Wholesale insurance is a vital part of the insurance industry, providing coverage for unique, complex, or high-risk situations that retail insurance companies may not handle. Wholesale brokers serve as intermediaries between retail agents and insurance carriers, offering tailored policies for specific needs or industries. They fill market gaps, particularly for high-risk businesses or those requiring specialized coverage. By accessing niche markets and diverse products, wholesale brokers mitigate risk and contribute to industry stability. Their expertise helps businesses protect assets and sustain operations, ensuring access to necessary coverage for individuals and organizations. Commercial property insurance is designed to protect business-owned properties, such as buildings, equipment, inventory, and other assets, from risks like fire, theft, or natural disasters. Wholesale insurance brokers offer specialized property insurance policies tailored to the unique needs of various industries or businesses, such as manufacturing facilities, storage warehouses, or historic buildings. Commercial liability insurance covers a business's legal responsibility for any bodily injury or property damage caused to third parties. Wholesale insurance brokers can provide specialized liability policies, including general liability, product liability, and umbrella liability, which cater to businesses with unique exposures or high-risk operations. Professional liability insurance, also known as errors and omissions (E&O) insurance, protects businesses from claims arising from their professional services or advice. Wholesale insurance brokers can offer customized professional liability policies for businesses operating in specialized industries or professions, such as architects, engineers, consultants, or technology service providers. Workers' compensation insurance provides medical and wage benefits to employees who suffer work-related injuries or illnesses. In some cases, businesses may require specialized workers' compensation coverage due to the nature of their operations or workforce, such as high-risk industries like construction or mining. Wholesale insurance brokers can help secure appropriate coverage for these situations. Commercial auto insurance covers vehicles used for business purposes, protecting against liability and physical damage. Wholesale insurance brokers can offer tailored commercial auto policies for businesses with unique needs, such as fleets of specialized vehicles, long-haul trucking companies, or transportation services with high-value cargo. Cyber liability insurance addresses the risks associated with cyberattacks, data breaches, and other technology-related incidents. Wholesale insurance brokers can provide customized cyber liability policies for businesses with specific exposures or vulnerabilities, such as e-commerce retailers, financial institutions, or healthcare providers. Wholesale insurance brokers also offer a variety of miscellaneous insurance products, such as environmental liability, directors and officers (D&O) liability, employment practices liability (EPLI), and event cancellation insurance. These policies cater to specific risks or industries that might not be adequately covered by standard insurance policies. By providing access to these specialized products, wholesale insurance brokers enable businesses to obtain comprehensive coverage tailored to their unique needs and circumstances. Wholesale insurance brokers play a critical role in assessing and managing risks on behalf of their clients. By leveraging their expertise in various industries and specialized insurance products, they can identify potential exposures and recommend appropriate coverage solutions. They may also offer risk management services, such as loss control and safety programs, to help clients mitigate and prevent potential losses. Wholesale insurance brokers serve as intermediaries between retail insurance agents or brokers and insurance carriers. They are responsible for placing and negotiating policies, ensuring that the coverage offered by carriers aligns with the needs and requirements of their clients. This process involves analyzing the client's risk profile, selecting the most suitable carrier, and negotiating policy terms and conditions, including coverage limits, deductibles, and premiums. In the event of a claim, wholesale insurance brokers act as advocates for their clients, assisting in the claims handling and resolution process. They help gather necessary documentation, communicate with the insurance carrier, and ensure that claims are handled promptly and fairly. By providing this support, wholesale brokers facilitate a smooth claims process and help clients obtain the compensation they are entitled to. Wholesale insurance brokers must adhere to various industry regulations and compliance requirements, including licensing, surplus lines tax reporting, and adherence to state insurance department regulations. They can also provide clients with guidance on regulatory matters, ensuring that their insurance policies and risk management practices remain compliant with the relevant rules and regulations. Wholesale insurance brokers have access to specialized carriers and niche markets that retail agents or brokers may not be able to reach. This enables them to provide clients with unique or hard-to-place coverage, ensuring that businesses can secure the protection they need, regardless of the complexity or riskiness of their operations. Wholesale insurance brokers possess specialized knowledge and expertise in addressing complex risks and exposures. This enables them to recommend tailored insurance solutions that adequately cover clients' unique needs and circumstances, providing a level of protection that might not be available through standard insurance policies. By working with multiple carriers and markets, wholesale insurance brokers can offer clients a broader range of coverage options and increased capacity. This allows businesses to obtain comprehensive coverage with higher limits, ensuring that they are adequately protected against potential losses. Wholesale insurance brokers can leverage their relationships with carriers and their knowledge of specialized markets to negotiate competitive rates and policy terms on behalf of