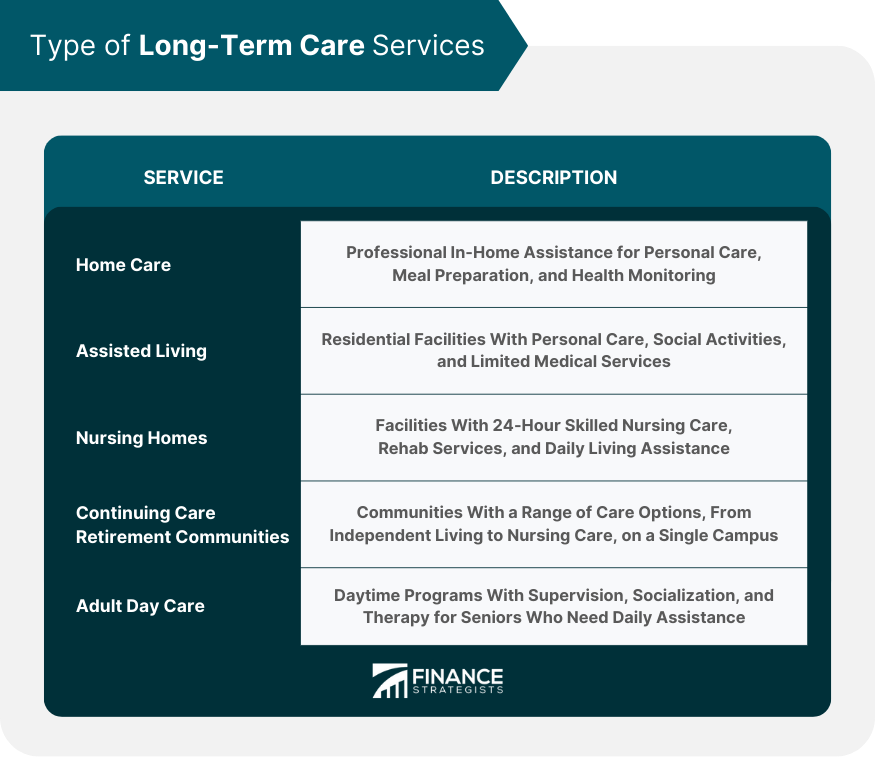

Long-term care planning is the process of making arrangements for your future care needs, particularly in the event that you become unable to care for yourself due to aging, illness, or disability. This may involve identifying potential care options, estimating care costs, and considering ways to finance those costs. Long-term care planning is a proactive approach to prepare for the possibility of needing assistance with activities of daily living or medical care in the future. The goal of long-term care planning is to ensure that you receive the necessary care while reducing the burden on yourself and your family. Long-term care planning is an ongoing process, and it is important to regularly review and update your plan as your circumstances and care needs may change over time. Home Care: Professional assistance provided in the individual's home, including personal care, meal preparation, and health monitoring. Assisted Living: Residential facilities offering personal care services, social activities, and limited medical care. Nursing Homes: Facilities providing 24-hour skilled nursing care, rehabilitation services, and assistance with daily living activities. Continuing Care Retirement Communities: Communities offering a continuum of care, from independent living to nursing home care, within a single campus. Adult Day Care: Programs offering daytime supervision, socialization, and therapeutic activities for seniors who require daily assistance. Evaluate personal and family preferences, health status, and potential care needs to determine the most suitable long-term care options. Assess income, savings and investments, real estate, and retirement funds to determine the financial resources available for long-term care expenses. Personal Savings: Utilizing personal financial resources to cover long-term care expenses. Health Insurance: Some health insurance policies may cover certain long-term care services. Long-Term Care Insurance: Policies specifically designed to cover long-term care expenses. Government Programs: Medicaid provides long-term care coverage for eligible individuals with limited resources. Veterans Benefits: Some veterans may be eligible for long-term care benefits through the Department of Veterans Affairs. Reverse Mortgages: Converting home equity into cash to cover long-term care expenses. Traditional LTC insurance: Standalone policies that provide benefits specifically for long-term care services. Hybrid Policies: Life insurance policies with a long-term care rider allow the policyholder to access life insurance and long-term care benefits. Benefit Amount and Duration: The daily or monthly benefit amount and the maximum duration of benefits. Inflation Protection: An optional feature that increases the benefits of keeping pace with inflation. Elimination Period: The waiting period before benefits begin, often ranging from 30 to 90 days. Benefit Triggers: Criteria that must be met for benefits to be payable, typically based on the inability to perform activities of daily living (ADLs) or cognitive impairment. Exclusions and Limitations: The policy may not cover certain conditions or services. Factors Influencing Premium Rates: Age, health status, benefit amount and duration, inflation protection, and elimination period. Strategies for Reducing Costs: Selecting a longer elimination period, reducing the benefit amount or duration, and forgoing inflation protection. Research and comparing various insurance providers, considering financial strength, reputation, customer service, and policy offerings. Power of Attorney: A legal document that grants a designated person the authority to make financial and legal decisions on your behalf. Living Will: A written statement outlining your medical treatment preferences in case you cannot communicate your wishes. Health Care Proxy: A document that designates a trusted individual to make medical decisions on your behalf if you become incapacitated. Revocable Living Trusts: Trusts that can be changed or revoked during the grantor's lifetime, allowing for flexibility in managing assets. Irrevocable Living Trusts: Trusts that cannot be changed or revoked once established, providing more protection from creditors and potential Medicaid eligibility. Special Needs Trusts: Trusts designed to provide financial support for disabled individuals without jeopardizing their eligibility for government benefits. Asset Transfer: Transferring assets to a spouse, family member, or trust to protect them from potential long-term care costs. Medicaid Planning: Structuring assets and income to meet eligibility requirements for Medicaid long-term care coverage. Openly discuss your long-term care preferences and expectations with family members to ensure they understand your wishes. Inform family members about the financial resources available for long-term care, including savings, insurance policies, and government benefits. Determine which family members will be involved in providing care and support and establish clear roles and responsibilities. Discuss potential areas of disagreement among family members and develop strategies for resolving conflicts. Regularly review and update your long-term care plan to ensure it remains aligned with your needs and circumstances. Adjust your long-term care plan as needed, considering factors such as changes in health, financial resources, or family dynamics. Consult with financial planners, attorneys, and other professionals to ensure your long-term care plan is comprehensive and up-to-date. Long-term care planning is a critical process that involves preparing for future care needs that may arise due to aging, illness, or disability. It involves identifying suitable care options, such as home care, assisted living, nursing homes, and adult day care. It also evaluates financial resources and potential funding sources, including personal savings, health insurance, long-term care insurance, government programs, and reverse mortgages. Legal and estate planning documents, such as powers of attorney, living wills, health care proxies, and trusts, play a key role in protecting individuals' preferences and assets. Long-term care insurance is an important consideration, with various policy types, features, and cost factors to evaluate. Family involvement and open communication are essential for discussing preferences, assigning caregiving roles, and addressing potential conflicts. Periodic review and adaptation of the long-term care plan, in coordination with financial and legal advisors, ensure that the plan remains relevant to changing circumstances. By proactively engaging in long-term care planning, individuals can secure their future well-being and minimize the burden on themselves and their loved ones.What Is Long-Term Care Planning?

