HomePath properties are homes repossessed by Fannie Mae due to foreclosures. Subsequently, they are listed for sale on the official HomePath website. A defining feature of these properties is the potential exemption from private mortgage insurance, a common requirement in other real estate transactions. Furthermore, their listing on an exclusive platform ensures a transparent buying process. HomePath properties are renowned for being more accessible to the average buyer. Often priced below market value, they can come with reduced down payment requirements. In addition, certain HomePath listings might qualify for distinct financing alternatives not available elsewhere. Plus, their typically lower prices can provide room for potential appreciation, making them a sound investment in the long run. Your credit score isn't just a number; it's your financial report card. A commendable score can open doors to better mortgage rates. For HomePath properties, it's crucial as it influences both your eligibility and the financing terms you're offered. Additionally, maintaining a healthy credit history could expedite the approval process, making the journey smoother. When it comes to HomePath properties, the down payment can differ from conventional property purchases. Potential buyers need to be well-informed about these specifics, ensuring they have the necessary funds at the ready. It's always a good idea to consult financial experts to understand the nuances and plan better. Not all properties listed by Fannie Mae are ripe for the picking. The property's current occupancy status can influence its eligibility for the HomePath program. Thus, understanding the property's history can provide insights into its current standing and potential issues. A property's condition plays a pivotal role. Its current state, combined with its valuation, can determine whether it's a viable HomePath contender or not. It's recommended to view properties in person when possible, providing a tangible understanding of its condition. Where a property stands geographically might impose certain restrictions. These location-bound criteria are essential to understand before diving into the buying process. Knowing the local real estate market trends can offer additional advantages when deciding on a property. Kickstart your endeavor by scouring the HomePath website. Regularly updated, this platform showcases properties spanning various states, offering a wide array of choices from condos to sprawling family homes. Setting alerts on desired property types or locations can help you stay ahead of other potential buyers. While going solo is an option, there's unparalleled value in seeking guidance from mortgage brokers when navigating HomePath properties. Their expertise can illuminate potential financing avenues and offer insights tailored to your financial situation. Moreover, they can assist in negotiating better terms, ensuring maximum savings. Each mortgage product is like a unique key designed for a specific door. Whether you lean towards traditional mortgages or the unique ones attached to HomePath properties, the right choice hinges on aligning with your financial profile and goals. Weighing the pros and cons of each product can result in more favorable terms and a seamless buying process. Gauge the Right Price: Assessing comparable properties and their recent sale prices can help determine a competitive bid for the HomePath property. Strategize the Timing: Timing your bid can be crucial; consider making an offer shortly after a property is listed to avoid heightened competition. Understand Bidding Nuances: Each property may have unique factors affecting its value; understanding these can provide a bidding edge. Observe Past Bid Results: Analyzing the outcomes of previous bids on similar properties can guide your current bidding strategy, ensuring it's aligned with market trends. The realm of HomePath properties isn't without its intricacies. Enlisting a real estate agent's expertise can smooth out potential bumps, ensuring you traverse the pathway with confidence. Their seasoned experience can also provide insights into property histories and neighborhood profiles. The HomePath online platform is your gateway to making and managing offers. Commence by setting up an account, your personal dashboard for all things related to your property hunt. This account also allows for easy communication with sellers, enhancing transparency. Post-offer, the real game begins. The platform is robust, allowing you to monitor your offers, assess competing bids, and revise your proposals if necessary. Regularly checking your account ensures you don't miss out on any updates or opportunities. For first-time homebuyers, the HomePath Ready Buyer Program shines brightly as a beacon. Offering a plethora of benefits, from reduced down payments to potential assistance with closing costs, this program is tailor-made to make the home-buying journey less daunting. Its eligibility criteria, however, are the gateway to these benefits: First-Time Homebuyer Status: The primary requirement is that the applicant must be a first-time homebuyer. This typically means that the buyer hasn't owned a property in the past three years. Completion of Online Course: Before making an offer, prospective buyers must complete an online home-buying education course and receive a completion certificate. Primary Residence Requirement: The property purchased through the program must serve as the buyer's primary residence. This means it can't be bought as an investment property or a second home. Financing With Public Funds: If the buyer is utilizing public funds for the purchase, they might still be eligible for this program. Agreement to Reside for Duration: The buyer must commit to living in the property for a specific duration, typically a year, to ensure it's not merely an investment ploy. Embarking on the HomePath Ready Buyer Program begins with an online home-buying course, laying the groundwork for the journey ahead. Prospective buyers must then prepare essential financial and identity documents, choose a suitable HomePath property, and submit an offer. Once the offer is accepted, the next phase involves a detailed loan application, primarily hinging on the previously prepared documents. Keeping abreast of any program updates is crucial to ensure a smooth process, culminating in the final step of closing the deal, where inspections are conducted, and property ownership is transferred. Conventional Mortgages: This is the most straightforward type of mortgage, not guaranteed by the federal government. They can be conforming (adhering to the loan limits set by Fannie Mae and Freddie Mac) or non-conforming. Federal Housing Administration (FHA) Loans: Guaranteed by the Federal Housing Administration (FHA), these loans cater primarily to first-time homebuyers, boasting lenient credit requirements and low down