Strategic asset allocation refers to the long-term investment strategy that involves allocating a portfolio's assets among different asset classes to achieve an optimal balance between risk and return. This approach aims to maximize returns based on an investor's risk tolerance, time horizon, and investment goals while minimizing portfolio volatility. Strategic asset allocation plays a critical role in portfolio management, as it helps investors create a well-diversified portfolio that aligns with their financial objectives and risk preferences. By following a strategic asset allocation plan, investors can increase the likelihood of achieving their financial goals while managing the inherent risks associated with investing. The key principles of strategic asset allocation include understanding risk and return profiles, diversification, and the importance of regularly reviewing and adjusting the asset allocation. These principles help guide investors in constructing a portfolio that aligns with their long-term financial objectives while managing risk. Risk tolerance is crucial in determining an investor's strategic asset allocation. It refers to an individual's willingness to accept potential losses in pursuit of investment returns. Assessing risk tolerance helps investors choose an appropriate mix of assets that aligns with their ability to withstand market fluctuations. Expected returns are the potential gains an investor anticipates from their investments. Understanding the expected returns of various asset classes helps investors make informed decisions about their strategic asset allocation, selecting a mix of assets that aligns with their desired investment outcomes and risk tolerance. Balancing risk and return is a fundamental aspect of strategic asset allocation. Investors must consider the trade-offs between the potential for higher returns and the associated risks of different asset classes. Investors can create a well-diversified portfolio that optimizes their risk-adjusted returns by carefully weighing these factors. Diversification is a critical component of strategic asset allocation, as it helps spread risk across a variety of investments. By investing in different asset classes that respond differently to market conditions, investors can reduce the overall volatility of their portfolios and increase the likelihood of achieving their long-term financial goals. Correlation between asset classes refers to the degree to which their returns move in tandem. Understanding the correlation between different asset classes is essential for effective diversification, as it enables investors to construct a portfolio that balances assets with low or negative correlations, reducing overall portfolio risk. While diversification offers significant benefits in terms of risk management, it has its limitations. Diversification cannot eliminate all types of investment risk, such as systemic or market risk. Additionally, over-diversification can dilute potential returns, making it crucial for investors to strike an appropriate balance. Equities, or stocks, represent ownership shares in publicly traded companies. They offer the potential for capital appreciation and dividend income, making them an essential component of many strategic asset allocations. However, equities can be volatile and carry higher risks compared to other asset classes. Fixed income investments, such as bonds and other debt instruments, provide regular income payments and typically exhibit lower volatility than equities. They are an important part of strategic asset allocation, offering a more conservative investment option that can help offset riskier assets within a portfolio. Cash and cash equivalents, including money market funds and short-term government securities, provide liquidity and safety for investors. Although they offer lower returns than equities and fixed income, they are essential to strategic asset allocation. Real estate investments involve owning, managing, or financing properties, such as residential, commercial, or industrial properties. Real estate can offer capital appreciation, rental income, and diversification benefits as part of a strategic asset allocation. However, it may also involve higher transaction costs, lower liquidity, and potential property management challenges. Commodities are physical goods, such as metals, energy resources, and agricultural products, that can be traded on global markets. Commodities can provide diversification benefits and serve as a hedge against inflation, but they are also subject to price volatility and other risks associated with global supply and demand dynamics. Alternative investments include assets that fall outside traditional asset classes, such as private equity, hedge funds, and collectibles. These investments can offer diversification benefits and potential for higher returns, but they often involve higher fees, lower liquidity, and greater complexity compared to traditional investments. An investor's time horizon and investment goals play a crucial role in determining their optimal asset allocation. Longer time horizons generally allow for greater risk-taking, as investors have more time to recover from potential losses. Shorter time horizons may require a more conservative approach to preserve capital. An investor's risk profile, which includes factors such as risk tolerance and financial capacity, is