A trust deed, also known as a deed of trust, is a legal document used in certain jurisdictions as an alternative to a mortgage. It serves as a means of securing a loan by transferring the legal title of a property to a trustee until the loan is fully repaid. The trustee holds the title on behalf of the beneficiary, typically the lender, while the borrower, known as the trustor, retains the equitable title and the right to use and occupy the property. The primary purpose of a trust deed is to provide security for a loan, ensuring that the lender can recover their investment if the borrower defaults on their loan payments. In this arrangement, the trustee acts as an intermediary, holding the legal title to the property until the debt is repaid. This setup allows for a more streamlined foreclosure process in the event of default, as the trustee has the authority to sell the property to recover the outstanding debt. Trust deeds play a significant role in financial transactions, particularly in real estate financing. They provide lenders with a secure means of protecting their investment, while borrowers benefit from the opportunity to access financing with potentially lower interest rates and more flexible terms. By offering an alternative to traditional mortgage financing, trust deeds contribute to a more diverse and competitive lending market. A mortgage trust deed is a type of trust deed used to secure a loan for the purchase or refinancing of real property. In this arrangement, the borrower transfers the legal title of the property to the trustee, who holds it as collateral on behalf of the lender. Once the loan is repaid, the legal title is transferred back to the borrower. A land trust deed is a legal document that transfers the title of a parcel of land to a trustee, who holds it for the benefit of one or more beneficiaries. Land trusts can be used for various purposes, including estate planning, privacy, and asset protection. In this type of trust deed, the beneficiaries may remain anonymous, and the trust can be structured to limit the liability associated with the land ownership.

