A fixed-rate mortgage is a type of mortgage loan in which the interest rate remains the same throughout the life of the loan. This means that the borrower will pay the same interest rate and the same monthly payment amount every month for the entire term of the loan. The term of a fixed-rate mortgage is typically 15, 20, or 30 years. The longer the term, the lower the monthly payment, but the more interest the borrower will pay over the life of the loan. Fixed-rate mortgages are popular among borrowers who prefer the stability of a consistent monthly payment and want to avoid the risk of interest rate fluctuations. They are also useful for budgeting and financial planning purposes since borrowers can know exactly what their mortgage payments will be for the entire term of the loan. Fixed-rate mortgages offer a consistent interest rate throughout the loan term. The interest rate remains unchanged regardless of market fluctuations, providing peace of mind and allowing borrowers to budget more accurately. Fixed-rate mortgages come in various terms, typically ranging from 10 to 40 years. The most common loan terms are 15-year and 30-year mortgages. Shorter loan terms usually have lower interest rates but higher monthly payments, while longer terms have higher interest rates and lower monthly payments. An amortization schedule is a table that shows the breakdown of principal and interest payments over the loan term. With a fixed-rate mortgage, the amortization schedule remains constant, allowing borrowers to understand how much of each payment goes toward the principal and interest. With a fixed-rate mortgage, borrowers can predict their monthly payments throughout the loan term. This predictability makes financial planning easier and provides a sense of security for homeowners. Fixed-rate mortgages can be an excellent option for long-term financial planning. With consistent payments and no surprises, homeowners can budget and plan for other financial goals. The overall state of the economy, including employment rates, inflation, and market conditions, can impact fixed-rate mortgage rates. Inflation affects the purchasing power of money, and as a result, influences interest rates. When inflation is high, lenders may increase mortgage rates to compensate for the loss in purchasing power. Higher credit scores indicate a lower risk for lenders, which can lead to lower fixed-rate mortgage rates. Borrowers with lower credit scores may face higher interest rates due to the increased risk of default. The loan-to-value (LTV) ratio is the percentage of the loan amount compared to the appraised value of the property. A lower LTV ratio indicates a lower risk for lenders, potentially resulting in a lower fixed-rate mortgage rate. The size of the mortgage loan can also impact fixed-rate mortgage rates. Larger loans may carry higher interest rates, while smaller loans may have lower rates. Conventional fixed-rate mortgages are not insured or guaranteed by the government. They are typically offered by banks, credit unions, and private lenders. Conventional loans require a down payment and usually have stricter credit requirements than government-backed loans. FHA fixed-rate mortgages are insured by the Federal Housing Administration (FHA) and are designed to help borrowers with lower credit scores and smaller down payments. They often have lower interest rates compared to conventional loans. VA fixed-rate mortgages are guaranteed by the Department of Veterans Affairs (VA) and are available to eligible veterans, active-duty service members, and their families. These loans typically offer lower interest rates and do not require a down payment. USDA fixed-rate mortgages are backed by the United States Department of Agriculture (USDA) and are designed for low-to-moderate income homebuyers in rural areas. These loans offer competitive interest rates and can be obtained with no down payment. Jumbo fixed-rate mortgages are loans that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are used to finance more expensive properties and typically have higher interest rates than conforming loans due to the increased risk for lenders. Jumbo loans often require a larger down payment and have more stringent credit requirements. Adjustable-rate mortgages (ARMs) have interest rates that change over time based on market conditions. They typically start with a lower rate than fixed-rate mortgages, but after the initial fixed period, the rate can increase or decrease. While ARMs can provide lower initial payments, they come with the risk of payment increases if interest rates rise. Interest-only mortgages allow borrowers to pay only the interest portion of the loan for a specified period, usually 5 to 10 years. After the interest-only period ends, borrowers must begin paying principal and interest, which can result in significantly higher monthly payments. Interest-only mortgages can be beneficial for short-term homeowners or those with fluctuating incomes but carry the risk of payment shock when the principal payments begin. Balloon mortgages have a short-term fixed-rate period followed by a large lump-sum payment (or "balloon" payment) at the end of the loan term. These mortgages can be beneficial for borrowers who plan to sell their homes before the balloon payment is due, but they carry the risk of default if the borrower cannot make the large payment or refinance the loan. Hybrid ARMs combine features of both fixed-rate mortgages and adjustable-rate mortgages. They begin with a fixed-rate period (usually 3, 5, 7, or 10 years) and then convert to an adjustable-rate mortgage for the remainder of the loan term. Hybrid ARMs can offer initial stability, but borrowers must be prepared for potential payment increases once the adjustable period begins. Reverse mortgages are designed for homeowners aged 62 or older who have substantial home equity. These loans allow borrowers to convert their home equity into cash, providing additional income during retirement. Reverse mortgages do not require monthly payments, but the loan balance becomes due when the borrower sells the home, moves out, or passes away. Before applying for a fixed-rate mortgage, borrowers should review their credit reports, gather necessary documentation, and determine their budget for monthly mortgage payments. Lenders typically require documentation such as income verification, tax returns, bank statements, and credit reports to evaluate a borrower's ability to repay the loan. Borrowers should research multiple lenders to find the best fixed-rate mortgage options. Comparing loan offers from different lenders can help borrowers find the most competitive interest rates and loan terms. When evaluating mortgage offers, borrowers should consider the interest rate, loan term, closing costs, and any other fees associated with the loan. Once a borrower has chosen a lender and been approved for a fixed-rate mortgage, they will need to attend a closing meeting to sign the final loan documents and pay any required closing costs. Homeowners may choose to refinance their fixed-rate mortgage to take advantage of lower interest rates, change the loan term, or access home equity. The refinancing process is similar to the initial mortgage application process. Borrowers will need to provide documentation, have their home appraised, and undergo a credit check. Refinancing a fixed-rate mortgage can involve closing costs and other fees, which should be taken into account when deciding whether to refinance. Borrowers should also consider the potential impact on their overall financial situation, including the length of time they plan to stay in the home and the break-even point for recouping the refinancing costs. There are several refinancing programs available, including rate-and-term refinancing, cash-out refinancing, and streamline refinancing for government-backed loans. When evaluating refinancing options, borrowers should consider the potential benefits, costs, and long-term impacts on their financial goals. Comparing loan offers from multiple lenders can help borrowers find the best refinancing option for their needs. Fixed-rate mortgages offer borrowers the stability of a consistent monthly payment throughout the loan term, making them a popular option for those who want to avoid the risk of interest rate fluctuations. They also provide predictability, making financial planning easier for homeowners. However, borrowers should consider the factors that influence fixed-rate mortgage rates, as well as the different types of fixed-rate mortgages available, and compare them to other mortgage options to determine which is best for their individual circumstances. The application process involves preparing for the mortgage application, gathering documentation, finding a lender, evaluating offers, and closing the mortgage. Refinancing a fixed-rate mortgage can also be an option, but borrowers should consider the costs, potential impact on their financial situation, and evaluate different refinancing programs before making a decision.Definition of Fixed-Rate Mortgages