their clients. This can result in cost-effective coverage solutions that provide clients with the protection they need at a reasonable price. Wholesale insurance brokers can expedite the claims process by acting as intermediaries between clients and insurance carriers. Their expertise in handling complex claims and their familiarity with the carriers' processes can help ensure that claims are resolved quickly and efficiently. The wholesale insurance industry is undergoing significant transformation due to advances in technology and digitalization. These changes present both challenges and opportunities for wholesale brokers, who must adapt to new tools, platforms, and processes to remain competitive and provide value to their clients. Embracing technology can streamline operations, enhance customer service, and enable more effective risk management. The risk landscape is continually evolving, with new and emerging risks presenting challenges for the wholesale insurance industry. Climate change, pandemics, and technological advancements, such as artificial intelligence and the Internet of Things (IoT), are reshaping the nature of risk and driving the need for innovative insurance solutions. Wholesale insurance brokers must stay abreast of these developments to identify and address emerging risks, helping their clients navigate an increasingly complex risk environment. The insurance industry is subject to a myriad of regulations and compliance requirements, which can vary by jurisdiction and change over time. Wholesale insurance brokers must remain vigilant in monitoring these changes and ensuring that their practices, as well as their clients' policies and risk management strategies, remain compliant. This can involve significant investments in training, technology, and resources to stay up to date with the latest regulatory developments. The wholesale insurance industry is experiencing increasing competition and market consolidation, with mergers and acquisitions reshaping the landscape. Wholesale brokers must adapt to these changes, which may involve developing new strategies or expanding their service offerings to differentiate themselves in a competitive market. This may also require brokers to establish strong relationships with carriers, clients, and other industry stakeholders to maintain their position in the market. As businesses continue to expand their operations globally, the wholesale insurance industry must also adapt to the challenges and opportunities presented by globalization. This can involve navigating different regulatory environments, understanding diverse risk exposures, and catering to the unique needs of multinational clients. Wholesale brokers must develop the necessary expertise and capabilities to serve clients operating in a global marketplace, ensuring that their insurance solutions are both comprehensive and compliant with local requirements. To remain competitive in the rapidly evolving insurance industry, wholesale brokers must embrace innovation and technology. This can involve adopting new tools and platforms to streamline operations, enhance customer service, and improve risk management capabilities. By staying at the forefront of technological advancements, brokers can better serve their clients and position themselves for success in a changing market. Building and maintaining strong relationships with carriers and clients is essential for success in the wholesale insurance market. This involves establishing trust, providing exceptional service, and demonstrating expertise in specialized insurance products and risk management. By fostering strong relationships, brokers can enhance their reputation, increase client retention, and secure their position in the market. Wholesale insurance brokers can differentiate themselves from the competition by expanding their product and service offerings. This may involve exploring new niche markets, developing specialized insurance products, or offering value-added services such as risk management consulting or loss control programs. By diversifying their offerings, brokers can better meet the needs of their clients and generate new business opportunities. Given the dynamic nature of the insurance industry, wholesale brokers must invest in continuous professional development to stay abreast of the latest trends, risks, and regulatory changes. This can involve participating in industry conferences, pursuing professional certifications, or engaging in ongoing training and education. By cultivating a deep understanding of the industry and its challenges, brokers can better serve their clients and navigate the complexities of the wholesale insurance market. Effective risk management is crucial for success in the wholesale insurance industry. Brokers must develop robust risk management practices to identify, assess, and address potential exposures, ensuring that their clients receive the appropriate coverage and protection. This can involve leveraging data analytics, predictive modeling, and other advanced tools to enhance risk assessment capabilities and inform decision-making. Wholesale insurance, as a specialized segment of the insurance industry, plays a vital role in providing businesses and individuals with access to tailored coverage for unique, complex, or high-risk situations. It encompasses various types of policies, such as commercial property, commercial liability, professional liability, workers' compensation, commercial auto, cyber liability, and other miscellaneous insurance products. Wholesale insurance brokers perform essential functions, including risk assessment and management, policy placement and negotiation, claims handling and resolution, and compliance and regulatory support. Despite challenges, the wholesale insurance industry provides benefits like specialized markets, expertise in complex risks, increased coverage options, cost-effectiveness, and streamlined claims processing. To succeed in wholesale insurance, brokers must embrace innovation, build relationships, expand offerings, prioritize professional growth, and practice effective risk management. If you are seeking specialized coverage for your unique insurance needs or operating in a high-risk industry, consider reaching out to a wholesale insurance broker. What Is Wholesale Insurance?

