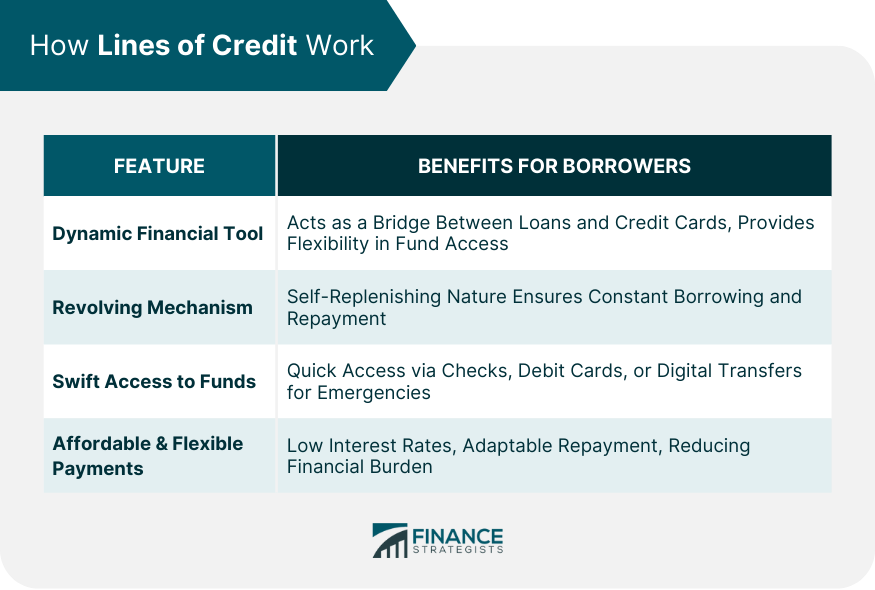

A line of credit is a versatile financial tool, acting as a bridge between traditional loans and revolving credit accounts. It provides borrowers with a predetermined sum, offering the convenience to draw funds as and when required. Essentially, think of it as a credit card but with more generous limits, designed to grant financial agility to users. This instrument functions as a safety net against unforeseen expenses and can serve as financial lifelines for both individuals and businesses. Businesses leverage lines of credit to tackle seasonal variations, sustain operations, and capitalize on growth opportunities without the constraints of strict financing setups. At the core of its appeal is its self-replenishing nature. Once approved, borrowers get a credit limit. The available credit diminishes as funds are utilized and revives upon repayment, forming a sustainable loop. This feature ensures constant borrowing and repayment as circumstances dictate. Borrowers can quickly draw from their credit line using checks, debit cards, or digital transfers. Such immediate availability proves invaluable during unexpected events, such as medical emergencies or abrupt expenses. Only the used portion incurs interest, which often attracts rates lower than typical credit cards. Repayment is adaptable, with borrowers usually covering just the interest on the used amount each month, granting them financial relief without the burden of hefty fixed. Foremost among the benefits is the unparalleled borrowing flexibility. Unlike traditional loans' one-shot nature, lines of credit let individuals and businesses tailor borrowing to precise needs. It's like having a financial toolbelt with customizable instruments for each situation. Cost-efficiency is an enduring appeal. Lines of credit offer competitive interest rates, making them economical compared to pricier options like credit cards or payday loans. This cost-effectiveness translates into potential interest savings over time, rendering lines of credit a prudent choice for affordable short-term financing. In times of crisis, a line of credit is a lifeline. Whether facing unexpected medical bills or sudden repairs, these credit lines act as swift-response emergency funds, mitigating stress and ensuring urgent costs are promptly covered. For businesses, maintaining sufficient working capital is pivotal. A line of credit serves as a flexible resource, ensuring operational continuity, capitalizing on opportunities, and weathering cash flow fluctuations without resorting to more rigid financing. Responsible line of credit management can enhance an individual's credit score. By punctually repaying and effectively managing borrowing, one showcases creditworthiness to lenders, potentially paving the way for better future terms. Unlike fixed-term loans, lines of credit offer repayments tailored to your situation. You can choose to repay the full amount or make minimum monthly payments, accommodating your financial standing and circumstances. In urgent situations, swiftness matters. With lines of credit, funds are accessible almost instantaneously, negating the delay typical of traditional loan applications and approvals. Lines of credit can serve as a strategic tool for debt consolidation. By amalgamating higher-interest debts into a single line of credit with a lower rate, borrowers can trim overall interest payments and streamline repayment. Remember the flexibility, while beneficial, requires careful management to avoid potential pitfalls such as overspending or accumulating debt. Since there isn't a fixed repayment schedule like traditional loans, it's crucial to have a clear repayment strategy. Without one, there's a risk of making only the minimum payments and extending the debt for longer periods, leading to more interest payments in the long run. Before diving into a line of credit, it's wise to compare it with other financing options available. Evaluate factors like interest rates, tenure, and other terms to decide if it's the best fit for your financial situation. Before delving into a line of credit, assess your finances. Examine income, expenses, and existing debt to align your decisions with your financial reality. Define your borrowing needs clearly. Are you securing a financial safety net or aiming to seize business opportunities? Clarity here directs decision-making. Scrutinize line of credit options in comparison to alternatives. Weigh interest rates, fees, terms, and suitability for your objectives to make an informed choice. Thoroughly research lenders offering lines of credit. Analyze interest rates, fees, and terms to identify a lender aligned with your preferences. Lenders require documentation—proof of income, ID, credit history. Having these ready expedites the application process. Submit your application and required documents. This is often done online, streamlining the process. Upon submission, lenders assess eligibility and creditworthiness. This involves credit checks and information verification. Post-approval, review your line of credit offer meticulously. Study rates, fees, credit limit, and terms before accepting. Outline a clear borrowing strategy. Determine when and how to use funds, and craft a repayment plan to steer clear of overborrowing. Conduct regular financial reviews. This aids in tracking borrowing patterns and repayment progress to avoid debt pitfalls. Timely payments are vital for a positive credit history. Set reminders or enable auto-payments to never miss due dates. Stay abreast of prevailing interest rates. This helps gauge line of credit cost-effectiveness and informs your borrowing choices. In the dynamic landscape of personal and business finance, the line of credit stands tall as a beacon of financial agility. Its adaptive nature offers unparalleled flexibility, allowing borrowing to align precisely with specific needs. The cost-efficiency, swift access to funds, and potential for credit score improvement make it a compelling choice. Yet, navigating this realm demands careful consideration. The allure of accessibility is balanced by the risk of overspending, variable interest rates, and potential credit score impacts. Through meticulous assessment of individual circumstances and a keen eye on financial goals, the line of credit can be harnessed as a strategic tool. Informed by the benefits and aware of the pitfalls, individuals and businesses can wield the line of credit to their advantage, embracing financial possibilities while maintaining a responsible and prudent approach.How Lines of Credit Empower Borrowers