payments. VA Loans: For veterans, active-duty service members, and certain members of the National Guard or Reserves, the Department of Veterans Affairs offers these mortgages. They often come with competitive interest rates, no down payment, and no private mortgage insurance. USDA Loans: The U.S. Department of Agriculture backs these loans for rural homebuyers, often requiring no down payment and featuring competitive interest rates. Adjustable-Rate Mortgages (ARMs): Unlike fixed-rate mortgages, where interest remains constant, ARMs have interest rates that can change over time, depending on market conditions. They often start with lower rates but can fluctuate later. Interest-Only Mortgages: Here, borrowers pay only interest for a certain period, after which they'll start paying the principal. This structure offers low initial payments but can mean higher payments down the line. Balloon Mortgages: These have smaller initial payments, with a large "balloon" payment due at the end of the loan term. They're typically short-term and might be suitable for those planning to refinance or sell before the balloon payment comes due. Jumbo Mortgages: When you're eyeing a high-priced property exceeding the federal loan limits, jumbo mortgages come into play. They typically have stricter credit requirements and larger down payments. Loan Origination Fees: Lenders typically charge for processing, underwriting, and funding the loan. This fee can be a percentage of the loan amount or a flat charge. Appraisal Fees: Before granting a loan, lenders require a property appraisal to determine the home's value. This ensures the loan amount doesn't exceed the property's worth. Credit Report Fees: Lenders will access your credit report to evaluate your creditworthiness, and there's usually a fee attached to this. Escrow Fees: An escrow company, acting as a neutral third party, holds funds until the deal is closed. They charge for this service, ensuring that all financial conditions are met before transferring ownership. Title Search and Insurance: This involves a thorough search to ensure there are no liens against the property and provides insurance to protect against any unforeseen title disputes in the future. Survey Fees: In some cases, a survey of the property is required to determine its exact boundaries. Recording Fees: These are fees charged by the local recording office to officially record the change of ownership. Underwriting Fees: This is what lenders charge to evaluate your loan application, determining the risk of lending to you. Home Inspection Fee: A critical step before finalizing the purchase is the home inspection, which can reveal potential structural issues or needed repairs. Property Taxes and Mortgage Insurance: Depending on your down payment and the type of loan, you might have to pay an upfront amount for property taxes and mortgage insurance. Homeowners Association (HOA) Fees: If the property is part of an HOA, there might be initial fees or dues to consider. Discount Points: These are optional fees you can pay to the lender to reduce your interest rate, effectively allowing you to “buy down” your rate. Think of a home inspection as a health checkup for the house. It tells you if the house is healthy or if there are problems you can't see. For example, there might be a roof that leaks or a basement with water damage. Knowing about these problems before you buy can help you decide if you still want the house, or if you want to ask the seller to fix them. Plus, if you know about problems and the seller doesn't want to fix them, you can try to get a lower price. When you buy a house, you want to make sure you're paying a fair price. That's where an appraisal comes in. An appraiser looks at the house and says how much they think it's worth. Sometimes, with HomePath properties, the appraiser might say the house is worth less than you thought. This can be tricky, especially if you're trying to get a loan for the full price. It helps to work with appraisers who know a lot about HomePath properties. They can help you understand how they decide on a price and what you can do if there's a problem. Buying a house involves a lot of paperwork. It's like signing up for something but with a lot more steps and details. You have to make sure everything is correct and that you agree with all the terms. Once all the paperwork is done, the house becomes yours. It's a good idea to keep copies of everything you sign. That way, if there are questions later, you can look back and see what was agreed upon. Bidding Wars: As multiple buyers often express interest in the same property, a competitive environment can lead to escalating bids. Unexpected Property Conditions: Sometimes, the actual condition of the property might differ from what's portrayed, leading to unforeseen repairs or modifications. Delays in Response: There might be lag times in getting responses from sellers, especially if there are many offers on a property. Financing Hurdles: As HomePath properties are unique, some lenders might be hesitant, causing delays or higher interest rates. Lack of Transparency: Information about the property might not always be exhaustive, leading to blind spots during the purchase. Thorough Research: Delve deep into property history, previous ownership, and any existing liens to have a transparent view. Professional Help: Engage a realtor or broker who has experience with HomePath properties to guide you through the nuances. Stay Updated: HomePath's guidelines or terms might evolve; regular check-ins on their official site can ensure you're always informed. Networking: Connect with other HomePath buyers in forums or local groups to share experiences and gain insights. Inspection and Appraisal: Never skip a property inspection and ensure your appraiser is well-acquainted with HomePath properties to get an accurate valuation. Buying a HomePath property presents a unique opportunity for potential homeowners, offering benefits like exemption from private mortgage insurance and access to distinct financing alternatives. These properties, repossessed by Fannie Mae due to foreclosures, are often priced below market value, making them an appealing investment. However, the process requires a keen understanding of several facets, from credit score considerations to understanding property eligibility based on factors like occupancy status, condition, valuation, and location. Leveraging resources, such as engaging a knowledgeable mortgage broker and real estate agent, can be invaluable. The HomePath Ready Buyer Program offers additional advantages, especially for first-time buyers. Challenges like bidding wars and unexpected property conditions may arise, but with thorough research, professional guidance, and staying updated on HomePath's guidelines, potential pitfalls can be effectively navigated, culminating in a successful purchase.Understanding HomePath Properties

