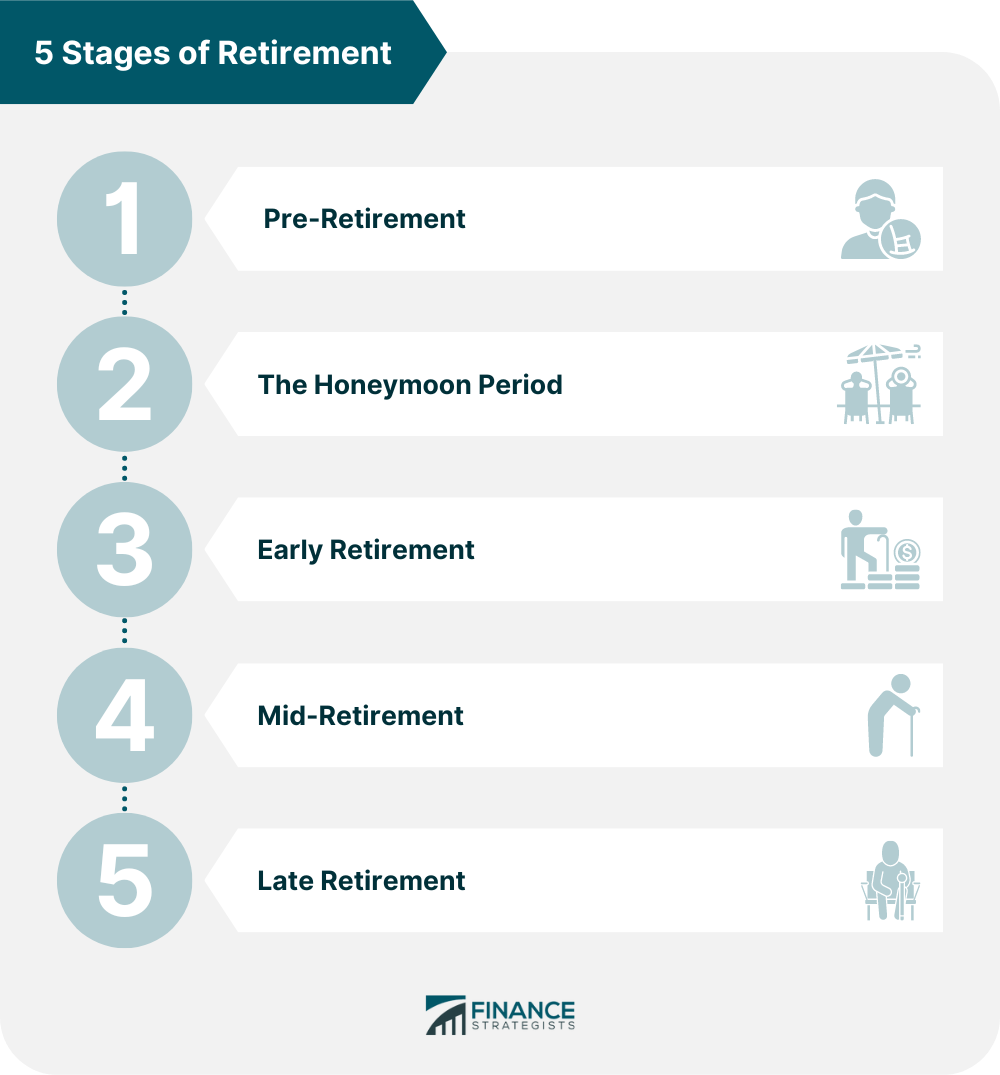

The average retirement age for current retirees is 62, which coincides with the earliest age when individuals can start to claim retirement benefits from Social Security. This average is estimated to rise to 64 for current workers. The average retirement savings for workers aged 35 to 44 has been reported at $97,000. In general, women have fewer retirement savings, with an average of $57,000 compared to the average of $118,000 saved by men. Some costs associated with a comfortably supported retirement tend to increase. For example, average healthcare expenses increased from $4,762 to $6,668 when workers transitioned into retirement. For various reasons, more than half of all workers, or 55%, now plan on continuing their occupations even after reaching the necessary retirement age. These reasons include the desire to stay active and the continued reliance on working as a primary source of income. Regardless of the age at which you plan to retire or the activities you plan to engage in, retirement planning is an essential step that everyone must undergo. Retirement stages provide an essential guide to help individuals plan for their retirement. There are five stages: pre-retirement; the honeymoon period; early retirement; mid-retirement; and late retirement. Taking the time to understand each stage ensures that retirees will be ready for the challenges ahead and have the means to make the most out of their post-retirement years. For example, individuals can start making more conservative investments when they enter their pre-retirement years and learn how to budget their savings during the honeymoon period. Pre-retirement is the final 10 to 15 years leading up to retirement. It can be a crucial time for making sure your retirement accounts are properly prepared. It is important to remember that you can continue contributing to tax-advantaged plans, like a Health Savings Account (HSA). With an HSA, you make penalty-free withdrawals after age 65 - making it a viable asset when you want to start withdrawing from your retirement savings. Furthermore, these HSAs are great supplementary devices to a 401(k) if you have already contributed your maximum amount into one. So, use this secure phase leading up to your retirement wisely and consider putting money into an HSA. Researching Social Security during retirement can significantly benefit your budget and long-term finances. Knowing when you will start receiving payouts, how much money you will earn, and how it will factor into your overall budget is key to a successful retirement plan. Pre-retirement planning goes far beyond saving enough money to live on. Medicare is vital because healthcare expenses can quickly add up. Knowing your options in terms of healthcare coverage will go a long way toward ensuring your peace of mind when entering your retirement. The period immediately following retirement is often a thrilling and liberating experience for those who have worked their entire lives for it. Retirees feel an amazing sense of freedom when they are no longer tethered to the routine of a job. From picking up new hobbies and traveling the world to spending quality time with family and friends, retirees have countless possibilities during this period. For anyone looking forward to retirement all their life, these golden years can be an incredible adventure full of excitement. As much as retirement can feel like a time to indulge and reward yourself after a long career, it is important to continue to live responsibly and within your means. This is particularly true in the early stage of retirement when meeting your financial goals is essential as they form the benchmark for how well-prepared you are for the remainder of retirement. However, if you find yourself short in this retirement stage, adjust your budget accordingly so that you are confident you will have enough throughout the later stages. Downsizing during the early retirement period may be necessary to ensure a comfortable lifestyle for yourself. This can include moving into a smaller home or selling off secondary vehicles and luxury items that are no longer feasible for a retired individual. Though this may open up opportunities for extra financial freedom, you should be prepared for the psychological