Liquid alternatives, also known as alternative investments or alt funds, are investment vehicles that provide access to alternative investment strategies traditionally used by hedge funds and private equity firms. These alternatives include mutual funds, Exchange-Traded Funds (ETFs), and closed-end funds, which aim to deliver diversification and potential risk-adjusted returns beyond traditional asset classes. Liquid alternative funds employ strategies such as long/short, global macro, event-driven, relative value, managed futures, and multi-strategy. These strategies involve a wide range of investment approaches, from betting on market movements to exploiting pricing inefficiencies or special situations. Unlike traditional hedge funds, liquid alternatives offer daily liquidity, allowing investors to buy or sell shares on any trading day. This accessibility makes liquid alternatives more suitable for retail investors seeking exposure to alternative investment strategies without the high minimum investment requirements or lock-up periods associated with hedge funds. The concept of liquid alternatives has been around for a while, but it was not until the aftermath of the 2008 financial crisis that they gained significant traction. In a landscape dominated by traditional investments, the crisis underscored the need for diversification and risk mitigation, leading to the increased adoption of liquid alternatives. Liquid alternatives have since experienced substantial growth, both in terms of Assets Under Management (AUM) and product variety. Liquid alternative mutual funds are structured similarly to traditional mutual funds but implement hedge fund-like strategies. They offer daily liquidity, transparency, and are subject to the regulatory oversight of the Securities and Exchange Commission (SEC). Liquid alternative ETFs are exchange-traded funds that employ alternative strategies. Like mutual funds, they provide daily liquidity and transparency. However, ETFs can be traded throughout the day like stocks, offering additional flexibility. Closed-end liquid alternative funds issue a fixed number of shares that trade on an exchange. They can employ leverage to a greater extent than mutual funds or ETFs, potentially enhancing returns but also increasing risk. Other types of liquid alternatives include managed futures funds, Real Estate Investment Trusts (REITs), and commodity ETFs. These offer exposure to different asset classes and strategies, further broadening the range of liquid alternatives. Liquid alternatives operate under a regulated environment, primarily overseen by the SEC. They are subject to the Investment Company Act of 1940, which imposes restrictions on leverage, liquidity, and transparency. This regulatory framework is designed to protect investors by ensuring adequate disclosure and preventing excessive risk-taking. Each type of liquid alternative comes with its own set of advantages and disadvantages. Mutual funds and ETFs offer daily liquidity and transparency, making them suitable for retail investors. However, they are subject to certain restrictions on short selling and leverage, potentially limiting their ability to fully replicate hedge fund strategies. On the other hand, closed-end funds can employ greater leverage, potentially enhancing returns. However, they may trade at a discount or premium to net asset value (NAV), introducing additional risk. Other types of liquid alternatives, such as REITs and commodity ETFs, offer unique exposure but come with their own set of risks and considerations. Long/short equity is a common strategy employed by liquid alternatives. It involves taking long positions in stocks expected to increase in value and short positions in stocks expected to decrease in value. This strategy aims to generate positive returns regardless of market direction. Global macro strategies aim to profit from macroeconomic trends and events. They involve trading a variety of instruments, including equities, bonds, currencies, commodities, and derivatives. These strategies can be complex and require a deep understanding of global markets and macroeconomics. Event-driven strategies seek to profit from corporate events such as mergers, acquisitions, bankruptcies, and restructurings. These strategies require specialized knowledge and thorough research to identify and evaluate potential opportunities. Relative value strategies aim to exploit price discrepancies between related financial instruments. They involve taking a long position in an undervalued security and a short position in an overvalued security, profiting from the convergence of their prices. Managed futures strategies involve trading futures contracts on commodities, currencies, equity indexes, and interest rates. These strategies can profit from both rising and falling markets, providing diversification and risk mitigation benefits. Multi-strategy liquid alternatives employ a combination of the above strategies. They offer broad diversification and flexibility, allowing the fund manager to allocate capital