A balloon mortgage is a type of home loan with a shorter term than traditional mortgages, typically between 5 and 7 years. It features lower monthly payments throughout the term, but requires a large lump-sum payment, known as the "balloon payment," at the end of the term to pay off the remaining loan balance. Balloon mortgages can be an attractive option for borrowers who expect to sell their home or refinance their mortgage before the term ends, as they offer lower initial monthly payments and can potentially have lower interest rates compared to other mortgage options. Balloon mortgages have three key components: Initial Term: The initial term is the length of time the borrower has to make monthly payments before the balloon payment is due. Common terms for balloon mortgages range from 5 to 7 years. Monthly Payments: During the initial term, the borrower makes lower monthly payments compared to a traditional fixed-rate mortgage with the same loan amount and interest rate. These payments typically only cover the interest on the loan and a small portion of the principal balance. Balloon Payment: At the end of the initial term, the borrower must make a large lump-sum payment to pay off the remaining loan balance. This payment is known as the "balloon payment." Balloon mortgages often have lower monthly payments during the initial term compared to other mortgage options, providing borrowers with increased financial flexibility. For borrowers who plan to sell their home or refinance their mortgage within a few years, a balloon mortgage can offer a cost-effective financing solution due to the lower initial monthly payments. Balloon mortgages can sometimes have lower interest rates than other mortgage options, as the shorter term reduces the lender's risk exposure. The balloon payment at the end of the initial term can be a significant financial burden for borrowers who are unable to sell their home, refinance their mortgage, or save enough to cover the lump sum. Borrowers who plan to refinance their balloon mortgage at the end of the term may face challenges if interest rates have increased or their creditworthiness has declined. Balloon mortgages are less common than other mortgage options and may not be available through all lenders or in all regions. Lenders typically require borrowers to have a good to excellent credit score to qualify for a balloon mortgage. The specific credit score requirements may vary by lender and loan program. Lenders will evaluate a borrower's debt-to-income (DTI) ratio to determine their ability to afford the mortgage payments. A lower DTI ratio indicates a stronger financial position and a higher likelihood of loan approval. Down payment and equity requirements for balloon mortgages may vary by lender and loan program. Generally, a larger down payment or more home equity can result in better loan terms and a lower interest rate. Fixed-rate mortgages offer borrowers predictable monthly payments and long-term stability, as the interest rate remains constant throughout the life of the loan. This mortgage type is well-suited for borrowers who plan to stay in their homes for an extended period and want to avoid the risk of a large balloon payment. Adjustable-rate mortgages (ARMs) feature an interest rate that changes periodically based on market conditions. They typically offer lower initial interest rates than fixed-rate mortgages, and the interest rate may increase or decrease over time, affecting the borrower's monthly mortgage payment. ARMs can be a viable alternative for borrowers who want lower initial monthly payments without the risk of a balloon payment. Interest-only mortgages allow borrowers to pay only the interest portion of their mortgage payment for a specified period, typically between 3 and 10 years. After the interest-only period ends, the loan converts to a fully amortizing mortgage, which requires the borrower to make higher monthly payments that include both principal and interest. This mortgage option can provide lower initial payments without the need for a large lump-sum payment at the end of the term. Borrowers with balloon mortgages should have a plan in place for handling the balloon payment at the end of the term. This may include: Saving for the Lump Sum: Creating a savings plan to set aside funds for the balloon payment can help borrowers avoid financial stress when the payment is due. Preparing for Refinancing: Borrowers should monitor their credit scores, maintain a low debt-to-income ratio, and explore potential refinancing options well before the balloon payment is due to ensure they can secure favorable refinancing terms. Keeping an eye on interest rate trends is important for borrowers with balloon mortgages, as changes in rates may impact their ability to refinance or sell their home. If interest rates drop or the borrower's financial situation changes, refinancing the balloon mortgage to a fixed-rate or adjustable-rate mortgage with more favorable terms may be a viable option. Having a solid understanding of balloon mortgages, including their unique features, benefits, and risks, is crucial for potential borrowers considering this type of home loan. By carefully evaluating their financial situation, risk tolerance, and homeownership goals, borrowers can make informed decisions about whether a balloon mortgage is the right choice for their specific circumstances. Comparing various mortgage options and seeking guidance from qualified professionals can help borrowers make the best choice for their individual needs and long-term financial goals.What Are Balloon Mortgages?