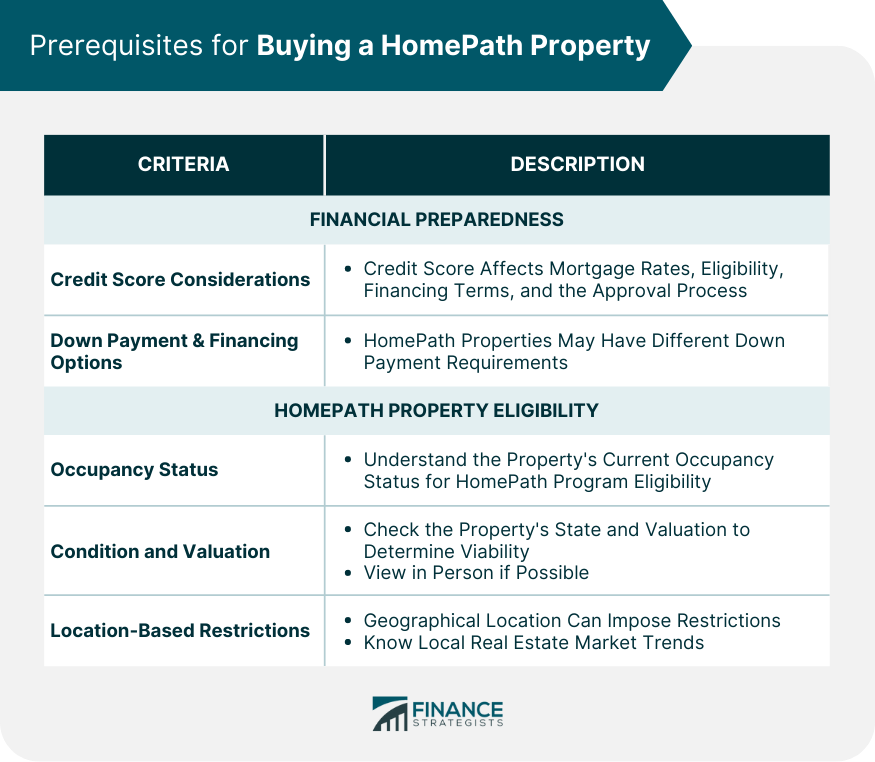

Prerequisites for Buying a HomePath Property

Financial Preparedness

Credit Score Considerations

Down Payment and Financing Options

HomePath Property Eligibility Criteria

Occupancy Status

Condition and Valuation

Location-Based Restrictions

How to Buy a HomePath Property

Search for Available HomePath Properties

Engage a Mortgage Broker or Lender

Benefits of Using a Broker

Select the Right Mortgage Product

Make an Offer on a HomePath Property

Tips and Best Practices

Role of Real Estate Agents

Navigate HomePath's Online Offer System

Create an Account

Track and Manage Your Offers

Securing Financing for a HomePath Property

HomePath Ready Buyer Program

Benefits and Eligibility Criteria

Application Process

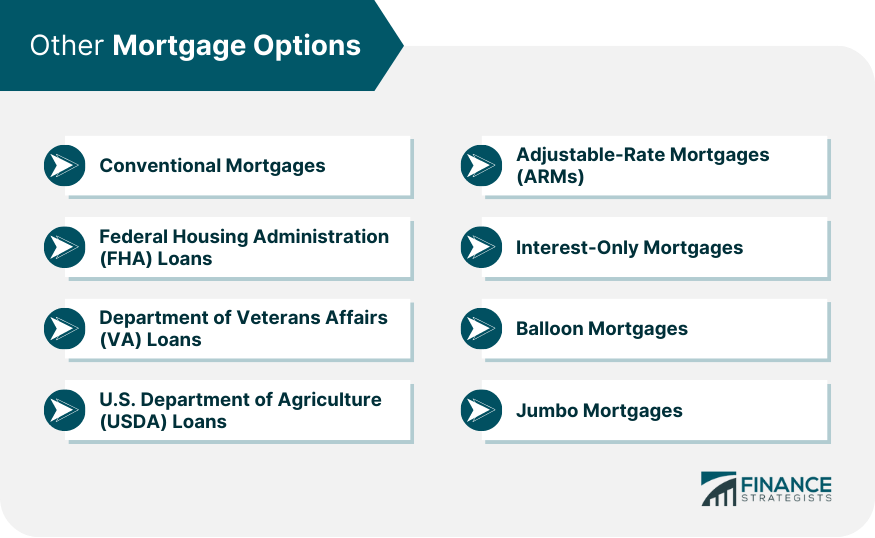

Other Mortgage Options

Closing Costs and Associated Fees

Closing the Deal

Home Inspection Considerations

Appraisal Process and Challenges

Finalizing Paperwork and Ownership Transfer

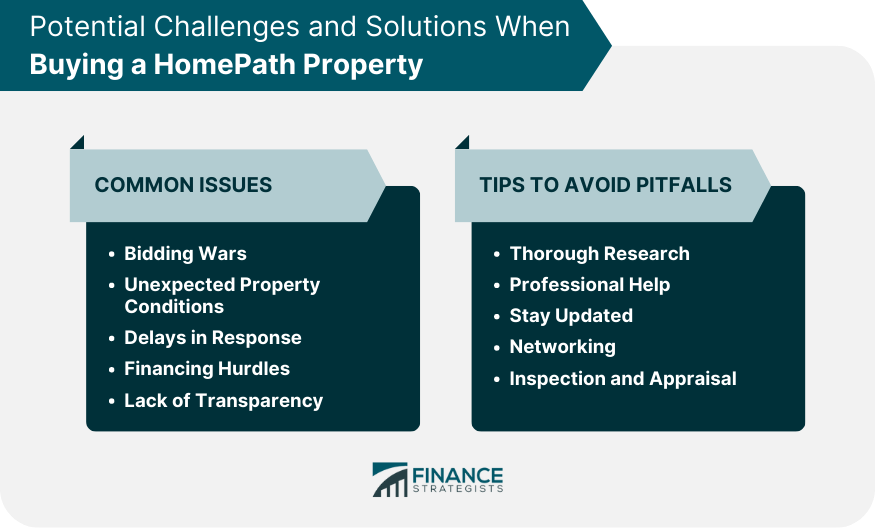

Potential Challenges and Solutions When Buying a HomePath Property

Common Issues Encountered by Buyers

Tips to Avoid Pitfalls

Bottom Line

How to Buy a HomePath Property FAQs

HomePath properties are homes owned by Fannie Mae, typically obtained through foreclosure, and listed for sale on the official HomePath website.

HomePath properties offer unique financing options, often come priced below market value, and have a distinct buying process owned by Fannie Mae.

Consider your credit score, understand down payment requirements, and explore various financing options available specifically for HomePath purchases.

Yes, the HomePath Ready Buyer Program offers benefits like reduced down payments and potential closing cost assistance for eligible first-time homebuyers.

Buyers might encounter bidding wars, unexpected property conditions, and appraisal surprises, but with proper preparation and research, these can be navigated successfully.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.