With the approaching tax season just around the corner, it's time to equip yourself with the essential knowledge and tools to navigate the often daunting process of filing your taxes. I’ve put together the guide below to walk you through the steps of filing your taxes and discuss the latest updates. The goal is to simplify the process and provide you with the tools you need to navigate tax season with confidence. Let's dive in. Generally, acceptance of tax returns begins during the middle to late part of January each year. The IRS has made it easier than ever to manage your taxes online. Taxpayers and Individual Taxpayer Identification Number (ITIN) holders may now view, approve, and electronically sign the power of attorney and other tax information authorizations. If you haven’t already, create an account on the IRS website. This account will allow you to view your tax records, make payments, request tax transcripts, and track your refund status. If you already have an account, make sure your login information is up-to-date and secure. Before you begin the filing process, gather all necessary tax records including: W-2 forms received from your employer(s) 1099 forms from banks, issuing agencies, and other payers, which may include sources like unemployment compensation, dividends, pension, annuity, or retirement plan distributions 1099-K, 1099-MISC, W-2, or similar documents if you were part of the gig economy 1099-INT forms if you earned interest income Documentation related to other sources of income and records of digital asset transactions 1095-A, the Health Insurance Marketplace Statement, used for reconciling advance payments or claims for Premium Tax Credits related to 2022 Marketplace coverage Correspondence from the IRS or other government agencies CP01A Notice containing your new Identity Protection PIN Also, take note of taxable and non-taxable income. Your ITIN is a tax processing number issued by the IRS. Ensure that your ITIN is valid before filing. If it has expired, you will need to renew it. The IRS typically sends a notice if your ITIN is due to expire. You can learn more about ITINs on the IRS’s ITIN page. Review your withholding tax to ensure the correct amount has been withheld from your paychecks throughout the year. If too little was withheld, you may owe additional tax. The IRS’s Tax Withholding Estimator can help you determine the right amount to withhold. If any adjustments are needed, you will need to submit a new Form W-4 to your employer. If you earn a significant amount of non-wage income, such as self-employment earnings, investment returns, taxable Social Security benefits, and sometimes pension and annuity income, it is advisable to make quarterly estimated tax payments. These payments help you stay on top of your tax obligations throughout the year. The year is divided into four payment periods for estimated tax purposes, with the final payment due in mid-January. To make your estimated tax payments, you can conveniently log in to your online account and complete the payment online. Alternatively, you can visit IRS.gov/payments to process your payment securely. Setting up a direct deposit for your tax refund can expedite the process. You will only need to provide your bank account and routing numbers. This is a more convenient and faster means than the regular paper check The IRS has made several enhancements to its online accounts. These updates aim to make the tax filing process more user-friendly and efficient. Below are some of the various features that users can do with an online account: Users can access various features, including: Check tax liability and payment history, as well as schedule payments Request tax transcripts View or apply for payment arrangements Review digital copies of specific IRS notifications Examine critical information from latest tax return, such as adjusted gross income Validate bank accounts and save multiple accounts The IRS typically issues refunds within 21 days for e-filed tax returns. However, this timing can vary depending on the specifics of your return. The IRS advises taxpayers not to depend on a specific date for receiving their 2024 federal tax refund, particularly when considering significant purchases or bill payments. In cases where the IRS systems flag potential errors, encounter missing information, or suspect identity theft or fraud, some returns may undergo additional scrutiny and consequently take more time to process. Furthermore, it's important to note that the IRS is unable to process refunds for individuals claiming the EITC or ACTC before mid-February. This is due to legal requirements mandating that the IRS withhold the entire refund, not just the EITC or ACTC portion. Provided there are no additional issues with the tax return and the taxpayer selected direct deposit, the IRS anticipates that most refunds related to EITC and ACTC will be accessible in taxpayer bank accounts or on debit cards by February 27, 2024. The due date for the last quarterly payment of 2024 is January 15, 2025. Make sure to mark this date on your calendar to avoid late penalties. The IRS has decided to postpone the introduction of the new $600 reporting threshold for Form 1099-K for third-party settlement organizations until the 2024 calendar year. As the IRS strives to smoothly implement this new regulation, 2024 will serve as an additional transition year. This adjustment is intended to alleviate potential confusion arising from the issuance of Forms 1099-K to many taxpayers who may not anticipate receiving one or have a corresponding tax obligation. Consequently, reporting requirements will only be enforced if a taxpayer receives more than $20,000 and conducts over 200 transactions in 2024. Considering the intricacies of this new provision and the significant number of individual taxpayers affected, the IRS is planning to introduce a $5,000 threshold for the tax year 2024 as part of a gradual phase-in process to fully implement the $600 reporting threshold stipulated in the American Rescue Plan (ARP). There are several energy-related credits available for 2024. These credits can help offset the cost of energy-efficient home improvements. Taxpayers who have acquired a vehicle in 2024 should assess the modifications introduced by the Inflation Reduction Act of 2022 to determine if they qualify for tax credits related to new electric vehicles purchased in 2022 or earlier, or for new clean vehicles purchased in 2024 or later. To claim either of these credits, taxpayers must furnish the vehicle's VIN and submit Form 8936, the Qualified Plug-in Electric Drive Motor Vehicle Credit, along with their tax return. Additionally, if taxpayers have undertaken energy-related improvements to their residence, they are eligible for tax credits that cover a portion of qualifying expenses. The Inflation Reduction Act of 2022 has expanded both the credit amounts and the types of qualifying expenses. To avail of this credit, taxpayers are required to file Form 5695, specifically Part II, which pertains to Residential Energy Credits, along with their tax return. While preparing for tax filing in 2024, it's crucial to stay vigilant against tax scams that could compromise your financial security. Tax scams have become increasingly sophisticated, and scammers often target unsuspecting taxpayers through various means, including phone calls, emails, and even text messages. Here are some essential tips to help you detect and avoid tax scams: The IRS will never initiate contact with you via phone, email, or text message to request personal information, such as your Social Security number or bank details. If you receive such unsolicited communication, be extremely cautious and do not provide any sensitive information. Scammers often use scare tactics, such as threats of legal action or arrest, to pressure individuals into making immediate payments or providing personal information. The IRS does not operate in this manner. If you receive threatening communication, it's likely a scam. Never share personal or financial information, such as your Social Security number, bank account details, or credit card numbers, with anyone unless you are certain of their legitimacy. If you encounter a tax scam or believe you've been targeted, report it to the IRS by forwarding phishing emails to [email protected]. You can also report scams to the Federal Trade Commission (FTC). If you are uncertain about the legitimacy of any tax-related communication or request, consult with a trusted tax advisor or financial professional for guidance. In addition to these tips, the IRS website provides a wealth of resources and information on how to protect yourself from tax scams. Regularly checking the IRS's "Tax Scams and Consumer Alerts" page can help you stay up-to-date on the latest scams and fraudulent activities. By staying vigilant and informed, you can protect yourself against tax scams and ensure a smooth and secure tax filing process in 2024. Your financial security is of the utmost importance, and taking precautions against scams is a vital part of that protection. I am Taylor Kovar, the CEO and Founder of Kovar Wealth Management. My extensive experience in tax filing and financial management allows me to assist individuals and families with tax planning and compliance challenges. Whether you're a taxpayer looking to maximize deductions or a business owner optimizing your tax strategy, I offer personalized guidance. Contact me at [email protected] or 936-899-5629 for tailored advice and support in achieving your financial goals.How Soon Can You File Your 2024 Tax Return With the IRS?

