A negative bond yield occurs when the return on a bond is below zero, meaning investors effectively pay the issuer for holding the bond. This unconventional phenomenon is often seen as a sign of economic uncertainty and can have implications for both investors and the broader economy. Negative bond yields are relatively rare but have become more common in recent years, particularly in Europe and Japan. They typically emerge in response to central bank policies, economic conditions, and investor behavior, which collectively drive bond prices higher and yields lower. Negative bond yields present challenges for investors, as they imply reduced income from fixed-income investments and potential difficulties in preserving capital. Understanding the factors driving negative yields and adjusting investment strategies accordingly is essential in such an environment. Central banks may implement negative interest rates to stimulate economic growth and combat deflation. By setting interest rates below zero, they encourage lending and discourage saving, which can result in increased demand for bonds and push yields into negative territory. Quantitative easing (QE) is a monetary policy tool used by central banks to inject liquidity into the economy by purchasing financial assets, including government bonds. This increases bond prices and lowers yields, potentially driving them into negative territory. Low inflation or deflationary environments can contribute to negative bond yields. When investors expect prices to decline or remain stagnant, they may be more willing to accept negative yields on bonds as a means of preserving capital. In times of economic slowdown or recession, investors often seek safer investments, driving demand for bonds and pushing their prices higher. As a result, yields may fall, potentially turning negative. During periods of heightened market volatility or geopolitical uncertainty, investors may engage in a flight to safety, moving their assets into lower-risk investments such as government bonds. This increased demand can drive bond prices up and yields down, leading to negative bond yields. Some investors may purchase bonds with negative yields as a hedging tool, anticipating that bond prices will rise in a risk-off environment. This can help offset potential losses in other, riskier asset classes. Negative bond yields imply that investors are effectively paying issuers to hold their bonds, resulting in reduced income from fixed-income investments. This can be particularly challenging for income-focused investors, such as retirees and pension funds. With negative bond yields, investors face the risk of losing capital over time. This can pose a significant challenge for long-term investors and may require them to reevaluate their investment strategies. Negative bond yields can distort market signals, as they suggest that investors are willing to pay issuers for the privilege of holding their bonds. This can create confusion and uncertainty in financial markets, potentially leading to misallocations of capital. The artificially low-interest rate environment created by negative bond yields can encourage excessive borrowing and risk-taking, potentially leading to asset bubbles in various market segments. When these bubbles burst, they can have severe consequences for the economy. Negative bond yields can pose profitability challenges for financial institutions, as they reduce the net interest margin—the difference between the interest earned on loans and the interest paid on deposits. This can put pressure on banks' bottom lines and potentially lead to a reduction in lending activities or the tightening of credit standards. In some cases, financial institutions may pass on the cost of negative bond yields to their customers through higher fees or charges. Ultimately, these challenges can affect the stability and growth of the financial sector, with potential knock-on effects for the broader economy. Negative bond yields can affect lending practices by making it more expensive for financial institutions to hold excess reserves. This may encourage banks to lend more aggressively or alter their credit standards, potentially increasing the risk of defaults and financial instability. Investors can diversify their portfolios by including asset classes with positive yields, such as corporate bonds or emerging market debt, to offset the impact of negative bond yields on their fixed-income investments. Geographic diversification involves investing in bonds from different countries or regions, potentially providing exposure to positive-yielding bonds from economies with stronger growth prospects or higher interest rates. Investors can consider dividend-paying stocks as an alternative to negative-yielding bonds. These stocks provide regular income through dividend payments and may offer capital appreciation potential. Investing in real assets, such as real estate and infrastructure, can provide income and capital growth opportunities while diversifying an investment portfolio away from negative bond yields. Tactical asset allocation involves adjusting a portfolio's asset mix based on market conditions and opportunities. In a negative bond yield environment, investors can use this approach to seek out positive-yielding investments and manage risk. Implementing risk management techniques, such as stop-loss orders or portfolio rebalancing, can help investors protect their capital and navigate the challenges of a negative bond yield environment. It's crucial for investors to understand the implications of negative bond yields and how they can affect their portfolios. This knowledge can inform investment decisions and help mitigate potential risks. Investors may need to adjust their investment strategies to adapt to a negative bond yield environment, considering alternative investments or diversification techniques to preserve capital and generate income. Keeping a close eye on economic and market developments can help investors identify potential changes in the bond market and adjust their strategies accordingly to seize opportunities and manage risks. Navigating a negative bond yield environment requires understanding the implications and adjusting investment strategies accordingly. Factors contributing to negative bond yields include central bank policies, economic conditions, and investor behavior. Investors may face reduced income and capital preservation concerns, while the economy can experience distorted market signals and potential asset bubbles. Financial institutions may encounter profitability challenges and altered lending practices. To counter these challenges, investors can employ strategies such as diversification, including asset classes with positive yields and geographic diversification. Alternative options like dividend-paying stocks and real assets provide income and growth opportunities. Active portfolio management through tactical asset allocation and implementing risk management techniques are vital. Monitoring economic and market developments allows for timely adjustments. By comprehending the implications and adapting strategies, investors can navigate a negative bond yield environment more effectively.What Is Negative Bond Yield?

