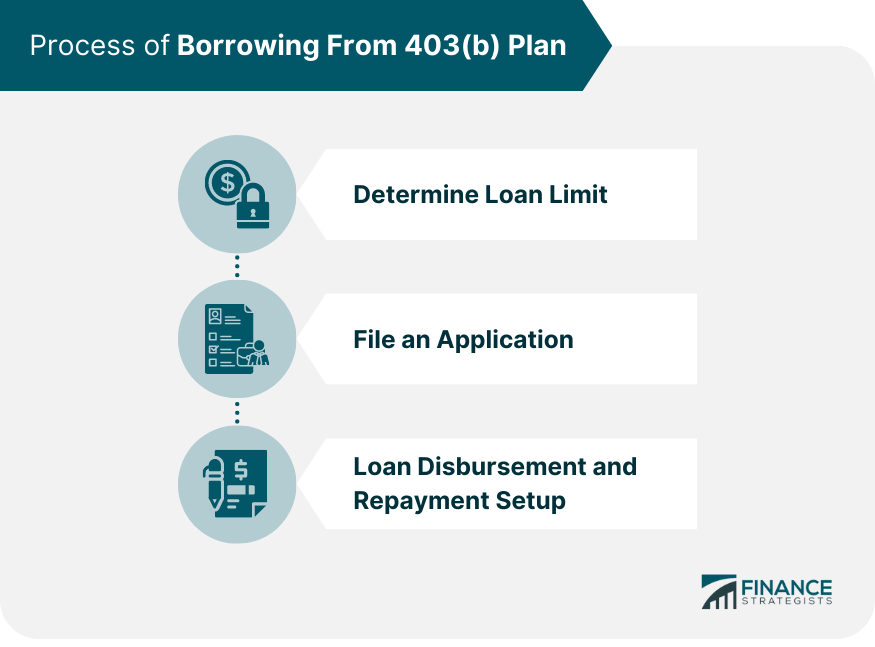

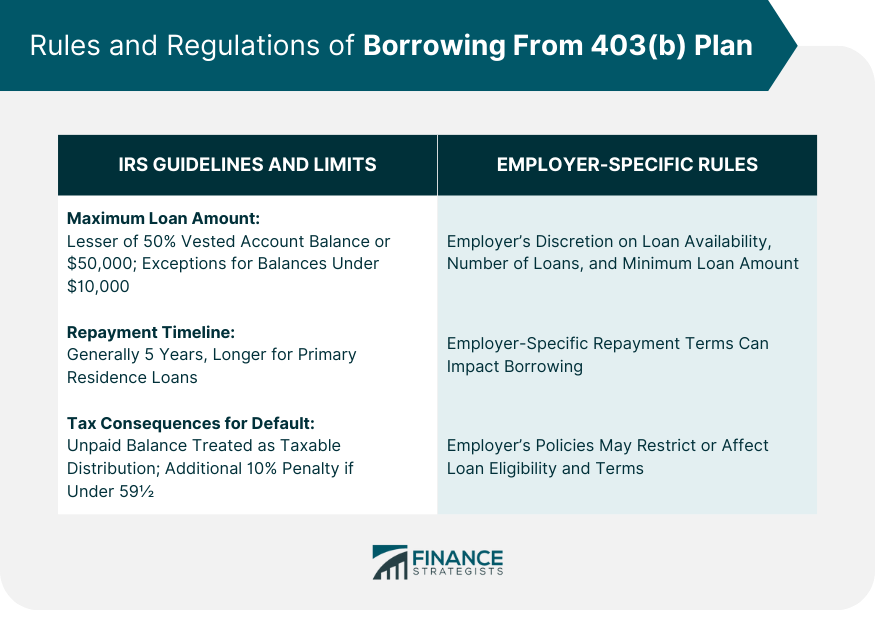

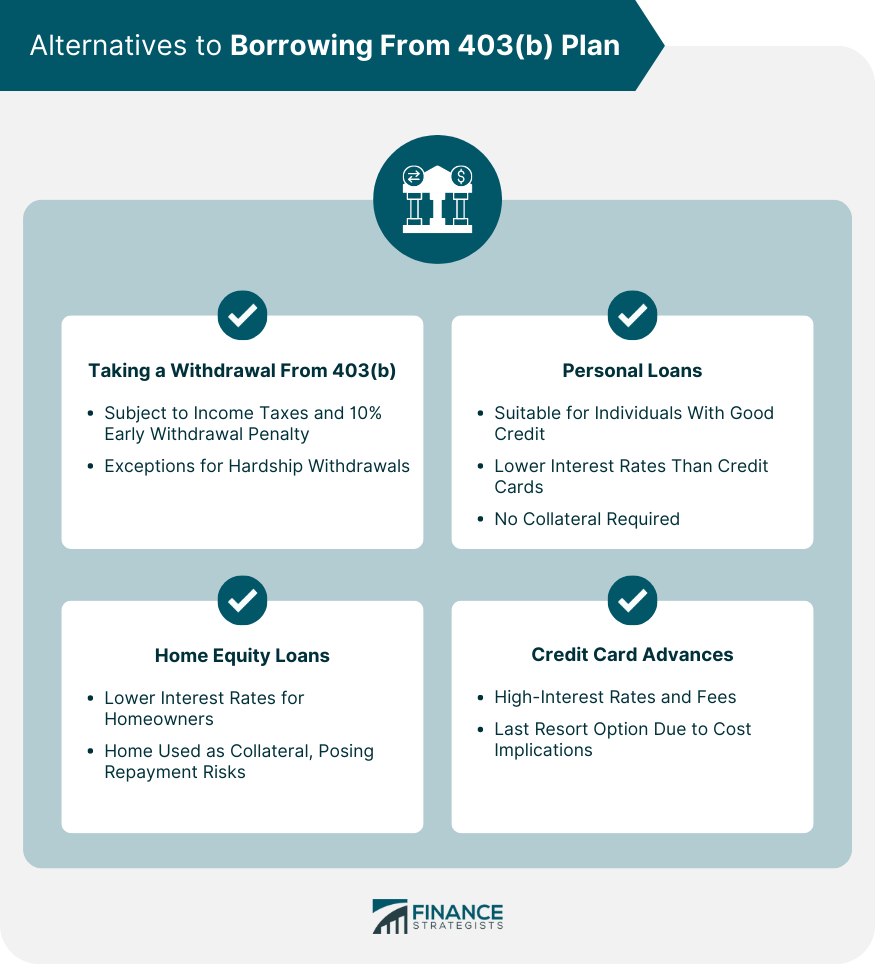

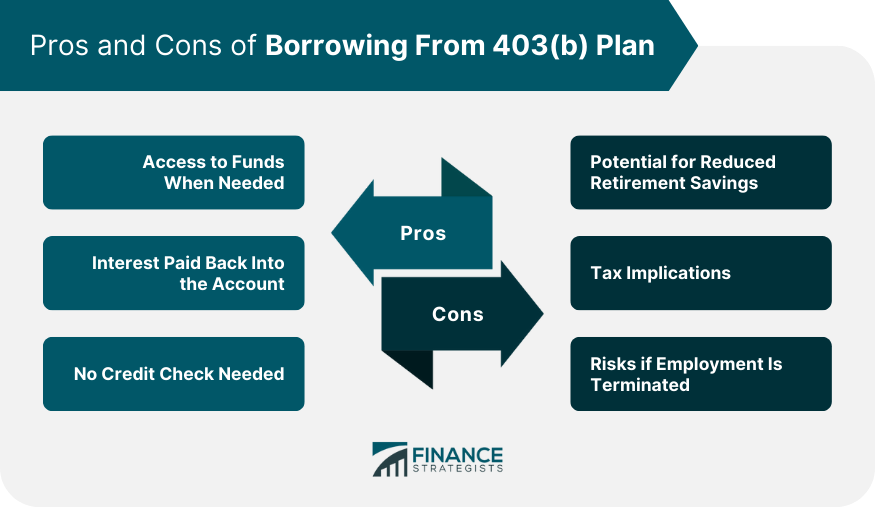

Borrowing from a 403(b) plan means taking a loan against the funds you have contributed to your 403(b) retirement savings account. T This option is typically available to employees of public schools and certain tax-exempt organizations who participate in these plans. The loan must be repaid with interest over a specified period, typically five years, though a longer period may be allowed for home purchases. The maximum loan amount is generally the lesser of 50% of your vested account balance or $50,000. Borrowing from your 403(b) is a way to access your funds without incurring taxes or penalties, provided the loan is repaid according to the agreed terms. However, it's essential to consider the potential impact on your long-term retirement savings before deciding to borrow. Obtaining a loan from your 403(b) plan involves understanding your loan limit, filing an application, and setting up a repayment plan. Typically, the IRS permits loans of up to 50% of your vested account balance, or $50,000, whichever is less. However, if your balance is less than $10,000, you may be able to borrow up to that amount. Once you've determined how much you can borrow, the next step involves contacting your plan administrator and filling out a loan application. Depending on your plan's rules, the process may be done online or require paper forms. After approval, the funds are disbursed, often in a lump sum. You'll then have to set up a repayment plan. Payments are typically taken directly from your paycheck on an after-tax basis. The IRS sets clear guidelines and limits on 403(b) loans, including maximum loan amount, repayment timeline, and tax consequences for default. As mentioned, the maximum loan amount is typically the lesser of 50% of your vested account balance or $50,000. However, exceptions may apply if your balance is less than $10,000. The IRS generally requires that you repay the loan within five years, though a longer repayment period may be allowed for a loan used to purchase a primary residence. If you fail to repay the loan as agreed, the IRS treats the unpaid balance as a taxable distribution. If