Hybrid long-term care policies combine the features of life insurance or annuity products with long-term care coverage. These policies provide financial protection for policyholders, ensuring they receive long-term care benefits if needed, while also offering a death benefit or return of premium option if care is not required. Long-term care planning is essential to prepare for the potential costs of care associated with aging, chronic illnesses, or disabilities. It helps individuals and families secure their financial future, maintain their independence, and access quality care services when needed. Hybrid policies combine the features of life insurance or annuity products with long-term care coverage. This means policyholders can access long-term care benefits when needed or receive a death benefit, annuity payout, or return of premium option if care is not required. Hybrid long-term care policies provide a guaranteed death benefit to beneficiaries, ensuring financial protection for loved ones even if long-term care benefits are not utilized. Some hybrid policies offer a return of premium feature, allowing policyholders to receive a refund of their paid premiums if they decide to cancel the policy or if long-term care benefits are not needed. Hybrid long-term care policies may offer tax advantages, such as tax-free withdrawals for long-term care expenses or tax-free death benefits for beneficiaries, depending on the policy structure and applicable tax laws. This type of hybrid policy combines a life insurance policy with a long-term care rider, allowing policyholders to access their death benefit for long-term care expenses while they are alive. The remaining death benefit is paid to beneficiaries upon the policyholder's death. An annuity-based hybrid policy combines an annuity product with a long-term care rider. Policyholders receive regular annuity payments, which can be increased or accessed in a lump sum to cover long-term care expenses if needed. Asset-based long-term care policies allow policyholders to leverage an existing financial asset, such as a life insurance policy or annuity, to fund long-term care coverage. This can be an attractive option for individuals who have existing financial products but need additional long-term care protection. Consider the financial strength and credit rating of the insurance provider to ensure they can fulfill their policy obligations and pay claims when needed. Evaluate the flexibility of the hybrid policy's features, such as the ability to adjust coverage levels, benefit periods, and elimination periods to meet your changing needs. Compare the cost of premiums for various hybrid policies and consider whether the benefits provided justify the expense. Inflation protection is an essential feature to preserve the purchasing power of your long-term care benefits over time. Review the available inflation protection options and choose a policy that offers adequate protection against rising costs. Consider the elimination and benefit periods offered by the hybrid policy. The elimination period is the waiting time before long-term care benefits are payable, while the benefit period is the duration for which benefits are provided. Select a policy that aligns with your long-term care planning goals and financial resources. Hybrid policies offer guaranteed benefits, ensuring policyholders receive value from their policy, whether through long-term care coverage, a death benefit, or a return of premium option. Hybrid policies provide flexibility in accessing benefits for various needs, such as long-term care expenses, a death benefit for loved ones, or a return of premium if care is not required. Hybrid policies may offer tax advantages, such as tax-free withdrawals for long-term care expenses or tax-free death benefits for beneficiaries. Hybrid policies often have more stable premium structures compared to traditional long-term care policies, reducing the risk of significant premium increases over time. Hybrid policies may have a higher initial cost compared to traditional long-term care insurance due to the combined nature of the policy and guaranteed benefits. Understanding the complex features and options of hybrid policies can be challenging, making it essential to work with a knowledgeable financial advisor or insurance agent. Hybrid policies may offer lower long-term care benefits compared to traditional policies, as the coverage is shared with other financial products, such as life insurance or annuities. Investing in a hybrid policy may result in an opportunity cost, as the funds used to purchase the policy could have been invested elsewhere, potentially yielding higher returns. Before purchasing a hybrid policy, evaluate your individual long-term care needs, considering factors such as your age, health, family history, and financial resources. Consult with a financial advisor or insurance agent who specializes in long-term care planning to help navigate the complexities of hybrid policies and choose the right product for your needs. Compare policy options and quotes from multiple insurance providers to find a hybrid policy that offers the best coverage and value for your specific situation. Before purchasing a hybrid long-term care policy, carefully review the policy terms and conditions, including coverage levels, elimination and benefit periods, inflation protection options, and any exclusions or limitations. Long-term care planning is an essential aspect of financial planning, providing security and peace of mind for individuals and their families as they face the potential costs of care associated with aging, chronic illnesses, or disabilities. Hybrid long-term care policies can be a suitable solution for individuals who want the flexibility and guaranteed benefits offered by combining life insurance or annuity products with long-term care coverage. However, it's crucial to carefully evaluate your individual needs and weigh the pros and cons of hybrid policies before making a decision. Regularly review and update your long-term care coverage to ensure it continues to meet your needs and reflects any changes in your financial situation, health, or long-term care planning goals.What Are Hybrid Long-Term Care Policies?

