A Spousal IRA is a type of individual retirement account that allows a married couple to contribute to an IRA on behalf of the non-working spouse. This type of IRA is designed to provide retirement savings options for individuals who do not earn an income or earn an income that is below the IRA contribution limit. Contributions to a Spousal IRA are made with after-tax dollars, and the funds in the account grow tax-deferred until they are withdrawn during retirement. The contribution limits for a Spousal IRA are the same as for a traditional or Roth IRA, with a maximum contribution amount set by the IRS each year. Spousal IRAs can provide a valuable source of retirement income for couples who may not have access to other retirement savings options. There are two main types of Spousal IRAs: Traditional and Roth. Each type has its own tax benefits, contribution rules, and withdrawal regulations. A Traditional Spousal IRA allows the working spouse to make tax-deductible contributions on behalf of the non-working spouse. The contributions grow tax-deferred, which means taxes are paid only upon withdrawal. Tax-Deductible Contributions: Contributions to a Traditional Spousal IRA may be tax-deductible, depending on the couple's modified adjusted gross income (MAGI) and whether the working spouse participates in an employer-sponsored retirement plan. Tax-Deferred Growth: Investments in a Traditional Spousal IRA grow tax-deferred, meaning taxes are not due until withdrawals are made. Withdrawal Rules and Taxes: Withdrawals from a Traditional Spousal IRA are generally subject to income tax. Additionally, a 10% early withdrawal penalty may apply if withdrawals are made before age 59½, with some exceptions. A Roth Spousal IRA allows for non-deductible contributions, which grow tax-free and can be withdrawn tax-free under certain conditions. Non-deductible Contributions: Contributions to a Roth Spousal IRA are not tax-deductible. Tax-free growth and withdrawals: Investments in a Roth Spousal IRA grow tax-free, and qualified withdrawals are also tax-free. Withdrawal Rules and Taxes: Qualified withdrawals from a Roth Spousal IRA are tax-free, provided that the account has been open for at least five years, and the account holder is at least 59½ years old or meets other qualifying criteria. For 2024, the annual contribution limit for a Spousal IRA is $7,000, or $8,000 for those aged 50 or older, which includes catch-up contributions. There is no age limit for contributions. You can contribute to your IRA for as long as you want if one spouse generates earned income. Income limitations apply to both deductible contributions to a Traditional Spousal IRA and contributions to a Roth Spousal IRA. These limitations are based on the couple's MAGI and can change annually. Individuals aged 50 or older can make additional catch-up contributions of $1,000 per year to their Spousal IRA. Required Minimum Distributions (RMDs): Account holders must begin taking RMDs from their Traditional Spousal IRA by April 1st of the year following the year in which they turn 73. Failure to take RMDs can result in a 50% excise tax on the amount not distributed as required. Early Withdrawal Penalties: Withdrawals made before the age of 59½ may be subject to a 10% early withdrawal penalty, in addition to income taxes, unless specific exceptions apply. Tax Implications: Withdrawals from a Traditional Spousal IRA are generally subject to income tax at the account holder's ordinary income tax rate. Qualified Distributions: Qualified withdrawals from a Roth Spousal IRA are tax-free and penalty-free, provided the account has been open for at least five years and the account holder is at least 59½ years old or meets other qualifying criteria. Early Withdrawal Penalties: Non-qualified withdrawals made before the age of 59½ may be subject to a 10% early withdrawal penalty on the earnings portion, in addition to income taxes, unless specific exceptions apply. Tax Implications: Qualified withdrawals from a Roth Spousal IRA are not subject to income tax. Properly designating beneficiaries for a Spousal IRA is crucial for ensuring a smooth transfer of assets upon the account holder's death. The rules for inheriting a Spousal IRA depend on the relationship between the beneficiary and the deceased account holder. Spousal beneficiaries have several options for handling an inherited Spousal IRA, including treating the IRA as their own, transferring assets to their own IRA, or taking required distributions. Non-spousal beneficiaries typically have fewer options, such as taking a lump-sum distribution or transferring assets to an inherited IRA. Retirement Savings for Non-Working Spouses: Spousal IRAs allow non-working spouses to save for retirement, even without earned income. Tax Benefits: Spousal IRAs offer various tax benefits, depending on the type of account. Estate Planning Benefits: Properly designated beneficiaries can inherit Spousal IRA assets, providing financial support for loved ones. Limited Investment Choices: Spousal IRAs may have limited investment options compared to employer-sponsored retirement plans. Potential Tax Consequences: Withdrawals from Traditional Spousal IRAs are subject to income tax, and early withdrawals from either type of Spousal IRA may result in penalties. Required Minimum Distributions for Traditional IRAs: Traditional Spousal IRA account holders must take RMDs, which can affect their tax planning. A Spousal IRA is an important financial tool that allows non-working spouses to save for retirement and benefit from various tax advantages. Understanding the differences between Traditional and Roth Spousal IRAs, as well as the rules and regulations surrounding contributions, withdrawals, and inheritance, is crucial for maximizing the benefits of these accounts. As with any financial decision, it's essential to consult with a financial professional to determine the best approach to retirement planning for both spouses and ensure that their financial goals are met.Definition of Spousal IRA