you're under 59½, an additional 10% early withdrawal penalty may also apply. In addition to the IRS rules, your employer may have specific 403(b) loan policies that can impact your ability to borrow. Each employer can set its own rules for 403(b) loans, including whether to allow loans, how many loans you can have at once, and the minimum loan amount. Make sure to understand these rules before borrowing. Your employer's rules can significantly affect your ability to borrow from your 403(b). For instance, some employers may not allow loans at all, while others might have stricter repayment terms. Before considering a loan from your 403(b) plan, you might think about other options, like taking a withdrawal. Withdrawals before age 59½ are subject to income taxes and a 10% early withdrawal penalty, significantly reducing the amount available to you. The IRS allows penalty-free withdrawals for certain immediate and heavy financial needs, often referred to as hardship withdrawals. These can include medical expenses, education tuition, or costs related to purchasing a primary residence. Other sources of funds might be more suitable for your situation. Some options include personal loans, home equity loans, and credit card advances. Personal loans can be a good alternative, especially for those with good credit. They typically have lower interest rates than credit cards and don't require collateral. If you're a homeowner, a home equity loan or line of credit may provide lower interest rates. However, your home is used as collateral, which can be risky if you have trouble repaying the loan. While credit card advances can be quick, they often come with high-interest rates and fees. Therefore, they are usually considered a last resort. Borrowing from a 403(b) plan can provide financial relief when needed, with interest paid back into your own account and without needing a credit check. In case of an emergency or major expense, a 403(b) loan can provide funds quickly, typically within a week of applying. The interest you pay on the loan goes back into your own 403(b) account, not to a bank or other lender. Unlike many other types of loans, borrowing from your 403(b) doesn't require a credit check. This can make it a good option for those with poor credit. Despite its