How Balloon Mortgages Work

Structure of Balloon Mortgages

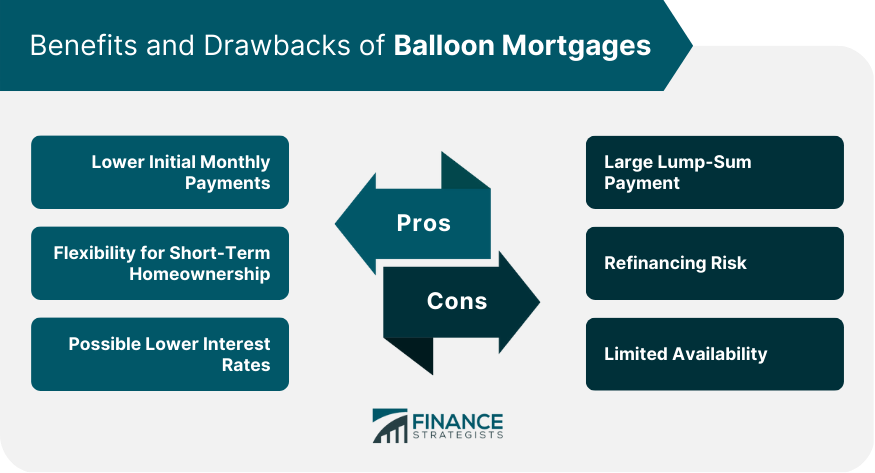

Pros and Cons of Balloon Mortgages

Pros

Lower Initial Monthly Payments

Flexibility for Short-Term Homeownership

Possible Lower Interest Rates

Cons

Large Lump-Sum Payment

Refinancing Risk

Limited Availability

Qualifying for a Balloon Mortgage

Credit Score Requirements

Debt-To-Income Ratio

Down Payment and Equity Requirements

Balloon Mortgage Alternatives

Fixed-Rate Mortgages

Adjustable-Rate Mortgages

Interest-Only Mortgages

Tips for Managing a Balloon Mortgage

Planning for the Balloon Payment

Monitoring Interest Rates

Evaluating Refinancing Options

Conclusion

Importance of Understanding Balloon Mortgages

Making Informed Decisions on Home Financing Options

Balloon Mortgages FAQs

A balloon mortgage is a type of mortgage loan that requires a large payment at the end of the loan term. The payment is usually significantly higher than the monthly payments made throughout the loan term.

A balloon mortgage is typically structured with a fixed interest rate and monthly payments for a set period, usually 5 to 7 years. At the end of the loan term, the remaining balance is due in a lump sum payment. Borrowers can either pay the lump sum or refinance the remaining balance.

The primary advantage of a balloon mortgage is that it usually has a lower interest rate and monthly payment than a traditional fixed-rate mortgage. This can make the loan more affordable for borrowers who plan to sell or refinance before the balloon payment is due.

The primary risk of a balloon mortgage is that the balloon payment can be significantly higher than the monthly payments made throughout the loan term. If the borrower is unable to make the payment or refinance the remaining balance, they may be forced to sell the property or face foreclosure.

A balloon mortgage may be suitable for borrowers who plan to sell or refinance before the balloon payment is due or those who expect their income to increase in the future. It may not be suitable for borrowers who plan to stay in the home long-term or those who may not be able to afford the balloon payment. It is important to consider your financial goals and circumstances when deciding if a balloon mortgage is right for you.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.