Yield basis refers to a financial concept used to determine the yield or return on an investment or financial instrument, particularly fixed-income securities. It is a measure of the return an investor can expect to receive from an investment in relation to its cost or current market price. It is commonly used in various financial contexts, including bonds, stocks, real estate, and other investment vehicles. Understanding the yield basis helps investors evaluate and compare different investment options, assess the risk and return tradeoff, monitor investment performance, and make informed investment decisions. The yield basis takes into account factors such as market interest rates, credit quality, duration, and economic conditions, providing a comprehensive understanding of investment returns. The yield basis measures the return or yield generated by an investment relative to its price. The yield basis takes into account various factors such as coupon payments, maturity dates, and market prices to calculate the rate of return on the investment. When an investor purchases a bond, they typically receive periodic interest payments known as coupon payments. The yield basis considers the coupon payments received over the life of the bond and compares it to the purchase price of the bond. This comparison allows investors to assess the annualized return they can expect from the bond. The yield basis can be calculated in different ways, such as current yield, yield to maturity, or yield to call. Each method takes into account specific factors and assumptions, providing different perspectives on the investment's yield. The current yield is a simple yield calculation that measures the return on an investment relative to its current market price. It is calculated by dividing the annual interest or dividend payment by the market price of the investment. Yield to maturity (YTM) is a measure of the total return an investor can expect to earn on a bond if it is held until maturity. It takes into account the bond's current market price, coupon payments, and the time remaining until maturity. Yield to call (YTC) is the yield an investor would earn if a bond is called or redeemed by the issuer before its maturity date. It considers the potential early redemption of the bond at the call price, which may be different from the face value. Yield on cost (YOC) is the yield calculated based on the original cost or purchase price of an investment. It allows investors to evaluate the return they are earning on their initial investment rather than the current market value. Changes in market interest rates have a significant impact on the yield basis. When interest rates rise, the yield on fixed-income investments generally increases, while falling interest rates result in lower yields. Investments with higher credit ratings typically offer lower yields as they are considered less risky, while lower-rated investments tend to offer higher yields to compensate investors for the additional risk. The duration of an investment, which measures its sensitivity to changes in interest rates, influences the yield basis. Longer-duration investments are more sensitive to interest rate fluctuations and may offer higher yields to compensate for this added risk. Overall economic conditions, such as inflation expectations and economic growth, impact the yield basis. Inflationary pressures or a strong economy may lead to higher interest rates and lower bond yields, while economic uncertainties or low inflation can result in lower interest rates and higher yields. The yield basis allows wealth managers to evaluate and compare different investment options, considering their yield potential relative to their risk profiles. This helps in selecting investments that align with clients' financial objectives and risk tolerance. The yield basis assists in assessing the risk-return tradeoff of investments. Wealth managers can analyze the potential yield and weigh it against the associated risks to determine if the investment offers an appropriate balance of return and risk. By tracking the yield basis, wealth managers can monitor the performance of investments over time. Comparing the actual yield achieved to the expected yield basis provides insights into the investment's performance and helps in identifying any deviations or opportunities for improvement. Wealth managers rely on the yield basis to make informed investment decisions. It provides a standardized measure for comparing different investment options and helps in aligning investment strategies with clients' financial goals and risk preferences. The yield basis focuses primarily on income generated by an investment and may not account for potential capital gains or losses. Investments with higher yields may not necessarily result in better overall returns if their capital appreciation potential is limited. The yield basis is sensitive to changes in interest rates, especially for fixed-income investments. Fluctuations in interest rates can impact the market value of the investment, potentially affecting its yield and overall performance. While the yield basis provides insight into the potential return of an investment, it may not provide comprehensive information on its quality. Other factors such as the issuer's financial stability, industry dynamics, and market conditions should also be considered in assessing investment quality. The yield basis refers to the method used to calculate and express the yield of an investment. The yield basis is influenced by factors such as market interest rates, credit quality, investment duration, and economic conditions. These factors impact the yield potential and risk profile of investments. Different types of yield basis, such as current yield, yield to maturity, yield to call, and yield on cost, offer distinct perspectives on the return characteristics of various investments. The yield basis plays a vital role in evaluating investment options, assessing risk-return tradeoffs, monitoring investment performance, and guiding investment decisions in wealth management. Understanding the yield basis is crucial in wealth management for evaluating investment options, assessing risk and return, monitoring performance, and making informed investment decisions.What Is Yield Basis?

