Tax bracket management is a financial planning strategy that involves managing your income and investments to reduce your tax liability. It is the process of optimizing your tax situation by making smart financial decisions that minimize the amount of tax you owe. Tax bracket management involves understanding how tax brackets work and using this knowledge to your advantage. It also involves taking advantage of tax deductions, credits, and other tax-saving strategies to minimize your tax burden. Tax bracket management is important because it can help you keep more of your hard-earned money. The tax system is designed to ensure that people who earn more pay a higher percentage of tax than those who earn less. However, there are ways to minimize your tax burden by making smart financial decisions. Tax bracket management can help you take advantage of these strategies and keep more of your money in your pocket. There are several strategies for effective tax bracket management, including income tax planning, investment planning, and business tax planning. Income tax planning involves managing your income and deductions to minimize your tax liability. There are several strategies you can use to reduce your taxable income and take advantage of deductions and credits: One strategy for effective income tax planning is to time your income. You can do this by delaying income until the next tax year or accelerating income into the current tax year. For example, you might delay a bonus until the following year to reduce your taxable income for the current year, or you might accelerate a bonus payment into the current year to take advantage of a lower tax rate. Tax deductions and credits can reduce your taxable income and lower your tax liability. Deductions are expenses that you can deduct from your income, such as charitable donations or mortgage interest. Credits are dollar-for-dollar reductions in your tax liability, such as the child tax credit or the earned income tax credit. Retirement planning can also be an effective income tax planning strategy. Contributions to retirement accounts such as 401(k)s and IRAs are tax-deductible, which can reduce your taxable income. In addition, the earnings on these accounts are tax-deferred until you withdraw them in retirement, when you may be in a lower tax bracket. Investment planning involves managing your investments to minimize your tax liability. There are several strategies you can use to reduce your tax burden on investments: Capital gains and losses can have a significant impact on your tax liability. If you sell an investment for more than you paid for it, you have a capital gain. If you sell an investment for less than you paid for it, you have a capital loss. You can use capital losses to offset capital gains, which can reduce your tax liability. Tax-efficient investment strategies can also help you minimize your tax liability. For example, investing in tax-free municipal bonds can generate tax-free income. Similarly, investing in exchange-traded funds (ETFs) that track indexes can reduce your tax liability by minimizing the amount of buying and selling within the fund. Diversification can also be an effective investment planning strategy. By diversifying your portfolio across different asset classes, you can reduce your risk and potentially increase your returns. In addition, investing in tax-advantaged accounts such as 401(k)s and IRAs can also help you minimize your tax liability. Business tax planning involves managing your business finances to minimize your tax liability. There are several strategies you can use to reduce your tax burden on your business: Choosing the right business entity can have a significant impact on your tax liability. For example, a sole proprietorship is taxed at the individual tax rate, while a corporation is taxed at the corporate tax rate. Choosing the right entity can help you minimize your tax liability. Accounting methods can also have an impact on your tax liability. For example, using the cash method of accounting can help you delay tax payments by recognizing income when you receive payment, rather than when you bill for it. Similarly, using the accrual method of accounting can help you accelerate deductions by recognizing expenses when you incur them, rather than when you pay for them. Finally, taking advantage of tax deductions and credits can help you minimize your tax liability. There are several deductions and credits available to businesses, such as the research and development credit and the small business health care tax credit. The advantages of tax bracket management include: Effective tax bracket management enables you to keep more of your money by reducing your tax liability. It involves making smart financial decisions, such as maximizing deductions and credits, to minimize the amount of tax you owe. One of the primary benefits of tax bracket management is that it can reduce your tax liability. By understanding how tax brackets work and making strategic financial decisions, you can minimize your taxable income and take advantage of tax deductions and credits to reduce your tax bill. By reducing your tax liability, tax bracket management can increase your overall wealth. This can be achieved by investing the savings in tax-advantaged accounts, such as 401(k)s and IRAs, which can generate tax-free or tax-deferred returns. Effective tax bracket management can also help you achieve your financial goals, such as saving for retirement, faster. By keeping more of your money and minimizing your tax liability, you can free up resources to invest in your future. Another benefit of tax bracket management is the ability to plan for future tax liabilities. By understanding how tax brackets work and how your income and deductions will affect your tax liability, you can make smart financial decisions to minimize your tax burden and avoid surprises at tax time. The disadvantages of tax bracket management include: Effective tax bracket management requires time and effort to manage your finances effectively. It involves staying up-to-date on changing tax laws, understanding how tax brackets work, and making strategic financial decisions. This can be time-consuming and may require the help of tax professionals, which can be costly. Tax bracket management involves navigating the complexity of the tax code, which can be challenging. Making mistakes can result in penalties or interest charges, which can offset the savings from effective tax bracket management. It is crucial to ensure that all financial decisions are well-informed and accurate. The tax code is complex, and tax laws can change frequently. This can make it difficult to keep up with the latest tax-saving opportunities and strategies. It is crucial to stay up-to-date on the latest tax laws and regulations to effectively manage your tax bracket. Tax bracket management requires long-term planning and may limit your flexibility in making financial decisions. Some tax-saving strategies may require you to hold onto investments or delay income, which can limit your ability to make other financial decisions. Tax bracket management may not be effective for those who earn lower incomes or have limited investment options. Lower-income earners may not have enough taxable income to take advantage of many tax-saving strategies. Similarly, those with limited investment options may not have many opportunities to reduce their taxable income. There are several tools and resources available to help with tax bracket management, including: Tax planning software can help you manage your income, deductions, and investments to minimize your tax liability. There are several tax planning software options available, including TurboTax, H&R Block, and TaxAct. Tax professionals, such as certified public accountants (CPAs), can provide expert advice on tax bracket management. They can help you navigate the complexity of the tax code and keep up with changing tax laws. They can also prepare and file your tax returns for you, saving you time and effort. The Internal Revenue Service (IRS) provides several resources to help with tax bracket management, including: The IRS Tax Withholding Estimator is a tool that helps individuals estimate their tax liability and determine how much tax they should have withheld from their paycheck. The tool takes into account factors such as income, deductions, and credits to provide an accurate estimate of your tax liability. It is recommended to use this tool at the beginning of the year and after any major life changes that may impact your tax liability. The IRS Free File program is a partnership between the IRS and several tax software companies that provides free tax preparation and filing services to eligible taxpayers. The program is available to individuals with an adjusted gross income of $79,000 or less. Eligible taxpayers can use the software to prepare and file their federal tax returns for free. The IRS Taxpayer Advocate Service is a program that provides assistance to taxpayers who are experiencing financial hardship or are having difficulty resolving a tax issue with the IRS. The service is free and confidential, and it is available to individuals and businesses that meet certain criteria. The service can provide assistance with issues such as collection actions, audit appeals, and taxpayer rights. These resources can help you manage your income, deductions, and investments to minimize your tax liability. Tax bracket management is a financial planning strategy that aims to minimize tax liability by making smart financial decisions and utilizing deductions, credits, and tax-saving strategies. It offers several advantages, including keeping more of your hard-earned money, reducing tax liability, increasing overall wealth, enabling savings for retirement or financial goals, and planning for future tax liabilities. However, tax bracket management has its challenges, such as the time and effort required, the risk of making mistakes, the complexity of the tax code and changing laws, limited flexibility, and its ineffectiveness for lower-income earners or those with limited investment options. Utilizing tools and resources like tax planning software, tax professionals, and IRS resources can aid in effective tax bracket management.Definition of Tax Bracket Management

