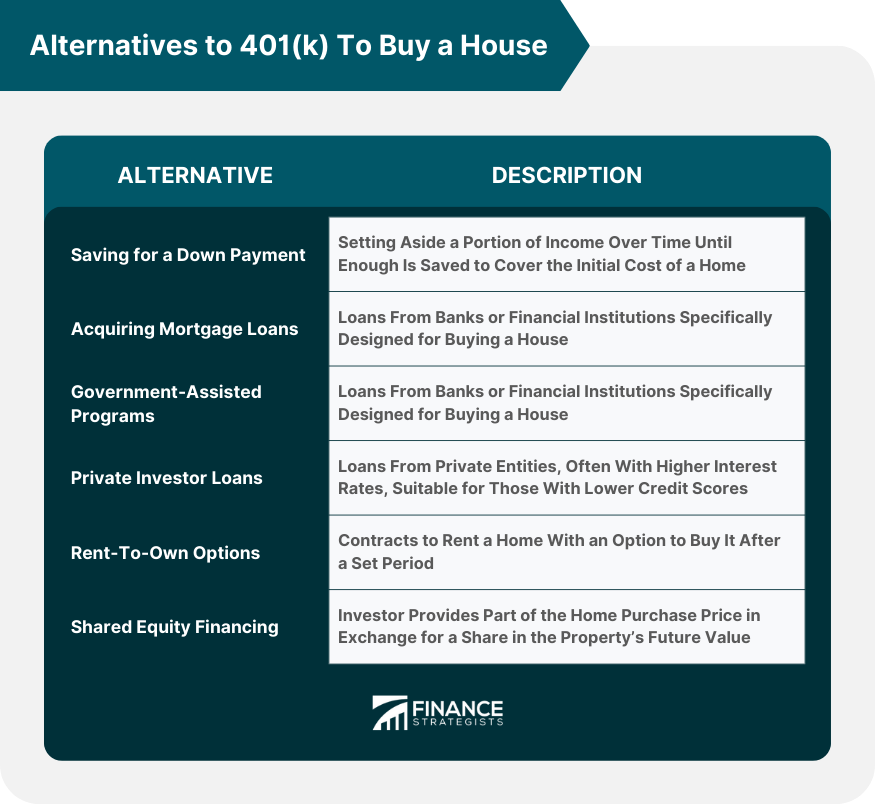

Alternatives to using your 401(k) to buy a house often provide more financial flexibility and security. These alternatives include saving for a down payment, which involves setting aside funds over time until you have enough for the upfront cost of a home. Acquiring mortgage loans from banks or other financial institutions is another option, spreading the cost over many years. Government-assisted programs aim to make homeownership more accessible by offering lower down payments and interest rates. Private investor loans and rent-to-own options can also be suitable for those with lower credit scores. Finally, shared equity financing allows an investor to share the home's purchase price, reducing initial costs and the mortgage loan size, in exchange for a stake in the property's future value. Before diving into the alternatives, it's essential to understand the basics of using your 401(k) for homeownership. Your 401(k) is primarily a retirement savings plan, but certain circumstances may allow you to withdraw funds for significant life events, such as buying a home. However, early withdrawal often comes with penalties. For instance, if you're under 59 ½ years old, you may have to pay a 10% penalty in addition to regular income tax on the amount withdrawn. Additionally, using your 401(k) for a home purchase can significantly impact your retirement savings, potentially leaving you with less income during your retirement years. A common alternative to using your 401(k) for home buying is saving for a down payment. This strategy involves setting aside a portion of your income over time until you have enough to cover the initial cost of a home. It may take time, but it doesn't risk your retirement savings and could lead to lower mortgage payments. Mortgage loans are another alternative. These are loans from banks or other financial institutions specifically designed for buying a house. While interest rates and terms vary, this option can spread the cost of a home over many years, making it more affordable upfront. Government-assisted programs are also viable alternatives. These programs aim to make homeownership more accessible to individuals who may not qualify for traditional mortgage loans. They may offer lower down payments, lower interest rates, or both. Private investor loans are another option. These are loans from private entities, such as personal investors or investment companies. While they may have higher interest rates than traditional mortgage loans, they can be a good option for those with lower credit scores. Rent-to-own options are contracts where you rent a home with the option to buy it after a set period. Part of your rent may go toward the purchase price of the house. It can be a good option if you're not yet ready to buy but plan to in the future. In shared equity financing, an investor provides a portion of the home purchase price in exchange for a share in the property's future value. This strategy can reduce your initial costs and mortgage loan size, but you'll have to share any appreciation in your home's value with the investor. This strategy allows you to retain your retirement savings, leading to more financial security in your later years. Additionally, these alternatives often offer lower interest rates than a 401(k) loan, making them more cost-effective for financing a home purchase, especially if you have a good credit score. Beyond the traditional 401(k) loan, exploring other alternatives provides you with a broader variety of options for financing a home purchase. For instance, opting for a mortgage can open up a range of mortgage rates that could be considerably lower than the interest rates associated with a 401(k) loan, ultimately providing more flexibility and control over your financial future. If you have a low credit score, it can be challenging to secure a mortgage loan with favorable terms. For example, private investor loans generally have higher interest rates than traditional mortgage loans. Moreover, these options could have long-term financial implications, like a longer mortgage term, which means you could be paying off your home for more years. If the property value dramatically increases, you'll be sharing a significant portion of that appreciation with the investor. When choosing an alternative to using your 401(k) to buy a house, it's crucial to evaluate your financial situation. Understand your income, expenses, and how much you can comfortably afford to put towards homeownership without risking your retirement or financial stability. It's also important to weigh the pros and cons of each alternative. Understand the implications of each choice, including potential tax impacts and the role of home equity and market value in your decision. Successfully navigating these alternatives requires strategic planning. Starting early with saving can build a substantial down payment over time, reducing the amount you need to borrow. It is also crucial, as it affects your ability to secure a mortgage loan and influences the terms of the loan. You should also explore various financing options to find the one that best suits your needs and circumstances. It is also beneficial as it gives you a clear idea of your budget, making house hunting easier. Lastly, always consider the long-term implications of your choice, ensuring it aligns with your financial goals and capabilities. Alternatives to using your 401(k) to buy a house offer greater financial flexibility and reduce potential impacts on your retirement savings. These alternatives encompass strategies like saving for a down payment, obtaining a mortgage loan, using government programs, getting private investor loans, considering rent-to-own options, and employing shared equity financing. Each option comes with its advantages and challenges, making it essential to consider your financial situation, goals, and risk tolerance. Whether you're building your credit, saving for a down payment, or exploring various financing options, the journey to homeownership is a significant endeavor. Your path should align with your long-term financial objectives, ensuring that your dream home doesn't come at the cost of your financial security or retirement comfort. Exploring these alternatives may provide a more sustainable path to homeownership, fitting your needs better than dipping into your 401(k).What Are the Alternatives Used in 401(k) To Buy a House?

