Social Security benefits are payments made by the Social Security Administration (SSA) to eligible individuals, such as retirees, disabled persons, and their families. These benefits are designed to provide a basic level of income to help support people in their retirement years or in case of disability or death. The purpose of Social Security benefit taxation is to help fund the Social Security system. Social Security is primarily funded by payroll taxes, which are taxes paid by employees and employers on their earnings. However, Social Security benefit taxation is an additional source of revenue that helps to keep the system financially solvent. Social Security benefits may be subject to taxation if your income exceeds certain thresholds. These thresholds are based on your combined income, which is your adjusted gross income (AGI) plus any tax-exempt interest and half of your Social Security benefits. To calculate your taxable Social Security benefits, you will need to determine your provisional income, which is your AGI plus any tax-exempt interest and half of your Social Security benefits. If your provisional income exceeds the threshold for your filing status, a portion of your Social Security benefits will be taxable. The exact amount of your taxable Social Security benefits will depend on your filing status and income. The tax rate on Social Security benefits is based on your marginal tax rate, which is the highest tax rate that applies to your income. Certain types of income are excluded from your provisional income when calculating your taxable Social Security benefits. These exclusions include tax-exempt interest, veterans' benefits, and Supplemental Security Income (SSI) payments. If you receive income from these sources, it will not be counted towards your provisional income, which may reduce the amount of your Social Security benefits that are subject to taxation. If you have deductible expenses, such as medical expenses, that exceed a certain percentage of your AGI, you may be able to deduct them from your income when calculating your taxable Social Security benefits. The percentage of your AGI that you can deduct depends on your age and is subject to annual adjustments. Keep in mind that the standard deduction may be more beneficial than itemizing deductions in some cases, so it's important to consult with a tax professional to determine the best approach for your situation. Taxing Social Security benefits helps generate revenue to sustain and support the Social Security program. This funding is essential to ensure the stability and longevity of the program, providing financial security to retired and disabled individuals. Social Security benefit taxation follows a progressive tax system, where higher-income individuals pay a higher tax rate on their benefits. This helps distribute the tax burden more equitably and promotes fairness in the taxation system. Taxing Social Security benefits helps offset the costs associated with providing Social Security benefits in the first place. By collecting taxes on these benefits, the government can recoup some of the funds paid out, reducing the strain on other areas of the budget. Social Security benefits are meant to provide a safety net for retirees and disabled individuals. Taxing these benefits primarily affects higher-income recipients, who may have additional sources of income beyond Social Security. This targeted approach ensures that those who are more financially secure contribute a portion of their benefits back into the system. Social Security benefits may be a critical source of income for many retirees and disabled individuals. Taxing these benefits reduces the amount of income that recipients can use to cover living expenses and other costs, potentially leading to financial strain. Taxing Social Security benefits can be seen as unfair treatment of recipients who have paid into the system for many years. These individuals may feel that they are being penalized for accessing benefits they have earned, even if they have additional sources of income. The taxation of Social Security benefits can be confusing and difficult to understand, with many recipients unsure of how their benefits are being taxed and what they can do to minimize their tax liability. This lack of transparency can lead to frustration and anxiety, especially for those who are already struggling financially. Calculating the amount of tax owed on Social Security benefits can be complex and time-consuming, requiring recipients to navigate a complex web of income thresholds and tax rates. This can be particularly challenging for those who have multiple sources of income or whose income varies from year to year. One strategy to minimize Social Security benefit taxation is to time your retirement benefits to minimize your provisional income. This can result in a higher overall benefit amount and a lower tax liability if you are able to keep your provisional income below the threshold. Another strategy is to adjust your other sources of income to keep your provisional income below the threshold. This may include reducing withdrawals from retirement accounts, such as traditional IRAs or 401(k)s, or converting some of your traditional retirement accounts to Roth accounts, which are not subject to required minimum distributions or taxation. Investment strategies, such as tax-loss harvesting and tax-efficient asset allocation, can also help to minimize your tax liability. Tax-loss harvesting involves selling securities that have decreased in value to offset gains and reduce your overall tax liability. Tax-efficient asset allocation involves investing in tax-efficient vehicles, such as exchange-traded funds (ETFs) or municipal bonds, to reduce your tax liability. Social Security Benefit Taxation is a mechanism designed to fund the Social Security program by taxing eligible individuals' benefits. It follows a progressive tax system, where higher-income individuals pay a higher tax rate on their benefits. Taxing Social Security benefits helps offset government expenditures and ensures that higher-income recipients contribute a portion of their benefits back into the system. However, there are disadvantages to this taxation, including a reduction in income for recipients and perceptions of unfair treatment. The complexity of tax calculations and lack of transparency further complicate matters. Strategies to minimize Social Security Benefit Taxation include timing retirement benefits, adjusting other sources of income, and implementing tax-efficient investment strategies. By understanding the implications and exploring these strategies, individuals can make informed decisions to optimize their Social Security benefits and manage their tax liability effectively.What Is Social Security Benefit Taxation?