Strategies for Effective Tax Bracket Management

Income Tax Planning

Investment Planning

Business Tax Planning

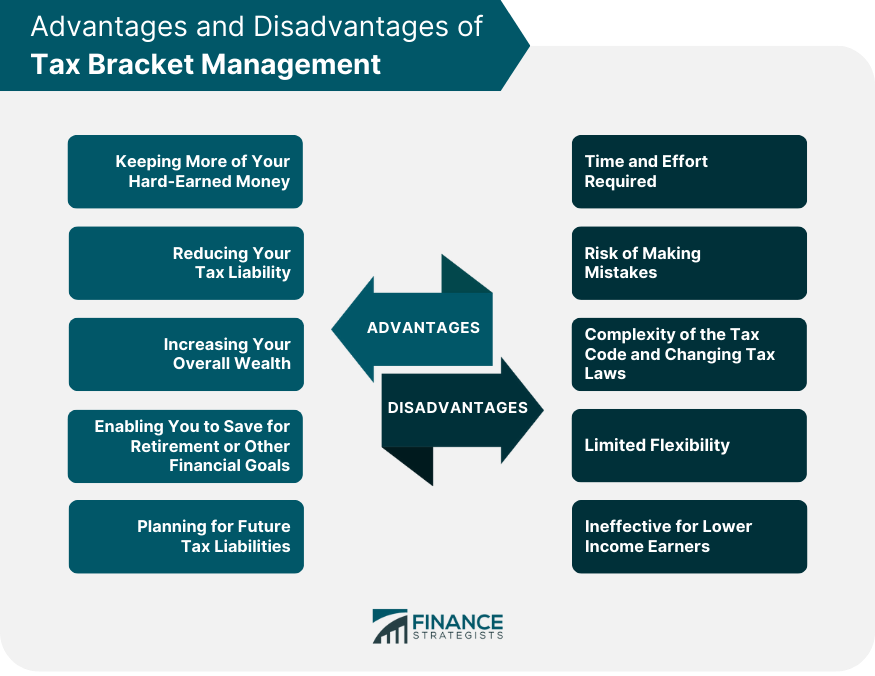

Advantages of Tax Bracket Management

Keeping More of Your Hard-Earned Money

Reducing Your Tax Liability

Increasing Your Overall Wealth

Enabling You to Save for Retirement or Other Financial Goals

Planning for Future Tax Liabilities

Disadvantages of Tax Bracket Management

Time and Effort Required

Risk of Making Mistakes

Complexity of the Tax Code and Changing Tax Laws

Limited Flexibility

Ineffective for Lower Income Earners

Tools and Resources for Tax Bracket Management

Tax Planning Software

Tax Professionals

IRS Resources

IRS Tax Withholding Estimator

IRS Free File

IRS Taxpayer Advocate Service

Final Thoughts

Tax Bracket Management FAQs

Tax bracket management is the process of effectively managing your income and investments to minimize the amount of taxes you owe.

The advantages of Tax Bracket Management include keeping more of your hard-earned money, reducing your tax liability, increasing your overall wealth, enabling you to save for retirement or other financial goals, and planning for future tax liabilities.

The disadvantages of Tax Bracket Management include the time and effort required, the risk of making mistakes, the complexity of the tax code and changing tax laws, limited flexibility in financial decisions, and its ineffectiveness for lower-income earners or those with limited investment options.

Effective tax bracket management strategies include income tax planning, investment planning, and business tax planning.

Tax planning software, tax professionals, and IRS resources can all be useful tools and resources for effective tax bracket management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.