benefits, borrowing from your 403(b) plan can lead to reduced retirement savings, has tax implications, and poses risks if your employment is terminated. Taking a loan can reduce your retirement savings, particularly if you decrease or stop contributions during the repayment period. Although not taxed at disbursement, the loan repayments are made with after-tax dollars. Also, if you default on the loan, it will be treated as a distribution and become subject to income tax and possibly early withdrawal penalties. If your employment is terminated while you have a loan outstanding, you may need to repay the full balance quickly, often within 60 days, or face taxes and penalties. Once you've taken a 403(b) loan, developing a strategy for repayment is essential. You'll need to consider the impact on your retirement savings and manage repayment efficiently. Repaying your 403(b) loan quickly can help minimize the impact on your retirement savings. However, the more money you dedicate to repaying the loan, the less you might be able to contribute to your plan, potentially slowing the growth of your retirement savings. One strategy is to maintain your regular 403(b) contributions while repaying the loan. This can be challenging but will help ensure your retirement savings continue to grow. Another is to tighten your budget or seek additional income to cover loan payments. While borrowing from your 403(b) plan can provide immediate financial relief, it's a decision that requires careful consideration. The advantages, such as rapid access to funds and interest paid back to your own account, need to be weighed against the potential risks. These risks include a reduction in your retirement savings, the impact of tax implications, and possible penalties upon termination of employment. Adherence to both IRS and employer-specific regulations is critical when opting for a loan from your 403(b). Alternatives, like personal loans or hardship withdrawals, may provide viable solutions. If you do proceed with a 403(b) loan, crafting a robust repayment strategy that maintains your retirement contributions is crucial. Ensuring a full understanding of the potential implications on your future financial security is key when considering a 403(b) loan.Borrowing From a 403(b) Overview

