An Asset Manager is a professional who meticulously oversees, manages and coordinates the assets of an individual or a business entity. These assets could range from tangible ones, such as real estate and equipment, to intangible ones, such as investments and cash reserves. The primary objective of an asset manager is to maximize returns while minimizing risks, thereby ensuring the growth and preservation of wealth. The assets managed by these professionals can be part of pension funds, endowments, or personal wealth. An asset manager undertakes numerous responsibilities tailored toward achieving the most effective and efficient utilization of resources. Key among these is the development and implementation of investment strategies based on a client's financial goals, risk tolerance, and investment timeline. Asset managers also act as a bridge between investors and the financial markets, providing expert guidance and execution of investment strategies. One of the core tasks of an asset manager is constructing a diversified investment portfolio that matches a client's specific objectives. This involves selecting an appropriate mix of different asset classes, such as stocks, bonds, and alternative investments. The asset manager continuously monitors this portfolio to ensure it remains aligned with the client's goals. They use their expertise to fine-tune the portfolio, periodically adding or subtracting assets as per the market conditions and the client's evolving financial goals. Asset managers play a critical role in identifying potential risks associated with investment decisions. They use advanced financial models and statistical techniques to predict market trends, which help in making informed investment decisions. This, in turn, aids in mitigating risks and avoiding potential financial losses. Additionally, they employ robust risk management strategies to ensure the client's portfolio can withstand market volatility and other financial risks. Asset managers are also responsible for deciding how to allocate a client's resources across various investments. They must understand the client's financial situation, risk tolerance, and investment goals to distribute assets appropriately. This strategic asset allocation is a dynamic process that takes into consideration the changing financial landscape and the client's evolving needs and goals. An essential part of an asset manager's job is the regular review and rebalancing of a client's investment portfolio. This involves adjusting the allocation of assets as market conditions change and as the client's financial situation or goals evolve. Regular rebalancing ensures the portfolio does not deviate significantly from its target allocation, maintaining the desired level of risk and return. A strong educational background in finance, business administration, or a related field is generally required to become an asset manager. Various certifications, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations, are considered valuable in this profession. These credentials not only affirm the manager's expertise but also demonstrate their commitment to adhering to high professional and ethical standards. Asset management requires a unique blend of skills. Analytical abilities are crucial for evaluating investment options and financial data. A deep understanding of financial markets is necessary to predict trends and identify lucrative investment opportunities. Furthermore, strategic planning skills are vital in designing effective asset management strategies tailored to each client's needs. The asset manager's role is not limited to managing assets; they also need to have excellent problem-solving skills, an eye for detail, and a high level of financial literacy. Experience in the field of finance, particularly in areas related to investment and portfolio management, is invaluable for an asset manager. Additionally, the financial landscape is ever-evolving, making continuous learning and staying abreast of new trends, regulations, and investment vehicles a must for success in this profession. The best asset managers keep up-to-date with the latest market trends, economic news, and investment research to make informed decisions that best serve their clients. By strategically allocating resources, identifying lucrative investment opportunities, and mitigating potential risks, an asset manager can significantly maximize an investor's returns. Their expertise and in-depth market understanding can help unlock the full potential of an investor's wealth. By keeping track of market fluctuations and adapting strategies accordingly, asset managers ensure that investment opportunities are fully capitalized, driving growth in an investor's wealth. Besides maximizing returns, asset managers also play a pivotal role in safeguarding an investor's wealth. Through regular monitoring and rebalancing of portfolios, they ensure that a client's investments are well-diversified and adjusted according to market conditions, reducing the risk of substantial losses. They consider a wide array of factors, including global economic conditions, market trends, and political developments, to anticipate potential threats and protect the portfolio. When selecting an asset manager, trust and reputation are paramount. This professional will have significant control over your financial future, so it's crucial to find someone who is reliable and has a strong track record. One should look for an asset manager who has a history of integrity and honesty in their professional dealings. Reviewing an asset manager's past performance can provide valuable insight into their investment strategy and success rate. While past performance is not a guarantee of future results, a consistent history of strong returns could indicate a higher probability of future success. A prospective client should also consider the consistency of an asset manager's performance over different market cycles. Effective communication is crucial in any professional relationship, and this is especially true when working with an asset manager. The professional should be able to explain investment strategies and decisions clearly and be willing to answer any questions you may have. The client should feel comfortable with the manager's communication style and frequency and should always feel informed about their investment decisions. Finally, it's essential to understand how an asset manager is compensated. This includes understanding their fee structure, which could be based on a percentage of assets under management, an hourly rate, or a flat fee. Be sure to compare these costs among different asset managers to ensure you're getting a fair deal. Understanding how and when these charges apply can help avoid unexpected expenses and ensure transparency between the client and the asset manager. An asset manager plays a pivotal role in shaping the financial trajectory of individuals and businesses alike. By providing a comprehensive suite of services, including portfolio construction, risk mitigation, resource allocation, and portfolio rebalancing, they expertly steer financial assets to maximize returns and protect wealth. Armed with a potent combination of education, certifications, and experience, along with analytical, strategic planning, and problem-solving skills, an asset manager keeps abreast of ever-evolving market trends and ensures client success. The impact of an asset manager on an investor's wealth is substantial, helping to unlock the full potential of one's assets and ensuring their preservation. When selecting an asset manager, it's crucial to consider factors like trust, reputation, past performance, communication, and understanding of fees and charges. Therefore, effectively navigating your financial future requires the skillful guidance of an asset manager.Definition and Roles of an Asset Manager

