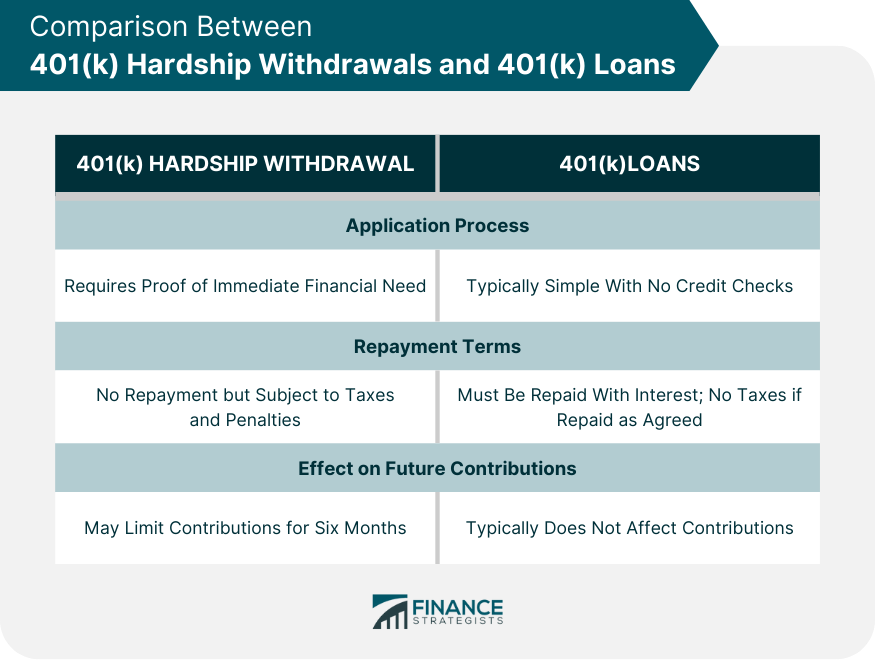

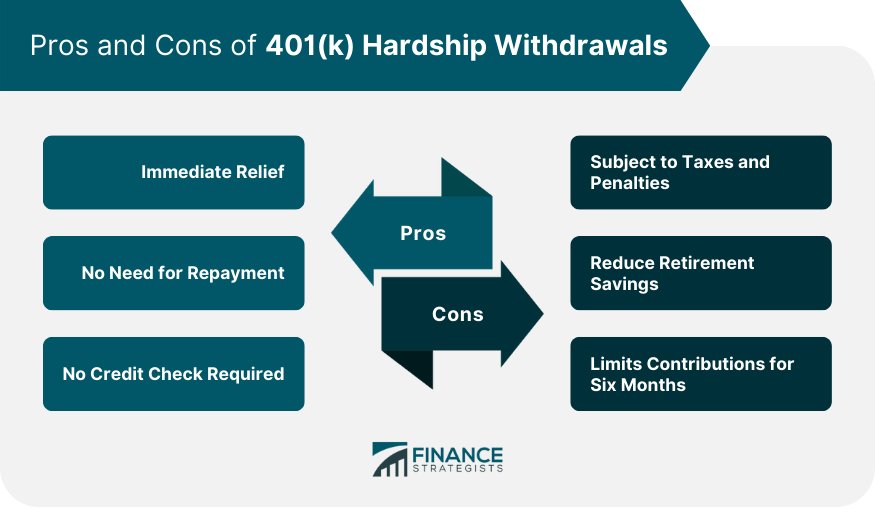

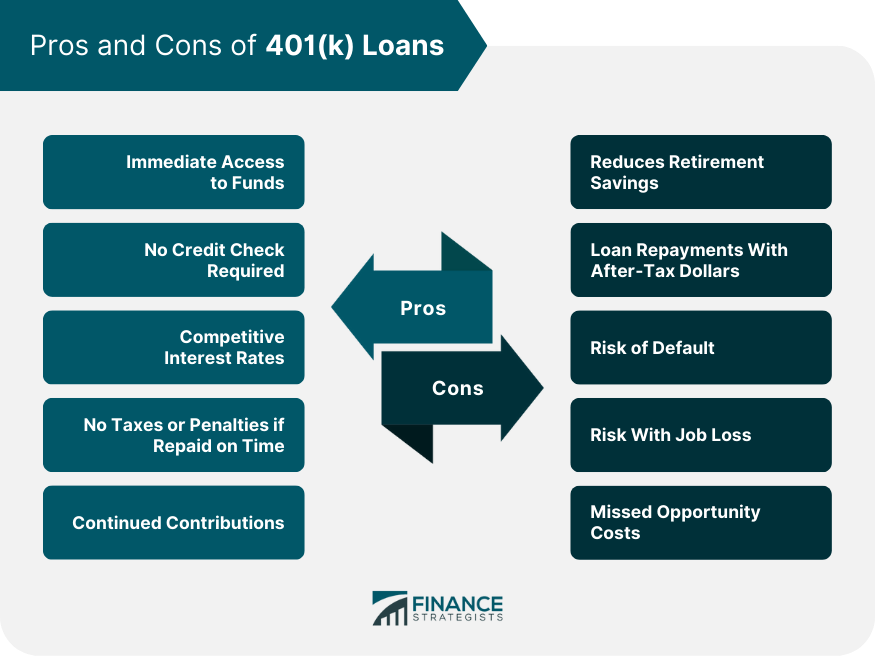

A 401(k) hardship withdrawal refers to the process of taking out funds from your 401(k) account due to immediate and severe financial need. These withdrawals, however, are subject to income tax, and additional penalties may apply if you're under 59½ years old. On the other hand, a 401(k) loan allows you to borrow money from your own retirement savings. You must repay it with interest within a specified timeframe, typically five years. Importantly, 401(k) loans aren't subjected to income tax or penalties provided they are repaid as agreed. Both methods are designed to provide financial relief but can impact your long-term retirement savings. Therefore, it's essential to consider all factors, including your immediate financial needs and potential tax implications before deciding between a 401(k) hardship withdrawal and a loan. The main purpose of both these financial tools is to provide access to funds when needed. They offer solutions during times of financial strain, such as significant medical expenses, purchase of a primary residence, or to prevent eviction or foreclosure. However, they should not be the first resort due to their impact on long-term retirement savings. When applying for a 401(k) hardship withdrawal, you need to provide documentation proving the immediate financial need. The plan administrator reviews the application and the evidence provided before granting the withdrawal. In contrast, applying for a 401(k) loan is typically easier. It often involves a simple process that doesn’t require credit checks or lengthy applications. Hardship withdrawals from your 401(k) do not need to be paid back. However, they are subject to income taxes and potential penalties. On the other hand, 401(k) loans must be repaid with interest within a specified timeframe. If the loan is not repaid as agreed, it may be considered a distribution, subjecting it to income taxes and potential penalties. Hardship withdrawals may limit your ability to make contributions to your 401(k) for six months, impacting your long-term retirement savings. Conversely, a 401(k) loan does not typically affect your ability to contribute to your 401(k). Regular contributions, along with loan repayments, can be automatically deducted from your paycheck. Immediate Relief: Hardship withdrawals provide access to your retirement savings when you're facing a severe financial strain. It could be due to unanticipated medical expenses, purchase of a primary home, tuition expenses, or to prevent eviction or foreclosure. No Need for Repayment: Unlike 401(k) loans, hardship withdrawals don't need to be repaid. This can be particularly beneficial if you're uncertain about your ability to repay within a specified timeframe. No Credit Check: To obtain a hardship withdrawal, you won't have to undergo a credit check. This makes it an accessible option for individuals with a poor credit score who may not qualify for other forms of financial assistance. Penalties and Taxes: When you take a hardship withdrawal, the withdrawn amount is subject to income tax. Plus, if you're under the age of 59½, you may also have to pay a 10% early withdrawal penalty, reducing the overall amount you receive. Impact on Retirement Savings: Taking a hardship withdrawal directly reduces your retirement savings. Contribution Restrictions: After taking a hardship withdrawal, you're generally not allowed to contribute to your 401(k) for six months. This pause further hampers your ability to rebuild your retirement savings. Immediate Access to Funds: Borrowing from your 401(k) can provide immediate liquidity in case of a financial crisis. The processing time is typically shorter than that for a conventional loan. No Credit Check Required: Unlike traditional loans, your credit score