An equipment trust deed is a legal document used to secure a loan for the purchase or leasing of equipment, such as machinery, vehicles, or other valuable assets. In this arrangement, the trustee holds the title to the equipment as collateral on behalf of the lender until the loan is repaid. This type of trust deed is commonly used in industries that require expensive equipment, such as construction, transportation, and manufacturing. An investment trust deed is a legal document that establishes an investment trust, a pooled investment vehicle that allows investors to collectively invest in a diversified portfolio of assets. The trust deed outlines the terms and conditions governing the trust's operation, including the roles and responsibilities of the trustee and the fund manager, as well as the rights and obligations of the investors. The trustor, also known as the borrower or grantor, is the party who transfers the legal title of the property to the trustee as security for a loan. The trustor retains the equitable title, allowing them to use and occupy the property during the loan term. The trustor is responsible for making timely loan payments and fulfilling any other obligations outlined in the trust deed. The trustee is a neutral third party who holds the legal title to the property on behalf of the beneficiary, typically the lender. The trustee's primary responsibility is to ensure that the terms of the trust deed are upheld and to act in the best interests of the beneficiary. In the event of default, the trustee has the authority to initiate the foreclosure process and sell the property to recover the outstanding debt. The beneficiary is usually the lender or investor who provides the loan secured by the trust deed. The beneficiary benefits from the security provided by the trust deed, which ensures that their investment is protected in the event of the borrower's default. Once the loan is fully repaid, the beneficiary releases the legal title back to the trustor, and the trust deed is terminated. The first step in creating a trust deed is drafting the trust agreement, which outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any other relevant provisions. Both the trustor and the beneficiary must agree to the terms of the trust agreement before the trust deed can be executed. Once the trust agreement is in place, the trustor receives the loan proceeds from the beneficiary, and the legal title to the property is transferred to the trustee. This transfer of title effectively "funds" the trust, providing the beneficiary with the security necessary to protect their investment. After the trust deed has been executed and the legal title has been transferred to the trustee, the trust deed must be recorded with the appropriate government office, such as the county recorder's office or the land registry. This public record ensures that the trust deed is legally enforceable and provides notice to any potential future buyers or creditors of the property. The trustor has the right to use and occupy the property during the loan term, as long as they fulfill their obligations under the trust deed. These obligations typically include making timely loan payments, maintaining the property, and paying property taxes and insurance premiums. Failure to meet these obligations may result in default and the initiation of the foreclosure process by the trustee. The trustee's primary responsibility is to ensure that the terms of the trust deed are upheld and to act in the best interests of the beneficiary. This may include monitoring the trustor's compliance with the trust deed terms and initiating the foreclosure process in the event of default. The trustee is also responsible for releasing the legal title back to the trustor once the loan is fully repaid. The beneficiary has the right to receive timely loan payments from the trustor and to enforce the terms of the trust deed in the event of default. The beneficiary is also obligated to release the legal title back to the trustor once the loan is fully repaid and to provide the trustor with a release or reconveyance document as evidence of the loan's satisfaction. Foreclosure is the legal process through which the trustee sells the property secured by the trust deed to recover the outstanding debt in the event of the trustor's default. The foreclosure process can be either judicial, requiring court intervention, or non-judicial, depending on the terms of the trust deed and the applicable state laws. In the event of default, the trustee must follow the prescribed foreclosure process, which typically involves providing notice to the trustor and other interested parties, conducting a public auction to sell the property, and distributing the sale proceeds to the beneficiary to satisfy the outstanding debt. Any remaining funds, after covering the foreclosure costs and the outstanding debt, are returned to the trustor. Foreclosure can have significant consequences for both the trustor and the beneficiary. For the trustor, foreclosure may result in the loss of their property, a negative impact on their credit score, and potential deficiency judgments if the sale proceeds do not cover the outstanding debt. For the beneficiary, foreclosure may result in the recovery of their investment, but the process can be lengthy and expensive, and there is no guarantee that the sale proceeds will fully satisfy the outstanding debt. One of the main advantages of trust deeds is that they provide a secure financing option for both borrowers and lenders. The trust deed ensures that the lender's investment is protected by the collateral of the property, while the borrower can access financing with potentially more favorable terms compared to unsecured loans. Trust deeds can be customized to suit the needs of both the borrower and the lender, allowing for flexibility in terms of repayment schedules, interest rates, and other loan provisions. This customization allows for a more tailored approach to financing, which can be beneficial for both parties involved. In some cases, trust deeds can offer tax advantages for the parties involved. For example, the interest paid on a trust deed loan may be tax-deductible for the borrower, while the lender may benefit from tax-deferred or tax-exempt income, depending on their jurisdiction and the specific circumstances of the loan. One drawback of trust deeds is that they may have limited transferability compared to traditional mortgages. Since the trustee holds the legal title to the property, transferring the loan to another borrower or refinancing the property can be more complicated and may require additional documentation and legal procedures. Trust deeds can also carry a higher risk of default compared to other types of secured loans. If the borrower fails to meet their obligations under the trust deed, the lender may be forced to initiate the foreclosure process to recover their investment, which can be costly and time-consuming. In some cases, trust deeds can be more expensive for borrowers than traditional mortgages. The costs associated with establishing and maintaining a trust deed, such as trustee fees and recording fees, may be higher than those associated with a mortgage, which could result in higher overall borrowing costs. A trust deed is a legal document used to secure a loan by transferring the legal title of a property to a trustee until the loan is repaid. Trust deeds serve various purposes, including securing loans for real estate, equipment, and investments. The parties involved in a trust deed are the trustor, trustee, and beneficiary, each with specific rights and obligations. There are advantages and disadvantages to using trust deeds in financial transactions. Some of the benefits include security for the lender, flexibility in loan terms, and potential tax advantages. However, trust deeds can also have drawbacks, such as limited transferability, high default risk, and potentially higher costs. By understanding the various aspects of trust deeds, borrowers and lenders can make informed decisions about whether a trust deed is the right financing option for their specific needs and circumstances.What Is a Trust Deed?

