Catastrophe bonds, or "cat bonds," are financial instruments that allow insurance and reinsurance companies to transfer risks related to natural disasters to capital market investors. Catastrophe bonds are a form of insurance-linked securities (ILS) designed to transfer the risk of catastrophic events, such as earthquakes, hurricanes, or floods, from insurers and reinsurers to capital market investors. They help insurance and reinsurance companies manage their financial exposure to natural disasters while providing investors with an attractive and uncorrelated investment opportunity. Understanding catastrophe bonds' structure, issuance process, and redemption is crucial to appreciate their role in risk management and financial markets. Catastrophe bonds have a unique structure that involves triggering events, risk modeling, and other critical components. A triggering event is a predefined catastrophic occurrence that initiates the payout process for catastrophe bond investors. These events can be based on parametric triggers (e.g., wind speed, earthquake magnitude) or indemnity triggers (actual losses incurred by the sponsor). Risk modeling is an essential aspect of catastrophe bonds, as it helps determine the probability of triggering events and potential losses. Sophisticated models incorporating historical data and scientific research are used to estimate the risks associated with various natural disasters. The catastrophe bond issuance process involves multiple parties and steps, including the sponsor, special purpose vehicle (SPV), and underwriting and pricing. The sponsor is typically an insurance or reinsurance company seeking to transfer catastrophic risks to investors. They initiate the catastrophe bond issuance process and define the terms of the bond, including coverage and triggers. An SPV is a separate legal entity created specifically for the issuance of catastrophe bonds. It issues the bonds, collects the premiums from the sponsor, and invests the proceeds in low-risk assets. In the event of a triggering event, the SPV uses these assets to pay the claims. Catastrophe bond underwriters assist in determining the bond's price based on the risk modeling and investor demand. The bond's price represents the premium paid by the sponsor to transfer the risk to investors. Catastrophe bond redemption and payout process depend on specific payout conditions and loss calculations. If no triggering event occurs during the bond's term, investors receive their principal back at maturity and any remaining interest. If a triggering event occurs, the principal may be reduced or entirely forfeited to cover the sponsor's losses. Loss calculations and payments depend on the bond's trigger type. Payment is based on a predefined formula for parametric triggers, while indemnity triggers rely on the sponsor's actual losses. Once the losses are calculated, the SPV makes the necessary payments to the sponsor. The catastrophe bond market consists of several key players, including sponsors, investors, and underwriters. Sponsors - Sponsors are insurance and reinsurance companies that issue catastrophe bonds by transferring risk to investors. They initiate the bond issuance process and define the terms of the bond. Investors - Investors in catastrophe bonds are typically institutional investors, such as pension funds, hedge funds, and asset managers, seeking portfolio diversification and attractive returns. They assume the risk of natural disasters in exchange for premium payments. Catastrophe Bond Underwriters - Underwriters play a crucial role in the catastrophe bond issuance process, helping determine the bond's price based on risk modeling and investor demand. Catastrophe bonds offer various benefits to both sponsors and investors. This includes: Catastrophe bonds allow sponsors to transfer catastrophic risk to investors, thereby reducing their financial exposure to natural disasters. For investors, catastrophe bonds offer an opportunity to diversify their portfolios with an asset class uncorrelated to traditional financial markets. By transferring catastrophic risk to investors, catastrophe bonds help insurance and reinsurance companies maintain financial stability