Types of Spousal IRA

Traditional Spousal IRA

Roth Spousal IRA

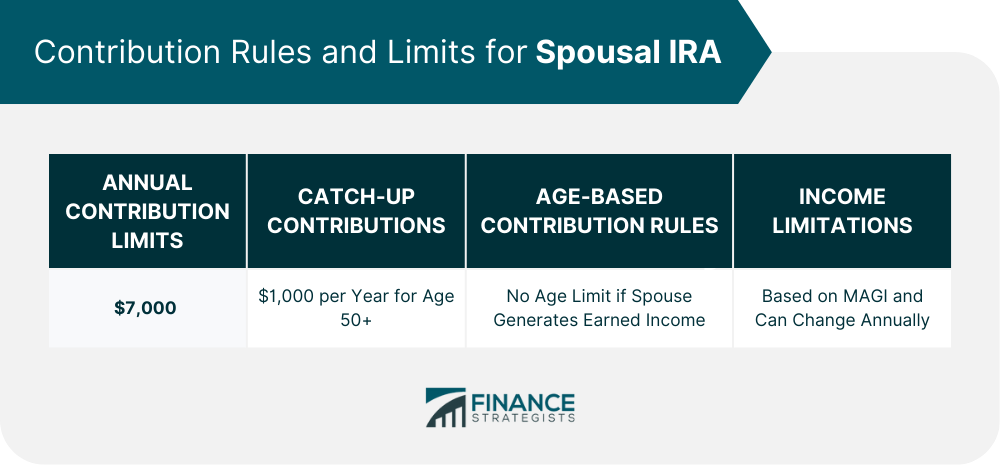

Contribution Rules and Limits

Annual Contribution Limits

Age-Based Contribution Rules

Income Limitations

Catch-up Contributions

Withdrawal Rules and Penalties

Traditional Spousal IRA

Roth Spousal IRA

Beneficiary Designations and Inheritance

Importance of Beneficiary Designations

Inheriting a Spousal IRA

Spousal and Non-spousal Inheritance Options

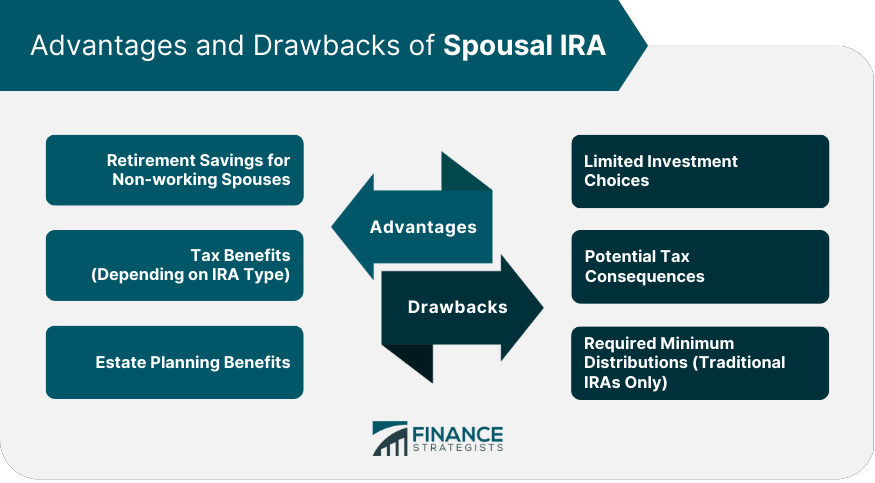

Advantages and Drawbacks of Spousal IRA

Advantages

Drawbacks

The Bottom Line

Spousal IRA FAQs

A Spousal IRA is designed to help non-working spouses save for retirement by allowing their working spouse to contribute to an IRA on their behalf, thereby providing the non-working spouse with the opportunity to build retirement savings and benefit from tax advantages.

The main differences between a Traditional Spousal IRA and a Roth Spousal IRA are in the tax treatment of contributions and withdrawals. Traditional Spousal IRAs allow for tax-deductible contributions and tax-deferred growth, while withdrawals are taxed as ordinary income. Roth Spousal IRAs have non-deductible contributions but offer tax-free growth and qualified withdrawals.

To contribute to a Spousal IRA, you must be married and file a joint tax return. The working spouse's earned income must be sufficient to cover the contributions made to both the working spouse's IRA and the non-working spouse's Spousal IRA.

Yes, early withdrawals from a Spousal IRA, made before the account holder reaches age 59½, may be subject to a 10% penalty. Additionally, withdrawals from a Traditional Spousal IRA are subject to income tax. However, there are some exceptions to the penalty, such as for qualified education expenses, first-time home purchases, or certain medical expenses.

Yes, you can contribute to a Spousal IRA even if you have a retirement plan through your employer, such as a 401(k). However, your eligibility for tax-deductible contributions to a Traditional Spousal IRA may be subject to income limitations if you or your spouse participate in an employer-sponsored retirement plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.