doesn't impact your ability to borrow against your 401(k). This makes it a viable option for individuals with poor credit history. Competitive Interest Rates: The interest rates on 401(k) loans are usually lower than those on credit cards or personal loans. Additionally, the interest paid goes back into your 401(k) account, essentially allowing you to pay interest to yourself. No Taxes or Penalties: As long as you repay the loan on time, there are no taxes or early withdrawal penalties involved. This is a significant advantage over taking a hardship withdrawal from your 401(k) plan. Continued Contributions: Typically, taking a loan doesn't affect your ability to continue making regular contributions to your 401(k) account. These contributions, along with loan repayments, can help rebuild your retirement savings. Impact on Retirement Savings: Taking out a 401(k) loan reduces the amount of money in your account, slowing down its growth and potentially delaying your retirement. Loan Repayments: Repayments for the loan are made with after-tax dollars, which means you're essentially paying taxes twice on the same amount of money. Risk of Default: If you're unable to repay the loan within the agreed timeframe, it could become a taxable distribution, subject to income tax and potential early withdrawal penalties. Job Loss Risks: If you leave or lose your job, the loan may be due much sooner than anticipated, often within 60 days. Failure to repay in that time frame will cause the loan to be treated as a distribution with potential taxes and penalties. Opportunity Costs: The money you borrow will miss out on any market gains, which could significantly impact the total size of your retirement fund. When determining which option is best, evaluate your current financial need. If the need is significant and other financial resources are not available, a hardship withdrawal might be considered. If the need is less significant or temporary, a 401(k) loan could be a more suitable choice. Each option comes with specific consequences, such as potential penalties, tax implications, and effects on retirement savings. Fully understanding these implications is crucial before making a decision. Taking funds from your 401(k) can significantly affect the compounding of your retirement savings. The less money in the account, the less there is to accrue interest, slowing the growth of your savings. Considering the complexities and long-term impacts of these financial decisions, consulting a financial advisor may be beneficial. They can help assess your financial situation and provide personalized advice on which option might be the best for you. A financial advisor can provide insight into the tax implications and potential penalties of each option. They can also help you understand how a 401(k) hardship withdrawal or loan could affect your retirement savings and timeline. Choosing between a 401(k) hardship withdrawal and a 401(k) loan is a complex decision that requires careful thought and consideration. Both options provide immediate access to funds but come with potential drawbacks, including the impact on your long-term retirement savings. The choice can also significantly affect your tax situation and may result in penalties if not handled correctly. It's essential to fully understand these implications and weigh your immediate financial needs against the long-term effects on your retirement savings and timeline. Considering these factors, it is crucial to consult a financial advisor when contemplating these options. They can provide personalized advice based on your financial situation, helping you make an informed decision that aligns with your current needs and long-term financial goals. Remember, it's your future financial stability at stake, so take the time to make a well-considered choice.401(k) Hardship Withdrawal vs 401(k) Loan: Overview

