

Macroeconomic Factors

Company Management and Governance

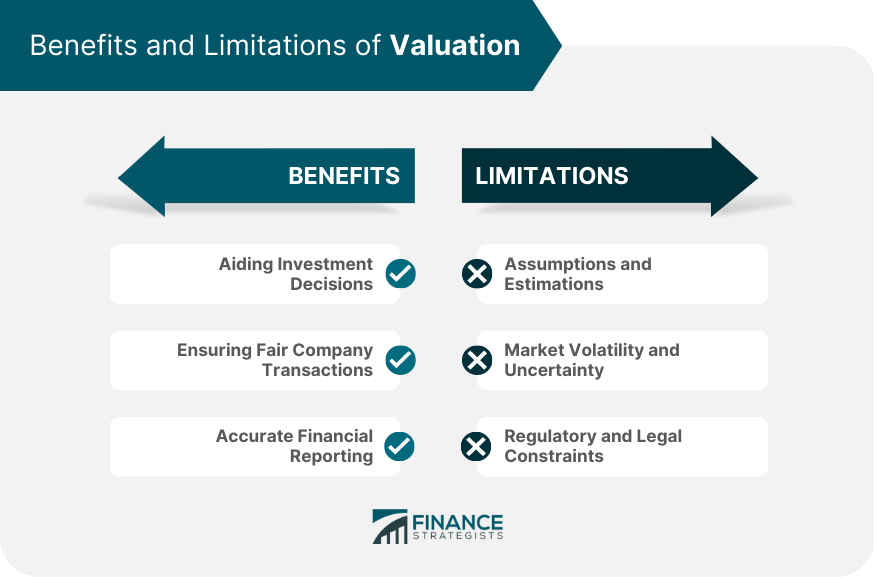

Benefits of Valuation

Aiding Investment Decisions

Ensuring Fair Company Transactions

Accurate Financial Reporting

Limitations of Valuation

Assumptions and Estimations

Market Volatility and Uncertainty

Regulatory and Legal Constraints

Bottom Line

For more information on company valuations, you may consult a wealth management professional.

What Is Valuation of a Company? FAQs

A company valuation determines the estimated worth or fair value of a company or asset, helping investors make informed investment decisions, facilitating company transactions, and ensuring accurate financial reporting.

There are several methods of company valuation, including market capitalization, discounted cash flow, price-to-earnings ratio, asset-based valuation, and comparable company analysis.

Valuation helps investors evaluate a company's financial health and potential for future growth, determine if a company is undervalued or overvalued, and make informed investment decisions.

Yes, company valuation is critical for companies involved in buying or selling assets, merging with other companies, or going public. Valuation helps determine the fair value of assets involved, ensuring that both parties get a fair deal.

Accurate valuation ensures that a company's financial statements reflect the fair value of its assets, promoting transparency and accountability in financial reporting. It helps companies comply with accounting standards and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.