An interest-only mortgage is a type of loan where the borrower only pays interest on the principal amount borrowed for a specified period, usually the first few years of the loan term. During this time, the borrower's monthly payments will only cover the interest on the loan, not the principal. As a result, the payments during the interest-only period are lower than with a traditional mortgage, which includes both interest and principal payments. After the interest-only period ends, the borrower must begin to make payments that include both principal and interest, resulting in higher monthly payments. These mortgages have an interest rate that fluctuates with market conditions after an initial fixed-rate period. The interest-only period is typically available during the initial fixed-rate period, after which the loan switches to a fully amortizing adjustable-rate mortgage. Interest-only fixed-rate mortgages maintain a constant interest rate during the interest-only period. After this period ends, the mortgage transitions to a fully amortizing fixed-rate mortgage, with monthly payments consisting of both principal and interest. Hybrid interest-only mortgages combine features of both adjustable-rate and fixed-rate mortgages. These loans offer a fixed interest rate during the interest-only period, followed by an adjustable interest rate for the remaining term of the loan. Jumbo mortgages are loans with principal balances exceeding the conforming loan limits set by the Federal Housing Finance Agency (FHFA). Jumbo interest-only mortgages follow similar structures as other interest-only mortgages but are designed for borrowers seeking larger loan amounts. During this period, borrowers are only required to make monthly interest payments, resulting in lower monthly payments compared to fully amortizing loans. After the interest-only period ends, the loan enters an amortization period in which the borrower begins making principal and interest payments, effectively paying down the loan balance. Interest-only mortgages typically have stricter LTV requirements due to their higher risk profile. Lenders may require a lower LTV ratio, indicating a larger down payment, to qualify for an interest-only mortgage. Lenders often impose stricter qualifying criteria for interest-only mortgages, including higher credit scores, stable income, and significant liquid assets to ensure borrowers can handle the payment increase after the interest-only period. Fully amortizing mortgages require principal and interest payments from the start, resulting in higher initial monthly payments but faster equity buildup and lower total interest costs compared to interest-only mortgages. While both loan types may feature interest rate fluctuations, adjustable-rate mortgages typically include principal and interest payments throughout the loan term, unlike interest-only mortgages that have an initial interest-only period. Fixed-rate mortgages have a constant interest rate for the entire loan term, offering predictability and stability in monthly payments. Interest-only mortgages, on the other hand, may have adjustable rates and involve payment increases after the interest-only period. Borrowers should ensure they have a stable income and financial resources to handle the payment increase after the interest-only period. Interest-only mortgages may be more suitable for those who plan to sell or refinance their property before the end of the interest-only period, avoiding the higher monthly payments. Borrowers should consider whether they expect significant income increases in the future, which could help them manage the increased payments after the interest-only period. Interest-only mortgages can be beneficial for borrowers with a well-planned investment strategy that takes advantage of the lower initial payments and potential for increased cash flow. Borrowers should assess current and expected market conditions, such as interest rates and housing prices, to determine the potential risks and benefits of an interest-only mortgage. Interest-only mortgages offer lower monthly payments during the interest-only period, allowing borrowers to allocate their finances to other investments or expenses. Borrowers has the option to make additional principal payments during the interest-only period, which can help reduce the loan balance and future monthly payments. The lower initial monthly payments can free up cash flow for borrowers, providing opportunities to invest or save for other financial goals. In some cases, the interest paid on interest-only mortgages may be tax-deductible, offering potential tax savings for borrowers. Borrowers may use the extra cash from lower initial payments to invest in other assets, potentially generating higher returns than the cost of mortgage interest. Interest-only mortgages often result in higher total interest payments over the life of the loan due to the extended period of interest-only payments. Borrowers may face significantly higher monthly payments after the interest-only period ends, leading to potential financial strain and payment difficulties. If the interest rate increases during the interest-only period, it can lead to negative amortization, where the loan balance grows instead of shrinking. Borrowers may struggle to build home equity during the interest-only period, as they are only paying interest and not reducing the principal balance. This can make it challenging to refinance or sell the property for a profit. Higher monthly payments after the interest-only period and the potential for negative amortization can increase the risk of foreclosure if borrowers are unable to meet their payment obligations. Interest-only mortgages are a unique home loan option in which borrowers only pay the interest on the principal balance during a specified period. There are various types of interest-only mortgages, including adjustable-rate, fixed-rate, hybrid, and jumbo mortgages, each with distinct features. While these mortgages offer several advantages such as lower initial monthly payments, increased cash flow, and investment opportunities, they also come with potential risks like higher total interest costs, payment shock, and difficulty in building home equity. Comparing interest-only mortgages with other options such as fully amortizing, adjustable-rate, and fixed-rate mortgages is essential to understand their suitability. Before choosing an interest-only mortgage, borrowers should carefully consider factors like financial stability, time horizon, future income expectations, investment strategies, and market conditions. Staying informed about the regulatory landscape and industry trends is also crucial when considering this mortgage option.What Are Interest-Only Mortgages?

