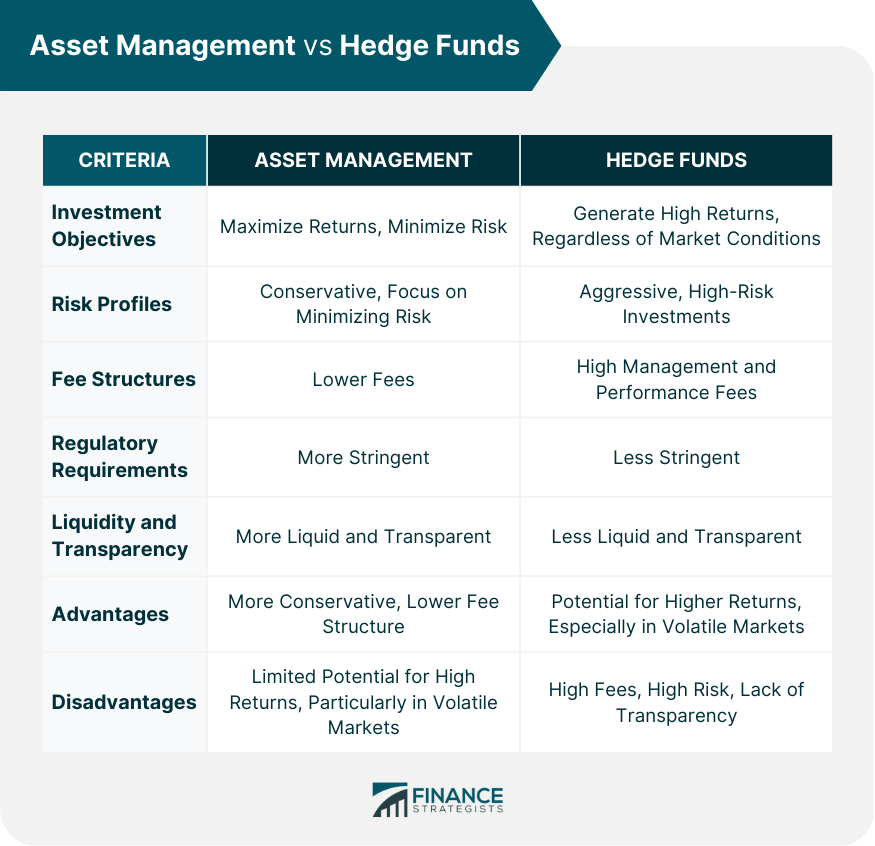

Asset management and hedge funds are two financial strategies that have become increasingly popular in recent years. Both strategies are used by individuals and institutions to invest their money in a diverse range of assets, such as stocks, bonds, real estate, and commodities. While there are some similarities between the two, there are also some important differences that investors should be aware of. Asset management is the professional management of assets on behalf of investors. This can include a wide range of financial instruments, including stocks, bonds, and other securities. The main objective of asset management is to maximize returns while minimizing risk. Asset managers use a variety of strategies to achieve these goals. Hedge funds, on the other hand, are a type of investment fund that is typically only available to accredited investors. They are known for their aggressive investment strategies and high fees. Hedge funds can invest in a wide range of assets, including stocks, bonds, derivatives, and currencies. The main objective of hedge funds is to generate high returns, regardless of market conditions. Hedge funds use a variety of strategies, such as short selling, leverage, and derivatives. Asset management is the professional management of assets on behalf of investors. Asset managers can manage a wide range of financial instruments, including stocks, bonds, and other securities. The main objective of asset management is to maximize returns while minimizing risk. Asset managers use a variety of strategies, including diversification, active management, and risk management, to achieve these goals. Diversification involves investing in a range of different assets to reduce risk. Active management involves actively managing a portfolio to achieve higher returns, and risk management involves managing risk through hedging and portfolio optimization. Hedge funds are an investment fund category accessible mainly to accredited investors. They are popular for their high-risk investment strategies and expensive fees. They have the flexibility to invest in various assets, such as bonds, stocks, derivatives, and currencies. The main objective of hedge funds is to generate high returns, regardless of market conditions. Hedge funds use a variety of strategies to achieve their investment objectives. Some common strategies include short selling, which involves betting that the price of a stock will fall, leverage, which involves borrowing money to increase the size of a position, and derivatives, which are financial instruments that derive their value from an underlying asset. While both asset management and hedge funds involve the management of assets on behalf of investors, there are some important differences between the two. Some of the key differences between asset management and hedge funds include: The main objective of asset management is to maximize returns while minimizing risk. In contrast, the main objective of hedge funds is to generate high returns, regardless of market conditions. This means that hedge funds may take on more risk in order to achieve their investment objectives. Asset management typically involves a more conservative approach to investing, with a focus on minimizing risk. Hedge funds, on the other hand, are known for their aggressive investment strategies and high-risk investments. Asset management typically involves lower fees than hedge funds. This is because hedge funds often charge high management fees and performance fees, which can significantly eat into investment returns. Typically asset management is subject to more stringent regulatory requirements than hedge funds. This is because asset management involves managing assets on behalf of retail investors, who are typically considered to be more vulnerable to financial risks than accredited investors. Asset management is more liquid and transparent than hedge funds. Assets managed by asset managers are typically held in publicly traded markets, while hedge funds often invest in private markets and may have restrictions on when investors can withdraw their funds. When comparing the two, asset management has the advantage of being more conservative and having a lower fee structure than hedge funds. Hedge funds, on the other hand, have the potential to