How Yield Basis Works

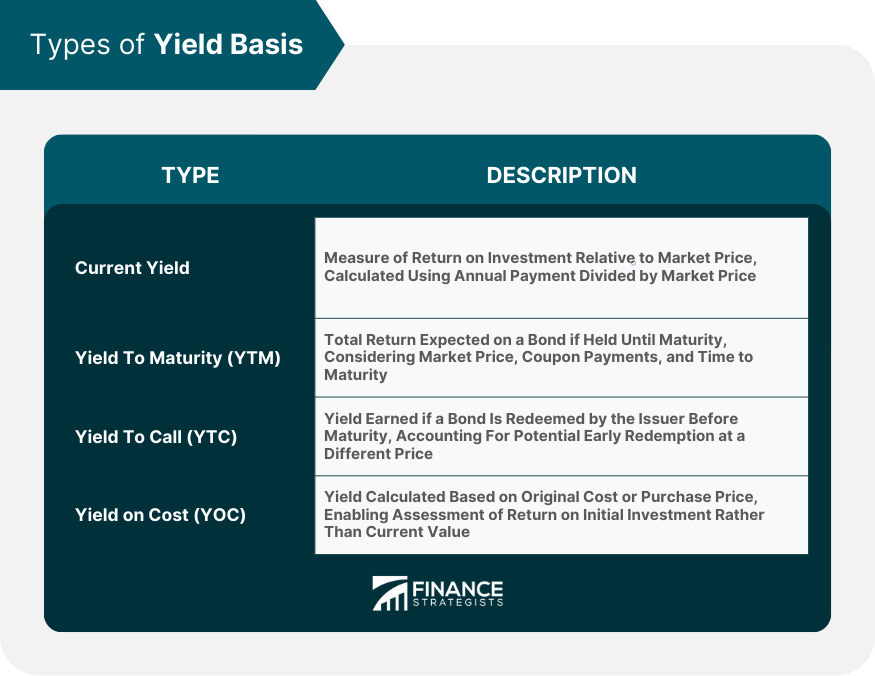

Types of Yield Basis

Current Yield

Yield To Maturity (YTM)

Yield To Call (YTC)

Yield on Cost (YOC)

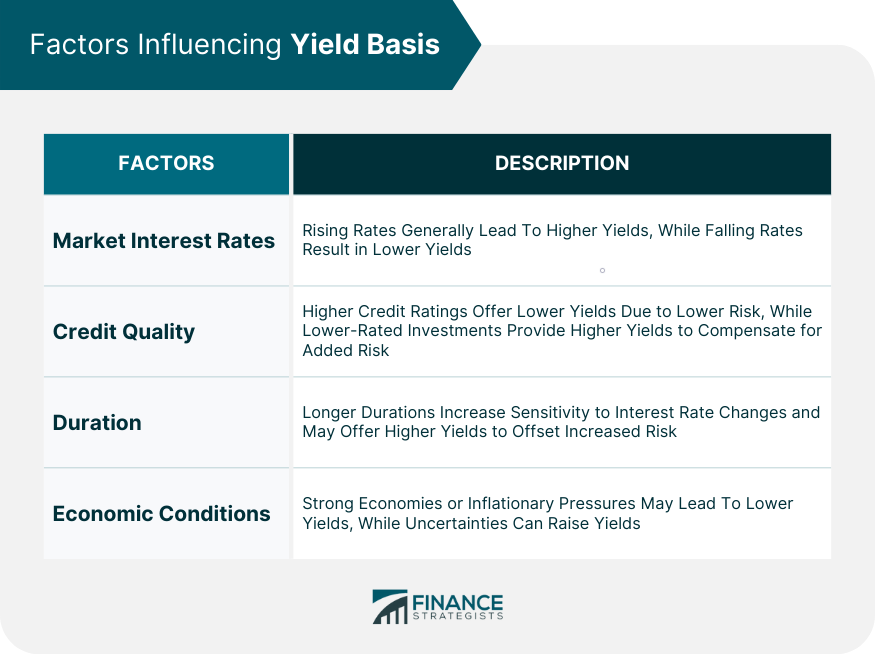

Factors Influencing Yield Basis

Market Interest Rates

Credit Quality of the Investment

Duration of the Investment

Economic Conditions

Importance of Yield Basis in Wealth Management

Evaluating Investment Options

Assessing Risk-Return Tradeoff

Monitoring Investment Performance

Making Informed Investment Decisions

Limitations of Yield Basis

Ignoring Capital Gains or Losses

Sensitivity to Interest Rate Changes

Limited Information on Investment Quality

The Bottom Line

Yield Basis FAQs

Yield basis refers to the method used to calculate and express the yield of an investment, allowing investors to assess its return relative to its cost or current market price.

The types of yield basis include current yield, yield to maturity (YTM), yield to call (YTC), and yield on cost (YOC).

Factors influencing yield basis include market interest rates, credit quality, duration of the investment, and economic conditions.

Yield basis is important in wealth management as it helps evaluate investment options, assess risk-return tradeoffs, monitor investment performance, and make informed investment decisions aligned with clients' financial goals.

Limitations of yield basis include ignoring capital gains or losses, sensitivity to interest rate changes, and limited information on investment quality. These limitations should be considered alongside other factors in investment analysis and decision-making.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.