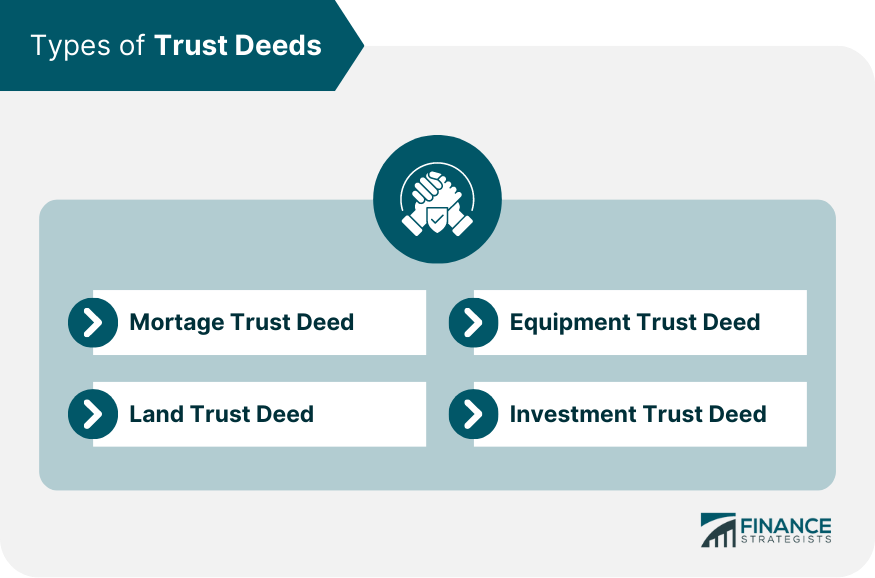

Types of Trust Deeds

Mortgage Trust Deed

Land Trust Deed

Equipment Trust Deed

Investment Trust Deed

Parties Involved in a Trust Deed

Trustor

Trustee

Beneficiary

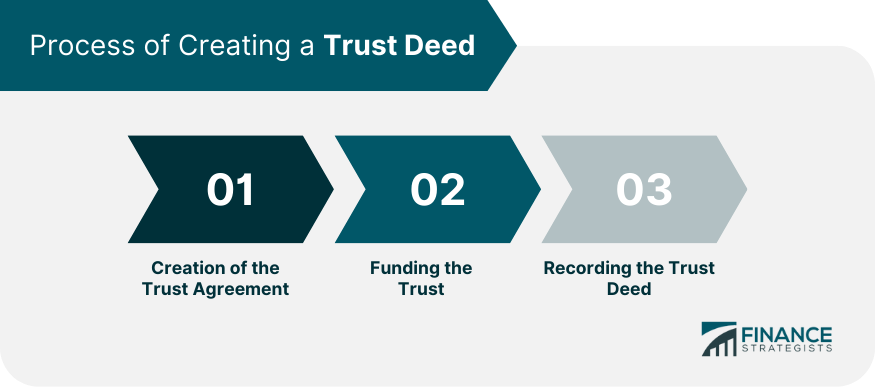

Process of Creating a Trust Deed

Creation of the Trust Agreement

Funding the Trust

Recording the Trust Deed

Rights and Obligations of Parties Involved in a Trust Deed

Trustor's Rights and Obligations

Trustee's Rights and Obligations

Beneficiary's Rights and Obligations

Foreclosure of a Trust Deed

Definition of Foreclosure

Process of Foreclosing a Trust Deed

Consequences of Foreclosing a Trust Deed

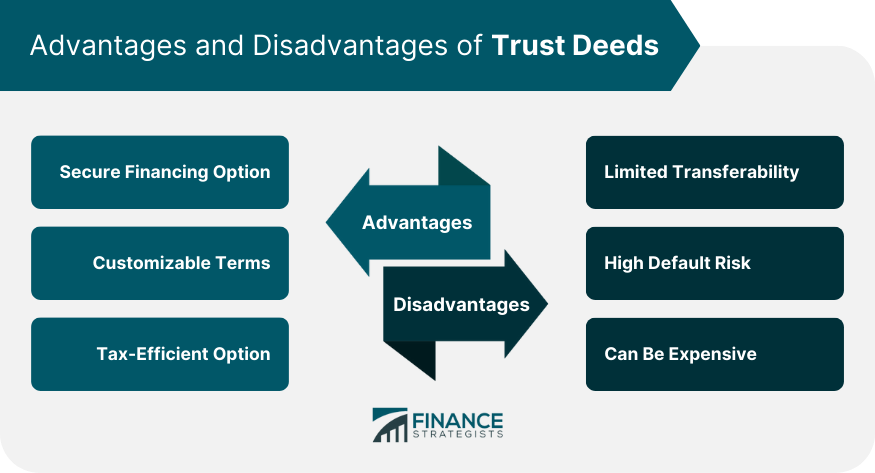

Advantages of Trust Deeds

Trust Deed as a Secure Financing Option

Trust Deed Can Be Customized

Trust Deed Can Be a Tax-Efficient Option

Disadvantages of Trust Deeds

Limited Transferability

High Default Risk

Trust Deed Can Be Expensive

Bottom Line

Trust Deed FAQs

A Trust Deed is a legal agreement where a property owner transfers the ownership of a property to a trustee who holds the property in trust for the benefit of a beneficiary.

A Trust Deed works by the property owner transferring the legal ownership of the property to a trustee, who holds the property in trust for the benefit of the beneficiary. The trustee has the power to manage and dispose of the property.

The types of Trust Deeds include Mortgage Trust Deed, Land Trust Deed, Equipment Trust Deed, and Investment Trust Deed. Each type of Trust Deed serves a specific purpose.

The process of creating a Trust Deed involves creating a trust agreement, funding the trust, and recording the Trust Deed. The Trust Deed must comply with legal requirements to be valid.

The advantages of a Trust Deed include a secure financing option, customized terms, and tax efficiency. Trust Deeds can be a useful tool for property owners looking to finance their property or restructure their finances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.