Retirement is a phase of life that typically commences once an individual stops working on a full-time basis. This stage generally occurs later in life, often after reaching a certain age or after fulfilling certain tenure criteria at work. Retirement is usually associated with the receipt of income from sources such as pensions, Social Security, savings, and investments. It is seen as a transition from active work life to a period of rest, recreation, or engagement in personally fulfilling activities. While traditionally, retirement has been associated with ceasing all forms of work, modern definitions are becoming more flexible, with many retirees engaging in part-time work, volunteering, or even starting new businesses. Earned income refers to the money that an individual receives in exchange for work or services provided. This includes wages, salaries, tips, and other taxable employee pay. It also encompasses net earnings from self-employment. The answer largely depends on the source of the retirement income. As a general rule, funds derived from pensions, Social Security benefits, and retirement account distributions are not classified as earned income. This is because these income sources are not a direct result of current work activities. However, it's important to note that if a retiree works part-time or has self-employment income, that portion of their income could be considered earned. While retirement in itself does not equate to earned income, retirees may still have earned income from continued employment or self-employment efforts. Retirement income and earned income are distinct categories of income. The primary difference between the two lies in their source. Earned income is directly linked to work activities, such as salaries from a current job or profits from a business you're actively involved in. In contrast, retirement income typically originates from benefits that accrue due to past employment, such as pensions or Social Security benefits. Additionally, retirement income and earned income often have different tax implications. Earned income is subject to Social Security and Medicare taxes. Retirement income, like Social Security benefits and pension payments, is typically exempt from these taxes. However, portions of these retirement benefits may still be subject to income tax. A pension is a type of retirement plan where an employer contributes funds to a pool of savings set aside for an employee's future retirement. Pension distributions, usually received monthly, are a common source of retirement income for many individuals. Social Security is a federal program in the United States that provides benefits to retirees based on their earnings history. The amount received depends on the income earned during the recipient's working life, the age at retirement, and the number of years worked. Investments such as stocks, bonds, mutual funds, and real estate can generate income for retirees. This income can come in various forms, including dividends, interest, rent, and capital gains. Other potential sources of retirement income include annuities, retirement savings accounts like 401(k)s and IRAs, rental income, and part-time work. According to the Internal Revenue Service (IRS), earned income includes all the taxable income and wages you get from working or from certain disability payments. This includes income from employment and net earnings from self-employment, but excludes things like interest and dividends, retirement income, social security, unemployment benefits, alimony, and child support. Understanding the IRS's definition of earned income is essential as it not only impacts tax liability but also eligibility for certain tax credits, such as the Earned Income Tax Credit (EITC). Social Security benefits, one of the main income sources for many retirees, are not considered earned income under IRS guidelines. These benefits, while taxable in some instances, do not originate directly from current work activity. Similarly, pension payments are not classified as earned income. These payments represent benefits accumulated from past work and do not directly correlate with current employment or self-employment activities. Retirees who engage in part-time work or self-employment generate income that is classified as earned income. This is true regardless of the retiree's receipt of other retirement income like Social Security benefits or pensions. It's important for retirees to remember that this type of income may affect the taxability of their Social Security benefits and may contribute to their eligibility for certain tax credits. The IRS employs specific criteria to determine if an income source can be classified as earned income. Essentially, earned income must be either wages you receive from an employer or net earnings from self-employment activities. With retirement income, the deciding factor often lies in whether the income is the result of current work or past employment. If a retiree is still working, whether in a part-time capacity or through self-employment, this income is considered earned income. For example, if a retiree starts a consulting business or works part-time at a local store, the income from these activities is considered earned income. While Social Security benefits aren't considered earned income, they may still be taxable, depending on your total income. For individuals with substantial income from other sources (including wages, self-employment, interest, dividends, and other taxable income), a portion of their Social Security benefits may be subject to federal income tax. The tax treatment of pension income can be complex and varies depending on the type of pension plan and the manner in which the retiree made contributions to the plan. Some retirees may find that a portion of their pension income is tax-free, while others may owe taxes on the full amount. Income from part-time work during retirement is subject to the same taxes as income from employment before retirement. This means that part-time income is generally subject to federal and state income taxes, as well as Social Security and Medicare taxes. Retirement income such as Social Security benefits, pension payments, and retirement account distributions are not considered earned income. However, income from part-time work or self-employment during retirement is considered earned income. The primary distinction between retirement income and earned income lies in their sources. While retirement income comes from benefits built up from past employment, earned income stems from current work activity. Social Security benefits may be subject to federal income tax if a taxpayer's combined income exceeds a certain threshold. Pension income is generally taxable, although the portion that represents a return of the taxpayer's contributions may be tax-free. Any part-time employment income earned during retirement is considered earned income and is subject to income tax.Overview of Retirement and Earned Income

Does Retirement Count as Earned Income?

Differentiating Retirement Income From Earned Income

Common Sources of Retirement Income

Pensions

Social Security

Investments

Other Sources

IRS Definition of Earned Income

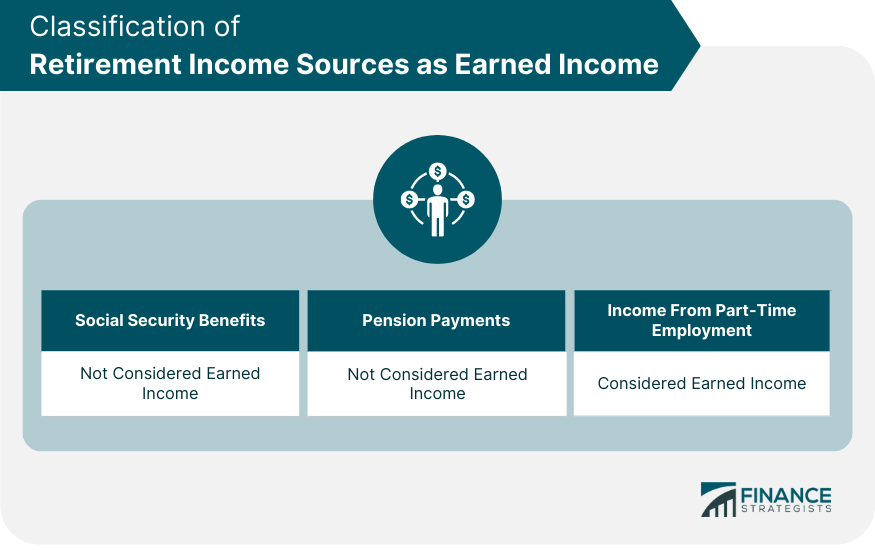

Retirement Income Sources and Their Classification as Earned Income

Social Security Benefits

Pension Payments

Income From Part-Time Employment During Retirement

IRS Guidelines on Classifying Retirement Income as Earned Income

Tax Treatment of Retirement Income

Taxable Portion of Social Security Benefits

Taxability of Pension Income

Tax Considerations for Part-Time Employment Income

Conclusion

Does Retirement Count as Earned Income? FAQs

Generally, no. Retirement income, such as Social Security benefits, pension payments, and retirement account distributions, are not considered earned income. However, income from part-time work or self-employment during retirement is considered earned income.

The primary difference between these two types of income is their source. Earned income is money that you make by working, whereas retirement income comes from benefits accrued from past employment.

No, the IRS typically does not classify retirement income as earned income. However, income that a retiree earns from current employment or self-employment is considered earned income.

No, Social Security benefits are not considered earned income.

Yes, part-time work during retirement is considered earned income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.