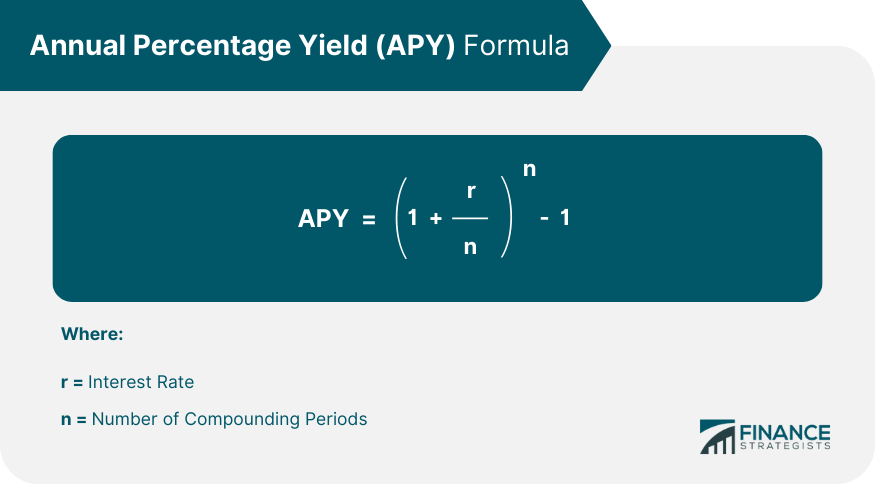

Bond Equivalent Yield is a financial metric used to standardize the yield of bonds with different payment frequencies. It enables investors to compare the yields of various bonds on an equal footing by annualizing the yields of bonds that pay interest semi-annually or quarterly. BEY is important for investors to make informed decisions when comparing bonds with different payment structures. By standardizing the yield, investors can easily assess which bonds offer better returns and make appropriate investment decisions. BEY differs from other yield measures like yield to maturity (YTM) and current yield. While YTM considers the bond's price, coupon rate, and time to maturity, and current yield focuses on annual income relative to the bond's price, BEY enables direct comparison of bonds with different payment frequencies. The formula for calculating BEY involves two key components: annual percentage yield (APY) and the semi-annual bond period. The formula below, annualizes the yield of a bond that pays interest semi-annually. Title: Formula for Calculating Bond Equivalent Yield (BEY) Bond Equivalent Yield (BEY) = (1+APY2)2-1 To calculate BEY, investors must first determine the bond's annual percentage yield (APY). The Annual Percentage Yield (APY) formula is used to calculate the effective annual rate of return for an investment or a savings account that takes compounding into account. The APY reflects the actual yield earned over a one-year period. The formula for calculating Annual Percentage Yield is as follows: In this formula, the interest rate is expressed as a decimal, and the number of compounding periods represents how frequently the interest is compounded in a year (e.g., quarterly, monthly, daily). To calculate the APY, you raise the expression within the parentheses to the power of the number of compounding periods, subtract 1, and multiply by 100 to express it as a percentage. The APY formula provides a standardized measure for comparing the annualized yield of investments or savings accounts that compound interest at different frequencies. It helps investors assess the true rate of return on their investments and make informed decisions. Next, they should input the APY and the bond's semi-annual period into the BEY formula. Finally, they can compute the BEY to obtain an annualized yield that is directly comparable to other bonds. Suppose a bond has an APY of 4% and pays interest semi-annually. To calculate its BEY, use the formula above.This results in a BEY of approximately 4.04%, which is the annualized yield that investors can use for comparison purposes. Interest rates play a crucial role in determining a bond's BEY. When interest rates rise, bond prices typically fall, which in turn impacts the BEY. Conversely, when interest rates decline, bond prices increase, which can result in a higher BEY. The time to maturity affects a bond's BEY, as bonds with longer maturities are typically more sensitive to interest rate changes. Consequently, the BEY of longer-maturity bonds may fluctuate more significantly compared to shorter-maturity bonds. The credit quality of a bond issuer can influence the BEY, as lower credit quality issuers generally offer higher yields to compensate for the increased risk. Thus, bonds with lower credit ratings will typically have higher BEYs compared to those with higher credit ratings. Market conditions can also impact a bond's BEY. Factors such as economic growth, inflation, and geopolitical events can influence investor sentiment and, in turn, affect bond prices and yields. As a result, the BEY of bonds may change in response to evolving market conditions. BEY is useful for comparing bonds with different characteristics, such as varying maturities, coupon rates, and payment frequencies. By providing a standardized measure, investors can make better-informed decisions when selecting bonds for their portfolios. BEY allows investors to directly compare the annualized yields of bonds with different maturities. This enables investors to assess the potential returns of bonds with various time horizons, facilitating more informed investment decisions. BEY also aids in comparing bonds with different coupon rates. By annualizing the yield, investors can evaluate the potential income generated by bonds with various coupon rates, regardless of the payment frequency. BEY is particularly useful for comparing bonds with different payment frequencies, such as semi-annual or quarterly payments. By standardizing the yield, investors can assess the annualized return on investment for bonds with varying payment schedules. BEY assists in portfolio management and risk assessment by enabling investors to identify bonds that offer the best risk-adjusted returns. By understanding the BEY, investors can create a diversified bond portfolio that aligns with their risk tolerance and return objectives. BEY plays a vital role in bond pricing and valuation, as it allows investors to compare the yields of bonds with differing characteristics. This information can help investors determine the fair value of a bond and decide whether to buy or sell it based on its current market price. One limitation of BEY is the assumption that interest payments will be reinvested at the same rate as the BEY. In reality, interest rates may fluctuate, and reinvestment opportunities may not always be available at the same rate, which could impact an investor's actual return. BEY may not be applicable to bonds with variable coupon rates, as these rates change over time based on a reference rate, such as the London Interbank Offered Rate (LIBOR). Since BEY is based on a fixed coupon rate, it may not accurately reflect the potential yield of variable rate bonds. BEY does not account for potential capital gains or losses that may occur when a bond is sold before maturity. This limitation means that BEY may not fully represent the total return an investor could achieve by holding a bond until maturity or selling it at a different price. Yield to maturity is the total return an investor would receive if they held a bond until maturity, considering its price, coupon rate, and time to maturity. YTM is a comprehensive measure of a bond's return, but it does not standardize yields for bonds with different payment frequencies, as BEY does. Yield to call (YTC) measures the return an investor would receive if they held a callable bond until the issuer exercises their right to call the bond before maturity. Like YTM, YTC does not standardize yields for bonds with different payment frequencies, making BEY a more useful metric for comparing bonds with varying payment structures. Current yield is the annual income an investor receives from a bond, relative to its current market price. While it provides a snapshot of a bond's income potential, it does not account for the time value of money or changes in interest rates, making BEY a more comprehensive measure for comparing bond yields. Yield to worst (YTW) is the lowest potential yield an investor could receive from a bond, considering all possible call dates and provisions. Although YTW provides a conservative estimate of a bond's return, it does not standardize yields for bonds with different payment frequencies, which is where BEY offers an advantage. Bond Equivalent Yield is a financial metric used to standardize the yield of bonds with different payment frequencies. It allows for direct comparison of bond yields by annualizing the yields of bonds that pay interest semi-annually or quarterly. BEY is useful for comparing bonds with different characteristics, such as varying maturities, coupon rates, and payment frequencies. It assists in portfolio management, risk assessment, bond pricing, and valuation. However, BEY has limitations, including the assumption of reinvestment at the same rate, inapplicability to bonds with variable coupon rates, and the inability to capture potential capital gains or losses. Other yield measures like yield to maturity, yield to call (YTC), current yield, and yield to worst (YTW) offer different perspectives on bond returns but do not standardize yields for different payment frequencies like BEY does.What Is Bond Equivalent Yield (BEY)?