Features of Fixed-Rate Mortgages

Interest Rate Stability

Loan Term Options

Amortization Schedule

Predictability of Payments

Impact on Financial Planning

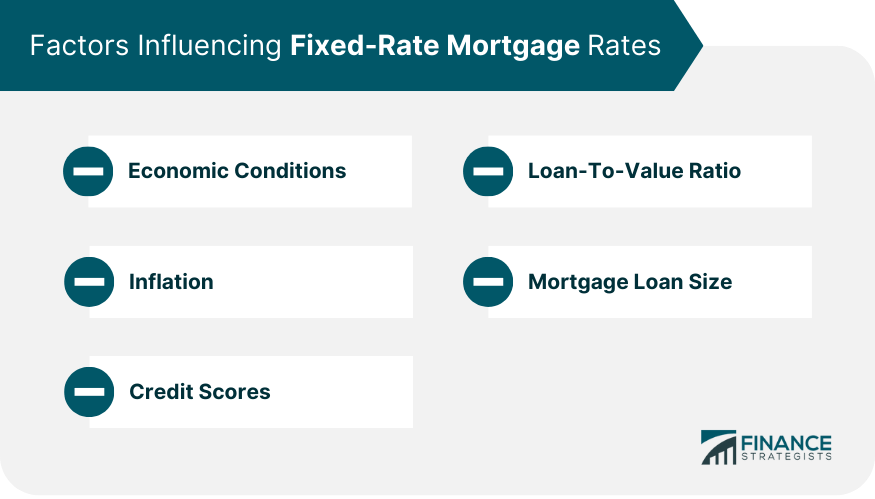

Factors Influencing Fixed-Rate Mortgage Rates

Economic Conditions

Inflation

Credit Scores

Loan-To-Value Ratio

Mortgage Loan Size

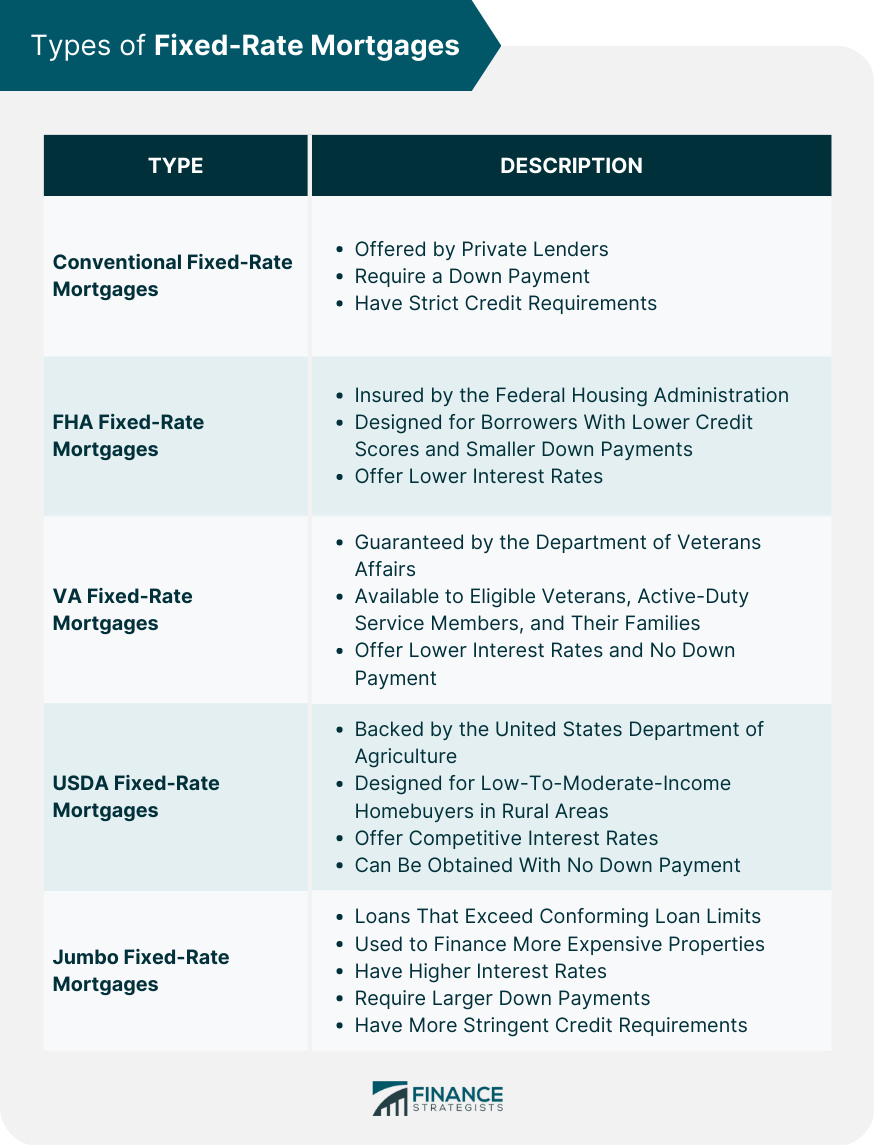

Types of Fixed-Rate Mortgages

Conventional Fixed-Rate Mortgages

FHA Fixed-Rate Mortgages

VA Fixed-Rate Mortgages

USDA Fixed-Rate Mortgages

Jumbo Fixed-Rate Mortgages

Comparing Fixed-Rate Mortgages to Other Mortgage Types

Adjustable-Rate Mortgages (ARMs)

Interest-Only Mortgages

Balloon Mortgages

Hybrid ARMs

Reverse Mortgages

How to Apply for a Fixed-Rate Mortgage

Preparing for the Mortgage Application Process

Required Documentation

Finding a Lender

Evaluating Mortgage Offers

Closing the Mortgage

Fixed-Rate Mortgage Refinancing Options

Reasons for Refinancing

Refinancing Process

Costs and Considerations

Types of Refinancing Programs

Evaluating Refinancing Options

Conclusion

Fixed-Rate Mortgages FAQs

Fixed-rate mortgages offer stability and predictability in monthly payments due to their consistent interest rate throughout the loan term. This allows borrowers to budget more accurately and simplifies long-term financial planning.

Fixed-rate mortgage rates are influenced by various factors, including economic conditions (such as inflation and employment rates), personal credit scores, loan-to-value ratios, and mortgage loan size. These factors can affect the interest rate offered by lenders.

Fixed-rate mortgages are available in various loan terms, typically ranging from 10 to 40 years. The most common loan terms are 15-year and 30-year mortgages, with shorter terms usually offering lower interest rates but higher monthly payments.

Fixed-rate mortgages provide consistent interest rates and monthly payments throughout the loan term, while adjustable-rate mortgages (ARMs) have interest rates that change over time based on market conditions. ARMs can offer lower initial payments but carry the risk of payment increases if interest rates rise.

When refinancing a fixed-rate mortgage, borrowers should consider their reasons for refinancing, such as lowering interest rates or changing the loan term, as well as the associated costs, break-even point, and long-term financial impact. Comparing loan offers from multiple lenders can help borrowers find the best refinancing option for their needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.