another critical determinant of optimal asset allocation. Investors with higher risk tolerance and greater financial capacity can afford to allocate a larger portion of their portfolio to riskier assets, while more risk-averse investors should prioritize safer investments. Economic conditions and market outlook can influence the optimal asset allocation for investors. Factors such as interest rates, inflation, and market performance can impact the expected returns and risks associated with different asset classes, necessitating adjustments to an investor's strategic asset allocation. Regularly reviewing and rebalancing a portfolio is essential for maintaining an optimal asset allocation. Changes in market conditions, investment goals, or risk tolerance may require adjustments to the allocation of assets within the portfolio to ensure alignment with an investor's long-term objectives. Passive asset allocation involves creating a diversified portfolio that mirrors a market index or benchmark, with minimal adjustments over time. On the other hand, active asset allocation involves actively managing the portfolio to outperform a benchmark or achieve specific investment objectives, which may require more frequent adjustments and higher management fees. Tactical asset allocation is a short-term, active strategy that involves adjusting a portfolio's asset allocation based on market conditions or investment opportunities. While tactical asset allocation can provide opportunities for higher returns, it requires a greater degree of market knowledge and skill to implement effectively. Age-based asset allocation models adjust an investor's asset allocation based on their age, gradually shifting from riskier assets to more conservative investments as they approach retirement. These models aim to balance risk and return over an investor's life, providing growth potential during their working years while preserving capital as they near retirement. Target-date funds are mutual funds or exchange-traded funds designed to simplify long-term investing by automatically adjusting their asset allocation based on a predetermined retirement date. As the target date approaches, the fund's allocation shifts from higher-risk investments to more conservative assets, reducing portfolio risk over time. Risk parity is an asset allocation strategy that aims to equalize risk across different asset classes within a portfolio. This approach seeks to achieve a more balanced risk profile, potentially improving portfolio performance and reducing the impact of market volatility on investment returns. Selecting appropriate investment vehicles is crucial for implementing a strategic asset allocation plan. Investors can choose from a variety of options, such as individual stocks and bonds, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs), each with its unique features, fees, and potential tax implications. Understanding the costs and tax implications of different investment vehicles is essential for implementing strategic asset allocation effectively. Costs, such as management fees, transaction fees, and expense ratios, can impact investment returns, while tax considerations, such as capital gains and dividend taxes, can also influence an investor's overall financial outcome. Regularly monitoring and rebalancing the portfolio is an essential aspect of implementing strategic asset allocation. Rebalancing ensures that the portfolio remains aligned with the investor's risk tolerance and investment objectives, adjusting asset allocations as needed to account for market fluctuations and changes in personal circumstances. Market unpredictability is a significant challenge in strategic asset allocation, as it is difficult to predict the future performance of asset classes accurately. Additionally, strategic asset allocation often relies on historical data and assumptions that may not hold true in the future, limiting the strategy's effectiveness. Behavioral biases can impact investor decision-making and undermine the effectiveness of strategic asset allocation. Common biases, such as loss aversion, overconfidence, and herding, can lead investors to make suboptimal investment decisions, deviating from their long-term asset allocation strategy. Reliance on historical data and projections are a limitation of strategic asset allocation, as past performance may not accurately predict future results. Market conditions and economic factors can change over time, potentially rendering historical data less useful for informing future investment decisions. Strategic asset allocation is crucial for long-term investing as it maximizes potential returns while managing risk. A well-diversified portfolio aligns with an investor's risk tolerance, time horizon, and objectives, increasing the chance of achieving financial goals. By adhering to a disciplined strategy, investors can resist reacting to short-term fluctuations and reduce behavioral biases. Regular reviews and adjustments are essential to maintain an optimal allocation that adapts to market conditions and personal circumstances. Seeking professional wealth management services can provide valuable guidance and support to overwhelmed investors. A qualified financial advisor can design and implement a tailored strategic asset allocation plan, providing peace of mind and a pathway to long-term financial success.What Is Strategic Asset Allocation?