Purpose and Importance

How 401(k) Hardship Withdrawals and 401(k) Loans Work

Process of Applying for Each

Repayment Terms

Effect on Future Contributions

Pros and Cons of 401(k) Hardship Withdrawals

Pros

Cons

This means you have less money invested, which over time can significantly affect your retirement balance due to the missed opportunity for compound growth.

Pros and Cons of 401(k) Loans

Pros

Cons

Factors to Consider When Choosing Between a 401(k) Hardship Withdrawal vs a 401(k) Loan

Determining the Level of Financial Need

Understanding the Consequences of Each Option

Effect on Long-Term Retirement Savings

Importance of Seeking Financial Advice

When to Consult a Financial Advisor

How Advice Can Inform Decision-making

Conclusion

401(k) Hardship Withdrawal vs 401(k) Loan FAQs

A 401(k) hardship withdrawal refers to taking funds from your 401(k) due to immediate and heavy financial needs, subject to taxes and possible penalties if you're under 59½. It does not need to be repaid but could limit future contributions. A 401(k) loan is a loan taken against your 401(k) balance. It's not subject to taxes or penalties if repaid on time, typically within five years, and does not impact future contributions.

A 401(k) hardship withdrawal might be a better option when you have an immediate and heavy financial need that you can't meet with other resources, and you're prepared to deal with the potential tax consequences and early withdrawal penalties, if applicable. It's important to consider that a hardship withdrawal permanently reduces your retirement balance.

A 401(k) loan might be a better choice if you need immediate funds but also have the financial ability to repay the loan within the specified term. Since the loan is not subject to taxes or penalties when repaid on time, it can be less costly than a hardship withdrawal.

Both a 401(k) hardship withdrawal and a 401(k) loan can significantly impact your future retirement savings. Hardship withdrawals permanently reduce your retirement balance, while unpaid 401(k) loans can become distributions, reducing your retirement savings. Also, both options can affect the compound interest that your savings could have earned.

Yes, due to the complexity and long-term impacts of these financial decisions, it can be beneficial to consult a financial advisor. They can help assess your situation, explain the tax implications, potential penalties, and impacts on retirement savings, and help you make an informed decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.