Types of Wholesale Insurance Policies

Commercial Property Insurance

Commercial Liability Insurance

Professional Liability Insurance

Workers' Compensation Insurance

Commercial Auto Insurance

Cyber Liability Insurance

Miscellaneous Insurance Products

Functions of Wholesale Insurance Brokers

Risk Assessment and Management

Policy Placement and Negotiation

Claims Handling and Resolution

Compliance and Regulatory Support

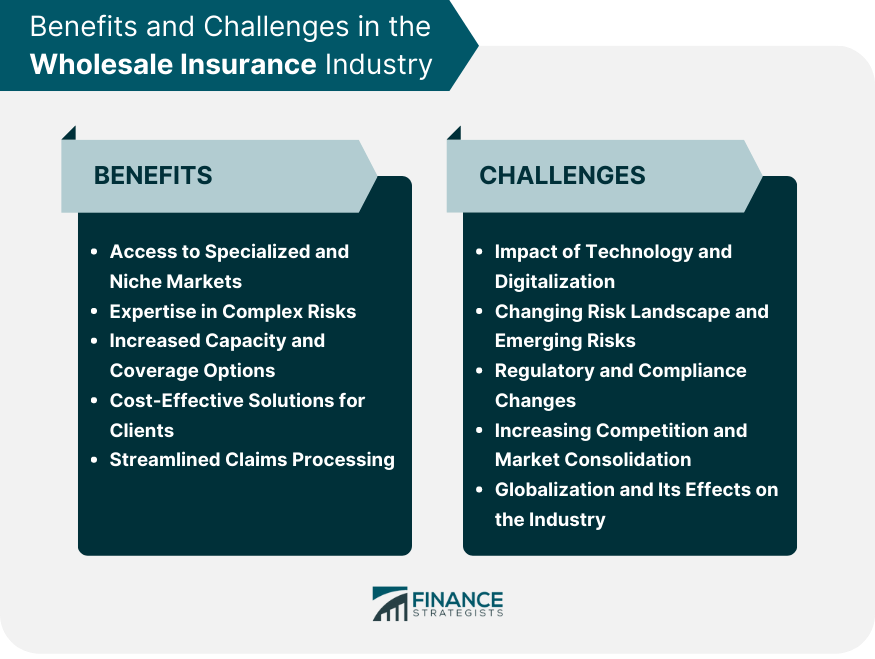

Benefits of Wholesale Insurance

Access to Specialized and Niche Markets

Expertise in Complex Risks

Increased Capacity and Coverage Options

Cost-Effective Solutions for Clients

Streamlined Claims Processing

Challenges and Trends in the Wholesale Insurance Industry

Impact of Technology and Digitalization

Changing Risk Landscape and Emerging Risks

Regulatory and Compliance Changes

Increasing Competition and Market Consolidation

Globalization and Its Effects on the Industry

Strategies for Success in the Wholesale Insurance Market

Embracing Innovation and Technology

Developing Strong Relationships with Carriers and Clients

Expanding Product and Service Offerings

Focusing on Continuous Professional Development

Implementing Effective Risk Management Practices

Final Thoughts

Wholesale Insurance FAQs

Wholesale insurance refers to the specialized segment of the insurance industry that provides coverage for unique, complex, or high-risk situations that traditional retail insurance companies might not be able to accommodate. Unlike retail insurance, which deals directly with policyholders, wholesale insurance brokers act as intermediaries between retail insurance agents or brokers and insurance carriers, offering a diverse range of policies tailored to specific needs, industries, or risks.

Wholesale insurance offers a wide range of policies, including commercial property, commercial liability, professional liability, workers' compensation, commercial auto, cyber liability, and various miscellaneous insurance products. These policies are designed to address the unique needs and risks associated with specific industries, professions, or situations that may not be adequately covered by standard retail insurance policies.

Businesses or individuals facing unique, complex, or high-risk situations that may not be covered by standard retail insurance policies should consider using wholesale insurance. This can include businesses operating in high-risk industries, those with unique exposures or specialized coverage needs, or those seeking tailored insurance solutions to address specific risks.

Wholesale insurance brokers assess risks, provide expertise, and act as intermediaries between retail agents and carriers. They identify exposures, recommend coverage, and negotiate policies, ensuring clients receive suitable insurance solutions in various industries.

Wholesale insurance provides access to niche markets, expertise in complex risks, and tailored coverage solutions. Brokers offer increased capacity, cost-effective options, and streamlined claims processing, ensuring businesses and individuals receive comprehensive protection for unique risks not covered by standard policies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.