Types of Long-Term Care Services to Plan For

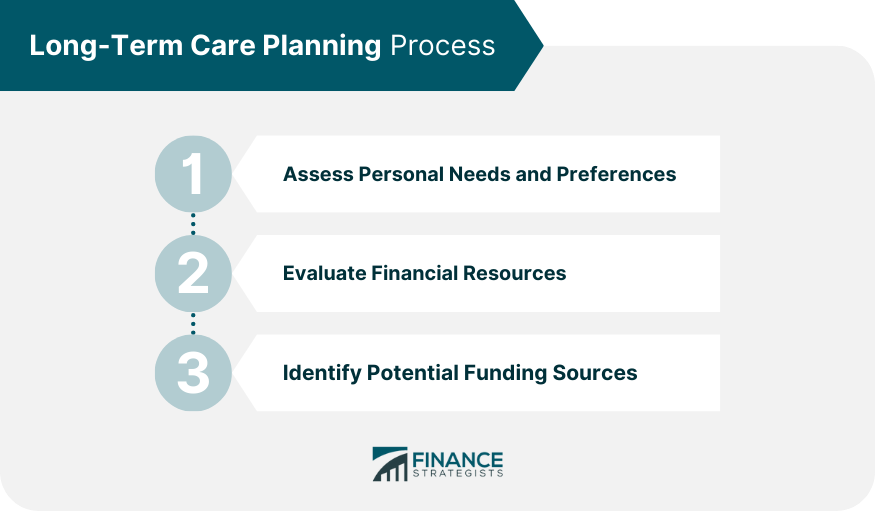

Long-Term Care Planning Process

Assess Personal Needs and Preferences

Evaluate Financial Resources

Identify Potential Funding Sources

Insurance and Long-Term Care Planning

Types of Policies

Key Features and Considerations

Cost of Long-Term Care Insurance

Evaluating and Selecting an Insurance Provider

The Relationship Between Estate Planning and Long-Term Care Planning

Importance of Legal Documents

Trusts for Long-Term Care Planning

Strategies for Preserving Assets

Family Involvement and Long-Term Care Planning

Discussing LTC Preferences with Family Members

Sharing Information on Financial Resources

Identifying and Assigning Caregiving Roles

Addressing Potential Conflicts

Monitoring and Adjusting a Long-Term Care Plan

Periodic Review of LTC Plan

Adapting to Changing Circumstances and Needs

Coordinating With Financial and Legal Advisors

Conclusion

Long-Term Care Planning FAQs

Long-term care planning is the process of making arrangements for your future care needs, particularly in the event that you become unable to care for yourself due to aging, illness, or disability.

Long-term care planning is important because it helps you prepare for the financial, emotional, and logistical challenges of needing long-term care. You or your loved ones can afford or arrange the care you need with proper planning.

It's always early enough to start long-term care planning, as the need for care can arise unexpectedly at any age. However, starting planning in your 50s or earlier is generally recommended when you have more options and time to build up resources.

Factors to consider in long-term care planning include potential care options, estimated care costs, and how to finance those expenses.

Long-term care can be expensive, but there are several ways to pay for it. These may include private insurance policies, government programs like Medicaid, and personal savings or investments. It's important to explore your options and plan to ensure you have the necessary resources.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.