Understanding the Mechanics of 401(k) to Buy a House

How Alternatives Used in 401(k) to Buy a House Work

Saving for a Down Payment

Acquiring Mortgage Loans

Government-Assisted Programs

Private Investor Loans

Rent-to-Own Options

Shared Equity Financing

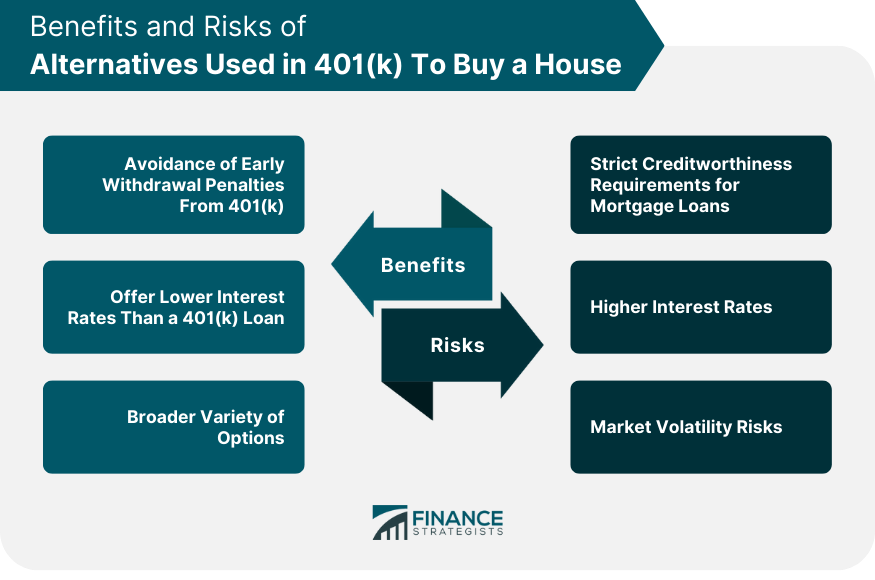

Benefits of Using 401(k) Alternatives to Buy a House

Avoidance of Early Withdrawal Penalties From 401(k)

Offer Lower Interest Rates Than a 401(k) Loan

Broader Variety of Options

Risks of Using 401(k) Alternatives to Buy a House

Strict Creditworthiness Requirements for Mortgage Loans

Higher Interest Rates

Market Volatility Risks

Considerations When Choosing an Alternative to Using Your 401(k) to Buy a House

Strategies Alternatives of 401(k) to Buy a House

Building and Maintaining Good Credit

Getting Pre-approved for a Loan

Conclusion

Alternatives to Using Your 401(k) To Buy a House FAQs

Common alternatives to using your 401(k) to buy a house include saving for a down payment, acquiring a mortgage loan, taking advantage of government-assisted programs, securing private investor loans, exploring rent-to-own options, and considering shared equity financing.

Considering alternatives to using your 401(k) to buy a house can help you avoid early withdrawal penalties, preserve your retirement savings, potentially access lower interest rates, and provide a variety of options that can suit different financial situations and preferences.

The downsides can include stringent creditworthiness requirements, higher interest rates for some options, potential long-term financial impact, and market volatility risks, especially for options like shared equity financing.

You should consider your financial situation, the pros and cons of each alternative, the potential tax implications, and the role of home equity and market value in your decision. It's also crucial to consider the long-term implications of each alternative.

Yes, these strategies include starting to save early, building and maintaining good credit, exploring various financing options, getting pre-approved for a loan, and considering the long-term implications of each choice

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.