Medicaid is a state and federal program that provides health insurance to eligible low-income individuals and families. This program aims to ensure access to necessary medical care for those who cannot afford it. Long-term care coverage is an essential aspect of Medicaid, as it helps individuals in need of ongoing support due to chronic illness, disability, or aging. This coverage is vital for older adults and people with disabilities, as it provides services to maintain their quality of life. Long-term care coverage becomes increasingly important as the population ages. It provides financial support for individuals who require assistance with daily living tasks, ensuring they receive the care they need. By offering long-term care coverage, Medicaid helps to ease the financial burden on families and caregivers. This support allows people to access necessary services without depleting their life savings or relying solely on family members for care. To qualify for Medicaid long-term care coverage, individuals must meet specific income limits determined by their state. These limits vary based on factors such as family size, age, and disability status. States may adjust income limits for long-term care coverage to accommodate higher living costs or other factors. It is essential to check with your state's Medicaid office for up-to-date information on income eligibility requirements. Asset limits are another essential criterion for Medicaid long-term care eligibility. These limits include the value of an individual's financial resources, such as bank accounts, stocks, bonds, and real estate. Different states have different asset limits, and certain assets may be exempt, such as a primary residence or a vehicle. It is crucial to review your state's specific asset limits and exemptions to determine eligibility for long-term care coverage. Medicaid long-term care coverage includes nursing home care for eligible individuals. Nursing homes provide round-the-clock care and support for those who cannot live independently due to medical conditions or disabilities. This coverage is crucial for people who require constant supervision, medical care, or assistance with daily living tasks. Medicaid helps to alleviate the financial burden of nursing home care, making it more accessible to those in need. Home and community-based services (HCBS) are an essential component of Medicaid long-term care coverage. These services allow individuals to receive necessary care within their homes or communities, promoting independence and quality of life. HCBS may include personal care assistance, home health care, respite care, and adult day services. These services enable individuals to maintain their independence while receiving support tailored to their specific needs. Assisted living facilities offer a supportive environment for individuals who need help with daily living tasks but do not require the level of care provided in a nursing home. These facilities provide personal care, medication management, and social activities. Medicaid long-term care coverage may cover some or all of the costs associated with assisted living facilities. The extent of coverage varies by state, so it is essential to check with your state's Medicaid office for specific details. Adult day health care programs provide social, health, and therapeutic services to individuals who require assistance during the day. These programs offer a supportive environment for participants while giving caregivers respite from their caregiving responsibilities. Medicaid long-term care coverage may cover the cost of adult day health care programs for eligible individuals. The availability and extent of coverage vary by state, so it is crucial to consult with your state's Medicaid office for details. Personal care services help individuals with daily living tasks, such as bathing, dressing, and meal preparation. These services can be provided in the home or another community setting, depending on the individual's needs and preferences. Medicaid long-term care coverage may cover personal care services for eligible individuals. Coverage varies by state, so it is essential to check with your state's Medicaid office to determine the specific services covered and any associated costs. When applying for Medicaid long-term care coverage, applicants must provide documentation to verify their income, assets, and need for long-term care. This documentation may include pay stubs, bank statements, and medical records. Gathering the necessary documentation in advance can help streamline the application process. It is essential to consult with your state's Medicaid office for a complete list of required documents and any additional information needed for the application. Each state has its own application procedures for Medicaid long-term care coverage. These procedures may include submitting an application online, by mail, or in person at a local Medicaid office. It is crucial to familiarize yourself with your state's specific application process and follow all necessary steps to ensure your application is complete and accurate. Contact your state's Medicaid office for guidance on the application process and any required supporting documentation. The timeframe for Medicaid long-term care coverage approval varies by state. Generally, states must process applications within 45 to 90 days, depending on the complexity of the case and the need for additional information or documentation. Applicants should be prepared for potential delays in the approval process and plan accordingly. Regular communication with your state's Medicaid office can help keep you informed about the status of your application and any additional requirements. Spend-down strategies involve using excess income or assets to pay for medical or care expenses in order to qualify for Medicaid long-term care coverage. This process can be complex and may require the assistance of a financial planner or attorney. Spend-down strategies should be approached with caution, as they may have unintended consequences, such as creating financial hardship or impacting eligibility for other assistance programs. Consult with a professional to develop a spend-down plan that meets