generate higher returns, particularly in volatile markets. Asset management may have limited potential for high returns, particularly in volatile markets. Hedge funds, on the other hand, are associated with high fees, high risk, and a lack of transparency. When choosing between asset management and hedge funds, there are several factors that investors should consider. Some of these factors include: Investors should consider their investment goals and strategies when deciding between asset management and hedge funds. If they are looking for a conservative investment approach with lower risk and lower fees, asset management may be a better option. If they are looking for the potential for high returns and are willing to take on more risk and higher fees, hedge funds may be a better option. If they have a low risk tolerance and a longer investment horizon, asset management may be a better option. If they have a high risk tolerance and a shorter investment horizon, hedge funds may be a better option. Finally investors should consider the fees and regulatory requirements associated with each investment strategy. Asset management typically has lower fees and more stringent regulatory requirements than hedge funds. Asset management and hedge funds are two financial strategies that can be used to manage assets on behalf of investors. While both strategies have their advantages and disadvantages, there are some important differences between the two. They differ in several key areas. Asset management aims to maximize returns while minimizing risk, while hedge funds aim to generate high returns regardless of market conditions. Asset management takes a conservative approach to investing. While hedge funds are known for their aggressive investment strategies and high-risk investments. Asset management involves lower fees and more stringent regulatory requirements than hedge funds, and is more liquid and transparent. Hedge funds, on the other hand, have the potential for higher returns, especially in volatile markets, but are associated with high fees, high risk, and a lack of transparency. Investors should carefully consider their investment goals, risk tolerance, and fees when choosing between asset management and hedge funds. They should also be aware of the regulatory requirements associated with each strategy and the potential risks involved. Ultimately, investors may find that a combination of both asset management and hedge funds may be the most effective approach to achieving their investment goals. Therefore, it is highly recommended that investors seek professional wealth management services to get tailored advice that fits their financial goals and risk tolerance.Overview of Asset Management vs Hedge Fund

Asset Management: Key Features and Strategies

Hedge Funds: Key Features and Strategies

Differences Between Asset Management and Hedge Funds

Investment Objectives

Risk Profiles

Fee Structures

Regulatory Requirements

Liquidity and Transparency

Advantages

Disadvantages

Factors to Consider When Choosing Between Asset Management and Hedge Funds

Investment Strategies and Goals

Risk Tolerance and Investment Horizon

Fees and Regulatory Requirements

The Bottom Line

Asset Management vs Hedge Fund FAQs

The main difference between asset management and hedge funds is their investment objectives. Asset management aims to maximize returns while minimizing risk, while hedge funds aim to generate high returns regardless of market conditions.

Asset management has the advantage of being more conservative and having a lower fee structure compared to hedge funds. It is also typically more liquid and transparent.

Hedge funds are associated with high fees, high risk, and a lack of transparency compared to asset management. They may also have limited potential for high returns, particularly in volatile markets.

Investors should consider their investment strategies and goals, risk tolerance, and regulatory requirements when choosing between asset management and hedge funds. They should also consider fees and liquidity and transparency.

Yes, investors can combine asset management and hedge funds in their investment portfolios to achieve a balance between conservative and aggressive investment strategies. However, they should carefully consider the risks and fees associated with each strategy.