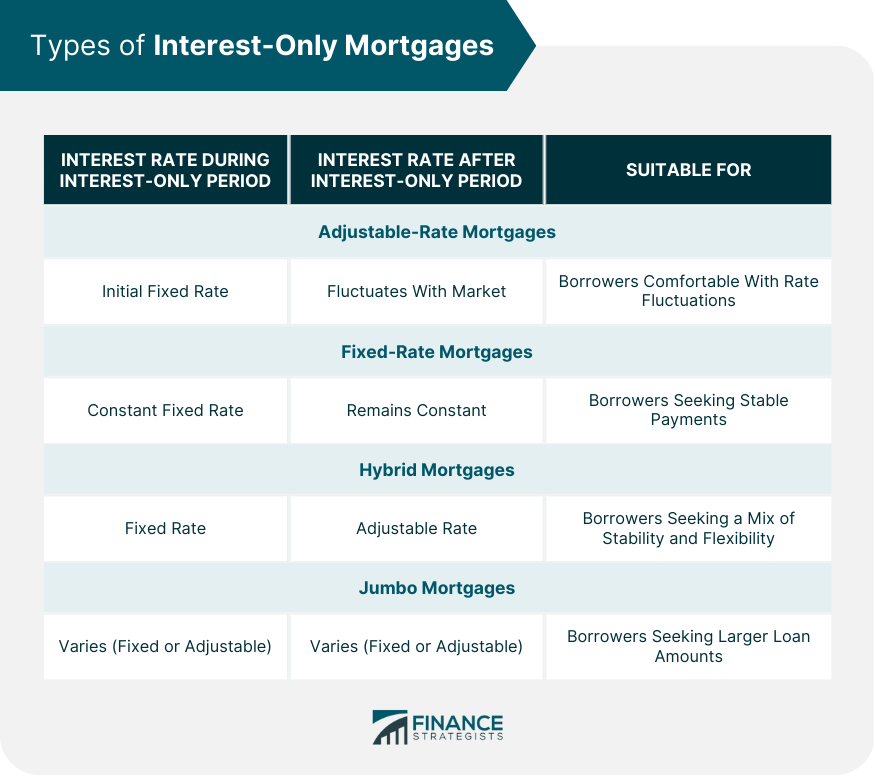

Types of Interest-Only Mortgages

Adjustable-Rate Mortgages (ARMs)

Fixed-Rate Mortgages (FRMs)

Hybrid Mortgages

Jumbo Interest-Only Mortgages

Features of Interest-Only Mortgages

Interest-Only Payment Period

Amortization Period

Loan-To-Value Ratio (LTV)