Consequently, for the tax year 2024, you should anticipate being able to commence the filing process around that same timeframe in 2024.

Nevertheless, it's important to keep in mind that these dates may fluctuate from one year to the next.

To ensure you have the most accurate and up-to-date information, it's advisable to visit the official website, where they regularly update important tax-related dates and deadlines.

Furthermore, it's crucial to be aware of the deadline for filing your federal income tax return for the 2024 tax year, which falls on Monday, April 15, 2024. Tax Filing Steps

1. Create or Access Your Online Account

2. Gather Your Tax Records

3. Check Your Individual Tax Identification Number (ITIN)

4. Review Your Withholding Tax

5. Set Up a Direct Deposit

Latest IRS Updates

IRS Online Account Enhancements

Tax Refund Timing

Due Date For 2024 Last Quarterly Payment

Receiving a Form 1099-K

Energy-Related Credits

Last Few Reminders

1. Be Skeptical of Unsolicited Communication

2. Beware of Threats and Urgency

3. Protect Your Personal Information

4. Report Suspicious Activity

5. Consult a Professional

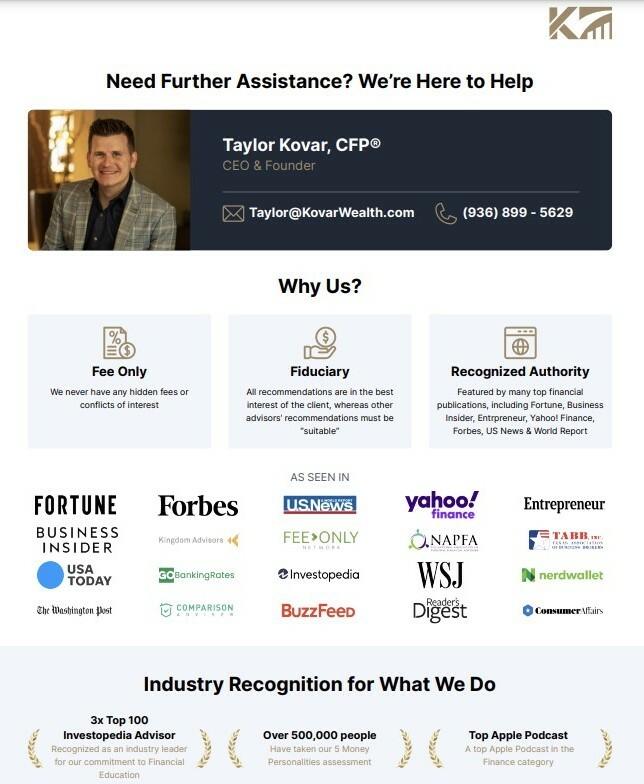

About the Author

2024 Tax Filing Guide