Capital Gains Tax is a levy imposed on the profit made from selling an asset that has increased in value. Such assets encompass investments like stocks, bonds, and property, amongst others. This tax is determined by the difference between the sale price and the original purchase price. The rate of this tax varies according to the type of asset, the income bracket of the owner, and the duration the asset was held. Assets held for less than a year yield short-term capital gains, which are typically taxed as per the individual's regular income tax rate. Conversely, assets held longer than a year generate long-term capital gains, usually taxed at reduced rates to promote lasting investments. Certain deductions, exclusions, and tax breaks can influence the final tax amount. The specific rules of capital gains tax can differ worldwide due to variations in tax laws and regulations.

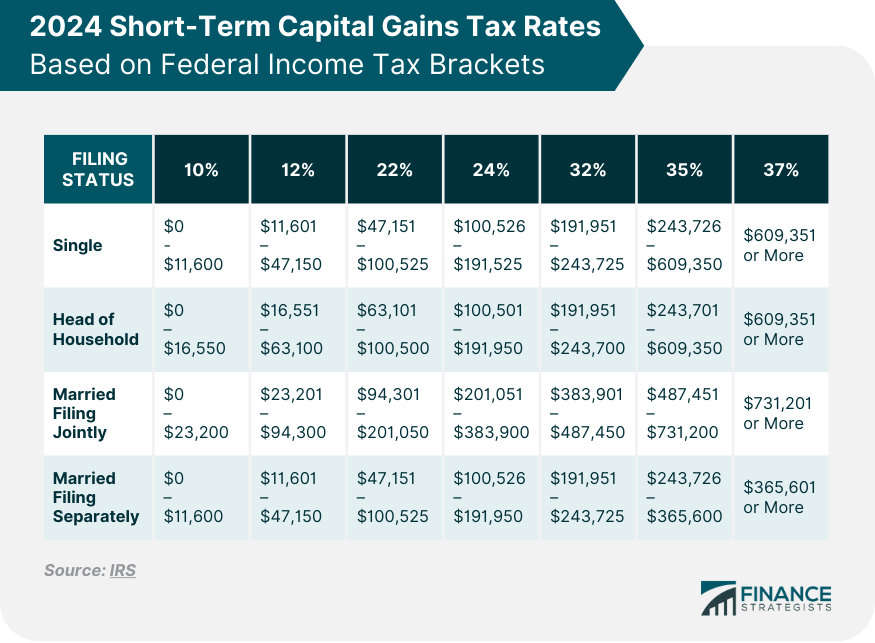

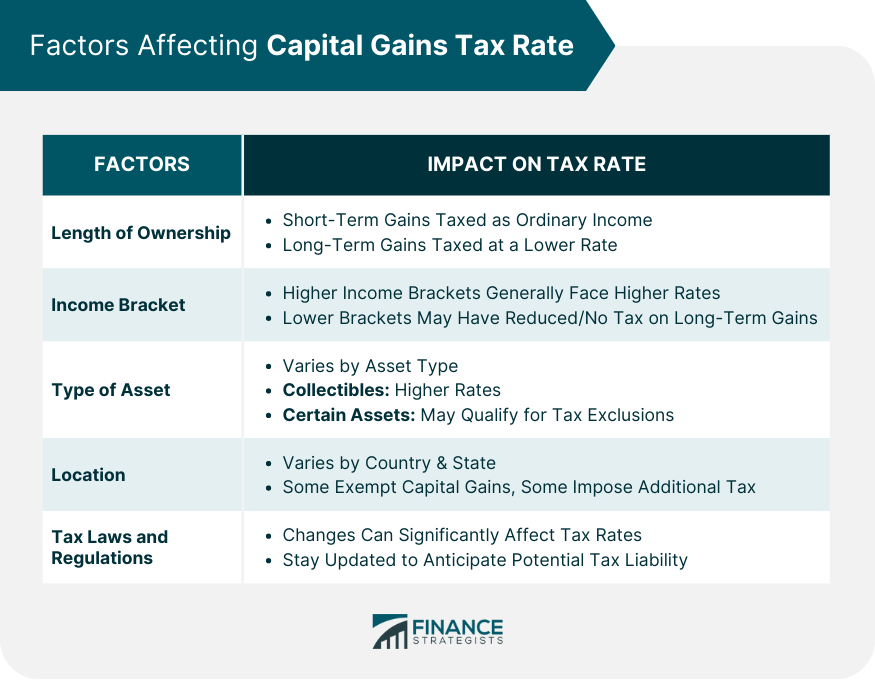

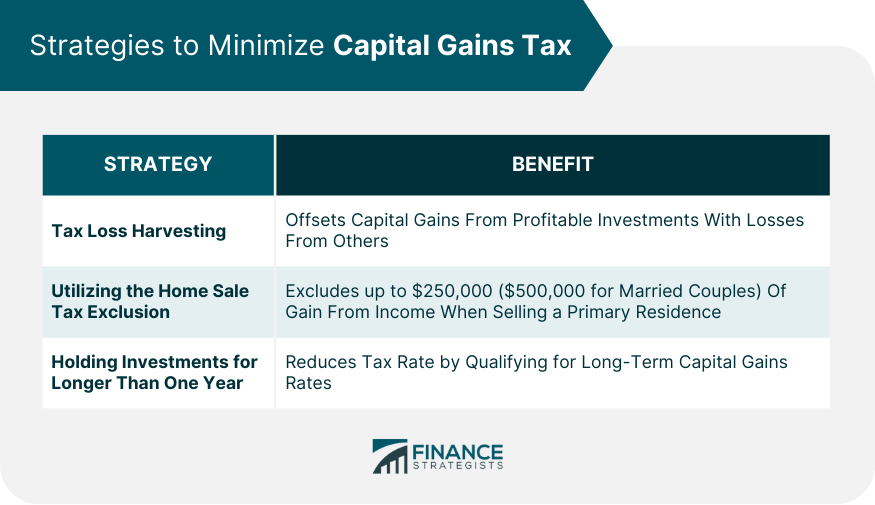

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. In 2022, I worked with a client facing a substantial capital gains tax from the sale of their decade-old family business. With careful planning, leveraging tax strategies, and using specific tax allowances, we successfully minimized their tax burden. When you're ready to sell your business or property, let's work together so you do it in the most tax-efficient way possible. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Short-term capital gains refer to the profits realized from the sale of an asset held for one year or less. They are typically taxed at ordinary income tax rates as they're considered regular income for the duration they were held. When an asset is sold within a year of its purchase, the profit generated is generally taxed as though it were part of an individual's wages or salary. This means these gains are combined with your standard earnings or ordinary income when filing a tax return. Similarly, dividends, which represent the profit derived from an asset, follow the same taxation rules even though they do not qualify as capital gains. In the U.S., these dividends are subjected to regular income tax for taxpayers who fall in the 15% tax bracket or higher. The taxation system takes a different approach to long-term capital gains. Long-term capital gains are the profits from the sale of an asset held for more than one year. These gains are generally taxed at a lower rate than ordinary income to encourage long-term investment. In such cases, the tax due depends on a rate schedule that corresponds to the taxpayer's taxable income for the given year. These rates are routinely adjusted for inflation on a yearly basis. How long you've held an asset is a significant factor in determining your capital gains tax rate. If you've owned the asset for one year or less before selling it, any profit you make is considered a short-term capital gain, which is taxed as ordinary income. However, if you've owned the asset for more than a year before selling, the profit is considered a long-term capital gain, and it's taxed at a lower rate. Your income level also influences the capital gains tax rate. In the United States, for example, taxpayers in the highest