A loan origination fee is a one-time charge levied by a lender for processing a new loan application. This fee is designed to cover the lender's costs of evaluating, approving, and funding a loan. The primary purpose of the loan origination fee is to compensate the lender for the time and resources they invest in processing a loan application. This fee helps cover the lender's overhead costs, including employee salaries, technology, and office expenses. Loan origination fees are typically associated with mortgages, personal loans, and student loans. They may also be found in auto loans and small business loans. However, not all loans carry origination fees, and the fees can vary significantly between lenders and loan types. One key aspect of loan origination is the evaluation of the borrower's credit history. The lender reviews the applicant's credit score, payment history, and outstanding debts to determine their creditworthiness. Lenders must verify the borrower's income to ensure they have the means to repay the loan. This step usually involves reviewing pay stubs, tax returns, and bank statements. The debt-to-income (DTI) ratio is another critical factor in determining a borrower's ability to repay a loan. The lender calculates the ratio by dividing the borrower's total monthly debt payments by their gross monthly income. During the loan application review process, the lender checks the application for completeness and accuracy. They may request additional information or documentation from the borrower if needed. The lender collects various documents from the borrower, such as identification, proof of income, and financial statements. These documents are necessary to process the loan application. Loan processing often involves working with third-party service providers, such as appraisers, title companies, and credit bureaus. The lender coordinates these services to ensure a smooth loan approval process. For secured loans, such as mortgages, the lender must determine the value of the collateral (e.g., a house). An appraisal is conducted to estimate the property's market value, which helps the lender assess the loan-to-value (LTV) ratio. A professional appraiser inspects the property and generates an appraisal report. This report provides details on the property's condition, comparable sales, and the appraiser's opinion of its value. A title search is conducted to ensure that the property's title is clear and free of any liens or encumbrances. This process is essential to protect the lender's interest in the property. Escrow fees cover the cost of managing the escrow account, which holds funds until the loan closes. The escrow company disburses funds to the appropriate parties, such as the seller, lender, and other service providers, upon closing. Legal fees may be incurred for services such as document preparation, review, and recording. These fees help ensure that the loan transaction is legally binding and properly recorded. The size of the loan often influences the origination fee. Larger loans may require more work and due diligence, resulting in higher fees. Borrowers with higher credit scores generally pose lower risks to lenders, which can result in lower origination fees. Conversely, borrowers with lower credit scores may face higher fees. The loan-to-value ratio is a key factor in determining the risk associated with a loan. A higher LTV ratio indicates a higher risk for the lender, which can lead to increased origination fees. Different lenders have varying policies and fee structures. Additionally, market competition can influence the number of origination fees charged by lenders. Borrowers are encouraged to shop around and compare loan offers to find the best rates and terms. Loan origination fees increases the upfront costs associated with obtaining a loan. These fees may require borrowers to come up with additional funds at the time of closing. While origination fees are typically paid upfront, they can sometimes be rolled into the loan balance. This option can increase the borrower's monthly payments and the total cost of the loan over time. The annual percentage rate reflects the true cost of borrowing, including interest and fees. A higher origination fee can result in a higher APR, which may make the loan more expensive for the borrower. Loan origination fees contribute to the overall cost of the loan. Borrowers should carefully consider the impact of these fees on the total cost of borrowing when comparing loan offers. One of the most effective ways to negotiate lower origination fees is to shop around and compare loan offers from multiple lenders. This allows borrowers to find competitive rates and potentially negotiate better terms. Borrowers should request loan estimates from multiple lenders and carefully compare the origination fees and other costs. This comparison can help borrowers identify the most favorable loan terms and negotiate better deals. Borrowers can use loan estimates from competing lenders to negotiate lower origination fees. In some cases, lenders may be willing to reduce fees to secure the borrower's business. Lender credits can help offset origination fees by reducing the borrower's out-of-pocket costs. However, these credits may come with higher interest rates, so borrowers should carefully weigh the long-term implications of accepting lender credits. The Truth in Lending Act is a federal law that requires lenders to provide clear and accurate disclosures about the terms and costs of a loan. This includes information about the loan origination fee and other charges. The Real Estate Settlement Procedures Act governs the disclosure of costs and fees associated with real estate transactions, including loan origination fees. This law aims to protect consumers by promoting transparency in the lending process. Lenders are required to provide borrowers with a Loan Estimate within three business days of receiving a loan application. This document outlines the estimated costs and fees, including the origination fee, associated with the loan. The Closing Disclosure form, provided at least three business days before closing, confirms the final costs and fees. Loan origination fees are a crucial aspect of the borrowing process, as they encompass the lender's costs of evaluating, approving, and funding a loan. The fees can vary based on factors such as loan size, credit score, loan-to-value ratio, and lender policies. These fees impact the total cost of borrowing, upfront costs, monthly payments, and the annual percentage rate. Borrowers can negotiate or reduce loan origination fees by shopping around for lenders, comparing loan estimates, and considering lender credits. Additionally, federal regulations such as the Truth in Lending Act and the Real Estate Settlement Procedures Act ensure that lenders provide clear disclosures about loan origination fees and other costs associated with loans. By understanding the intricacies of loan origination fees and employing effective negotiation strategies, borrowers can make informed decisions and secure favorable loan terms.Definition and Purpose of Loan Origination Fee