How Does Social Security Benefit Taxation Work

Thresholds for Taxation

Calculation of Taxable Social Security Benefits

Exclusions and Deductions From Taxable Social Security Benefits

Exclusions From Taxable Social Security Benefits

Deductions for Social Security Benefits

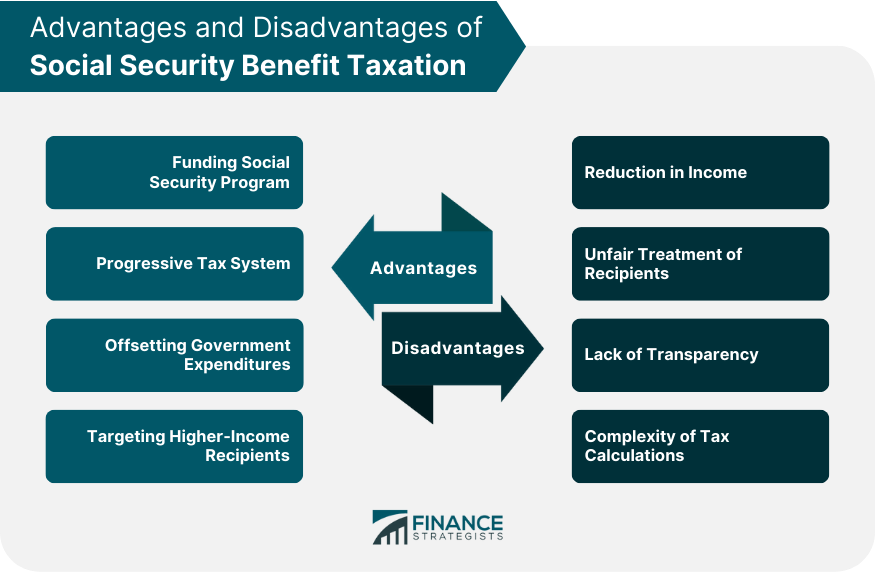

Advantages of Social Security Benefit Taxation

Funding Social Security Program

Progressive Tax System

Offsetting Government Expenditures

Targeting Higher-Income Recipients

Disadvantages of Social Security Benefit Taxation

Reduction in Income

Unfair Treatment of Recipients

Lack of Transparency

Complexity of Tax Calculations

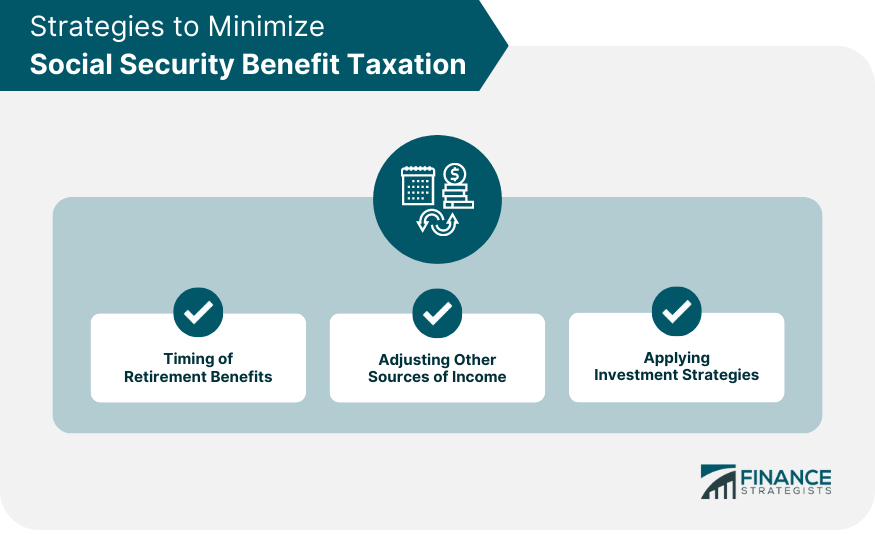

Strategies to Minimize Social Security Benefit Taxation

Timing of Retirement Benefits

Adjusting Other Sources of Income

Applying Investment Strategies

Bottom Line

Social Security Benefit Taxation FAQs

Social Security benefit taxation is the tax on a portion of Social Security benefits received by higher-income individuals.

Social Security benefit taxation is determined by calculating the individual's combined income, which includes adjusted gross income, tax-exempt interest, and half of their Social Security benefits.

No, some low-income individuals or those who rely primarily on Social Security for income may not have to pay taxes on their benefits.

There are several strategies to minimize Social Security benefit taxation, such as timing of retirement benefits and adjusting other sources of income.

No, not all states tax Social Security benefits. However, the taxability of benefits may vary depending on the state and the recipient's income level.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.