Tax-efficient income investing is a method of structuring an investment portfolio to minimize the impact of taxes on investment returns. It plays a crucial role in optimizing the overall performance of an investment portfolio and preserving wealth over time. This article discusses various types of tax-efficient investment income, strategies to maximize tax efficiency, investment vehicles that can help achieve this goal, and the importance of monitoring and adjusting tax-efficient portfolios. An investor's time horizon plays a critical role in determining the most appropriate tax-efficient investing strategies. Longer time horizons typically allow for greater flexibility in managing taxable events and taking advantage of tax-efficient strategies, while shorter time horizons may limit the potential benefits of certain tax-efficient approaches. An investor's current tax bracket and expected future tax rates should be considered when developing tax-efficient investing strategies. By understanding their current and future tax liabilities, investors can make more informed decisions about the timing and structure of their investments to optimize their tax efficiency. Risk tolerance is an essential consideration for tax-efficient investing. While some strategies may offer significant tax benefits, they may also involve higher levels of risk or volatility. Investors must carefully balance the potential tax savings against their risk tolerance and overall investment objectives. Finally, an investor's personal preferences and financial goals should be taken into account when developing tax-efficient investing strategies. Tax efficiency is just one aspect of a comprehensive investment plan, and investors must ensure that their strategies align with their broader financial goals and preferences. Allocating investments across taxable and tax-advantaged accounts is an essential strategy for tax-efficient income investing. Taxable accounts, such as individual and joint brokerage accounts, are subject to taxes on interest, dividends, and capital gains. In contrast, tax-advantaged accounts, like IRAs and 401(k)s, offer tax-deferred or tax-free growth, depending on the account type. Generally, tax-inefficient investments, such as bonds and REITs, should be placed in tax-advantaged accounts, while tax-efficient investments, like stocks, should be allocated to taxable accounts. Tax-loss harvesting is the process of selling underperforming assets to realize capital losses, which can be used to offset capital gains, reducing the investor's taxable income. By strategically realizing losses, investors can minimize their tax liabilities and improve their portfolio's overall tax efficiency. Maximizing long-term capital gains rates is another crucial aspect of tax-efficient income investing. By holding investments for more than one year, investors can benefit from the generally lower tax rates applied to long-term capital gains. The timing of investment sales can have a significant impact on an investor's tax liabilities. By holding onto investments for longer periods, investors can potentially benefit from more favorable long-term capital gains tax rates. Additionally, carefully timing the sale of investments around specific tax events or in response to changes in tax laws can help investors minimize their tax liabilities and maximize their after-tax returns. Municipal bonds offer tax-exempt interest income, making them an attractive option for investors in higher tax brackets. By investing in municipal bonds, investors can generate tax-free income, thereby improving their portfolio's tax efficiency. It is essential, however, to consider the credit quality and duration of municipal bonds to align them with the investor's risk tolerance and investment objectives. Contributing to retirement accounts like traditional IRAs, Roth IRAs, and 401(k)s is another effective tax-efficient investment strategy. Traditional IRA and 401(k) contributions are tax-deductible, reducing an investor's taxable income, and investments grow tax-deferred until withdrawal. Roth IRA contributions are made with after-tax dollars, but qualified withdrawals, including investment gains, are tax-free. Maximizing contributions to retirement accounts can help investors optimize their tax efficiency while saving for retirement. Index funds are passively managed mutual funds or exchange-traded funds (ETFs) that track a specific market index, like the S&P 500. These funds typically have lower turnover rates than actively managed funds, which translates to fewer taxable events and increased tax efficiency. Additionally, index funds often have lower expense ratios, further enhancing their overall efficiency and returns. ETFs are investment funds traded on stock exchanges, similar to individual stocks. They provide a diversified exposure to a specific market sector or index. ETFs generally have lower turnover rates than actively managed mutual funds, resulting in fewer taxable events. Furthermore, the unique structure of ETFs allows for more tax-efficient management, making them a suitable option for tax-efficient income investing. Tax-managed mutual funds are specifically designed to minimize taxable events and maximize after-tax returns. These funds employ strategies such as low portfolio turnover, tax-loss harvesting, and avoiding high dividend-yielding stocks to reduce tax liabilities for investors. Real estate investment trusts (REITs) are companies that own and manage income-producing real estate properties. REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. While REIT dividends are generally taxed at the investor's ordinary income tax rate, they can be an attractive tax-efficient investment option when held in tax-advantaged accounts like IRAs or 401(k)s. Taxable interest is generated from various sources, including savings accounts, bonds, and certificates of deposit (CDs). This type of interest income is subject to federal and state income taxes at the investor's ordinary income tax rate. Tax-exempt interest income is primarily earned from municipal bonds, which are issued by state