transition from worker to retiree. Feelings of disorientation, purposelessness and depression are common experiences among retirees who are suddenly yanked away from their full-time positions. Building a routine to anchor your new life to minimize the shock is important. Involvement in activities like community volunteering or even part-time positions can help sustain a comfortable lifestyle and ensure you get the most out of your retirement years. Retirees who surpass the age of 70 are considered to be in the mid-retirement stage. In reaching this age, you should be able to strike a balance between enjoying your free time and budgeting to maintain your financial stability. In mid-retirement, it is also essential to stay physically active and ensure that your long-term needs are thoughtfully considered. End-of-life care insurance is undoubtedly one priority that should be addressed. It can provide additional peace of mind as well as significant financial relief if health deteriorates in the later years. Keeping this in mind can help retirees plan for the future and avoid a tremendous burden on family members when the time comes. As people live longer and healthier lives, the need for part-time aid or round-the-clock care at some point during one's life is increasing. It is important to start preparing for the curveballs that may come our way earlier on in life rather than when it is too late. Updating a will and power of attorney, finalizing end-of-life care plans, and preparing final expense insurance policies are key steps in the planning process. While this certainly is not a fun topic to think about, financial and emotional preparation can bring great peace of mind. Use the post-retirement period to get your family in sync with what you would like for your care and end-of-life wishes. It is important to have detailed conversations about topics such as the power of attorney and last will and testament. Retirement is a major life transition that can be made smoother with proper planning and understanding of the different stages. These stages are pre-retirement, the honeymoon phase, early retirement, mid-retirement, and late retirement. During pre-retirement, individuals should create a budget, determine income sources in retirement, review insurance options, and identify essential documents. The honeymoon period marks the start of retirement. In this stage, individuals need to budget for their needs, even as they explore their post-retirement interests. Early retirement is when individuals adapt to the transition, usually through volunteering or taking on part-time jobs. Around mid-retirement, individuals are usually more well-adjusted and are encouraged to stay physically active, mentally stimulated, and socially connected. Finally, the last stage, late retirement, involves preparations for end-of-life care. By understanding these five stages of retirement, individuals can better prepare for their golden years.Overview of Retirement in the U.S.

Understanding the Retirement Stages

Stage 1: Pre-Retirement

Stage 2: The Honeymoon Period

Stage 3: Early Retirement

Stage 4: Mid-Retirement

Stage 5: Late Retirement

Final Thoughts

5 Stages of Retirement FAQs

The stages of retirement include pre-retirement, the honeymoon period, early retirement, mid-retirement, and late retirement.

The exact amount of money an individual needs to save for retirement depends on their goals and lifestyle. For example, some individuals aim to have ten times their current annual salary saved by reaching retirement age.

The most common retirement accounts include 401(k)s, Individual Retirement Accounts (IRAs), Health Savings Accounts (HSA), and annuities.

Saving for retirement early allows individuals to take advantage of compounding interest and build wealth over time. It also helps reduce stress in pre-retirement stages and provides financial security when entering post-retirement life.

The average retirement age for current retirees is 62, which coincides with the earliest age when individuals can start to claim retirement benefits from Social Security. This average is estimated to rise to 64 for current workers, although this can still vary depending on each individual’s circumstances and financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.