Qualifying Criteria

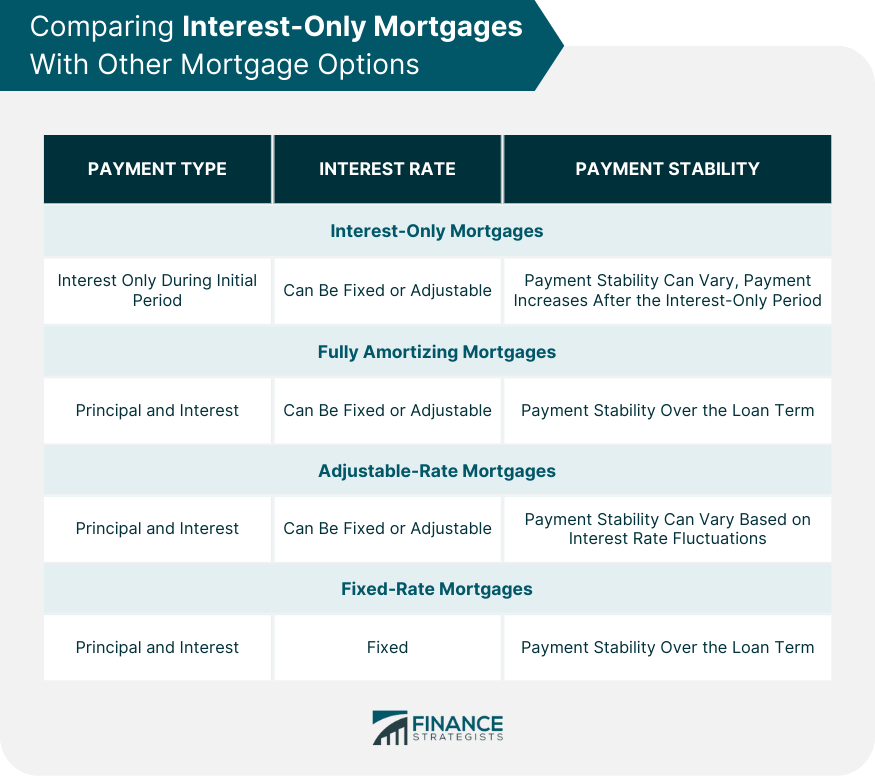

Comparing Interest-Only Mortgages With Other Mortgage Options

Interest-Only vs Fully Amortizing Mortgages

Interest-Only vs Adjustable-Rate Mortgages

Interest-Only vs Fixed-Rate Mortgages

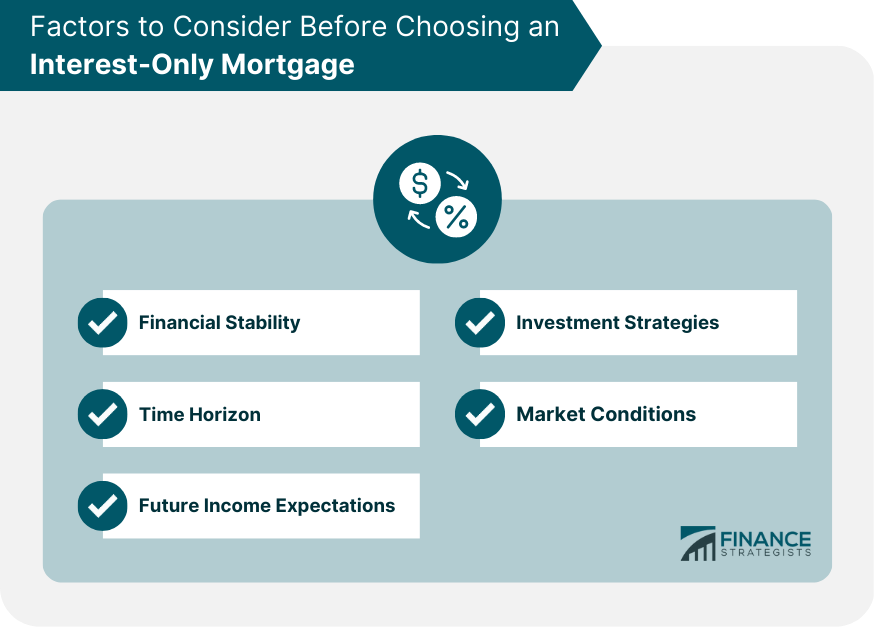

Factors to Consider Before Choosing an Interest-Only Mortgage

Financial Stability

Time Horizon

Future Income Expectations

Investment Strategies

Market Conditions

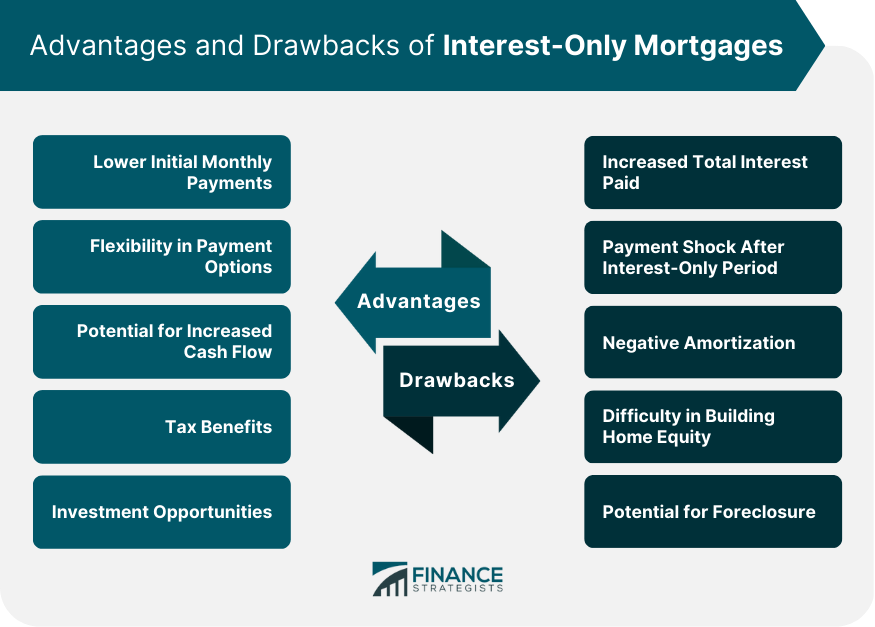

Advantages of Interest-Only Mortgages

Lower Initial Monthly Payments

Flexibility in Payment Options

Potential for Increased Cash Flow

Tax Benefits

Investment Opportunities

Risks and Drawbacks of Interest-Only Mortgages

Increased Total Interest Paid

Payment Shock After Interest-Only Period

Negative Amortization

Difficulty in Building Home Equity

Potential for Foreclosure

Conclusion

Interest-Only Mortgages FAQs

Interest-only mortgages are home loans in which borrowers only pay the interest on the principal balance during a specified period. Unlike traditional fully amortizing mortgages, interest-only mortgages have lower initial monthly payments but may result in higher total interest costs and payment shock after the interest-only period ends.

Interest-only mortgages offer lower initial monthly payments, increased cash flow, flexibility in payment options, potential tax benefits, and investment opportunities during the interest-only period.

The risks and drawbacks of interest-only mortgages include increased total interest paid, payment shock after the interest-only period, negative amortization, difficulty in building home equity, and potential for foreclosure.

Adjustable-rate interest-only mortgages have fluctuating interest rates after an initial fixed-rate period, while fixed-rate interest-only mortgages maintain a constant rate during the interest-only period. Hybrid interest-only mortgages combine features of both, offering a fixed rate during the interest-only period followed by an adjustable rate for the remaining loan term.

Before choosing an interest-only mortgage, borrowers should consider their financial stability, time horizon, future income expectations, investment strategies, and current market conditions to determine if this mortgage option is suitable for their needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.