income bracket are subject to a 20% long-term capital gains tax rate, while those in the middle-income brackets are subject to a 15% rate, and those in the lowest income bracket may not owe any long-term capital gains tax at all. Different types of assets can also have different capital gains tax rates. For example, collectibles like art and precious metals have a higher long-term capital gains tax rate compared to most other types of assets. Also, small business stock and certain real estate may qualify for partial or total exclusion from capital gains tax under specific conditions. The state and country in which you reside can also affect your capital gains tax rate. Some countries, such as Singapore and Switzerland, don't tax capital gains at all. On the other hand, some states in the U.S. impose their own capital gains tax in addition to the federal tax. The tax laws and regulations that are in place during the year you sell your asset can also significantly affect your capital gains tax rate. Lawmakers often adjust tax rates and rules, sometimes retroactively, in response to economic conditions, policy goals, or budgetary needs. Therefore, staying up-to-date with the latest tax laws and regulations can help you better anticipate your potential capital gains tax liability. If you're single and your taxable income (including your capital gain) is $60,000 in 2024. Let's say $20,000 of this is a long-term capital gain from the sale of stocks. Since $60,000 falls between $47,026 and $518,900, your long-term capital gain would be taxed at 15%. So, the tax on your capital gain would be 15% of your $20,000, which is $3,000. If you're filing as Head of Household and your total taxable income is $530,000 in 2024, with $100,000 of this being a long-term capital gain from the sale of real estate. Your income falls into the 20% category for long-term capital gains. Thus, the capital gains tax would be 20% of $100,000, which is $20,000. If you're married and filing jointly, and your combined taxable income is $120,000 in 2024, with $40,000 being a long-term capital gain. This falls into the 15% tax bracket, so the tax on the capital gain would be 15% of $40,000, which is $6,000. If you're married, filing separately, and your taxable income is $300,000 with $50,000 being a long-term capital gain. Your capital gain falls into the 20% tax bracket, so the tax on the capital gain would be 20% of $50,000, which is $10,000. One common strategy to reduce your capital gains tax is tax loss harvesting. This strategy involves selling investments that have declined in value to offset the capital gains from profitable investments. The sold investments can then be replaced with similar ones to maintain the desired asset allocation in your portfolio. It's important to be cautious about the "wash-sale" rule, which disallows claiming a loss if you purchase the same or substantially identical securities within 30 days before or after the sale. If you're selling your primary residence, you might be able to exclude up to $250,000 of gain (or $500,000 for married couples filing jointly) from your income under the home sale tax exclusion. To qualify, you must have owned the home and lived in it as your main home for at least two out of the five