Risk and Return Profiles for Strategic Asset Allocation

Assessing Risk Tolerance

Understanding Expected Returns

Balancing Risk and Return in Asset Allocation

Diversification and Correlation in Strategic Asset Allocation

Importance of Diversification in Strategic Asset Allocation

Correlation Between Asset Classes

Diversification Benefits and Limitations

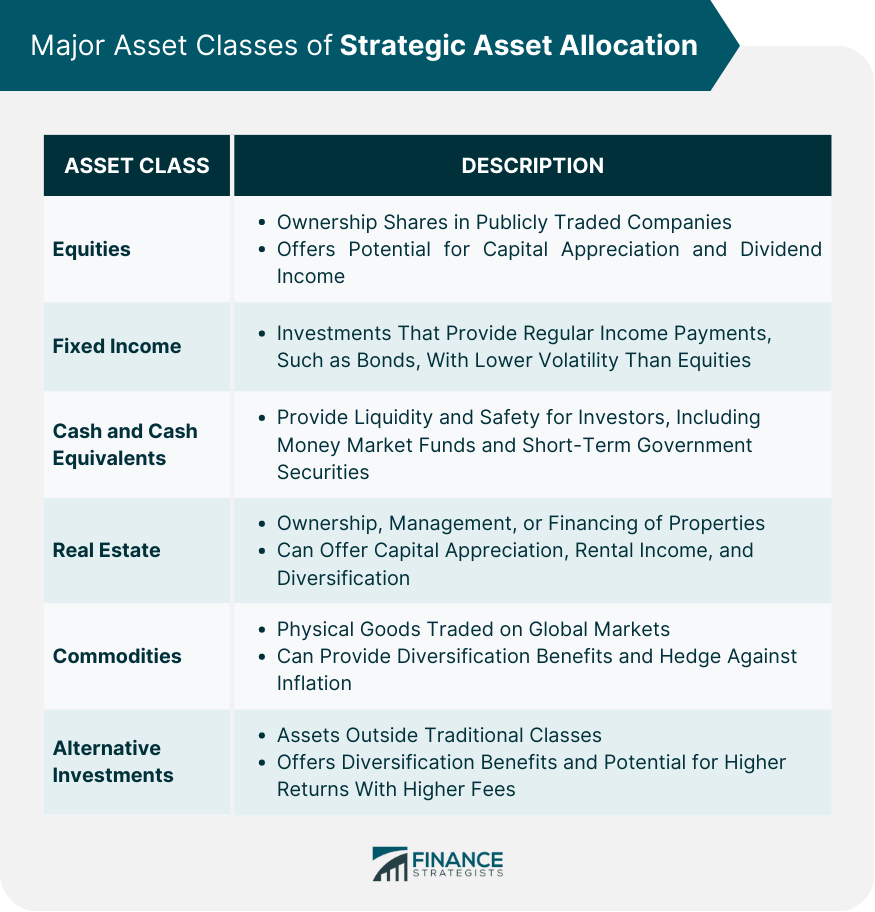

Major Asset Classes of Strategic Asset Allocation

Equities

Fixed Income

Cash and Cash Equivalents

Real Estate

Commodities

Alternative Investments

Determining the Optimal Strategic Asset Allocation

Time Horizon and Investment Goals

Investor's Risk Profile

Economic Conditions and Market Outlook

Periodic Reviews and Rebalancing

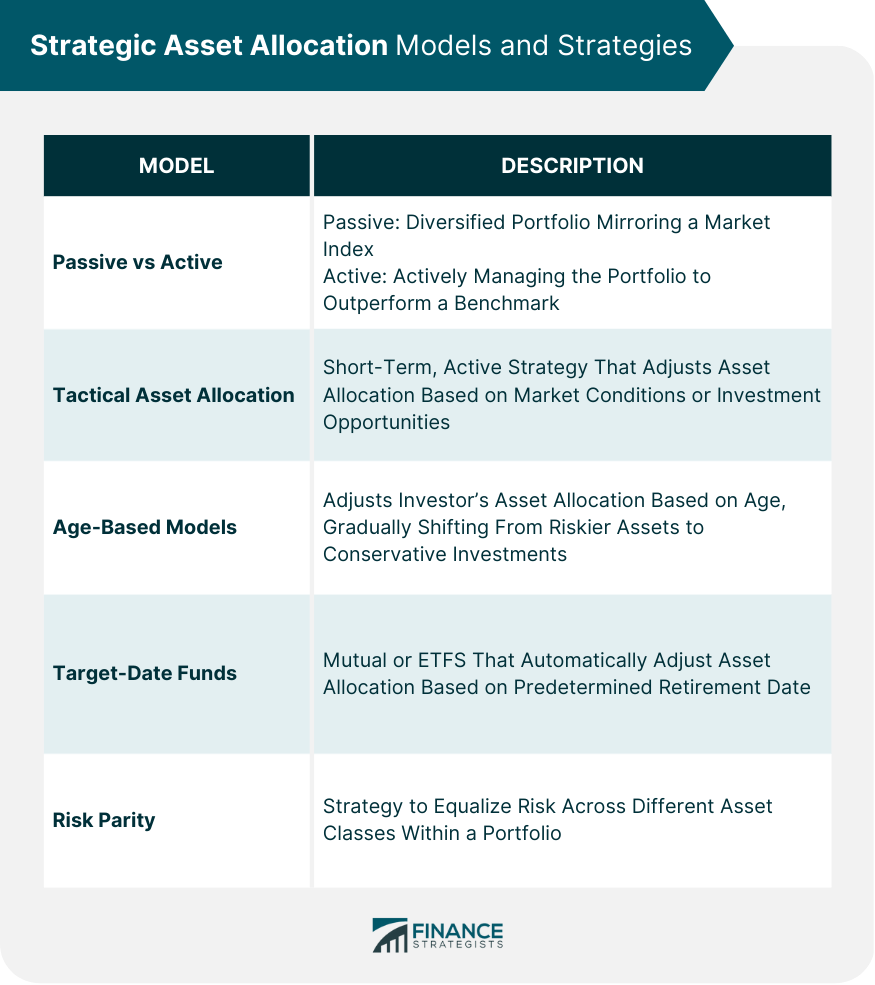

Strategic Asset Allocation Models and Strategies

Passive vs Active Asset Allocation

Tactical Asset Allocation

Age-Based Asset Allocation Models

Target-Date Funds

Risk Parity

Implementing Strategic Asset Allocation

Selecting Investment Vehicles

Costs and Tax Considerations

Monitoring and Rebalancing the Portfolio

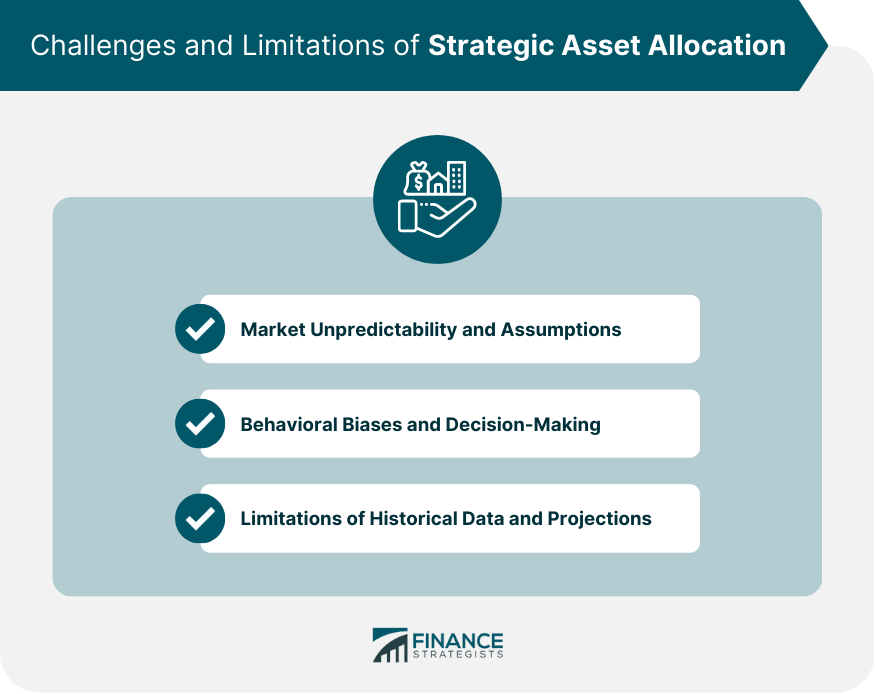

Challenges and Limitations of Strategic Asset Allocation

Market Unpredictability and Assumptions

Behavioral Biases and Decision-Making

Limitations of Historical Data and Projections

Final Thoughts

Strategic Asset Allocation FAQs

Strategic asset allocation is a long-term investment strategy that involves allocating a portfolio's assets among different asset classes to achieve an optimal balance between risk and return.

Strategic asset allocation plays a critical role in portfolio management as it helps investors create a well-diversified portfolio that aligns with their financial objectives and risk preferences, thereby increasing the likelihood of achieving their financial goals while managing the inherent risks associated with investing.

The major asset classes of strategic asset allocation are equities, fixed income, cash and cash equivalents, real estate, commodities, and alternative investments.

Market unpredictability, behavioral biases, and reliance on historical data and projections are some of the challenges and limitations of strategic asset allocation.

An investor can implement strategic asset allocation effectively by selecting appropriate investment vehicles, considering costs and tax implications, and regularly monitoring and rebalancing the portfolio to maintain an optimal asset allocation. Seeking professional wealth management services can also provide valuable guidance and support.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.