Definition of an Asset Manager

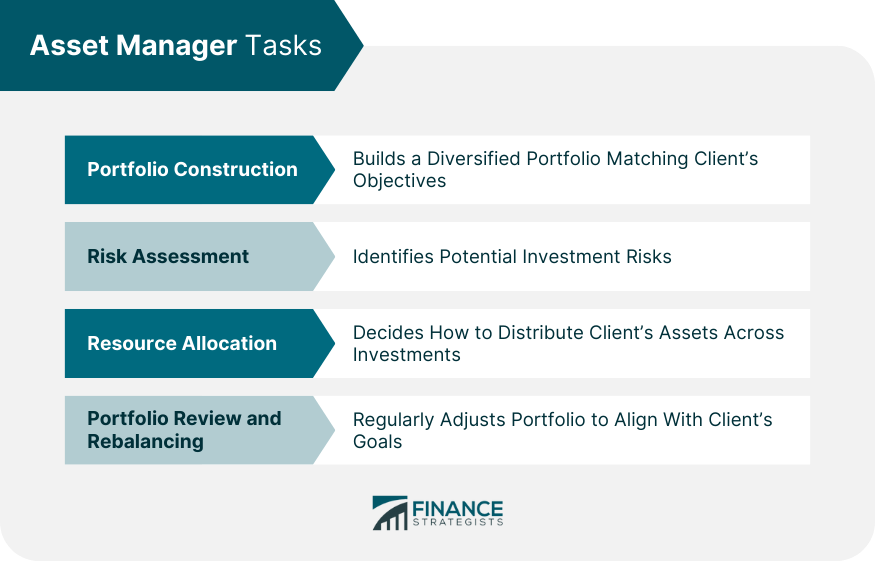

Primary Roles and Responsibilities of an Asset Manager

In-Depth Analysis of Asset Manager Tasks

Portfolio Construction and Management

Risk Assessment and Mitigation

Allocation of Resources and Assets

Regular Review and Rebalancing of Investment Portfolios

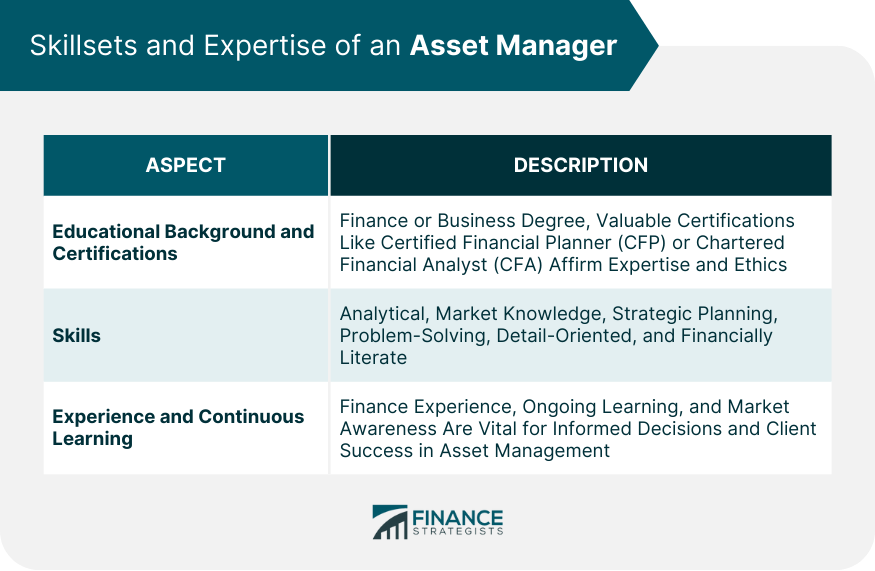

Skillsets and Expertise of an Asset Manager

Educational Background and Certifications

Skills

Experience and Continuous Learning

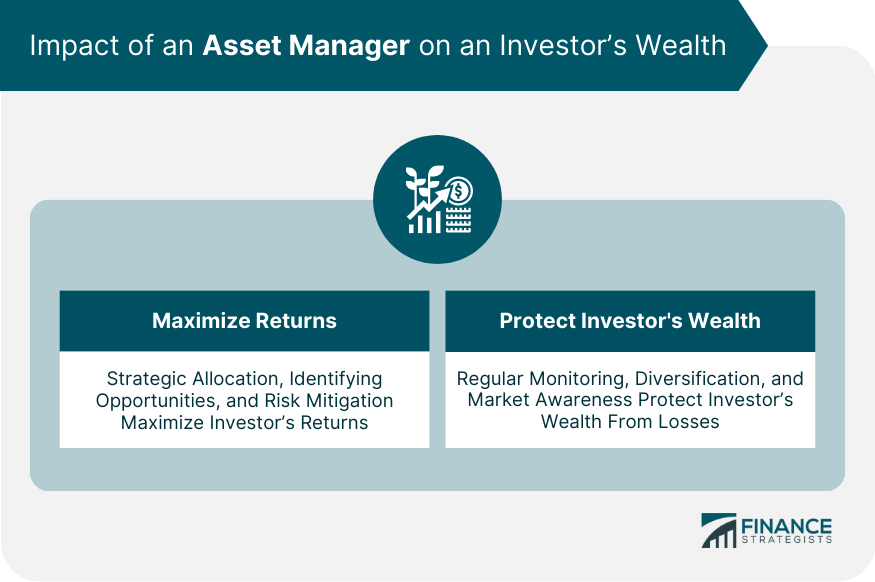

Impact of an Asset Manager on an Investor’s Wealth

How an Asset Manager Can Maximize Returns

Role of an Asset Manager in Protecting an Investor's Wealth

Factors to Consider When Selecting an Asset Manager

Trust and Reputation

Performance Track Record

Communication and Rapport

Fees and Charges

Bottom Line

Understanding What an Asset Manager Do FAQs

An asset manager oversees and coordinates an individual's or a business's assets, aiming to maximize returns and minimize risks.

Asset managers construct portfolios, assess and mitigate risks, allocate resources, and regularly review and rebalance investment portfolios.

An asset manager needs strong analytical abilities, knowledge of markets, strategic planning skills, and a solid educational background in finance.

An asset manager can maximize returns by strategically allocating resources and identifying investment opportunities, and protect wealth by mitigating risks.

Considerations include the asset manager's trustworthiness, reputation, past performance, communication style, and fee structure.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.