and local governments to finance public projects. The interest earned on these bonds is generally free from federal income tax and, in some cases, state and local taxes as well. Qualified dividends are paid by U.S. corporations and certain foreign corporations. They are subject to the long-term capital gains tax rate, which is generally lower than the ordinary income tax rate. To be considered qualified, dividends must meet specific holding period requirements. Non-qualified dividends are those that do not meet the requirements for qualified dividends. They are taxed at the investor's ordinary income tax rate. Short-term capital gains result from the sale of an investment held for one year or less. These gains are taxed at the investor's ordinary income tax rate. Long-term capital gains arise from the sale of an investment held for more than one year. They are generally taxed at a lower rate than short-term capital gains, depending on the investor's taxable income and filing status. Capital losses occur when an investment is sold for less than its purchase price. These losses can be used to offset capital gains, reducing an investor's taxable income. Any remaining losses can offset up to $3,000 of ordinary income per year, with any excess carried forward to future years. One of the main benefits of tax-efficient investing is the reduction of tax liabilities associated with investment income and gains. By strategically managing investments to minimize taxable events, investors can lower their overall tax burden and retain more of their earnings. Tax-efficient investing can lead to increased investment returns by minimizing the taxes paid on those returns. As a result, a larger portion of the returns can be reinvested, allowing for greater potential growth and compounding over time. This can have a significant impact on an investor's long-term financial goals and wealth accumulation. Tax-efficient investing can also contribute to improved portfolio diversification. By considering the tax implications of various investments, investors may be more inclined to allocate their assets across a wider range of investment types and asset classes, ultimately reducing portfolio risk and enhancing overall performance. For investors who rely on their investments to generate income, tax-efficient investing can lead to higher after-tax income. By maximizing the tax efficiency of their investments, these investors can potentially receive a larger portion of their investment income after taxes, providing them with more funds to meet their living expenses or other financial goals. One potential drawback of tax-efficient investing is the possibility of increased transaction costs. In some cases, implementing tax-efficient strategies may involve frequent trading or the purchase and sale of specific investments. These activities can result in higher transaction costs, which can offset some of the tax savings achieved through tax-efficient investing. Tax-efficient investing often requires a thorough understanding of complex tax laws and regulations. Investors must navigate a myriad of rules and requirements to effectively implement tax-efficient strategies, which can be time-consuming and challenging. This complexity can be particularly daunting for individual investors who may lack the expertise or resources to fully grasp these nuances. Identifying and selecting tax-efficient investments can be a challenging task for investors. Some investments may appear to be tax-efficient at first glance but may carry hidden tax implications or risks that could negate their benefits. This difficulty can make it challenging for investors to confidently implement tax-efficient strategies in their portfolios. While tax-advantaged accounts, such as IRAs and 401(k)s, can offer significant tax benefits, their availability may be limited for some investors. Contribution limits, income restrictions, and access to employer-sponsored plans can limit an investor's ability to take full advantage of these tax-efficient investment vehicles. Periodically reviewing the performance and tax implications of a tax-efficient investment portfolio is essential for maintaining its effectiveness. Investors should evaluate their investments based on their after-tax returns, as these provide a more accurate representation of their true performance. Rebalancing a portfolio to maintain the desired asset allocation is crucial for managing investment risk. However, rebalancing may create taxable events, such as capital gains. Investors should consider the tax implications of rebalancing and employ strategies like tax-loss harvesting to offset potential tax liabilities. Tax laws are subject to change, and staying informed about any updates is essential for optimizing tax efficiency. Investors should consult with a tax professional or financial advisor to ensure their investment strategies align with the current tax environment. Tax-efficient income investing is a valuable strategy for minimizing the impact of taxes on investment returns and optimizing overall portfolio performance. By considering factors such as investment time horizon, tax bracket, risk tolerance, and personal preferences, investors can develop strategies that align with their financial goals. Several strategies can enhance tax efficiency, including asset location, tax-loss harvesting, holding periods, timing of investment sales, municipal bonds, and maximizing contributions to retirement accounts. These strategies help minimize tax liabilities, take advantage of favorable tax rates, and generate tax-exempt income. Investors can also leverage tax-efficient investment vehicles such as index funds, ETFs, tax-managed mutual funds, and REITs to enhance tax efficiency and reduce taxable events. To maintain tax efficiency, regular monitoring and adjustments are crucial. Investors should review portfolio performance, consider tax implications, and periodically rebalance their portfolios. Staying updated with tax law changes is also important to ensure alignment with the current tax environment.What Is Tax-Efficient Income Investing?

