Roll yield is a crucial concept in the world of commodity futures trading. It represents the return achieved due to the convergence of futures prices to spot prices as the futures contracts approach their expiration dates. A positive roll yield occurs when the futures price is below the spot price and a negative roll yield arises when the futures price is above the spot price. The importance of understanding roll yield lies in its ability to influence the total return of a futures contract, impacting the potential profit or loss from the investment. In futures contracts, the buyer agrees to purchase a specific asset at a future date for a predetermined price. The price difference between the current futures contract and the future spot price is where roll yield comes into play. As the futures contract nears its expiration, the futures price will converge to the spot price, resulting in a gain or loss - the roll yield. The spot price is the current market price at which a commodity can be bought or sold for immediate delivery. It reflects the immediate demand and supply for that commodity. The futures price, on the other hand, is the agreed-upon price for the commodity's delivery at a future date. It takes into account various factors such as time value of money, storage costs, and expected future changes in supply and demand. The time to expiration of a futures contract plays a significant role in the calculation of roll yield. The closer a futures contract is to its expiration, the closer its price should be to the spot price. Therefore, the roll yield can be seen as the speed at which the futures price converges to the spot price. Positive roll yield occurs when the market is in backwardation, that is, futures prices are lower than the spot prices. In such a scenario, as the futures contract moves towards its expiration, the futures price increases, resulting in a gain for the holder of the futures contract. Conversely, negative roll yield is experienced when the market is in contango. This is when futures prices are higher than the spot prices. As the contract nears expiration, the futures price drops to align with the spot price, resulting in a loss for the holder of the futures contract. Market conditions significantly influence roll yield. In periods of market volatility, the difference between spot and futures prices can widen, leading to larger potential roll yields. Interest rates impact the cost of holding commodities, thus affecting futures prices and, in turn, roll yield. High interest rates increase storage costs, pushing futures prices higher and potentially leading to negative roll yield. Storage costs directly affect the futures price. Commodities that are expensive to store will have higher futures prices, increasing the likelihood of a negative roll yield. Commodity-specific factors such as seasonality, production cycles, and geopolitical influences can also impact roll yield by affecting spot and futures prices. Understanding roll yield is crucial for commodity futures investors. The roll yield can add to or subtract from the total return on investment of a commodity futures contract, especially in a contango or backwardation market. ETFs that track commodity indices often hold futures contracts. These ETFs need to "roll" their contracts as they approach expiration to avoid taking physical delivery of the commodity. The roll process can result in positive or negative roll yield, impacting the ETF's performance. Similar to ETFs, commodity mutual funds may also be exposed to roll yield as they manage their futures positions. Traders can use the concept of roll yield to implement calendar spread strategies, aiming to profit from the difference in price between two futures contracts for the same commodity but with different expiration dates. In efficient markets, any significant mispricing between spot and futures prices - which would result in high positive or negative roll yield - can provide arbitrage opportunities. Roll yield can also impact hedging strategies. For instance, if a company uses futures contracts to hedge against potential price increases for a commodity it needs, the roll yield could affect the cost-effectiveness of this hedging strategy. Understanding roll yield can help in better risk management. It allows investors to anticipate potential gains or losses and adjust their strategies accordingly. Roll yield can also play a role in portfolio diversification. Investing in commodities through futures can provide a diversification benefit, and the potential positive roll yield in a backwardation market can enhance returns. In the context of asset allocation, understanding the potential impact of roll yield is crucial. It can significantly affect the total return from commodities, thus influencing the optimal allocation to this asset class. One criticism of roll yield is that it assumes market efficiency, which is not always the case in reality. Inefficient markets may lead to discrepancies between futures prices and spot prices, affecting the roll yield. Roll yield is also inherently unpredictable, as it depends on future spot prices and market conditions, which are uncertain. This unpredictability can add a layer of risk to investment strategies based on roll yield. Roll yield is a vital concept in futures trading, signifying the gain or loss derived from the convergence of futures prices to spot prices as a futures contract approaches its expiration date. It is a crucial driver of return for futures contracts and can significantly impact the performance of commodity-focused investments. The concept touches various aspects of investment management, from trading strategies to portfolio diversification, risk management, and asset allocation. Understanding the components of roll yield and the factors affecting it forms the bedrock for its application in investment decisions. However, the application of roll yield is not without its challenges, including its inherent unpredictability and the assumption of market efficiency. As such, the intricacies of applying roll yield in real-world scenarios underscore the importance of professional guidance. Therefore it is recommended to seek advice from financial professionals who can help navigate the complexities of futures trading and manage the risks associated with roll yield.What Is Roll Yield?