Dynamic Financial Tool

Revolving Mechanism

Swift Access to Funds

Affordable and Flexible Payments

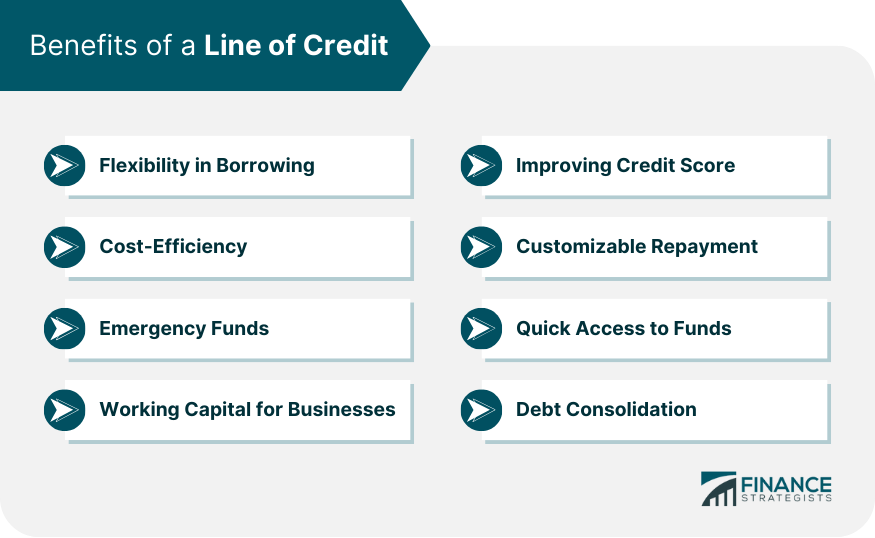

Benefits of Having a Line of Credit

Flexibility in Borrowing

Cost-Efficiency

Emergency Funds

Working Capital for Businesses

Improving Credit Score

Customizable Repayment

Quick Access to Funds

Debt Consolidation

Points to Consider While Using a Line of Credit

Is a Line of Credit Right for You?