Common Types of Loans with Origination Fees

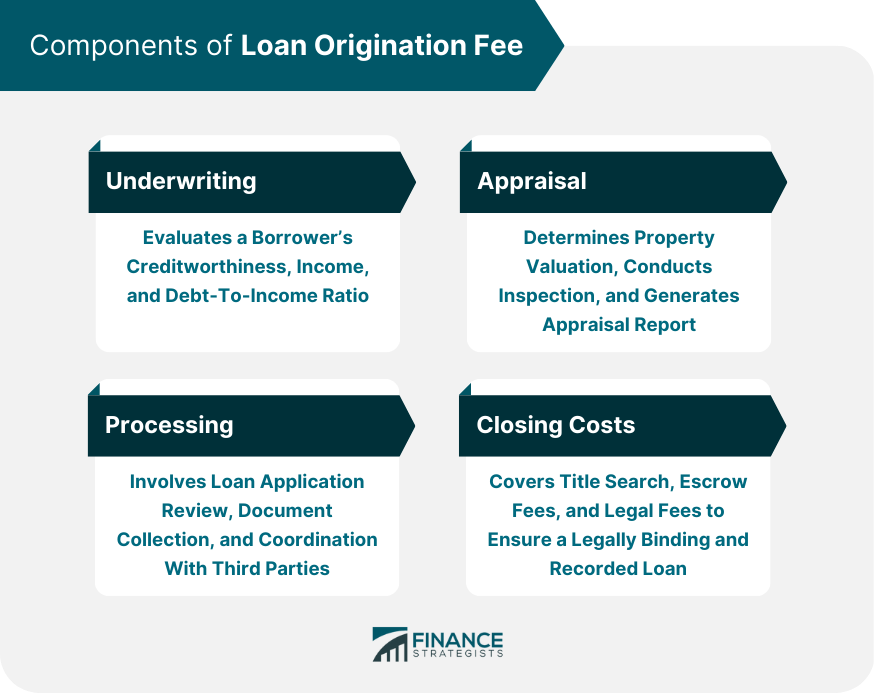

Components of Loan Origination Fee

Underwriting

Credit Evaluation

Income Verification

Debt-to-Income Ratio Assessment

Processing

Loan Application Review

Document Collection

Coordination with Third Parties

Appraisal

Property Valuation

Inspection and Report Generation

Closing Costs

Title Search

Escrow Fees

Legal Fees

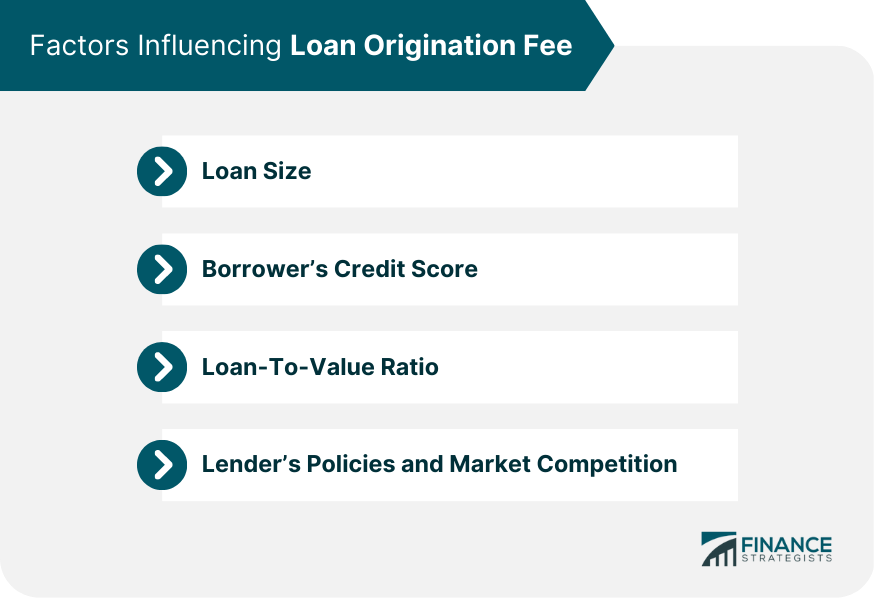

Factors Influencing Loan Origination Fee

Loan Size

Borrower's Credit Score

Loan-to-Value Ratio

Lender's Policies and Market Competition

Impact of Loan Origination Fee on Borrowers

Upfront Costs

Monthly Payments

Annual Percentage Rate (APR)

Total Cost of Loan

Negotiating Loan Origination Fee

Shopping Around for Lenders

Comparing Loan Estimates

Negotiating with Lenders

Considering Lender Credits

Regulatory Framework and Disclosure Requirements

Truth in Lending Act (TILA)

Real Estate Settlement Procedures Act (RESPA)

Loan Estimate and Closing Disclosure Forms

Conclusion

Loan Origination Fee FAQs

Loan origination fees are one-time charges levied by lenders for processing new loan applications. They help cover the lender's costs of evaluating, approving, and funding the loan, including employee salaries, technology, and office expenses.

Loan origination fees contribute to the overall cost of borrowing. They increase the upfront costs and, if rolled into the loan balance, can affect monthly payments and the annual percentage rate (APR), making the loan more expensive for the borrower.

Yes, loan origination fees can sometimes be negotiated or reduced. Borrowers can shop around for lenders, compare loan estimates, and use competing offers to negotiate better terms. Lender credits may also help offset origination fees, but may result in higher interest rates.

Lenders are required by the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) to provide clear disclosures about loan terms and costs, including loan origination fees. Borrowers receive a Loan Estimate within three business days of applying and a Closing Disclosure at least three business days before closing.

No, loan origination fees can vary between lenders and loan types. Factors such as the borrower's credit score, loan size, loan-to-value ratio, and lender policies can influence the amount of origination fees. It is essential for borrowers to shop around and compare offers to find the best rates and terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.