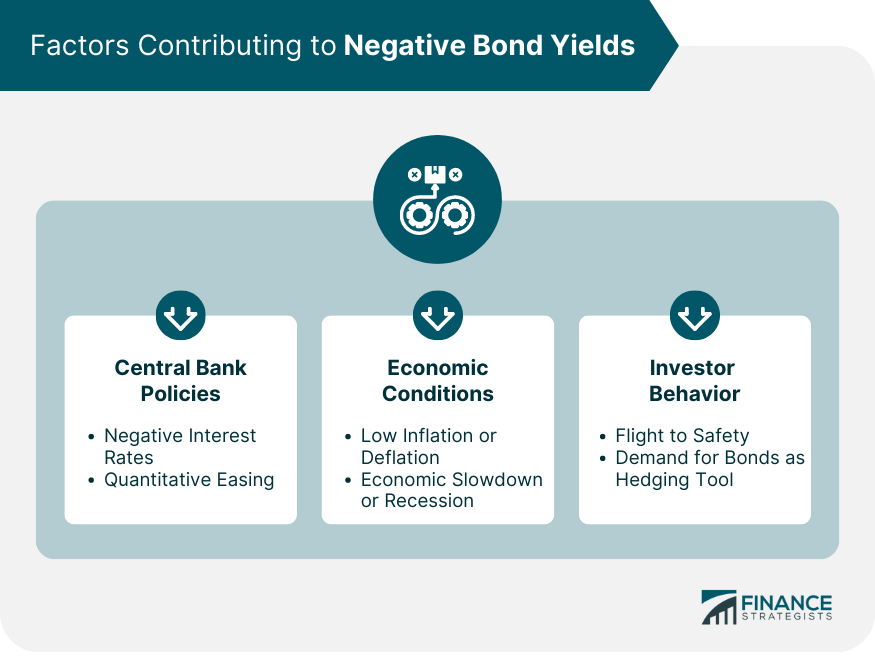

Factors Contributing to Negative Bond Yields

Central Bank Policies

Negative Interest Rates

Quantitative Easing

Economic Conditions

Low Inflation or Deflation

Economic Slowdown or Recession

Investor Behavior

Flight to Safety

Demand for Bonds as a Hedging Tool

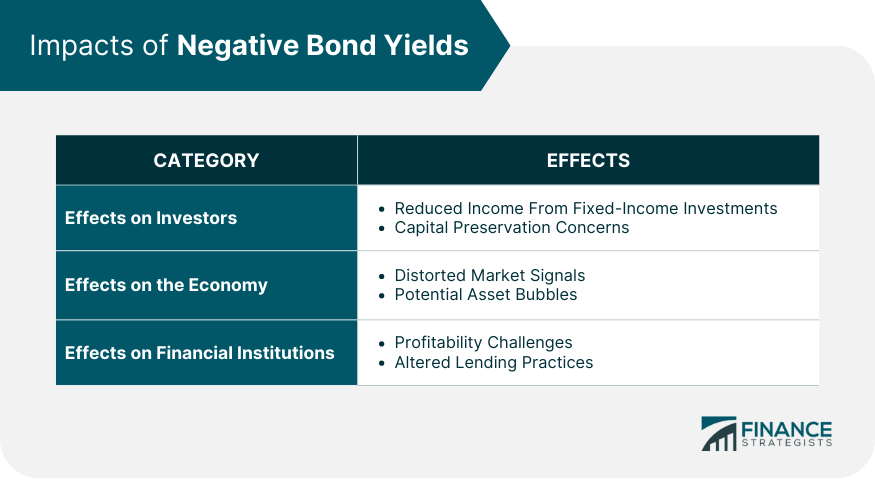

Impacts of Negative Bond Yields

Effects on Investors

Reduced Income from Fixed-Income Investments

Capital Preservation Concerns

Effects on the Economy

Distorted Market Signals

Potential Asset Bubbles

Effects on Financial Institutions

Profitability Challenges

Altered Lending Practices

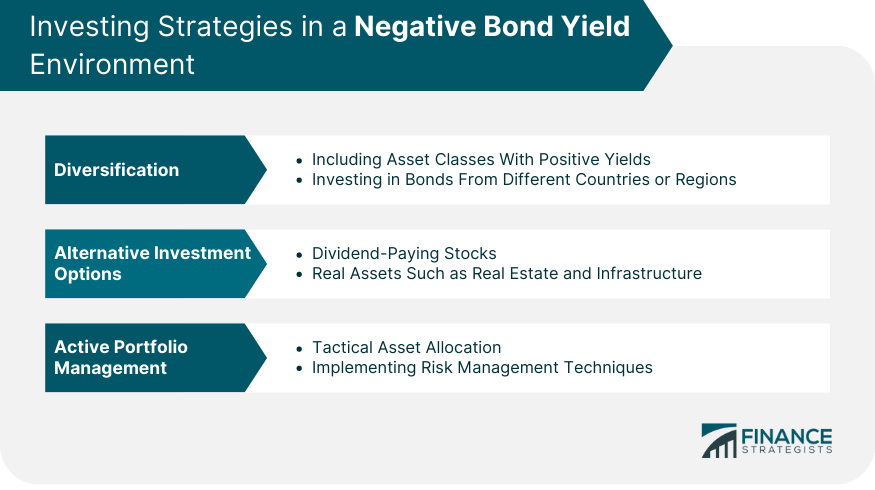

Investing Strategies in a Negative Bond Yield Environment

Diversification

Asset Classes With Positive Yields

Geographic Diversification

Alternative Investment Options

Dividend-Paying Stocks

Real Assets Such as Real Estate and Infrastructure

Active Portfolio Management

Tactical Asset Allocation

Risk Management Techniques

Navigating a Negative Bond Yield Environment

Understanding the Implications of Negative Bond Yields

Adjusting Investment Strategies to Adapt to Market Conditions

Monitoring Economic and Market Developments for Potential Changes

Final Thoughts

Negative Bond Yield FAQs

Negative bond yields occur when the return on a bond falls below zero, meaning that investors effectively pay the issuer for holding the bond. They usually arise due to central bank policies, economic conditions, and investor behavior, which collectively drive bond prices higher and yields lower.

Central bank policies, such as negative interest rates and quantitative easing, can contribute to negative bond yields. By implementing negative interest rates or purchasing financial assets like government bonds, central banks increase demand for bonds, pushing their prices up and yields down, potentially turning them negative.

Negative bond yields can reduce income from fixed-income investments and raise capital preservation concerns for investors. For the economy, they may distort market signals and contribute to potential asset bubbles. Financial institutions may face profitability challenges and altered lending practices due to negative bond yields.

Strategies for navigating a negative bond yield environment include diversification across asset classes and regions, alternative investments like dividend-paying stocks and real assets, and active portfolio management through tactical asset allocation and risk management techniques.

Understanding negative bond yields helps investors navigate the challenges and opportunities presented by this unconventional market phenomenon. By adapting investment strategies, such as diversification and exploring alternative investments, investors can mitigate risks and strive for positive returns in a challenging market landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.