Assessing Your Financial Situation

Considering Borrowing Needs

Comparison with Other Financing

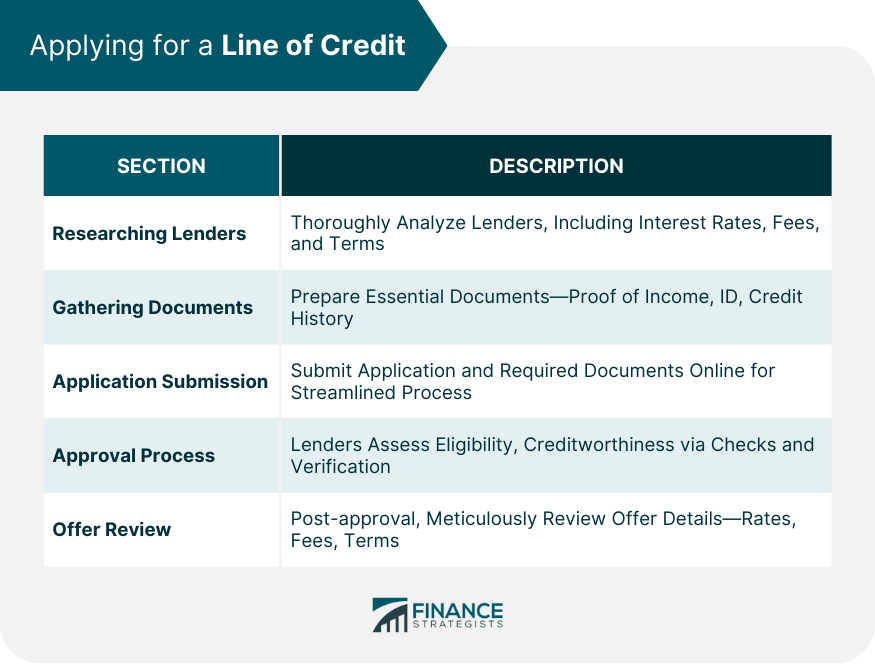

How to Apply for a Line of Credit

Researching Lenders

Gathering Documents

Application Submission

Approval Process

Offer Review

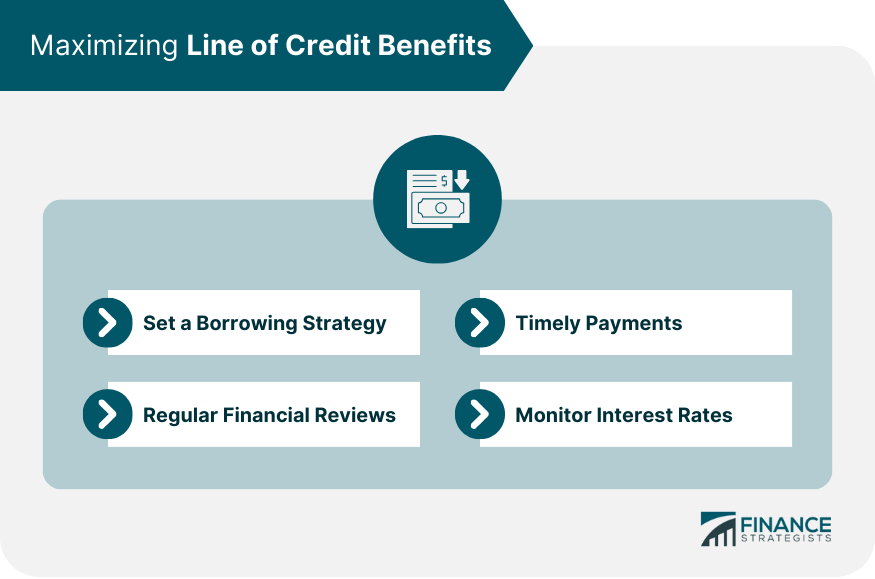

Tips for Maximizing Line of Credit Benefits

Setting a Borrowing Strategy

Regular Financial Reviews

Timely Payments

Monitoring Interest Rates

Conclusion

Advantages of Having a Line of Credit FAQs

Having a line of credit offers benefits like flexible borrowing, cost-efficiency, quick access to funds, potential credit score improvement, and customizable repayment.

A line of credit allows you to borrow as needed within a predetermined limit, giving you the flexibility to use funds when required and repay at your own pace.

Lines of credit often feature competitive interest rates, resulting in potential interest savings over time when compared to pricier options like credit cards or payday loans.

Yes, absolutely. Lines of credit act as a financial safety net, providing access to funds swiftly during unexpected emergencies like medical bills or sudden repairs.

Responsible management of a line of credit, such as making timely payments and effective borrowing, can positively impact your credit score, showcasing your creditworthiness to lenders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.