during times of significant loss, ensuring their ability to pay claims and continue operations. Despite their benefits, catastrophe bonds come with certain risks. Basis risk arises when the bond's payout does not fully cover the sponsor's actual losses. This risk is more prevalent in parametric-trigger bonds, as the payout is based on predefined parameters rather than the sponsor's actual losses. Modeling risk pertains to the potential inaccuracies in the catastrophe risk models used to estimate the probability of triggering events and potential losses. If these models underestimate the risk, investors may face higher losses than anticipated. Credit risk refers to the risk of the SPV defaulting on its payment obligations to investors or the sponsor. While typically low, given the conservative investment strategy of the SPV, credit risk still exists and should be considered by market participants. Catastrophe bonds and traditional reinsurance serve similar purposes but have distinct features that make them complementary risk management tools. While catastrophe bonds may have higher upfront costs than traditional reinsurance, they often provide multi-year coverage, reducing the frequency of renegotiations and the risk of capacity constraints in the reinsurance market. Additionally, catastrophe bonds may offer coverage for risks that are difficult to reinsure or lack capacity in the traditional market. Catastrophe bonds can be customized to meet the sponsor's specific needs, such as tailored triggers and coverage amounts. Traditional reinsurance contracts offer customization options but may have less flexibility regarding terms and conditions. Catastrophe bonds and traditional reinsurance can be used together to create a comprehensive risk management strategy. Sponsors may utilize catastrophe bonds to cover peak risks or specific perils while leveraging traditional reinsurance for other layers of coverage, creating a balanced and diversified approach to managing catastrophic risk. The future of catastrophe bonds will be influenced by various factors, such as the impact of climate change, technological advancements in risk modeling, and potential market growth and expansion. As climate change increases the frequency and severity of natural disasters, catastrophe bonds may become an even more critical risk management tool for insurance and reinsurance companies. The growing demand for catastrophe bonds may lead to an increase in market size and new types of bonds covering emerging risks. Advancements in technology, such as artificial intelligence and big data, may improve catastrophe bond risk modeling, leading to more accurate assessments of risk and the potential for new triggers and bond structures. The catastrophe bond market may expand into new regions and cover additional perils as the need for risk transfer and diversification becomes more apparent. Furthermore, governments and public entities may increasingly use catastrophe bonds to finance disaster recovery efforts, leading to growth in the market. Catastrophe bonds serve as an essential risk management tool for insurance and reinsurance companies by transferring the financial impact of natural disasters to capital market investors. They offer numerous benefits, including risk transfer, diversification, and financial stability, while also presenting certain risks, such as basis risk, modeling risk, and credit risk. The market for catastrophe bonds is expected to grow as climate change increases the frequency and severity of natural disasters and technological advancements improve risk modeling. To ensure a comprehensive risk management strategy, it is crucial for companies and investors alike to consider catastrophe bonds alongside traditional reinsurance. As the market continues to evolve and expand, leveraging the expertise of wealth management professionals can help stakeholders navigate the complexities of catastrophe bonds and optimize their financial planning. If you are interested in exploring the benefits of catastrophe bonds or other risk management strategies, seek the guidance of a wealth management expert to make well-informed decisions for your financial future.What Are Catastrophe Bonds?