your needs while preserving your financial security. Asset transfers, such as gifting or selling assets to family members, may be used to help individuals qualify for Medicaid long-term care coverage. However, transferring assets can have significant implications for eligibility and may result in penalties. Before considering asset transfers, it is important to consult with a financial planner or attorney who is familiar with Medicaid regulations. These professionals can help you navigate the complex rules surrounding asset transfers and develop a plan that protects your financial interests. The Medicaid Estate Recovery Program (MERP) is a federally mandated program that allows states to recoup some or all of the costs of Medicaid long-term care services provided to individuals. This recovery process typically occurs after the individual's death and may involve claiming assets from their estate. Understanding the potential implications of the Medicaid Estate Recovery Program is essential when planning for long-term care coverage. Consult with a financial planner or attorney to develop a strategy that takes MERP into account while preserving your estate for your heirs. One of the challenges of Medicaid long-term care coverage is that not all services or providers may be available to beneficiaries. This limitation can make it difficult for individuals to access the care they need or choose the most suitable care setting. To address this challenge, it is essential to research local service providers and explore alternative care options. Communicating with your state's Medicaid office can help identify available services and resources in your area. Medicaid long-term care coverage varies significantly by state, with each state setting its own eligibility criteria, covered services, and application procedures. This variation can create confusion and make it difficult to navigate the system. To overcome this challenge, it is crucial to familiarize yourself with your state's specific Medicaid long-term care coverage rules and regulations. Contact your state's Medicaid office for guidance and clarification on any questions you may have. In some states, waiting lists for Medicaid long-term care services may exist due to high demand and limited resources. Being placed on a waiting list can delay access to necessary care and support. To address this challenge, it is essential to explore alternative care options and consider other financing methods while waiting for Medicaid long-term care coverage. Regular communication with your state's Medicaid office can help keep you informed about the status of your application and any potential waiting periods. Long-term care insurance is a private insurance policy designed to cover the costs of long-term care services. These policies can provide financial protection and flexibility for individuals who require long-term care but do not qualify for Medicaid coverage. Long-term care insurance policies vary in terms of coverage, premiums, and benefit periods. It is essential to carefully review policy options and consider your long-term care needs before purchasing a policy. Some life insurance policies offer long-term care riders, which allow policyholders to access a portion of their death benefit to pay for long-term care services. This option can provide additional financial protection for those who need long-term care without requiring a separate insurance policy. When considering a life insurance policy with a long-term care rider, it is essential to review the policy's terms and conditions to ensure it meets your long-term care needs. Consult with a financial planner or insurance agent to explore available options and make an informed decision. Reverse mortgages are financial products that allow homeowners to convert a portion of their home equity into cash, which can be used to pay for long-term care services. This option can provide a source of funding for those who need long-term care but have limited income or assets. Reverse mortgages have specific eligibility requirements and may have implications for the homeowner's estate. It is crucial to consult with a financial planner or mortgage professional before pursuing this option to ensure it aligns with your long-term care and financial goals. Veterans and their spouses may be eligible for long-term care benefits through the Department of Veterans Affairs (VA). These benefits may include nursing home care, home and community-based services, and assisted living facilities. Eligibility for VA long-term care benefits depends on factors such as service history, disability status, and financial need. It is essential to explore available benefits and eligibility criteria by contacting your local VA office or visiting the VA website. Understanding and accessing VA long-term care benefits can help eligible individuals secure necessary care and support without relying solely on Medicaid coverage. Medicaid Long-Term Care Coverage is an essential program that provides assistance to low-income individuals and families who require ongoing care due to chronic illness or disability. The program covers various services, including nursing home care, home and community-based services, assisted living facilities, adult day health care, and personal care services. Eligibility requirements include income and asset limits, and applicants must provide documentation to verify their need for long-term care. However, the program has its limitations, including limited service availability, state-specific variations, and waiting lists for services. To address these challenges, individuals may explore alternative long-term care financing options, such as long-term care insurance, life insurance with long-term care riders, reverse mortgages, and veterans benefits. It is crucial to consult with financial planners, insurance agents, or Medicaid eligibility specialists to explore available options and make informed decisions. Overall, Medicaid Long-Term Care Coverage provides crucial support to individuals in need of ongoing care, promoting their independence and quality of life while easing the financial burden on families and caregivers.Definition of Medicaid Long-Term Care Coverage