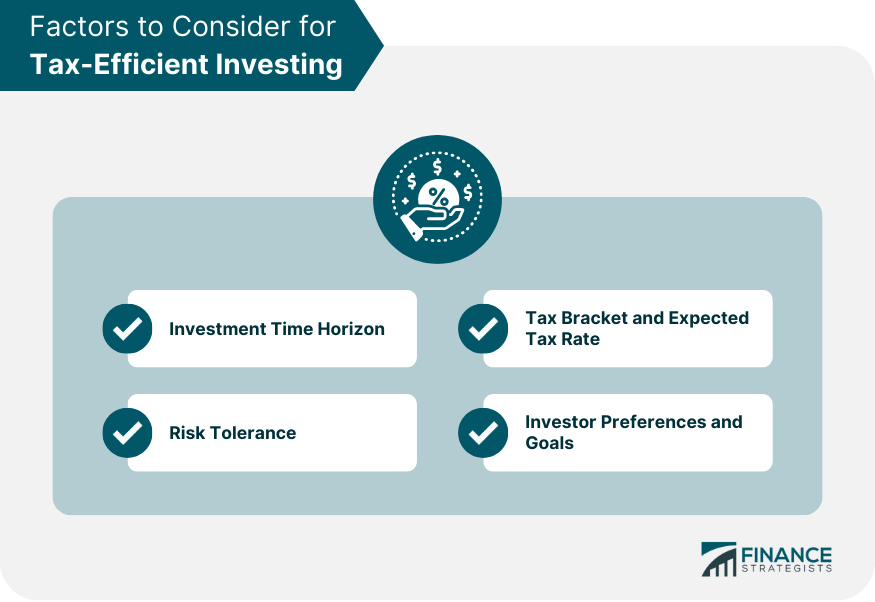

Factors to Consider for Tax-Efficient Investing

Investment Time Horizon

Tax Bracket and Expected Tax Rate

Risk Tolerance

Investor Preferences and Goals

Tax-Efficient Investment Strategies

Asset Location

Tax-Loss Harvesting

Holding Periods

Timing of Investment Sales

Municipal Bonds

Retirement Accounts

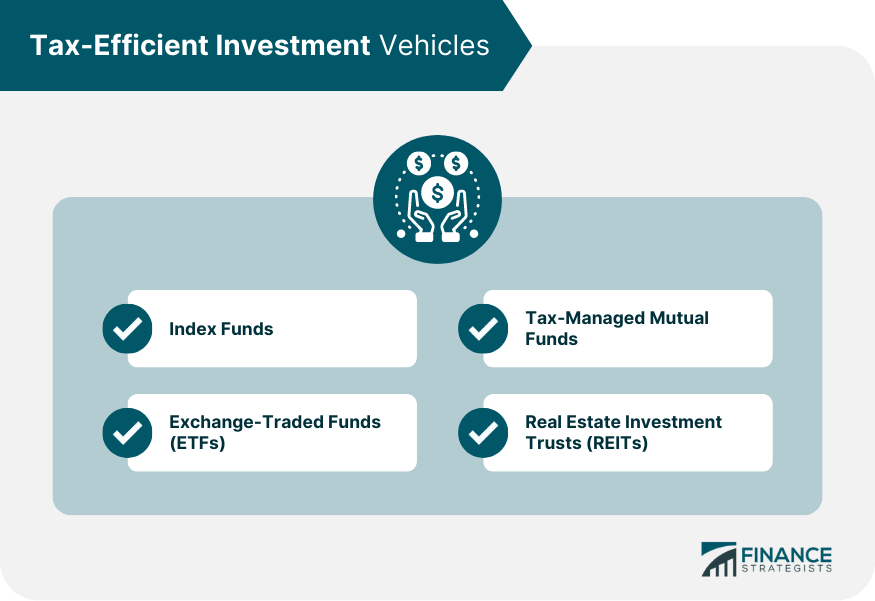

Tax-Efficient Investment Vehicles

Index Funds

Exchange-Traded Funds (ETFs)

Tax-Managed Mutual Funds

Real Estate Investment Trusts (REITs)

Types of Tax-Efficient Investment Income

Interest Income

Taxable Interest

Tax-Exempt Interest

Dividend Income

Qualified Dividends

Non-qualified Dividends

Capital Gains and Losses

Short-Term Capital Gains

Long-Term Capital Gains

Capital Losses

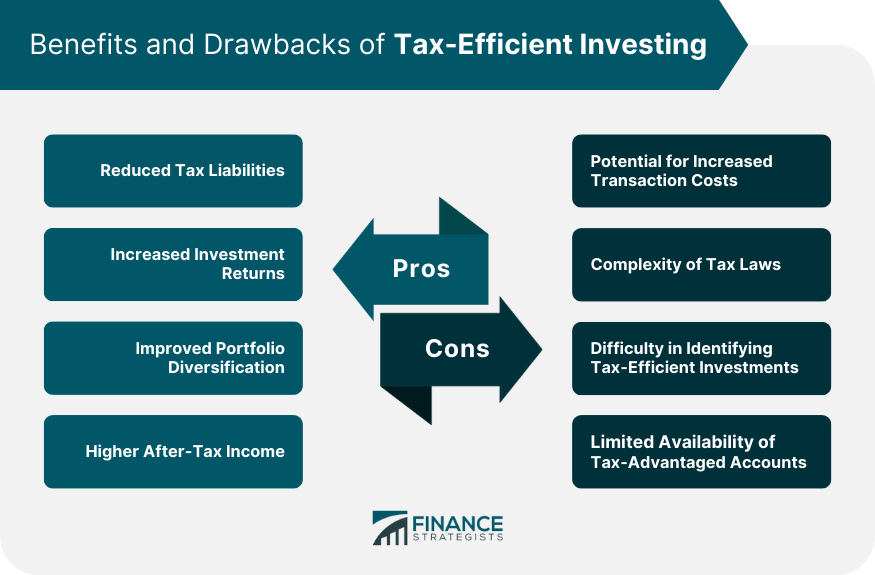

Benefits of Tax-Efficient Investing

Reduced Tax Liabilities

Increased Investment Returns

Improved Portfolio Diversification

Higher After-Tax Income

Drawbacks of Tax-Efficient Investing

Potential for Increased Transaction Costs

Complexity of Tax Laws

Difficulty in Identifying Tax-Efficient Investments

Limited Availability of Tax-Advantaged Accounts

Monitoring and Adjusting Tax-Efficient Portfolios

Regular Review of Portfolio Performance and Tax Implications

Rebalancing and Tax Considerations

Staying Up-To-Date With Tax Law Changes

Conclusion

Tax-Efficient Income Investing FAQs

Tax-efficient income investing involves selecting investment strategies that generate income while minimizing the tax impact on returns.

One way to make income investing more tax-efficient is by investing in tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s. Another way is to invest in municipal bonds, which are exempt from federal taxes.

Some tax-efficient income investments include municipal bonds, dividend-paying stocks, real estate investment trusts (REITs), and exchange-traded funds (ETFs) that focus on tax-efficient investing strategies.

The benefits of tax-efficient income investing include potentially higher after-tax returns, lower tax bills, and the ability to keep more of your investment gains.

Whether tax-efficient income investing is right for you depends on your individual financial situation and goals. Consulting with a financial advisor can help you determine the best investment strategies for your specific needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.