Calculating Bond Equivalent Yield (BEY)

Formula for Calculating BEY

Steps to Calculate BEY

Example Calculation of BEY

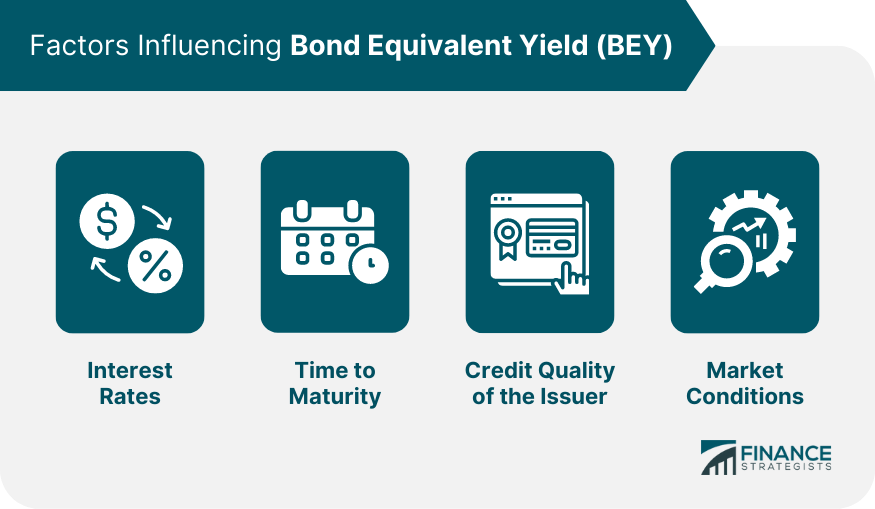

Factors Influencing Bond Equivalent Yield (BEY)

Interest Rates

Time to Maturity

Credit Quality of the Issuer

Market Conditions

Applications of Bond Equivalent Yield (BEY)