Catastrophe Bond Mechanics

Structure of Catastrophe Bonds

Triggering Events

Risk Modeling

Catastrophe Bond Issuance Process

Sponsor Role

Special Purpose Vehicle (SPV)

Underwriting and Pricing

Catastrophe Bond Redemption and Payout

Payout Conditions

Loss Calculation and Payment

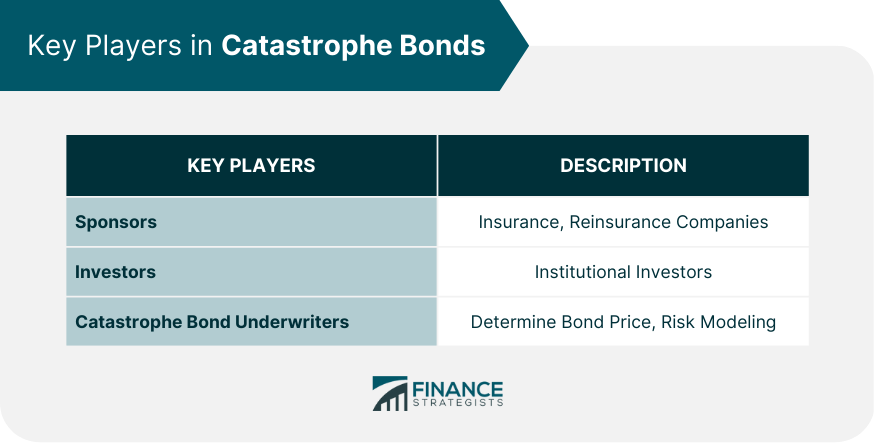

Key Players in Catastrophe Bonds

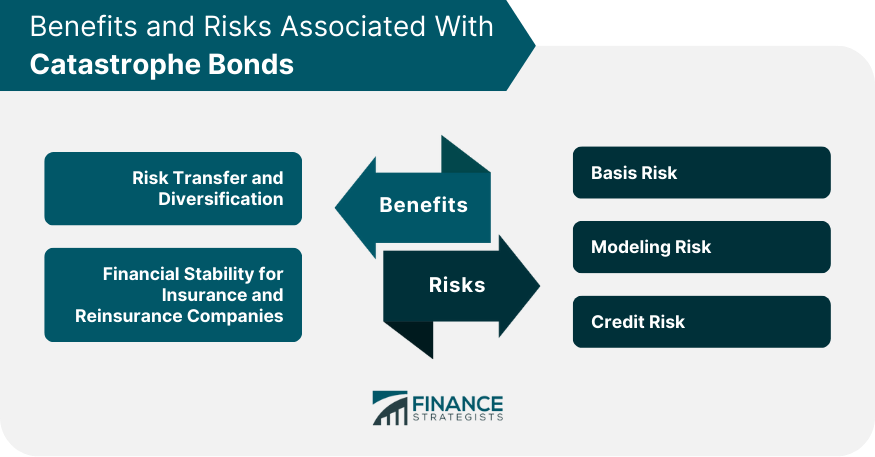

Benefits of Catastrophe Bonds

Risk Transfer and Diversification

Financial Stability for Insurance and Reinsurance Companies

Risks Associated with Catastrophe Bonds

Basis Risk

Modeling Risk

Credit Risk

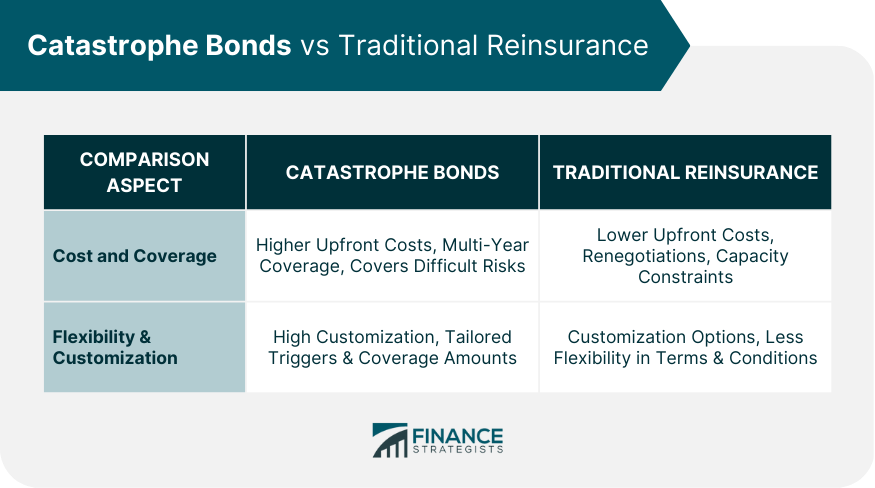

Catastrophe Bonds vs. Traditional Reinsurance

Cost and Coverage

Flexibility and Customization

Complementary Use of Catastrophe Bonds and Reinsurance

The Future of Catastrophe Bonds

Impact of Climate Change on Catastrophe Bonds

Technological Advancements in Catastrophe Bond Risk Modeling

Potential Growth and Expansion of the Catastrophe Bond Market

Final Thoughts

Catastrophe Bonds FAQs

Catastrophe bonds, or "cat bonds," are insurance-linked securities that transfer the risk of catastrophic events, such as earthquakes or hurricanes, from insurance and reinsurance companies to capital market investors. When a pre-defined triggering event occurs, investors may lose part or all of their principal, which is used to cover the sponsor's losses.

Catastrophe bonds provide multi-year coverage and can be customized with specific triggers and coverage amounts, offering an alternative or complement to traditional reinsurance. While catastrophe bonds may have higher upfront costs, they can cover risks that are difficult to reinsure or lack capacity in the traditional market.

Catastrophe bonds offer investors an attractive return, portfolio diversification, and a low correlation with traditional financial markets. They can provide a unique investment opportunity for institutional investors, such as pension funds, hedge funds, and asset managers.

Risks associated with catastrophe bonds include basis risk (when the bond's payout does not fully cover the sponsor's losses), modeling risk (inaccuracies in risk models leading to underestimated risk), and credit risk (the risk of the special purpose vehicle defaulting on its payment obligations).

Climate change may increase the frequency and severity of natural disasters, leading to a growing demand for catastrophe bonds and an expansion of the market. Technological advancements like artificial intelligence and big data can improve risk modeling and potentially introduce new triggers and bond structures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.