years before the sale. This exclusion can significantly reduce your capital gains tax. As previously mentioned, holding onto your investments for more than one year can significantly lower your capital gains tax. By doing so, your gains will be considered long-term and will be subject to a lower tax rate. This strategy is especially beneficial for those in higher income brackets. Understanding the Capital Gains Tax and its implications is essential for anyone involved in investments, property ownership, or other assets that might appreciate over time. In 202, the tax rates have been structured in a manner to reward long-term investments, with lower rates applied to those assets held for more than a year. The rates are stratified according to taxable income, influencing the final tax liability. Various factors like the length of ownership, income bracket, type of asset, location, and current tax laws and regulations play pivotal roles in determining the final tax amount. Strategies like tax loss harvesting, utilizing the home sale tax exclusion, and holding investments for longer periods can help minimize your tax liabilities. It would be beneficial to consider engaging with professional tax planning services to make the most of your assets and investments.Overview of Capital Gains Tax

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Capital Gains Tax Rate 2024

Short-Term Capital Gains Tax Rate 2024

Long-Term Capital Gains Tax Rate 2024

Factors Affecting Capital Gains Tax Rate

Length of Ownership

Income Bracket

Type of Asset

Location

Tax Laws and Regulations

Examples of Long-Term Capital Gains Tax Calculations

Single Filer

Head of Household

Married Filing Jointly

Married Filing Separately

Strategies to Minimize Capital Gains Tax

Tax Loss Harvesting

Utilizing the Home Sale Tax Exclusion

Holding Investments for Longer Than One Year

Bottom Line

Capital Gains Tax Rate FAQs

For a single filer in 2024, the capital gains tax rates are 0% for up to $47,025, 15% for $47,026 to $518,900, and 20% for amounts over $518,900.

In the U.S., your income bracket directly affects the capital gains tax rate. In 2024, the highest income bracket is subject to a 20% long-term capital gains tax rate, the middle-income brackets have a 15% rate, while the lowest income bracket may not owe any long-term capital gains tax at all.

Yes, different types of assets can have different capital gains tax rates in 2024. For instance, collectibles have a higher long-term capital gains tax rate compared to most other types of assets, while small business stock and certain real estate may qualify for partial or total exclusion from capital gains tax under specific conditions.

Some strategies to minimize capital gains tax in 2024 include tax loss harvesting, utilizing the home sale tax exclusion, and holding investments for longer than one year to benefit from lower long-term capital gains tax rates.

Short-term capital gains refer to profits from assets held for one year or less, taxed as ordinary income. Long-term capital gains, however, refer to profits from assets held for more than a year and are usually taxed at reduced rates to encourage long-term investments in 2024.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.