Key Features of Hybrid Long-Term Care Policies

Combination of Life Insurance or Annuity With Long-Term Care Benefits

Guaranteed Death Benefit

Return of Premium Option

Tax Advantages

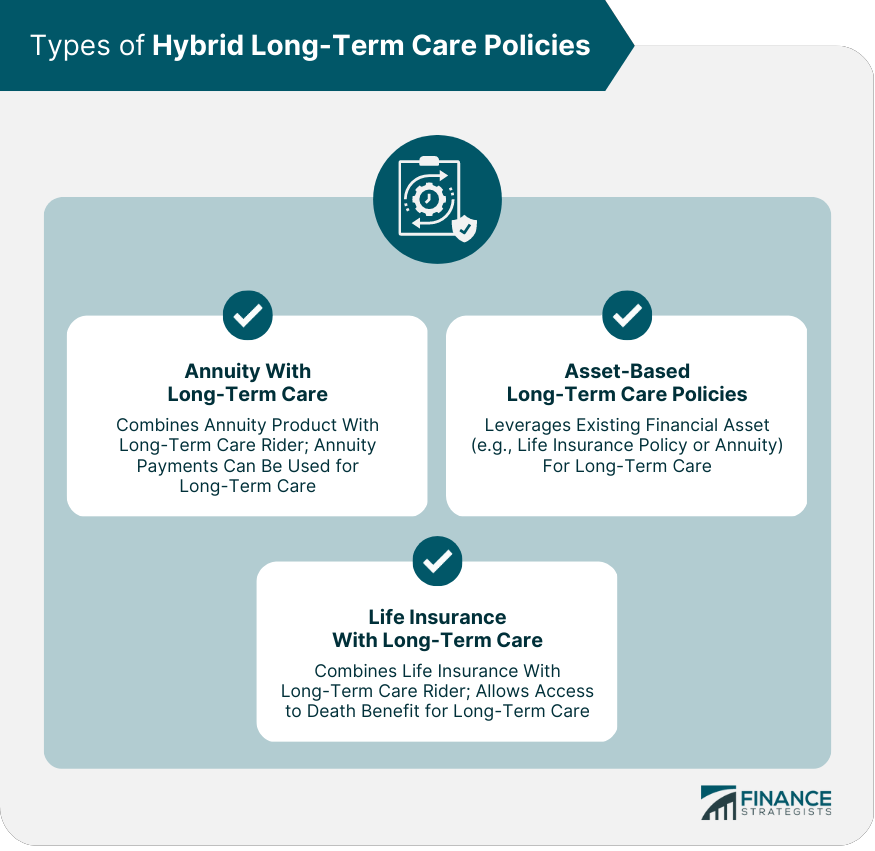

Types of Hybrid Long-Term Care Policies

Life Insurance With Long-Term Care Rider

Annuity With Long-Term Care Rider

Asset-Based Long-Term Care Policies

Factors to Consider When Choosing a Hybrid Long-Term Care Policy

Financial Stability of the Insurance Provider

Flexibility of Policy Features

Cost of Premiums

Inflation Protection Options

Elimination and Benefit Periods

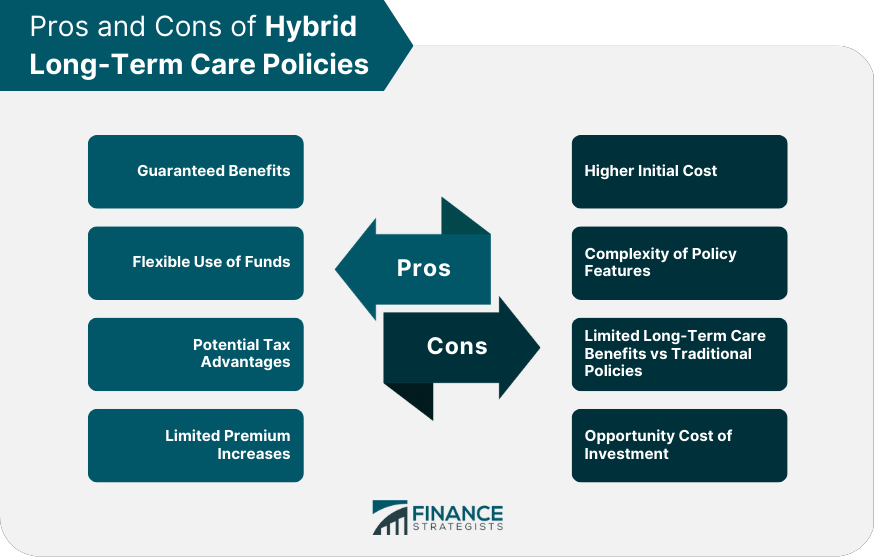

Pros and Cons of Hybrid Long-Term Care Policies

Pros

Guaranteed Benefits

Flexible Use of Funds

Potential Tax Advantages

Limited Premium Increases

Cons

Higher Initial Cost

Complexity of Policy Features

Limited Long-Term Care Benefits Compared to Traditional Policies

Opportunity Cost of Investment

How to Purchase a Hybrid Long-Term Care Policy

Assessing Individual Long-Term Care Needs

Working With a Financial Advisor or Insurance Agent

Comparing Policy Options and Quotes

Reviewing Policy Terms and Conditions Before Purchase

Conclusion

Hybrid Long-Term Care Policies FAQs

A hybrid long-term care policy is a type of insurance policy that combines long-term care coverage with life insurance or an annuity. These policies provide benefits for long-term care if you need it, and if you do not, the policy provides a death benefit or a return of premium.

Hybrid long-term care policies work by allowing you to use a portion of your death benefit or annuity for long-term care expenses. If you do not use the long-term care benefits, your beneficiaries will receive the full death benefit or the annuity value. These policies also typically have a return of premium feature that allows you to get back a portion of your premiums if you cancel the policy.

The benefits of a hybrid long-term care policy include the flexibility of having both long-term care and life insurance coverage in one policy, the ability to use the policy for long-term care expenses without depleting your retirement savings, and the potential to receive a death benefit if long-term care is not needed.

Hybrid long-term care policies can be more expensive than traditional long-term care insurance policies because they provide more coverage and have additional features, such as a return of premium option. However, the cost may be worth it for some individuals who want the added flexibility and protection.

A hybrid long-term care policy may be a good option for individuals who want the flexibility of having both long-term care and life insurance coverage, have a high net worth and want to protect their assets from long-term care expenses, or have concerns about paying for long-term care out of pocket. It's important to speak with a financial advisor or insurance professional to determine if a hybrid long-term care policy is the right choice for your individual needs and financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.