dynamically based on market conditions. One of the significant benefits of liquid alternatives is their potential for portfolio diversification. Since they often employ strategies that have low correlations with traditional asset classes such as equities and bonds, they can reduce portfolio volatility and enhance risk-adjusted returns. Liquid alternatives offer the potential for enhanced returns, particularly in volatile or declining markets. Strategies such as long/short equity, global macro, and event-driven can generate positive returns in different market conditions, offering a source of absolute return. By offering exposure to alternative strategies and asset classes, liquid alternatives can serve as a hedge against market downturns. This can help mitigate portfolio risk, particularly during periods of heightened market stress. Unlike traditional alternative investments, liquid alternatives provide daily liquidity, allowing investors to buy and sell shares on any trading day. They also offer transparency, with daily NAV reporting and regular disclosures of holdings. Liquid alternatives are accessible to retail investors, with lower minimum investment requirements than traditional alternative investments. This democratizes access to alternative strategies, which were previously available only to institutional investors or high-net-worth individuals. While liquid alternatives offer many benefits, they also come with unique risks. These include strategy risk, liquidity risk, and counterparty risk, among others. Understanding these risks is crucial for any investor considering liquid alternatives. Liquid alternatives can be operationally complex, particularly those employing sophisticated strategies such as global macro or relative value. This complexity can lead to operational risk, including the risk of errors or mismanagement. While liquid alternatives offer the potential for enhanced returns, they can also underperform traditional investments, particularly in strong bull markets. This is because many of their strategies are designed to profit from market inefficiencies or volatility, which may be less prevalent in steady, upward-trending markets. Liquid alternatives can be more expensive than traditional mutual funds or ETFs due to the complexity of their strategies and the expertise required to manage them. High fees can erode returns, particularly in low-return environments. Liquid alternatives can serve various roles in a portfolio, depending on an investor's objectives and risk tolerance. They can be used as a core holding, providing broad exposure to alternative strategies, or as a satellite holding, complementing traditional investments. Balancing risk and reward is crucial when incorporating liquid alternatives into a portfolio. While these funds can enhance returns and reduce risk, they should be used judiciously, considering their unique risk profile and potential for underperformance. When evaluating liquid alternatives, investors should consider various metrics, including return, volatility, correlation with traditional investments, maximum drawdown, and Sharpe ratio. These metrics can provide insights into a fund's performance, risk profile, and potential role in a portfolio. The role of fund managers is crucial in liquid alternatives, given the complexity of their strategies. Investors should assess the manager's experience, track record, investment process, and risk management capabilities. Due diligence is essential when selecting liquid alternatives. This should include a thorough review of the fund's strategy, performance, risk profile, fees, and the expertise of the fund manager. Consulting with a financial advisor can also be beneficial, given the complexity and unique characteristics of these funds. Liquid alternatives, often referred to as "liquid alts," have emerged as an important tool for diversification in modern investment portfolios. These are financial instruments that include mutual funds, ETFs, closed-end funds, and more, implementing strategies typically associated with hedge funds. The strategies employed by liquid alternatives range from long/short equity to global macro, event-driven, relative value, managed futures, and multi-strategy approaches. Investing in liquid alternatives offers numerous advantages, including portfolio diversification, the potential for enhanced returns, risk mitigation, liquidity, transparency, and accessibility to retail investors. However, they also pose unique challenges, such as a complex risk profile, operational complexity, potential for underperformance, and high fees. When evaluating and selecting liquid alternatives, key considerations should include the fund's performance metrics, the role and track record of the fund manager, and thorough due diligence of the fund's strategy and risk profile. For many investors, seeking the advice of a professional wealth management service can be a valuable step in navigating the complexity and potential opportunities presented by liquid alternatives.What Are Liquid Alternatives?