Comparing Bond Investments

Comparing Bonds With Different Maturities

Comparing Bonds With Different Coupon Rates

Comparing Bonds With Different Payment Frequencies

Portfolio Management and Risk Assessment

Bond Pricing and Valuation

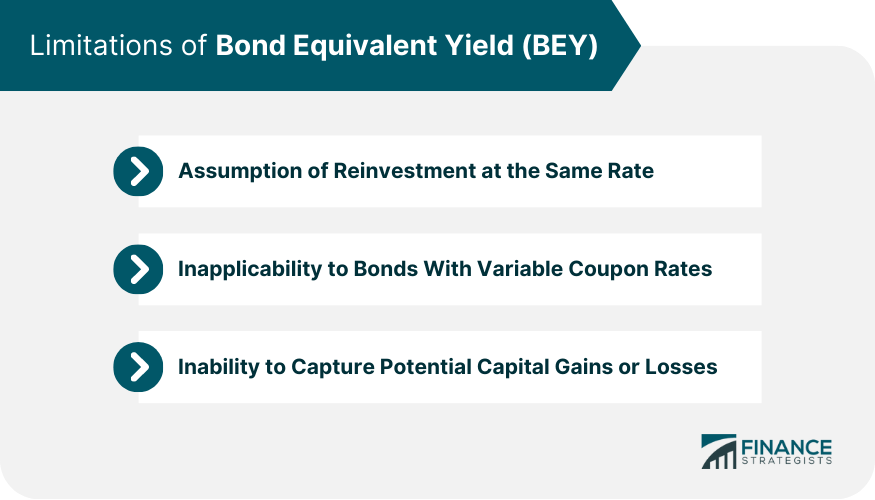

Limitations of Bond Equivalent Yield (BEY)

Assumption of Reinvestment at the Same Rate

Inapplicability to Bonds with Variable Coupon Rates

Inability to Capture Potential Capital Gains or Losses

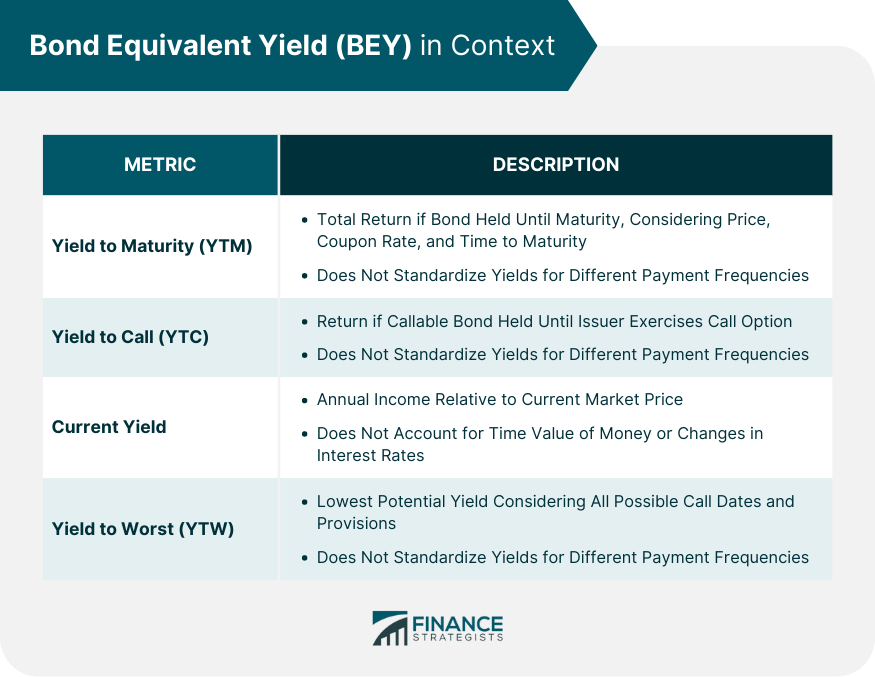

Bond Equivalent Yield (BEY) in Context

Yield to Maturity

Yield to Call (YTC)

Current Yield

Yield to Worst (YTW)

Final Thoughts

Bond Equivalent Yield (BEY) FAQs

The purpose of using Bond Equivalent Yield (BEY) is to provide investors with a standardized metric for comparing the yields of bonds with different payment frequencies, maturities, and coupon rates. By considering BEY, investors can make more informed decisions when selecting bonds for their portfolios.

To calculate the Bond Equivalent Yield (BEY) for a bond with semi-annual payments, first determine the bond's annual percentage yield (APY). Then use the BEY formula: BEY = (1 + APY/2)^2 - 1. This formula annualizes the bond's yield, making it directly comparable to other bonds.

Factors that can influence the Bond Equivalent Yield (BEY) of a bond include interest rates, time to maturity, credit quality of the issuer, and market conditions. These factors can impact bond prices and yields, which in turn affect the BEY.

The limitations of using Bond Equivalent Yield (BEY) include the assumption of reinvestment at the same rate, inapplicability to bonds with variable coupon rates, and the inability to capture potential capital gains or losses. Despite these limitations, BEY remains a valuable tool for comparing bond yields.

Bond Equivalent Yield (BEY) differs from other yield measures like Yield to Maturity (YTM) and Current Yield by providing a standardized, annualized yield that allows for the direct comparison of bonds with different payment frequencies. While YTM considers the bond's price, coupon rate, and time to maturity, and Current Yield focuses on annual income relative to the bond's price, BEY enables a more straightforward comparison of bond yields.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.