Eligibility Criteria for Medicaid Long-Term Care Coverage

Income Limits

Asset Limits

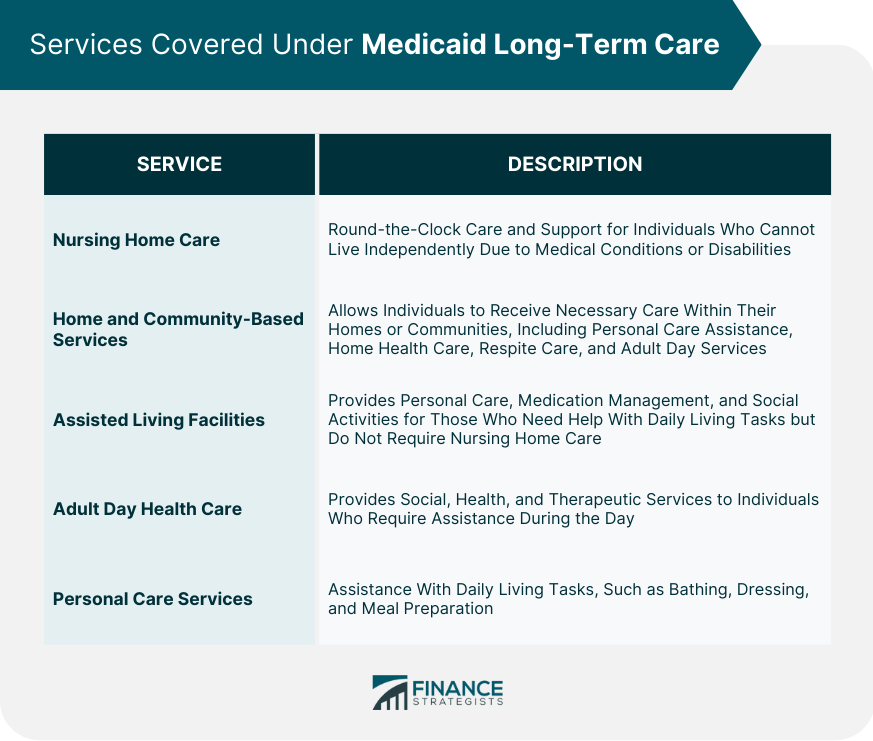

Services Covered Under Medicaid Long-Term Care

Nursing Home Care

Home and Community-Based Services

Assisted Living Facilities

Adult Day Health Care

Personal Care Services

Application Process for Medicaid Long-Term Care Coverage

Required Documentation

State-Specific Application Procedures

Timeframe for Approval

Financial Planning for Medicaid Long-Term Care Coverage

Spend-Down Strategies

Asset Transfers

Medicaid Estate Recovery Program

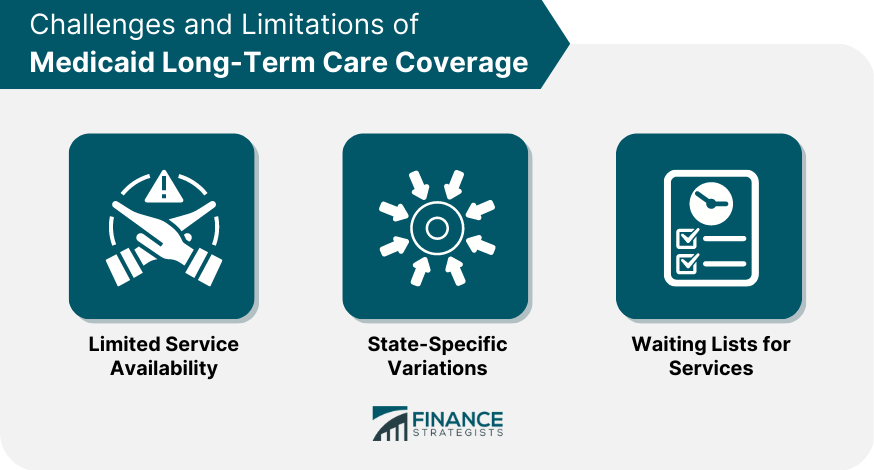

Challenges and Limitations of Medicaid Long-Term Care Coverage

Limited Service Availability

State-Specific Variations

Waiting Lists for Services

Alternative Long-Term Care Financing Options

Long-Term Care Insurance

Life Insurance With Long-Term Care Riders

Reverse Mortgages

Veterans Benefits

Final Thoughts

Medicaid Long-Term Care Coverage FAQs

Medicaid Long-Term Care Coverage is a program that provides assistance to individuals who require ongoing care due to chronic illness or disability.

To be eligible for Medicaid Long-Term Care Coverage, individuals must meet specific income and asset requirements and demonstrate a need for ongoing care.

Services covered under Medicaid Long-Term Care Coverage can vary by state but typically include nursing home care, in-home care, and other supportive services.

To apply for Medicaid Long-Term Care Coverage, individuals can contact their state's Medicaid office or speak with a Medicaid eligibility specialist.

Yes, it is possible to receive Medicaid Long-Term Care Coverage and Medicare at the same time. However, it is essential to understand the coverage limitations and eligibility requirements for both programs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.