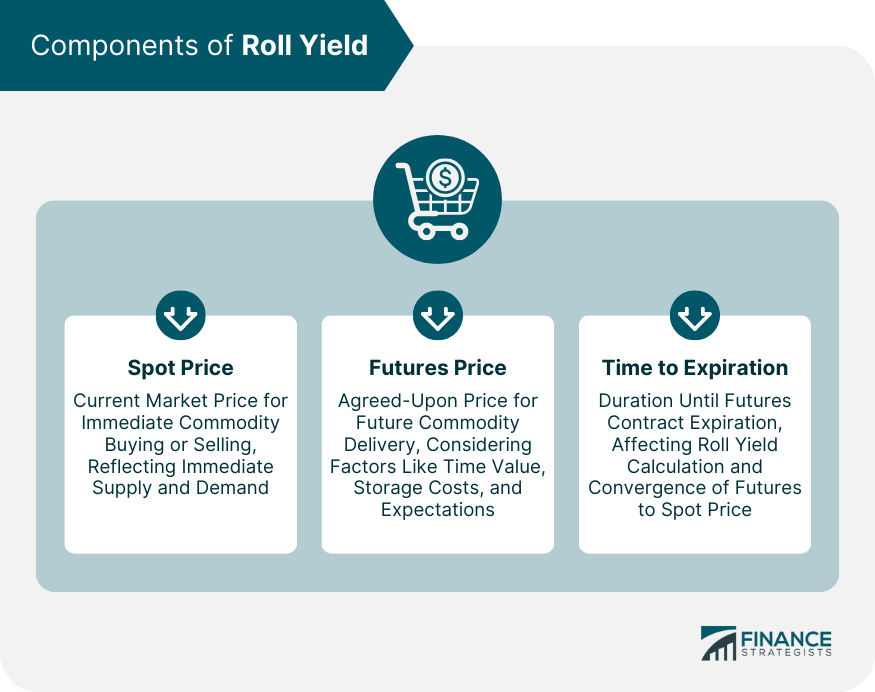

Components of Roll Yield

Spot Price

Futures Price

Time to Expiration

Positive and Negative Roll Yield

Factors Affecting Roll Yield

Market Conditions

Interest Rates

Storage Costs

Commodity-Specific Factors

Roll Yield and Commodity Investing

Commodity Futures

Exchange-Traded Funds (ETFs)

Mutual Funds

Roll Yield and Trading Strategies

Calendar Spreads

Arbitrage Opportunities

Hedging

Roll Yield and Portfolio Management

Risk Management

Diversification

Asset Allocation

Limitations of Roll Yield

Market Efficiency

Unpredictability

Final Thoughts

Roll Yield FAQs

Roll yield is the return due to the convergence of futures prices to spot prices as the futures contract approaches its expiration date.

Positive roll yield occurs when the futures price is below the spot price, a condition known as backwardation.

Negative roll yield occurs when the futures price is above the spot price, a condition known as contango.

Roll yield can add to or subtract from the total return on investment of a commodity futures contract, affecting the performance of investments like commodity futures, ETFs, and mutual funds.

Limitations of roll yield include the assumption of market efficiency and the inherent unpredictability of future spot prices and market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.