Evolution and Growth of Liquid Alternatives

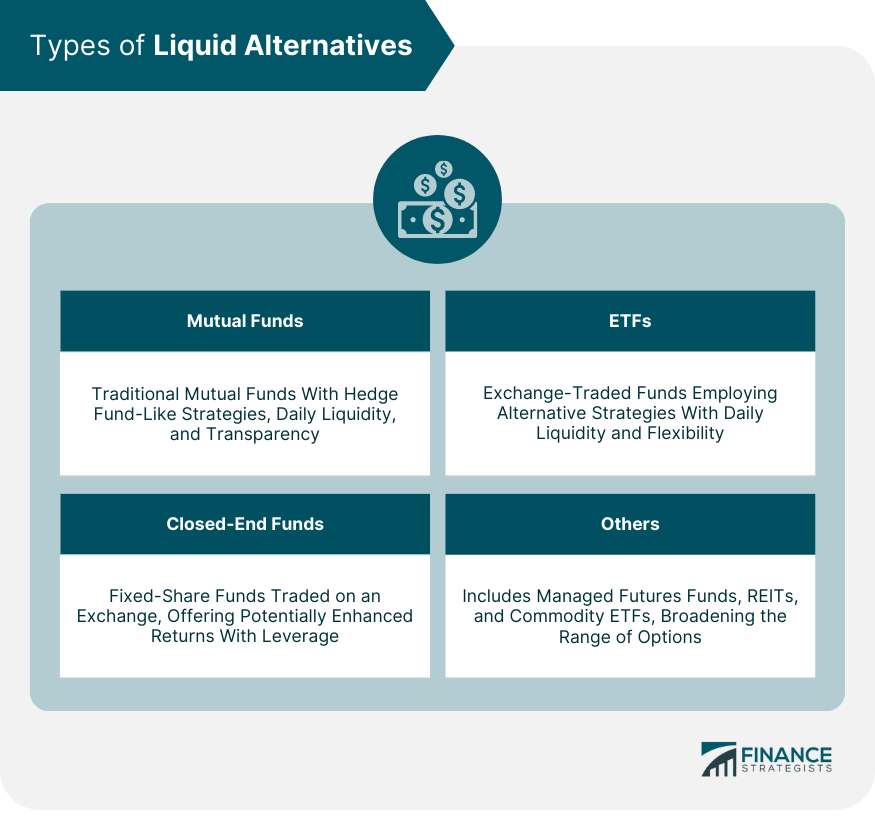

Understanding the Structure of Liquid Alternatives

Overview of Different Types of Liquid Alternatives

Mutual Funds

ETFs

Closed-End Funds

Others

Regulatory Environment for Liquid Alternatives

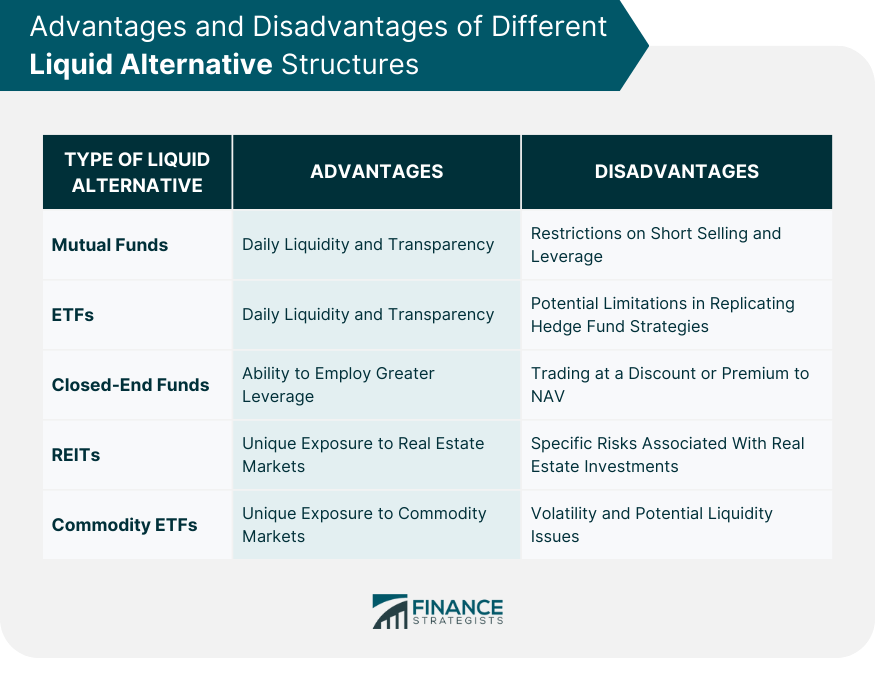

Advantages and Disadvantages of Different Structures

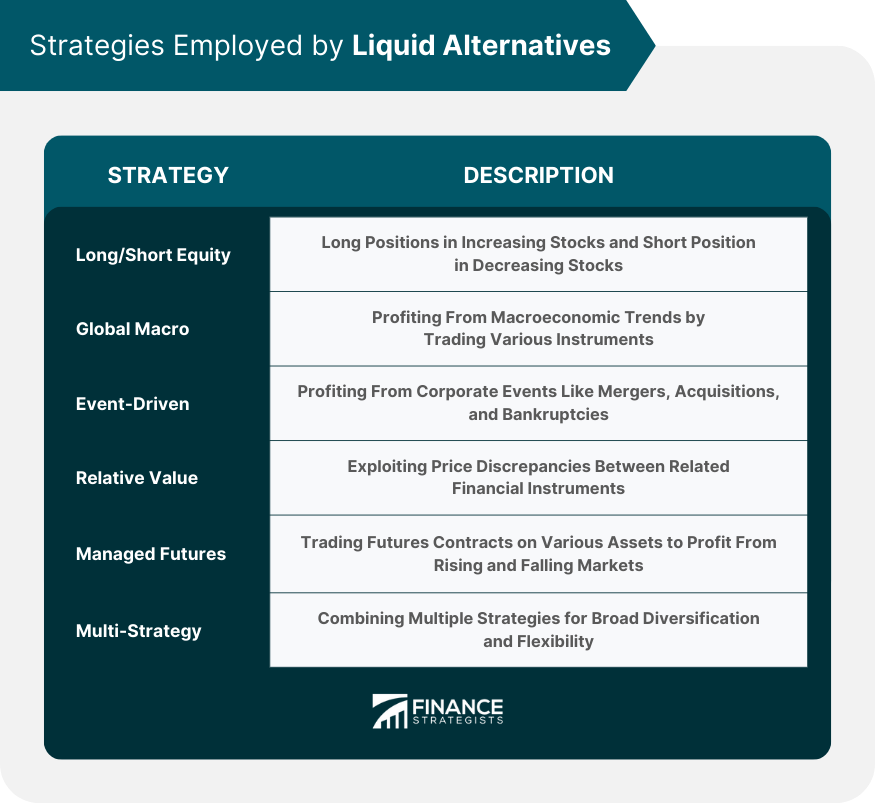

Strategies Employed by Liquid Alternatives

Long/Short Equity

Global Macro

Event-Driven

Relative Value

Managed Futures

Multi-Strategy

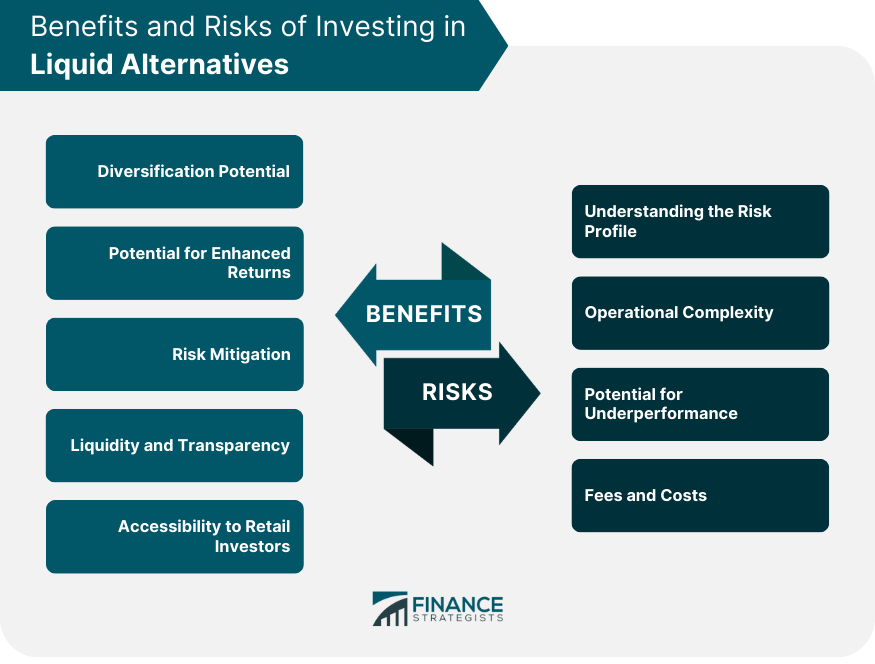

Benefits of Investing in Liquid Alternatives

Diversification Potential

Potential for Enhanced Returns

Risk Mitigation

Liquidity and Transparency

Accessibility to Retail Investors

Risks and Challenges of Liquid Alternatives

Understanding the Risk Profile

Operational Complexity

Potential for Underperformance

Fees and Costs

Role of Liquid Alternatives in Portfolio Construction

Positioning Liquid Alternatives in a Portfolio

Balancing Risk and Reward with Liquid Alternatives

Evaluating and Selecting Liquid Alternatives

Key Metrics for Evaluating Liquid Alternatives

Understanding the Role of Fund Managers

Due Diligence in Selecting Liquid Alternatives

Final Thoughts

Liquid Alternatives FAQs

Liquid alternatives are financial instruments that aim to replicate hedge fund strategies within structures that provide daily liquidity. They include investment vehicles like mutual funds, ETFs, and closed-end funds.

Liquid alternatives employ a range of strategies, including long/short equity, global macro, event-driven, relative value, managed futures, and multi-strategy.

Benefits of investing in liquid alternatives include portfolio diversification, the potential for enhanced returns, risk mitigation, liquidity, transparency, and accessibility to retail investors.

Risks associated with liquid alternatives include a complex risk profile, operational complexity, potential for underperformance, and high fees.

Evaluating and selecting liquid alternatives involve considering the fund's performance metrics, the role and track record of the fund manager, and performing thorough due diligence of the fund's strategy and risk profile.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.