Process of Borrowing From 403(b) Plan

Determine Loan Limit

File an Application

Loan Disbursement and Repayment Setup

Rules and Regulations of Borrowing From 403(b) Plan

IRS Guidelines and Limits on 403(b) Loans

Maximum Loan Amount

Repayment Timeline

Tax Consequences for Default

Employer-Specific Rules and Limitations

Alternatives to Borrowing From 403(b) Plan

Taking a Withdrawal From the 403(b) Plan

Understand the Penalty for Early Withdrawal

Potential Exceptions for Hardship Withdrawals

Exploring Other Loan Sources

Personal Loans

Home Equity Loans

Credit Card Advances

Pros and Cons of Borrowing From 403(b) Plan

Pros

Access to Funds When Needed

Interest Paid Back Into the Account

No Credit Check Needed

Cons

Potential for Reduced Retirement Savings

Tax Implications

Risks if Employment Is Terminated

Strategies for Repaying a 403(b) Loan

Conclusion

Borrowing From Your 403(b) Plan FAQs

A 403(b) plan is a retirement account for certain employees of public schools and tax-exempt organizations. It allows these employees to contribute a part of their salaries into the account on a pre-tax basis.

Yes, you can borrow from your 403(b) plan if your plan allows it. Typically, you can borrow up to 50% of your vested account balance, or $50,000, whichever is less. However, borrowing from your 403(b) plan should be done with caution due to the potential impact on your retirement savings.

Borrowing from a 403(b) plan means taking a loan against your retirement savings, which must be repaid with interest. Withdrawal, on the other hand, means taking out money permanently. Withdrawals before age 59½ often come with a 10% early withdrawal penalty and are taxable as income. Loans are not subject to tax or penalties as long as they're paid back within the specified timeframe.

If you fail to repay your 403(b) loan as agreed, the IRS treats the unpaid balance as a taxable distribution. If you're under 59½, an additional 10% early withdrawal penalty may apply. You may also have to repay the full loan balance quickly if your employment is terminated.

Alternatives to borrowing from your 403(b) plan can include taking a hardship withdrawal, getting a personal loan, a home equity loan, or a credit card advance. However, each of these alternatives comes with its own set of risks and benefits that should be carefully considered.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.